UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant

ý

Check the appropriate box:

|

|

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

|

Definitive Proxy Statement

|

|

ý

|

|

Definitive Additional Materials

|

|

¨

|

|

Soliciting Material Pursuant to §240.14a-12

|

Marathon Petroleum Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

ý

|

|

No fee required.

|

|

|

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which the transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which the transaction applies:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of the transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

|

|

April 11, 2017

Dear Fellow Marathon Petroleum Corporation Shareholders:

The Marathon Petroleum Corporation (“MPC”) 2017 Annual Meeting of Shareholders will be held on April 26, 2017. In advance of the meeting, I would like to share a few thoughts on Proposals 5 and 6 in the MPC Proxy Statement. The Proxy Statement provides the substantive bases for MPC’s opposition to these two proposals; this letter provides supplemental data I think useful to you.

First, let me state clearly that MPC values the perspectives of shareholders across our large and diverse shareholder base and we acknowledge the sincerity of certain shareholders and other stakeholders in raising concerns respecting the energy sector generally. In that spirit, MPC offers voluntary disclosures of our environmental performance and other aspects of our operations that frequently address the stated objectives of shareholders and stakeholders voicing concerns. Yet in some instances, those voices continue to call for MPC to issue template reports or make generalized commitments without recognition of certain facts or differentiation of specific company performance. In the interest of ensuring that you have the facts, including as to MPC’s differentiated, peer-leading performance, I respectfully ask that you consider this additional information in making your voting decision.

With regard to Proposal 5 - Report on Environmental and Human Rights Due Diligence, the proponent references the investment by MPLX LP (“MPLX”), the master limited partnership sponsored by MPC, in the Dakota Access Pipeline (“DAPL”) as an “entanglement” and questions whether MPLX has an “exit option” from the project. I want to assure investors that neither MPC nor MPLX views the approximate 9% interest MPLX holds in DAPL through a joint venture investment as an entanglement from which to exit. To the contrary, we are pleased to be a part of this important infrastructure project that is presently being placed in service and will provide a safer and more reliable alternative to the movement of crude oil by truck and rail for the foreseeable future.

As the basis for Proposal 5, the proponent raises concerns about the level of consultation with indigenous peoples and the adequacy of the project’s environmental review process. I welcome the opportunity here to assure my fellow MPC shareholders that MPC and its consolidated subsidiary MPLX have confidence in the rigorous planning, permitting and commissioning phases of the DAPL project as mandated under our U.S. federal, state and local laws and as carried out with respect for the human, cultural and legal rights of all persons and the environment. Neither MPC nor MPLX is the sponsor, constructor or operator of DAPL and therefore were not involved in the multi-year process to bring the project to fruition; through a joint venture MPLX made its minority investment in DAPL in February of this year only after it was clear that the project was proceeding to completion and commissioning. But as MPC and MPLX are experienced pipeline owners and operators, we are entirely familiar with the requirements governing the acquisition of rights of way, permitting, construction and operation of safe and technologically advanced pipelines like DAPL. And, in making investments in projects constructed by third parties, such as DAPL, we do employ our considerable subject matter expertise in reviewing the permitting record and other available information supporting such projects.

We appreciate that the adequacy of consultations with native tribes is a sensitive matter and do want to be sure our shareholders have the facts. The U.S. Army Corps of Engineers Environmental Assessment regarding the crossing of Lake Oahe that has been the focus of much attention, other permitting-related documents generated by the Corps and the Memorandum Opinion entered last September in the U.S. District Court for the District of Columbia denying the Standing Rock Sioux Tribe’s motion for a preliminary injunction, are replete with references to the many successful consultations and cooperative efforts with groups of indigenous peoples interested in the DAPL project and the attempts at consultation and cooperation that were rebuffed by others. These records reflect over 380 instances of outreach by the U.S. Army Corps of Engineers involving over 60 native tribes, including dozens of

attempts by the Corps to consult with the Standing Rock Sioux Tribe to discuss archaeological and other surveys and tribal concerns even though the pipeline route does not cross any Standing Rock Sioux land. Additionally, DAPL made 140 route deviations in North Dakota alone to avoid potential cultural resources. We believe that the interests of indigenous peoples and the environment were protected through the DAPL project generally, and specifically with respect to the Lake Oahe crossing, where the DAPL line route follows an existing pipeline corridor.

With regard to Proposal 6 - Report to Disclose Business Plan Alignment with the Paris Climate Change Agreement, the proponent asks MPC to disclose how it will align its business plan with the goal of the Paris Agreement on climate change to hold the increase in the global average temperature to well below 2°C above pre-industrial levels. The Paris Agreement is the latest in a long line of international accords setting forth goals respecting climate change. U.S. domestic policy makers at the federal, state and local levels have also advanced various climate change initiatives. But today there remains much uncertainty as to the form and timing of any specific greenhouse gas (“GHG”) emission restrictions that would be applicable to domestic refining, marketing and midstream companies like MPC. But, MPC has not taken this uncertainty as an invitation to inaction. Instead, MPC has established itself as an industry leader, owning and operating several of the most energy efficient petroleum refineries in the U.S.

Despite owning and operating 9.6% of U.S. refining capacity, MPC emits only 8.3% of the total direct GHG emissions for the U.S. refining industry. In other words, MPC’s refineries emit substantially less GHGs per share of crude capacity than the industry average. Further, on an individual basis all seven of MPC’s refineries emit less GHGs per share of crude capacity than the industry average. And, we continue to sit high atop the refining industry in recognitions by the EPA’s ENERGY STAR program. Again, with just 9.6% of U.S. refining capacity, we have earned 75% (36 of 48) of the recognitions awarded to refineries since the ENERGY STAR program began, including three of the four recognitions awarded for 2016. Two of our refineries have earned the award every year of the program’s existence, the only two refineries in the nation with that distinction. As a result, MPC has avoided emitting millions of tons of GHGs as compared to petroleum refineries operating at average U.S. efficiency levels.

MPC also led the industry by working with the EPA to significantly reduce emissions from flaring operations. In partnership with the EPA, we defined a series of operating parameters to ensure flares operate above 98% combustion efficiency on a continuous basis. As of 2015, MPC’s efforts resulted in an over 44% reduction in GHG emissions from our flares. MPC has commenced implementation of additional flare efficiency projects to be completed over the next few years, including the installation of flare gas recovery systems at five of our seven refineries, utilizing innovative compressor technologies specifically developed for MPC. These projects are expected to yield an 80% reduction in emissions of GHGs from flaring operations as compared to 2007 levels. These GHG emission reductions from flaring are anticipated to significantly reduce overall GHG emissions from our refineries.

Our peer-leading refinery emissions performance is a source of pride to the men and women of MPC who consistently, year after year, deliver these results. I expect our performance in this area is also a source of assurance to our shareholders that MPC is focused on results even in the face of future regulatory uncertainty.

Beyond MPC’s refining portfolio, we have taken steps to diversify our business and enhance our competitive position, including through MPLX’s acquisition of MarkWest in 2015, which positions the consolidated enterprise to benefit from increased demand for natural gas and natural gas liquids. MPC is also conducting research with Argonne National Laboratory (part of the U.S. Department of Transportation) in search of greater automobile engine efficiency. The collaboration between MPC and Argonne will bring together experts on fuel design, analysis and production with scientists who work on advanced engine combustion and emissions formation. Through this joint effort, researchers hope to make substantial gains in efficiencies leading to emission reductions that could not be achieved by studying engines or fuels separately. And, MPC has an established presence in the renewable energy and renewable fuels space. I invite you to review our Proxy Statement for more information about our involvement in ethanol and biodiesel production, solar and wind energy study projects and our E85, B11 and compressed natural gas retail fuel offerings.

MPC understands the risks to our traditional business should certain approaches to regulating GHG emissions be imposed. We cite those risks, which include increased costs to operate and maintain our facilities, and decreased demand for our products, routinely within our filings with the Securities and Exchange Commission. MPC’s business model, lines of business, products and capital investment decisions are assessed across a broad range of factors, not just a single international climate change accord that has yet to produce the first commitment on domestic companies. Absent a clear governmental policy directive or regulatory framework specific to the Paris

Agreement, we view the request for MPC to further disclose its competitive strategies and business plan to align with the Paris Agreement as not in the best interests of our shareholders and instead will continue to make the voluntary emission reduction disclosures our investors have come to appreciate.

MPC remains committed to the standard of excellence that continues to differentiate our assets and operations from others in our industry. We are focused on the risks to our traditional business attendant to climate change policy. When and as public policy developments result in the application of regulations aimed at reducing GHG emissions, I believe MPC is well positioned to compete on that level playing field with others in our industry and deliver the exemplary results we have in many other dynamic circumstances over time.

In closing, I ask that you consider this supplemental information and join me in voting against Proposals 5 and 6 in the MPC Proxy Statement.

Thank you for your interest and investment in Marathon Petroleum Corporation.

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

/s/ Gary R. Heminger

|

|

Gary R. Heminger

|

|

Chairman, President and Chief Executive Officer

|

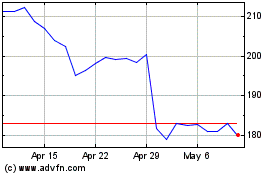

Marathon Petroleum (NYSE:MPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Petroleum (NYSE:MPC)

Historical Stock Chart

From Apr 2023 to Apr 2024