Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 10 2017 - 4:27PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Supplementing the Preliminary Prospectus Supplement dated April 10, 2017

to Prospectus dated October 6, 2016

Registration No. 333-213992

DARDEN RESTAURANTS, INC.

FINAL TERM SHEET

3.850%

Senior Notes due 2027

Dated: April 10, 2017

|

|

|

|

|

Issuer:

|

|

Darden Restaurants, Inc.

|

|

|

|

|

Size:

|

|

$500,000,000

|

|

|

|

|

Expected Ratings:

|

|

Baa3 by Moody’s Investors Service, Inc.

BBB by Standard & Poor’s Ratings Services

BBB by Fitch

Ratings

|

|

|

|

|

Trade Date:

|

|

April 10, 2017

|

|

|

|

|

Settlement Date:

|

|

April 18, 2017 (T+5)

|

|

|

|

|

Maturity Date:

|

|

May 1, 2027

|

|

|

|

|

Interest Payment Dates:

|

|

May 1 and November 1, beginning November 1, 2017

|

|

|

|

|

Coupon (Interest Rate):

|

|

3.850%

|

|

|

|

|

Benchmark Treasury:

|

|

2.250% due February 15, 2027

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

|

99-02+ / 2.355%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+150 basis points

|

|

|

|

|

Yield to Maturity:

|

|

3.855%

|

|

|

|

|

Price to Public:

|

|

99.957%

|

|

|

|

|

Optional Redemption:

|

|

Prior to February 1, 2027 (the “Par Call Date”) (which is a date three months prior to the maturity of the notes), the notes

will be redeemable at the Issuer’s option, in whole or from time to time in part, at a redemption price equal to the greater of (i) 100% of the principal amount of the notes being redeemed and (ii) the sum of the present values of the remaining

scheduled payments of principal and interest that would be due if the notes matured on the Par Call Date (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semiannual basis at the Treasury Rate,

plus 25 basis points, plus accrued and unpaid interest to the date of redemption.

On

or after the Par Call Date, the notes will be redeemable at the Issuer’s option, in whole or from time to time in part, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest to

the redemption date.

|

|

|

|

|

|

Special Mandatory Redemption:

|

|

The offering of the notes is not conditioned upon the completion of the Acquisition (as described in the Preliminary Prospectus Supplement dated April 10, 2017), which, if completed, will occur subsequent to the closing of

the offering of the notes. Upon the occurrence of a Special Mandatory Redemption Trigger (as described in the Preliminary Prospectus Supplement dated April 10, 2017), the Issuer will be required to redeem the notes, in whole, at a redemption

price equal to 101% of the aggregate principal amount of the notes being redeemed, plus accrued and unpaid interest on the aggregate principal amount of the notes being redeemed to, but excluding, the date of such redemption.

|

|

|

|

|

Special Optional Redemption:

|

|

The notes may be redeemed at the Issuer’s option, in whole, at any time before September 23, 2017, at a redemption price equal to 101% of the aggregate principal amount of such notes being redeemed, plus accrued and unpaid

interest on the aggregate principal amount of such notes being redeemed to, but excluding, the date of such redemption, if the Issuer determines that, in its judgment, the Acquisition will not be consummated on or before September 23,

2017.

|

|

|

|

|

Repurchase at the Option of Holders upon a Change of Control Triggering Event:

|

|

The notes will be subject to repurchase at the option of the holders at a purchase price of 101% of the principal amount thereof plus accrued and unpaid interest if the Issuer experiences a Change of Control Triggering Event (as

described in the Preliminary Prospectus Supplement April 10, 2017).

|

|

|

|

|

CUSIP / ISIN:

|

|

237194 AL9 / US237194AL90

|

|

|

|

|

Joint Book-Running Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Goldman, Sachs & Co.

Wells Fargo Securities, LLC

Fifth Third Securities, Inc.

SunTrust Robinson Humphrey, Inc.

U.S. Bancorp Investments, Inc.

|

|

|

|

|

Co-Managers:

|

|

Mizuho Securities USA LLC

Deutsche Bank

Securities Inc.

|

Note

: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer has filed a registration statement including a prospectus with the SEC for the offering to which this communication

relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by

visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus, if you request it by calling Merrill Lynch, Pierce, Fenner &

Smith Incorporated at 1-800-294-1322, Goldman, Sachs & Co. at 1-866-471-2526 or Wells Fargo Securities, LLC at 1-800-645-3751.

2

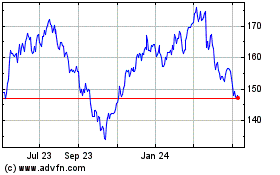

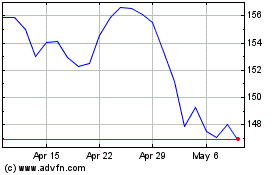

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Apr 2023 to Apr 2024