By Tim Higgins

DETROIT -- The Motor City has fallen to Silicon Valley.

Tesla Inc. on Monday became the largest U.S. auto maker by

market value, overtaking General Motors Co. -- a feat that would

have seemed highly improbable 13 years ago when the electric-car

maker first began tinkering with the idea of making a sports

car.

Shares of Palo Alto, Calif.-based Tesla rose as high as $312.75

during Monday morning trading, pushing the company's market

capitalization to $51.01 billion. That eclipsed Detroit-based GM's

$50.89 billion, based on its highest point in early trading. Ford

Motor Co., meanwhile, was valued at $44.95 billion.

The milestone underscores the seismic change occurring in the

global automotive industry as Silicon Valley pursues a vision for

transportation -- including self-driving cars and

vehicles-on-demand -- that could upend century-old players. Last

week's disappointing monthly sales results by traditional auto

makers served as a further example to investors concerned that the

profitable U.S. new-car market is plateauing.

"We've built a track record of strong financial performance," a

GM spokeswoman said in an email. "We'll stay focused on delivering

outstanding results and making decisions to deploy capital where it

will generate the strongest returns, to enhance shareholder

value."

Tesla declined to comment.

GM remains the largest auto maker in the U.S. by market share,

making up 17.3% of the sales last year, according to Autodata Corp.

Tesla had a 0.2% share, which beat Ferrari and Maserati.

"What's fun about following this company now is that anything

can happen, " Chaim Siegel, an analyst for Investing.com, said in

an email about Tesla that seems to mimic investor sentiment even as

the auto maker remains unprofitable and deeply in debt. "The

potential is huge. The hopes are huge."

Even some of Tesla's most optimistic followers are surprised at

the recent run up in value. "We're pretty surprised by the recent

run in Tesla's share price to over $300 so quickly," Adam Jonas, an

analyst for Morgan Stanley, wrote in a note to investors as Tesla's

market cap neared GM's. He has been targeting a $305 price for

Tesla. "Such is the power of technical factors over fundamental

drivers."

Tesla shares have been on roll this year, rising more than 40%,

a run that last week had Chief Executive Elon Musk's car company

surpass Ford Motor Co. as the second-largest car company. The

exuberance comes even as Mr. Musk faces huge challenges in

accomplishing all that he is claiming to do, including making

500,000 vehicles next year after building just 84,000 last year and

creating software that would enable a vehicle to drive itself.

"It's indicative of the market wanting to pay for potential,

including into markets that don't exist yet in any large size such

as EVs, home energy generation and storage, rather than profits and

cash flow today that the large auto makers generate," said David

Whiston, an analyst for Morningstar Research.

Mr. Musk, who has struggled to bring out new products before,

faces the daunting challenge of later this year rolling out the

$35,000 Model 3 sedan, the linchpin in his plans to take the

company into the mainstream from the rarefied air of selling luxury

vehicles.

His acquisition of SolarCity Corp. late last year and removal of

the word "Motors" from the company's official name is part of a

broader vision of being able to offer solar panels to generate

energy and batteries to store that power at home or the office --

all for the benefit of the vehicles being sold. He has also begun

shipping vehicles equipped with the hardware he says is needed to

make them fully self-driving once the software is completed, aiming

to demonstrate the prowess by year's end.

It is a vision that got a strong endorsement late last month

with the revelation that Chinese tech giant Tencent Holdings Ltd.,

best known for China's largest social network, WeChat, had acquired

a 5% stake in Tesla.

"The sooner investors view Tesla as a

transportation/infrastructure company rather than just a car

company, the more we believe the industry events to come over the

next 12 to 18 months will make sense," Mr. Jonas wrote.

Investors continued to push Tesla shares higher last week

following the announcement of a record quarter of vehicle sales.

Meanwhile, GM reported a modest U.S. sales gain for March, lifted

by truck demand, and said Chief Executive Mary Barra earned $22.6

million in 2016, a decline of 21% from 2015 when she was awarded a

sizable retention package. Ms. Barra, at the helm since 2014, has

said her goal is to make GM the most valued auto maker in the

world.

For GM, this day is particularly painful. The Detroit auto

maker, which sold 10 million vehicles last year globally, has been

rushing to develop its own self-driving technology, acquiring

Cruise Automation last year in a deal that could be worth $1

billion, and investing in ride-hailing service Lyft.

Ms. Barra's predecessor, Dan Akerson, a former

telecommunications executive, was concerned about the potential of

Tesla, setting up a team to study how Tesla could threaten GM and

challenging his senior executives to war-game-like scenarios.

GM has been especially aggressive in recent years in its attempt

to thwart Tesla, pushing legislation in states in an attempt to

block the company's strategy of selling directly to customers

instead of using franchised dealers like the rest of the auto

industry has done for generations.

In preparing the new Chevrolet Bolt all-electric small car, seen

by some as GM's answer to the Model 3, Ms. Barra took a veiled shot

at Tesla in January 2016 at CES, the high-profile annual consumer

electronics show in Las Vegas, saying GM's dealer network gave it a

competitive edge. Tesla's belief in having the ability to control

its own stores is held as tightly as a religion among senior

leaders, worth fighting protracted battles in states across the

country.

GM's vision of a world with self-driving cars dates back to

concepts it introduced at the World Fair in the 1930s, but

innovation took a back seat among the most recent generation as

leaders fought to keep the company from bankruptcy.

Ultimately, GM's crushing debt load and the 2007-09 recession

led to what was then unthinkable generations earlier: GM's U.S.

government-backed bankruptcy reorganization in 2009.

Financially, the company has roared back, reporting record

profits and developing some of its best vehicles in a generation.

But investors have largely yawed. GM shares closed Friday at

$33.71, compared with its postbankruptcy initial public offering

price of $33 in 2010.

"It's absolutely mind boggling that we're even discussing GM and

Tesla reaching a parallel," said Dave Sullivan, an industry analyst

with AutoPacific. "It's not as if they are sitting on some sort of

blockbuster drug that isn't available in generic form. The wide

rollout of electric vehicles by Jaguar, Daimler, BMW, and Audi is

right around the corner."

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

April 10, 2017 10:02 ET (14:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

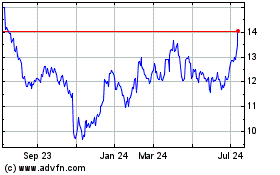

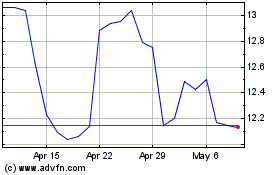

Ford Motor (NYSE:F)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2023 to Apr 2024