Delivering on Production Growth

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a

leading independent Latin American oil and gas explorer, operator

and consolidator with operations and growth platforms in Colombia,

Chile, Brazil, Argentina, and Peru, today announced its operational

update for the three-month period ended March 31, 2017

(“1Q2017”).

(All figures are expressed in US Dollars and growth comparisons

refer to the same period of the prior year, except when

specified).

Quarterly Highlights

Oil and Gas Production Up

- Consolidated oil and gas production up

12% to 25,180 boepd (up 6% compared to 4Q2016)

- Oil production up 25% to 20,487

bopd

- Gas production down 24% to 28.2

mmcfpd

- 1Q2017 exit production of approximately

26,100 boepd

- 2017 exit production target of 30,000+

boepd

Exploration, Appraisal and Development Well Drilling

Success

- In Colombia in the Llanos 34 Block

(GeoPark operated with 45% WI):

- Discovery of new Chiricoca oil field

with Chiricoca 1 exploration well currently producing 950 bopd

gross

- Further appraisal and development of

the Jacana oil field with:

- Appraisal well Jacana 11 extending

south-west limits of field and currently producing 2,200 bopd

gross

- Appraisal well Jacana Sur 2 and

development wells Jacana 7 and Jacana 8 were drilled and are

waiting for completion/testing expected during April/May

- Further development of Tigana oil field

with:

- Tigana Sur 6 development well found

thicker Guadalupe pay and is currently producing 1,700 bopd

gross

Long Term Gas Marketing Agreement

- Advanced negotiations with Methanex to

extend gas supply agreement in Chile to December 2026

Deleveraging Balance Sheet

- Repayment of $10 million on Itau term

loan with $40 million in principal remaining

Upcoming 2Q2017 Operational Catalysts

- Four drilling rigs operational (2 in

Colombia, 1 in Argentina, and 1 in Chile) targeting drilling 10

wells, including:

- Colombia: Explore four new prospects

including third major fault trend adjacent and parallel to existing

Llanos 34 producing trends

- Argentina: Explore new prospect in

Neuquen Basin CN-V Block (GeoPark operated with 50% WI)

- Chile: Explore new shallow gas play

prospect in Fell Block (GeoPark operated with 100% WI)

Breakdown of Quarterly Production by Country

The following table shows production figures for 1Q2017, as

compared with 1Q2016:

1Q2017

1Q2016

Total(boepd)

Oil

(bopd)a

Gas

(mcfpd)

Total(boepd)

% Chg. Colombia 19,330 19,267 378

14,871 30% Chile 3,351 1,182 13,008 4,061 -18% Brazil

2,499

38 14,766 3,586 -30%

Total

25,180 20,487 28,152

22,518 12% a) Includes royalties paid

in kind in Colombia for 608 bopd approximately in 1Q2017. No

royalties were paid in kind in Chile and Brazil operations.

Quarterly Production Evolution

(boepd) 1Q2016

2Q2016 3Q2016 4Q2016

1Q2017 Colombia 14,871 14,084 15,678

17,535 19,330 Chile 4,061 4,118 3,756 3,523 3,351

Brazil 3,586 2,941 2,636 2,535

2,499

Total 22,518 21,143

22,070 23,593 25,180 Oil 16,347

15,530 16,942 18,798 20,487 Gas 6,171 5,613 5,128

4,795

4,693

Oil and Gas Production Update

Consolidated:

Higher production in Colombia pushed up average consolidated oil

and gas production to 25,180 boepd in 1Q2017 from 22,518 boepd in

1Q2016. The increase was mainly attributed to new production from

the Jacana and Tigana oil fields - with three new wells drilled and

put into production during 1Q2017. On a consolidated basis, it was

offset by lower production in Chile due to the natural decline of

the fields and Brazil which is still being impacted by limited gas

consumption in northeast Brazil. Brazilian Finance Minister

Meirelles recently pointed to the beginning of an economic recovery

in Brazil, which could potentially lead to higher gas demand later

this year.

Oil increased in the production mix to 81% of the total reported

production in 1Q2017 (vs. 80% in 4Q2016 and 73% in 1Q2016) –

resulting from the successful drilling campaign in Llanos 34

Block.

Colombia:

Average net production in Colombia increased by 30% to 19,330

boepd in 1Q2017 compared to 14,871 boepd in 1Q2016, primarily

attributed to the Jacana and Tigana oil fields in Llanos 34 Block.

The Llanos 34 Block represented 95% of GeoPark’s Colombian

production in 1Q2017.

The 1Q2017 drilling campaign in the Llanos 34 Block continued to

provide positive results, as follows:

- Chiricoca 1 exploration well was

successfully completed and put on production in 1Q2017. The well is

currently producing approximately 950 bopd gross, with less than 1%

water cut

- Tigana Sur 6 development well was

drilled, completed and showed a net pay of approximately 57 feet,

which represents a significant thickening (~60%) of the average net

pay of the lower Guadalupe formation compared to other producing

wells in the Tigana oil field. The well is currently producing

approximately 1,700 bopd gross

- Jacana 11 appraisal well was drilled

approximately 2,500 meters south-west of Jacana 6, extending the

Tigana/Jacana oil play towards the southern limits of the Llanos.

The well is currently producing approximately 2,200 bopd with a 1%

water cut

- Jacana 7 and Jacana 8 development wells

and Jacana Sur 2 appraisal well were drilled with testing expected

during April/May

During 2Q2017, the campaign will be focused on testing four

exploration prospects, two located in the west and two in the east

fault trend parallel to the Tigana/Jacana fault trend in Llanos 34

Block. In addition, it will include two wells to continue

developing the Jacana oil field. For a summary of the drilling

activities in the next quarter, please refer to the table Expected

Drilling Schedule for 2Q2017, included below.

Chile:

Average net oil and gas production in Chile decreased by 18% to

3,351 boepd in 1Q2017 compared to 4,061 boepd in 1Q2016 due to the

natural decline of the fields with limited drilling activity since

2014. There was no drilling activity in Chile during 1Q2017. The

production mix during 1Q2017 was 65% gas and 35% oil, unchanged

from 1Q2016. The Fell Block (GeoPark operated with a 100% WI)

represented 98% of GeoPark’s Chilean production.

GeoPark is in advanced negotiations with Methanex to extend the

gas supply agreement in Chile to December 2026. In addition, the

Company is currently negotiating a new agreement with ENAP which

will allow sales to be interrupted if pricing conditions in the

export market are more competitive. As a result of these

negotiations, 1Q2017 oil production has been kept in storage and is

expected to be sold during 2Q2017, with no significant impact on

1Q2017 results. Chilean oil production represented 6% of The

Company´s consolidated net oil production during this period.

During 2Q2017, GeoPark will be targeting three different gas

opportunities through the drilling of one exploration and two

development wells in the Fell Block. Please refer to the table

Expected Drilling Schedule for 2Q2017, included below.

Brazil:

Average net oil and gas production in Brazil decreased 30% to

2,499 boepd in 1Q2017 compared to 3,586 boepd in 1Q2016, primarily

attributed to lower gas consumption by Brazilian industrial

users.

Manati Field production capacity remained unaffected and net

production could increase to approximately 3,500 boepd average

levels in the event gas consumption increases. The Manati Field

contractual take-or-pay provisions restrict volumes going below

current levels. The Manati Field (GeoPark non-operated with a 10%

WI) represented 100% of GeoPark’s Brazilian production.

Praia do Espelho exploration prospect in Reconcavo Basin was

drilled to a total depth of 2,333 meters. Main targets, Sergi and

Agua Grande formations, were found water bearing with reservoir

thicknesses of 36 ft and 46 ft, respectively. In addition, 47 ft of

reservoir with oil traces were encountered in a secondary target,

in the Gomo formation. As of the date of this release, and

following an in-depth G&G analysis, a decision was made to plug

and abandon the well. Drilling costs amounted to $2.3 million.

Argentina:

Exploration drilling of Rio Grande Oeste 1 well in CN-V Block

(GeoPark operated with a 50% WI), in the Neuquén Basin, is expected

to start in late April, in partnership with Wintershall (subsidiary

of BASF).

Expected Drilling Schedule for 2Q2017

The following is a summary of the expected drilling activities

scheduled for 2Q2017 with estimated total net capital expenditures

of $35-40 million (drilling and completion costs of $25-28 million

plus facilities of $10-12 million). All wells are operated by

GeoPark.

Prospect/Wella Country

Block

WorkingInterest

Type 1. Sinsonte 1 Colombia Llanos 34

45% Exploration 2. Guaco 1 Colombia Llanos 34 45%

Exploration 3. Jacamar 1 Colombia Llanos 34 45% Exploration 4.

Currucucu 1 Colombia Llanos 34 45% Exploration

5. Jacana 9

Colombia Llanos 34 45% Development 6. Jacana Sur 1 Colombia Llanos

34 45% Development

7. Kimiri Aike 4

Chile Fell 100% Development 8. Uaken 1 Chile Fell 100% Exploration

9. Ache 3 Chile Fell 100% Development 10. Rio Grande Oeste 1

Argentina CN-V 50% Exploration a) Information included in

the table above is subject to change and may also be subject to

partner or regulatory approval

NOTICE

Additional information about GeoPark can be found in the

“Investor Support” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts and

percentages included in this press release have been rounded for

ease of presentation. Percentage figures included in this press

release have not in all cases been calculated on the basis of such

rounded figures, but on the basis of such amounts prior to

rounding. For this reason, certain percentage amounts in this press

release may vary from those obtained by performing the same

calculations using the figures in the financial statements. In

addition, certain other amounts that appear in this press release

may not sum due to rounding.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING

INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward looking statements

contained in this press release can be identified by the use of

forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in

this press release include, but are not limited to, statements

regarding the intent, belief or current expectations, regarding

various matters, including expected 2017 production growth,

expected drilling schedule, economic recovery, payback timing, IRR,

drilling activities, demand for oil and gas and capital

expenditures plan. Forward-looking statements are based on

management’s beliefs and assumptions, and on information currently

available to the management. Such statements are subject to risks

and uncertainties, and actual results may differ materially from

those expressed or implied in the forward-looking statements due to

various factors.

Forward-looking statements speak only as of the date they are

made, and the Company does not undertake any obligation to update

them in light of new information or future developments or to

release publicly any revisions to these statements in order to

reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the

Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange

Commission.

Oil and gas production figures included in this release are

stated before the effect of royalties paid in kind, consumption and

losses, except when specified.

Readers are cautioned that the exploration resources disclosed

in this press release are not necessarily indicative of long term

performance or of ultimate recovery. Unrisked prospective resources

are not risked for change of development or chance of discovery. If

a discovery is made, there is no certainty that it will be

developed or, if it is developed, there is no certainty as to the

timing of such development. There is no certainty that any portion

of the Prospective Resources will be discovered. If discovered,

there is no certainty that it will be commercially viable to

produce any portion of the resources. Prospective Resource volumes

are presented as unrisked.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170410005413/en/

INVESTORS:GeoPark LimitedSantiago, ChileStacy Steimel,

+562 2242 9600Shareholder Value

Directorssteimel@geo-park.comorGeoPark LimitedBuenos Aires,

ArgentinaDolores Santamarina, +5411 4312 9400Investor

Managerdsantamarina@geo-park.comorMEDIA:Sard Verbinnen &

CoNew York, USAJared Levy, +1 212-687-8080jlevy@sardverb.comorSard

Verbinnen & CoNew York, USAKelsey Markovich, +1

212-687-8080kmarkovich@sardverb.com

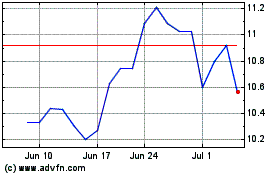

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

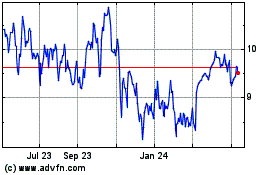

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024