QuickLinks

-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

Filed by the Registrant

ý

|

Filed by a Party other than the Registrant

o

|

Check the appropriate box:

|

ý

|

|

Preliminary Proxy Statement

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

o

|

|

Definitive Proxy Statement

|

o

|

|

Definitive Additional Materials

|

o

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

|

|

JAGUAR ANIMAL HEALTH, INC.

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

ý

|

|

No fee required.

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

201

Mission Street, Suite 2375, San Francisco, CA 94105

Tel: 415.371.8300

·

Fax: 415.371.8311

www.jaguaranimalhealth.com

April [ ],

2017

Dear

Stockholder:

You

are cordially invited to attend the 2017 Annual Meeting of Stockholders of Jaguar Animal Health, Inc. (the "Company") to be held at 201 Mission Street, Suite 2375, San

Francisco, CA 94105, on Monday, May 8, 2017, at 8:00 a.m., local time.

At

the Annual Meeting you will be asked to (i) elect two (2) directors to our Board of Directors, (ii) ratify the appointment of BDO USA, LLP as our

independent registered public accounting firm, and (iii) approve, pursuant to Nasdaq Listing Rule 5635(d), the issuance of additional shares of our common stock to Aspire Capital

Fund LLC, or Aspire Capital, pursuant to the common stock purchase agreement, dated June 8, 2016, between the Company and Aspire Capital.

As

previously announced, the Company intends to complete a business combination with Napo Pharmaceuticals, Inc. pursuant to the Agreement and Plan of Merger, dated as of

March 31, 2017. The Company intends to hold, as soon as practicable, a subsequent meeting to approve the proposed merger.

It

is important that your shares be represented and voted whether or not you plan to attend the annual meeting in person. You may vote on the Internet, by telephone or by completing and

mailing a proxy card. Voting over the Internet, by telephone or by written proxy will ensure your shares are represented at the annual meeting. If you do attend the annual meeting, you may, of course,

withdraw your proxy should you wish to vote in person. Please read the enclosed information carefully before voting.

|

|

|

|

|

|

|

Sincerely,

|

|

|

|

|

|

|

Lisa A. Conte.

Chief Executive Officer & President

|

JAGUAR ANIMAL HEALTH, INC.

201 Mission Street

Suite 2375

San Francisco, CA 94105

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 8, 2017

NOTICE HEREBY IS GIVEN that the 2017 Annual Meeting of Stockholders of Jaguar Animal Health, Inc. (the "Company") will be held at 201

Mission Street, Suite 2375, San Francisco, CA 94105, on Monday, May 8, 2017, at 8:00 a.m., local time, for the following purposes:

1. Electing

two (2) Class II directors;

2. Ratifying

the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2017;

3. Approving,

pursuant to Nasdaq Listing Rule 5635(d), the issuance of additional shares of our common stock to Aspire Capital Fund, LLC pursuant to the common

stock purchase agreement dated June 8, 2016; and

4. Such

other business as properly may come before the Annual Meeting or any adjournment or postponement thereof.

The

Board of Directors is not aware of any other business to be presented to a vote of the stockholders at the Annual Meeting. Information relating to the above matters is set forth in

the attached Proxy Statement. Stockholders of record at the close of business on April [ ], 2017 are entitled to receive notice of and to vote at the Annual

Meeting and any adjournment or postponement thereof. This Notice of Annual Meeting of Stockholders and Proxy Statement and Proxy Card are being sent to stockholders beginning on or about

April [ ], 2017.

|

|

|

|

|

|

|

By Order of the Board of Directors.

|

|

|

|

|

|

|

Lisa A. Conte.

|

|

|

|

Chief Executive Officer & President

|

San Francisco, California

April [ ], 2017

|

|

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on May 8, 2017. The proxy statement and annual report to

stockholders on Form 10-K for the year ended December 31, 2016 are available at http://phx.corporate-ir.net/phoenix.zhtml?c=253723&p=irol-irhome.

PLEASE CAREFULLY READ THE ATTACHED PROXY STATEMENT. EVEN IF YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE PROMPTLY COMPLETE, EXECUTE, DATE AND RETURN THE ENCLOSED PROXY CARD

IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE. NO POSTAGE IS NECESSARY IF MAILED IN THE UNITED STATES. YOU MAY ALSO VOTE ELECTRONICALLY VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON

THE PROXY CARD. IF YOU VOTE BY INTERNET OR TELEPHONE, THEN YOU NEED NOT RETURN A WRITTEN PROXY CARD BY MAIL. STOCKHOLDERS WHO ATTEND THE ANNUAL MEETING MAY REVOKE THEIR PROXIES AND VOTE IN PERSON IF

THEY SO DESIRE.

JAGUAR ANIMAL HEALTH, INC.

201 Mission Street

Suite 2375

San Francisco, CA 94105

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

FOR THE 2017 ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 8, 2017

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

We are furnishing this Proxy Statement to our stockholders in connection with the solicitation of proxies by our Board of Directors to be voted

at the 2017 Annual Meeting of Stockholders and at any adjournment or postponement thereof. The Annual Meeting will be held at 201 Mission Street, Suite 2375, San Francisco, CA 94105, on Monday,

May 8, 2017, at 8:00 a.m., local time.

When

used in this Proxy Statement, the terms the "Company," "we," "us," "our" and "Jaguar" refer to Jaguar Animal Health, Inc.

The

Securities and Exchange Commission ("SEC") rules require us to provide our Annual Report for the fiscal year ended December 31, 2016 to stockholders who receive this Proxy

Statement. Accordingly, we have enclosed our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, which was filed on February 15, 2017 with this Proxy

Statement, and we will also provide copies of such documents to brokers, dealers, banks, voting trustees and their nominees for the benefit of their beneficial owners of record. Pursuant to rules

adopted by the SEC, the Company is also providing access to its proxy materials over the Internet. All shareholders will have the ability to access the proxy materials at

http://investors.jaguaranimalhealth.com/phoenix.zhtml?c=253723&p=irol-reportsannual. Additional copies of the Annual Report (not including documents incorporated by reference), are available to any

stockholder without charge upon written request to Jaguar Animal Health, Inc., 201 Mission Street, Suite 2375, San Francisco CA 94105 to the attention of Karen S. Wright, Chief

Financial Officer and Treasurer. You may also obtain the Annual Report on Form 10-K over the Internet at the SEC's website, www.sec.gov, or at

http://phx.corporate-ir.net/phoenix.zhtml?c=253723&p=irol-sec.

The

date on which this Proxy Statement and form of proxy card are first being sent or given to stockholders is on or about April [ ], 2017.

As

previously announced, Jaguar intends to complete a business combination with Napo Pharmaceuticals, Inc. pursuant to the Agreement and Plan of Merger, dated as of

March 31, 2017. Jaguar intends to hold, as soon as practicable, a subsequent meeting (the "subsequent meeting") to approve the proposed merger. At that subsequent meeting, Jaguar does not

intend to submit a new slate of directors for election. Accordingly, the directors of Jaguar elected hereby at the annual meeting likely will hold office for the full terms described herein.

GENERAL INFORMATION ABOUT VOTING

Record Date

As of April [ ], 2017, the record date for the Annual Meeting,

[ ] shares of our Common Stock were outstanding. Only holders of record of our Common Stock as of the close of business on the

record date are entitled to notice

of, and to vote at, the Annual Meeting or at any adjournment or postponement thereof. A list of such holders will be open to the examination of any stockholder for any purpose germane to the meeting

at Jaguar Animal Health, Inc., 201 Mission Street, Suite 2375, San Francisco, CA 94105 for a period of ten

(10) days prior to the Annual Meeting. The list of stockholders will also be available for such examination at the Annual Meeting.

2

Quorum and Revocability of Proxies

Each share of our Common Stock entitles the holder of record thereof to one vote. No other securities are entitled to be voted at the Annual

Meeting. Each stockholder may vote in person or by proxy on all matters that properly come before the Annual Meeting and any adjournment or postponement thereof. The presence, in person or by proxy,

of stockholders entitled to vote a majority of the shares of Common Stock outstanding on the record date will constitute a quorum for purposes of voting at the Annual Meeting. Properly executed

proxies marked "ABSTAIN" or "WITHHOLD AUTHORITY," as well as broker non-votes will be counted as "present" for purposes of determining the existence of a quorum. If a quorum should not be present, the

Annual Meeting may be adjourned from time to time until a quorum is obtained.

Our

Board of Directors (the "Board") is soliciting the enclosed proxy for use in connection with the Annual Meeting and any postponement or adjournment thereof. If the enclosed proxy is

voted via the Internet, by telephone or the proxy card is executed and returned, the shares represented by it will be voted as directed on all matters properly coming before the Annual Meeting for a

vote. For each proposal, you may vote "FOR," "AGAINST" or you may elect to either: "WITHHOLD AUTHORITY" (Proposal 1) or "ABSTAIN" (Proposal 2 or Proposal 3). Returning your completed proxy card

or voting on the Internet or by telephone will not prevent you from voting in person at the Annual Meeting should you be present and desire to do so. You may revoke your proxy by (a) delivering

to the Secretary of the Company at or before the Annual Meeting a written notice of revocation bearing a later date than the proxy, (b) duly executing a subsequent proxy relating to the same

shares of Common Stock and delivering it to the Secretary of the Company at or before the Annual Meeting or (c) attending the Annual Meeting and voting in person (although attendance at the

Annual Meeting will not in and of itself constitute revocation of a proxy). Any written notice revoking a proxy should be delivered at or prior to the Annual Meeting to: Jaguar Animal

Health, Inc., 201 Mission Street, Suite 2375, San Francisco, CA 94105, Attention: Karen S. Wright. Beneficial owners of our Common Stock who are not holders of record and wish to

revoke their proxy should contact their bank, brokerage firm or other custodian, nominee or fiduciary to inquire about how to revoke their proxy.

The

shares represented by all valid proxies received will be voted in the manner specified on the proxies. Where specific choices are not indicated on a valid proxy, the shares

represented by such

proxies received will be voted: (1) for the nominees for director named in this Proxy Statement; (2) for the ratification of BDO USA, LLP as our independent registered public

accounting firm for the fiscal year ended December 31, 2017; (3) for the approval of the issuance of additional shares of our common stock to Aspire Capital Fund LLC, or Aspire

Capital, under common stock purchase agreement dated June 8, 2016, or the CSPA; and (4) in accordance with the best judgment of the persons named in the enclosed proxy, or their

substitutes, for any other matters that properly come before the Annual Meeting.

We

will bear all expenses of this solicitation, including the cost of preparing and mailing this Proxy Statement. In addition to solicitation by use of the mail, proxies may be solicited

by telephone, facsimile or personally by our directors, officers and employees, who will receive no extra compensation for their services. We will reimburse banks, brokerage firms and other

custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy soliciting materials to beneficial owners of shares of Common Stock.

Broker Voting

Brokers holding shares of record in "street name" for a client have the discretionary authority to vote on some matters if they do not receive

instructions from the client regarding how the client wants the shares voted at least 10 days before the date of the Annual Meeting. There are also some matters

3

with

respect to which brokers do not have discretionary authority to vote if they do not receive timely instructions from the client. When a broker does not have discretion to vote on a particular

matter and the client has not given timely instructions on how the broker should vote, a broker non-vote results. Any broker non-vote will be counted as present at the Annual Meeting for purposes of

determining a quorum, but will be treated as not entitled to vote with respect to certain matters.

The

proposal to ratify the appointment of our independent registered public accounting firm (Proposal 2) is considered a "routine" item and brokers are permitted to vote in their

discretion on this matter on behalf of clients who have not furnished voting instructions at least 10 days before the date of the Annual Meeting. In contrast, the proposal to elect directors

(Proposal 1) and the proposal to issue additional shares to Aspire Capital (Proposal 3) are not considered "routine" items and brokers do not have discretionary authority to vote on

behalf of clients on such matters.

Required Vote

Proposal 1

In voting with regard to the proposal to elect directors (Proposal 1), you may vote in favor of all nominees, withhold your vote as to all

nominees or vote in favor of or withhold your vote as to specific nominees. The vote required to approve Proposal 1 is governed by Delaware law, our Second Amended and Restated Certificate of

Incorporation and our Amended and Restated Bylaws and is a plurality of the votes cast by the holders of shares represented and entitled to vote at the Annual Meeting, provided a quorum is present. As

a result, in accordance with Delaware law, votes that are withheld will be counted in determining whether a quorum is present but will have no other effect on the election of directors. Stockholders

have no right to cumulative voting as to any matter, including the election of directors.

Proposal 2

In voting with regard to the proposal to ratify the Audit Committee's appointment of the independent registered public accounting firm (Proposal

2), you may vote in favor of the proposal, vote against the proposal or abstain from voting. The vote required to approve the proposal is governed by Delaware law, our Second Amended and Restated

Certificate of Incorporation and our Amended and Restated Bylaws and is the affirmative vote of the holders of a majority of the shares represented and entitled to vote at the Annual Meeting, provided

a quorum is present. As a result, abstentions will be considered in determining whether a quorum is present and the number of votes required to obtain the necessary majority vote and therefore will

have the same legal effect as voting against the proposal.

Proposal 3

In voting with regard to the proposal to issue additional shares to Aspire Capital (Proposal 3), you may vote in favor of the proposal, vote

against the proposal or abstain from voting. The vote required to approve the proposal is governed by Delaware law, our Second Amended and Restated Certificate of Incorporation and our Amended and

Restated Bylaws and is the affirmative vote of the holders of a majority of the shares represented and entitled to vote at the Annual Meeting, provided a quorum is present. As a result, abstentions

will be considered in determining whether a quorum is present and the number of votes required to obtain the necessary majority vote and therefore will have the same legal effect as voting against the

proposal.

NO DISSENTERS' RIGHTS

The corporate action described in this Proxy Statement will not afford to stockholders the opportunity to dissent from the actions described

herein and receive an agreed or judicially appraised value for their shares of Common Stock.

4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of shares of our Common Stock as of April 1, 2017

for:

-

•

-

each person known to us to be the beneficial owner of more than 5% of our outstanding shares of Common Stock;

-

•

-

each of our named executive officers;

-

•

-

each of our directors; and

-

•

-

all directors and named executive officers as a group.

Information

with respect to beneficial ownership has been furnished by each director, executive officer or beneficial owner of more than 5% of our Common Stock. Beneficial ownership is

determined in accordance with the rules of the SEC and generally includes voting and investment power with respect to the securities. Except as otherwise provided by footnote, and subject to

applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. The number of

shares of Common Stock used to calculate the percentage ownership of each listed person includes the shares of Common Stock underlying options or warrants held by such persons that are currently

exercisable or exercisable within 60 days of April 1, 2017, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Percentage

of beneficial ownership is based on 14,424,128 shares of Common Stock outstanding as of April 1, 2017.

Except

as otherwise set forth below, the address of each beneficial owner listed in the table below is c/o Jaguar Animal Health, Inc., 201 Mission Street, Suite 2375, San

Francisco, California 94105.

|

|

|

|

|

|

|

|

|

|

Name and address of beneficial owner

|

|

Number of

Shares

Beneficially

Owned

|

|

Percentage of

Shares

Beneficially

Owned

|

|

|

5% Stockholders:

|

|

|

|

|

|

|

|

|

Napo Pharmaceuticals, Inc.(1)

|

|

|

2,666,666

|

|

|

18.5

|

%

|

|

Entities affiliated with BVCF(2)

|

|

|

1,569,841

|

|

|

10.8

|

%

|

|

Invesco Ltd.(3)

|

|

|

1,974,360

|

|

|

13.7

|

%

|

|

Entities affiliated with Kingdon Capital Management L.L.C.(4)

|

|

|

1,297,815

|

|

|

9.0

|

%

|

|

Named executive officers and directors:

|

|

|

|

|

|

|

|

|

James J. Bochnowski(5)

|

|

|

678,707

|

|

|

4.7

|

%

|

|

Lisa A. Conte(6)

|

|

|

393,058

|

|

|

2.7

|

%

|

|

Jiahao Qiu(7)

|

|

|

7,405

|

|

|

—*

|

|

|

Zhi Yang, Ph.D.(8)

|

|

|

1,569,841

|

|

|

10.8

|

%

|

|

Folkert W. Kamphuis(9)

|

|

|

91,829

|

|

|

—*

|

|

|

Steven R. King, Ph.D.(10)

|

|

|

145,353

|

|

|

1.0

|

%

|

|

John Micek III(11)

|

|

|

39,164

|

|

|

—*

|

|

|

Ari Azhir, Ph.D.(12)

|

|

|

13,618

|

|

|

—*

|

|

|

Karen S. Wright(13)

|

|

|

35,475

|

|

|

—*

|

|

|

Roger Waltzman(14)

|

|

|

32,113

|

|

|

—*

|

|

|

All current executive officers and directors as a group (10 persons)(15)

|

|

|

3,012, 715

|

|

|

19.5

|

%

|

5

-

(1)

-

Lisa

A. Conte, our Chief Executive Officer, is the interim chief executive officer of Napo. Napo's four-person board of directors, consisting of Lisa A. Conte,

Richard W. Fields, Joshua Mailman and Gregory Stock, has ownership and control of the shares of common stock held by Napo. Certain members of our board of directors, as well as certain of our

executive officers and employees beneficially own common stock in Napo. As a group, our executive officers and directors (10 persons total), collectively beneficially own 9.8% of the issued and

outstanding common stock of Napo, including the Bochnowski Family Trust, which holds 6.5%. Mr. Bochnowski, a member of our board of directors, is a co-trustee and beneficiary of such trust and

shares voting and investment control over such shares with his spouse. See "Certain Relationships and Related Persons Transactions—Napo Arrangements—Napo Beneficial Ownership."

-

(2)

-

Includes

(i) 1,483,326 shares of common stock directly held by Kunlun Pharmaceuticals, Ltd., and (ii) 39,555 shares of common stock, stock

options to purchase 10,000 shares of common stock held by Dr. Yang, and warrants to purchase 39,555 shares of common stock held by Sichuan Biopharma. Kunlun Pharmaceuticals, Ltd. is

wholly-owned by BVCF III, L.P. and BVCF III-A, L.P., Cayman Islands limited partnerships. BVCF III, L.P. and BVCF III-A, L.P. are managed by BioVeda

Management, Ltd., a Cayman Islands company, or BVCF, and Sichuan Biopharma is an investment vehicle of BVCF. Dr. Yang is the sole shareholder of BVCF. BVCF may be deemed to beneficially

own all shares held by Kunlun Pharmaceuticals, Ltd. and Sichuan Biopharma. BVCF's principal business address is Suite 2606, Tower 1, New Richport Center, 763 Mengzi Road, Huangpu

District, Shanghai 200023, China.

-

(3)

-

Represents

1,974,360 shares of common stock owned by Invesco Ltd.

-

(4)

-

Represents

1,297,815 shares of common stock owned by Kingdon Capital Management, L.L.C.

-

(5)

-

Includes

(i) 487,576 shares of common stock, (ii) 76,074 shares of common stock issuable under stock options that are exercisable or will become

exercisable within 60 days of April 1, 2017 and (iii) 121,209 shares of common stock issuable under warrants that are exercisable or will become exercisable within 60 days

of April 1, 2017. All securities other than stock options are held by the Bochnowski Family Trust. Mr. Bochnowski is a co-trustee and beneficiary of such trust and shares voting and

investment control over such shares with his spouse.

-

(6)

-

Represents

5,412 shares of common stock, and 387,646 shares of stock issuable under stock options that are exercisable or will become exercisable within

60 days of April 1, 2017.

-

(7)

-

Represents

7,405 shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days of April 1, 2017.

-

(8)

-

Represents

1,569,841 shares of common stock beneficially held by BVCF. Dr. Yang is the Chairperson, Founder, Managing Partner and sole shareholder of BVCF and

he may be deemed to beneficially own all the shares held by BVCF.

-

(9)

-

Represents

91,829 shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days of April 1, 2017.

-

(10)

-

Represents

3,157 shares of common stock, and 142,196 shares of stock issuable under stock options that are exercisable or will become exercisable within

60 days of April 1, 2017.

6

-

(11)

-

Represents

39,164 shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days of April 1, 2017.

-

(12)

-

Represents

13,618 shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days of April 1, 2017.

-

(13)

-

Represents

35,475 shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days of April 1, 2017.

-

(14)

-

Represents

32,113 shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days of April 1, 2017.

-

(15)

-

See

footnotes (5) - (14).

7

PROPOSAL 1—ELECTION OF DIRECTORS

Nominees

Our Board of Directors currently consists of seven (7) members, James J. Bochnowski, Lisa A. Conte, Folkert W. Kamphuis, Jiahao Qiu, Zhi

Yang, Ph.D, John Micek III and Ari Azhir, Ph.D., who are divided into three classes with staggered three-year terms. The Board has nominated Jiahao Qiu and John Micek III for re-election as

Class II directors. If elected as a Class II director at the Annual Meeting, each of the nominees will serve and hold office for a three-year term expiring in 2020.

Each

of the nominees has consented to continue his/her service as a director if elected. If any of the nominees should be unavailable to serve for any reason (which is not anticipated),

the Board of Directors may designate a substitute nominee or nominees (in which event the persons named on the enclosed proxy card will vote the shares represented by all valid proxy cards for the

election of such substitute nominee or nominees), allow the vacancies to remain open until a suitable candidate or candidates are located, or by resolution provide for a lesser number of directors or

fill the position.

Both of the nominees for director are, at present, directors of Jaguar and have been nominated by our Nominating and Corporate Governance Committee and ratified by our full Board.

The Board of Directors unanimously recommends that the stockholders vote "FOR" Proposal No. 1 to elect Jiahao Qiu and John Micek III as Class II

directors.

Information Regarding the Board of Directors and Director Nominees

The following table lists our directors and proposed director nominees, their respective ages and positions as of April 5, 2017:

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Position

|

|

James J. Bochnowski(1)(2)(3)

|

|

|

73

|

|

Chairman of the Board of Directors

|

|

Lisa A. Conte

|

|

|

58

|

|

Chief Executive Officer, President and Director

|

|

Jiahao Qiu(1)

|

|

|

31

|

|

Director

|

|

Zhi Yang, Ph.D.(1)

|

|

|

61

|

|

Director

|

|

Folkert W. Kamphuis(2)(3)

|

|

|

57

|

|

Director

|

|

John Micek III(1)(2)(3)

|

|

|

64

|

|

Director

|

|

Ari Azhir, Ph.D.(1)(2)

|

|

|

69

|

|

Director

|

-

(1)

-

Member

of the Audit Committee.

-

(2)

-

Member

of the Compensation Committee.

-

(3)

-

Member

of the Nominating Committee.

James J. Bochnowski.

Mr. Bochnowski has served as a member of our board of directors since February 2014 and as Chairperson of our

board since

June 2014. Since 1988, Mr. Bochnowski has served as the founder and Managing Member of Delphi Ventures, a venture capital firm. In 1980, Mr. Bochnowski co-founded Technology Venture

Investors. Mr. Bochnowski holds an M.B.A. from Harvard University Graduate School of Business and a B.S. in Aeronautics and Astronautics from Massachusetts Institute of Technology.

We

believe Mr. Bochnowski is qualified to serve on our board of directors due to his significant experience with venture capital backed healthcare companies and experience as both

an executive officer and member of the board of directors of numerous companies.

Lisa A. Conte.

Ms. Conte has served as our President, Chief Executive Officer and a member of our board of directors since she

founded the

company in June 2013. From 2001 to 2014, Ms. Conte

8

served

as the Chief Executive Officer of Napo Pharmaceuticals, Inc., a biopharmaceutical company she founded in November 2001. In 1989, Ms. Conte founded Shaman

Pharmaceuticals, Inc., a natural product pharmaceutical company. Additionally, Ms. Conte is Napo Pharmaceutical's current Interim Chief Executive Officer and has served as a member of

its board of directors since 2001. Ms. Conte is also currently a member of the board of directors of Healing Forest Conservatory, a California not-for-profit public benefit corporation and the

Board of Visitors of the John Sloan Dickey Center for International Understanding, Dartmouth College. Ms. Conte holds an M.S. in Physiology and Pharmacology from the University of California,

San Diego, and an M.B.A. and A.B. in Biochemistry from Dartmouth College.

We

believe Ms. Conte is qualified to serve on our board of directors due to her extensive knowledge of our company and experience with our product and product candidates, as well

as her experience managing and raising capital for public and private companies.

Jiahao Qiu.

Mr. Qiu has served as a member of our board of directors since February 2014. Mr. Qiu has been employed at

BioVeda

Management, Ltd., a life science investment firm, as associate (2010-2012), senior associate (2012-2014) and Principal since April 2014. From 2009 to 2010, he served as an interpreter for the

Delegation of the European Union to China. Mr. Qiu holds a B.S. in Biotechnology from the Jiao Tong University in Shanghai, China.

We

believe Mr. Qiu is qualified to serve on our board of directors due to his experience with evaluating, managing and investing in life science portfolio companies for BioVeda

Management, Ltd.

Zhi Yang, Ph.D.

Dr. Yang has served as a member of our board of directors since February 2014. Since 2005, Dr. Yang has

served as the

Chairperson, Managing Partner and Founder of BioVeda Management, Ltd., a life science investment firm. Dr. Yang is currently an advisor to the China Health and Medical Development

Foundation, under China's Ministry of Health. Dr. Yang holds a Ph.D. in Molecular Biology and Biochemistry, as well as an M.A. in Cellular and Developmental Biology, both from Harvard

University.

Folkert W. Kamphuis

Mr. Kamphuis has served as a member of our board of directors since June 2015. Mr. Kamphuis currently has

his own

consulting business. He most recently served as a member of the Executive Committee of the animal health unit of Swiss pharmaceutical giant Novartis until its acquisition by Elanco.

Mr. Kamphuis joined Novartis Animal Health in 2005, and held several executive positions from 2012 to 2014 as General Manager North American and as Chief Operating Officer from 2009 to 2012 and

Head of Global Marketing and Business Development from 2005 to 2009. Prior thereto, Mr. Kamphuis spent 20 years in various executive, business development and global marketing roles at

Pfizer/Pharmacia Animal Health and Merial/Merck AgVet. Mr. Kamphuis served a total of 10 years on the IFAH-Europe board, of which 9 years as treasurer. Mr. Kamphuis holds a

B.A. in Marketing from the Dutch Institute of Marketing, Amsterdam, the Netherlands, and a MSc in Animal Nutrition from the Wageningen University and Research Center, Wageningen, the Netherlands.

We

believe Mr. Kamphuis is qualified to serve on our board of directors due to his extensive experience and education in the animal health sector and is an experienced executive

and strategist in animal health care companies who designs creative and effective companies.

John Micek III.

Mr. Micek has served as a member of our board of directors since April 2016. From 2000 to 2010, Mr. Micek was

managing

director of Silicon Prairie Partners, LP, a Palo Alto, California based family-owned venture fund. Since 2010, Mr. Micek has been managing partner of Verdant Ventures, a merchant bank

dedicated to sourcing and funding university and corporate laboratory spinouts in areas including pharmaceuticals and cleantech. Mr. Micek serves on the board of directors of Armanino Foods of

Distinction, Innovare Corporation and JAL/Universal Assurors. He is also a board member and the Chief Executive Officer and Chief Financial Officer of Enovo Systems and from March 2014 to August 2015

he served as interim Chief Financial Officer for Smith Electric

9

Vehicles, Inc.

Mr. Micek is a cum laude graduate of Santa Clara University and the University of San Francisco School of Law, and is a practicing California attorney specializing in

financial services.

We

believe Mr. Micek is qualified to serve on our board of directors due to his many years of executive experience in management and on boards of director.

Ari Azhir, Ph.D.

Dr. Azhir has served as a member of our board of directors since December 2016. Dr. Azhir is an entrepreneur

and

founder and CEO of two companies focused on central nervous system (CNS) therapeutics: Neuraltus Pharmaceuticals and Neurocea LLC. She has broad experience launching and building life science

companies and has successfully commercialized and brought more than 20 healthcare products to market, ranging from small molecule pharmaceuticals for CNS and dermatology to disruptive technologies in

medical devices. These technologies include flow cytometry products at Becton Dickinson and ultrasound devices at Accuson, where she held executive management positions. Dr. Azhir has

wide-ranging drug development experience and has filed an NDA and gained approval for Luxiq®, a drug that has been successfully commercialized. She also has extensive experience building

strong patent portfolios and is the key inventor and patent holder of 12 patents. She serves on the translational research board of UCSF and has served on private boards (Polar Springs and Neuraltus),

as well as nonprofit boards (The Hearing Society and American Women in Science). Dr. Azhir received her B.SC in Biochemistry and Mathematics, as well as her M.Ph. in Biophysics, from Kings'

College, London University, and received a PhD. in Biophysics from Tehran University.

We

believe Dr. Azhir is qualified to serve on our board of directors due to her many years of executive experience in management and on boards of director and her human heath

experience.

There

are no family relationships among any of our directors and executive officers.

See

"Corporate Governance" and "Compensation of Directors and Executive Officers" below for additional information regarding the Board of Directors.

10

PROPOSAL 2—RATIFICATION OF APPOINTMENT OF THE INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending

December 31, 2017, and the Board is asking stockholders to ratify that selection. Representatives of BDO USA, LLP are expected to attend the Annual Meeting in order to respond to

questions from stockholders and will have the opportunity to make a statement.

Principal Accountant Fees and Services

The following table sets forth the fees billed for audit and other services rendered:

|

|

|

|

|

|

|

|

|

|

|

Years ended

December 31,

|

|

|

|

2016

|

|

2015

|

|

|

Audit Fees

|

|

$

|

413,792

|

|

$

|

459,830

|

|

|

Audit Related Fees

|

|

|

—

|

|

|

—

|

|

|

Tax Fees

|

|

|

—

|

|

|

—

|

|

|

All Other Fees

|

|

|

—

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

413,792

|

|

$

|

459,830

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit

fees include fees and out-of-pocket expenses, whether or not yet invoiced, for professional services provided in connection with the audit of our annual financial statements and

review of our quarterly financial statements. In 2015, audit fees also include fees for our initial public offering. In 2015 and 2016, audit fees include reviews of services provided in connection

with other SEC filings.

Policy on Audit Committee Preapproval of Audit and Permissible Non-audit Services of the Independent Registered Public Accounting Firm

As

specified in the Audit Committee charter, the Audit Committee pre-approves all audit and non-audit services provided by the independent registered public accounting firm prior to the

receipt of such services. Thus, the Audit Committee approved 100% of the services set forth in the above table prior to the receipt of such services and no services were provided under the permitted

de minimus

threshold provisions.

The

Audit Committee of the Board of Directors determined that the provision of such services was compatible with the maintenance of the independence of BDO USA, LLP.

The Board of Directors unanimously recommends that the stockholders vote "FOR" Proposal No. 2 to ratify the appointment of BDO USA, LLP as the

independent registered public accounting firm of Jaguar Animal Health, Inc. for the fiscal year ended December 31, 2017.

11

PROPOSAL 3—APPROVAL, PURSUANT TO NASDAQ LISTING RULE 5635(D), OF THE ISSUANCE OF ADDITIONAL SHARES OF JAGUAR COMMON STOCK TO ASPIRE CAPITAL

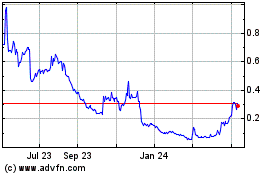

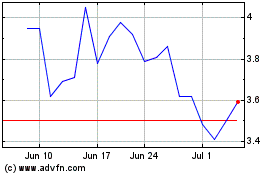

At our annual meeting, holders of our common stock will be asked to approve the issuance of an additional 3,555,514 shares of our common stock

to Aspire Capital pursuant to the common stock purchase agreement, or CSPA, between Aspire Capital and us, dated June 8, 2016. The CSPA limits the number of shares that we can sell to Aspire

Capital thereunder to 2,027,490 shares, which equals 19.99% of our outstanding shares as of the date of the CSPA (such limit, sometimes referred to herein as the 19.99% exchange cap), unless either

(i) we obtain stockholder approval to issue more than such 19.99% exchange cap or (ii) the average price paid for all shares of our common stock issued under the CSPA is equal to or

greater than $1.32 per share, a price equal to the closing sale price of our common stock on the date of the execution of the CSPA, in either case in compliance with Nasdaq Listing

Rule 5635(d).

We

have been using the net proceeds generated from the CSPA to fund our working capital needs and anticipate continuing to do so, subject to stockholder approval of this proposal. As of

April 1, 2017, we sold 2,444,486 shares of our common stock to Aspire Capital pursuant to the CSPA, for gross proceeds of approximately $3,227,134. Because of the 19.99% exchange cap, unless

our stockholders approve this proposal, we will not be able to sell any additional shares to Aspire Capital where the average price paid for all shares issued under the CSPA is below $1.32 per share,

and we would need to seek alternative sources of financing. We are seeking stockholder approval for the issuance of an additional 3,555,514 shares of our common stock under the CSPA, which when

combined with the 2,444,486 shares that we have already sold to Aspire Capital, equals an aggregate of 6,000,000 shares. We would seek additional stockholder approval before issuing more than such

6,000,000 shares.

Background

On June 8, 2016, we entered into the CSPA with Aspire Capital. Upon the terms and subject to the conditions and limitations set forth in

the CSPA, Aspire Capital is committed to purchase up to an aggregate of $15.0 million of our shares of common stock over the approximately 30-month term of the CSPA, which commenced in June

2016. In consideration for entering into the CSPA, concurrently with the execution of the CSPA, we issued to Aspire Capital 456,667 shares of our common stock as a commitment fee (sometimes referred

to herein as the commitment shares). We also concurrently entered into a registration rights agreement with Aspire Capital, in which we agreed to file one or more registration statements as

permissible and necessary to register under the Securities Act of 1933 the sale of the shares of our common stock that have been and may be issued to Aspire Capital under the CSPA. We filed a

registration statement on Form S-1 (File No. 333-212173) registering the sale of up to 3,000,000 shares of our common stock by Aspire Capital, which registration statement was declared

effective by the SEC on July 8, 2016, and then filed a registration statement on Form S-1

(File No. 333-213751) registering the sale of up to 3,000,000 additional shares of our common stock by Aspire Capital, which registration statement was declared effective by the SEC on

October 5, 2016.

As

of April 1, 2017, there were 14,424,128 shares of our common stock outstanding (9,738,436 shares held by non-affiliates), including the 2,444,486 shares previously issued to

Aspire Capital pursuant to the CSPA. If we were to issue to Aspire Capital the remaining 3,555,514 shares of our common stock previously registered under the registration statements described above,

we would have issued a total of 6,000,000 shares to Aspire Capital under the CSPA, which would have represented approximately 33.4% of the total common stock outstanding or approximately 45.1% of the

non-affiliate shares of common stock outstanding as of April 1, 2017. Under the CSPA, we have the right but not the obligation to register for sale more than the 6,000,000 shares of common

stock previously registered.

12

On

July 12, 2016, the conditions necessary for purchases under the CSPA were satisfied. On any trading day on which the closing sale price of our common stock exceeds $0.50, we

have the right, in our sole discretion, to present Aspire Capital with a purchase notice, or each a Purchase Notice, directing Aspire Capital (as principal) to purchase up to 100,000 shares of our

common stock per trading day, up to $15.0 million of our common stock in the aggregate at a per share price, or the Purchase Price, equal to the lesser

of:

-

•

-

the lowest sale price of our common stock on the purchase date; or

-

•

-

the arithmetic average of the three lowest closing sale prices for our common stock during the ten consecutive trading days ending on the

trading day immediately preceding the purchase date.

In

addition, on any date on which we submit a Purchase Notice for 100,000 shares to Aspire Capital, we also have the right, in our sole discretion, to present Aspire Capital with a

volume-weighted average price purchase notice, or each a VWAP Purchase Notice, directing Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of our common stock

traded on the Nasdaq Capital Market on the next trading day, or the VWAP Purchase Date, subject to a maximum number of shares we may determine, or the VWAP Purchase Share Volume Maximum, and a minimum

trading price, or the VWAP Minimum Price Threshold (as more specifically described below). The purchase price of such shares, or the VWAP Purchase Price, is the lower

of:

-

•

-

the closing sale price on the VWAP Purchase Date; or

-

•

-

97% of the volume-weighted average price for our common stock traded on the NASDAQ Capital Market:

-

•

-

on the VWAP Purchase Date, if the aggregate shares to be purchased on that date have not exceeded the VWAP Purchase Share Volume

Maximum or

-

•

-

during that portion of the VWAP Purchase Date until such time as the sooner to occur of (i) the time at which the aggregate

shares traded on the NASDAQ Capital Market exceed the VWAP Purchase Share Volume Maximum or (ii) the time at which the sale price of our common stock falls below the VWAP Minimum Price

Threshold.

The

Purchase Price will be adjusted for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring during the trading day(s) used to

compute the Purchase Price. We may deliver multiple Purchase Notices and VWAP Purchase Notices to Aspire Capital from time to time during the term of the CSPA, so long as the most recent purchase has

been completed.

The

CSPA and registration rights agreement are attached as Exhibit 10.1 and Exhibit 4.1, respectively, to our Current Report on Form 8-K filed with the SEC on

June 9, 2016.

Stockholder Approval Requirement

As noted above, the CSPA restricts the amount of shares that may be sold to Aspire Capital to the 19.99% exchange cap, or 2,027,490 shares. We

can remove this 19.99% exchange cap by obtaining stockholder approval in compliance with the applicable Listing Rules of the Nasdaq Stock Market. Our common stock is listed on the Nasdaq Capital

Market and, as such, we are subject to the Nasdaq Listing Rules.

Pursuant

to Nasdaq Listing Rule 5635(d), stockholder approval is required prior to the issuance of securities in connection with a transaction other than a public offering

involving: (i) the sale, issuance or potential issuance by us of common stock (or securities convertible into or exercisable for common stock) at a price less than the greater of book or market

value which together with sales by our officers, directors or substantial stockholders equals 20% or more of common stock or 20% or more of

13

the

voting power outstanding before the issuance; or (ii) the sale, issuance or potential issuance by us of common stock (or securities convertible into or exercisable common stock) equal to

20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the greater of book or market value of the stock. Stockholder approval of this proposal

will constitute stockholder approval for purposes of Nasdaq Listing Rule 5635(d).

We

are seeking stockholder approval for the issuance of an additional 3,555,514 shares of our common stock under the CSPA, which when combined with the 2,444,486 shares that we have

already sold to Aspire Capital, equals an aggregate of 6,000,000 shares. Our Board of Directors previously reserved 6,000,000 shares for issuance under the CSPA, and we would seek additional

stockholder approval before issuing more than such 6,000,000 shares. We would also seek additional stockholder approval before agreeing to any increase in the value of the shares of common stock that

we may issue to Aspire Capital under the CSPA above $15.0 million.

Reasons for Transaction and Effect on Current Stockholders

Our Board of Directors has determined that the CSPA with Aspire Capital is in the best interests of us and our stockholders because the right to

sell shares to Aspire Capital provides us with a reliable source of capital and the ability to access that capital when and as needed.

The

CSPA does not affect the rights of the holders of our shares of common stock currently outstanding, but the sale of shares to Aspire Capital pursuant to the terms of the CSPA will

have a dilutive effect on the existing stockholders, including the voting power and economic rights of the existing stockholders. If we were to sell to Aspire Capital all 3,555,514 shares we are

seeking stockholder approval to issue under the CSPA, Aspire Capital would have purchased in the aggregate under the CSPA approximately 33.4% of our outstanding shares.

The

CSPA provides that we shall not issue, and Aspire Capital shall not purchase, any shares of our common stock under the CSPA if such shares proposed to be issued and sold, when

aggregated with all other shares of our common stock then owned beneficially (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended) by Aspire Capital and

its affiliates, would result in the beneficial ownership by Aspire Capital and its affiliates of more than 19.99% of then issued and outstanding shares of our common stock. Unlike the 19.99% exchange

cap, which limits the aggregate number of shares we may issue to Aspire Capital under the CSPA, this beneficial ownership limitation limits the number of shares Aspire Capital may beneficially own at

any one time to 19.99% of our outstanding common stock. Consequently, the number of shares Aspire Capital may beneficially own in compliance with the beneficial ownership limitation may increase over

time as the number of outstanding shares of our common stock increases over time. Aspire Capital may sell some or all of the shares it purchases under the CSPA, permitting it to purchase additional

shares in compliance with the beneficial ownership limitation. The beneficial ownership limitation reflects the requirements of Nasdaq Listing Rule 5635(b), which requires stockholder approval

prior to the issuance of securities when the issuance or potential issuance will result in a change of control of Jaguar. Generally, Nasdaq considers a change of control to have occurred when, as a

result of an issuance, an investor would own, or have the right to acquire, 20% or more of the outstanding shares of our common stock and such ownership is the largest ownership position. We are not

seeking stockholder approval to lift such 19.99% beneficial ownership limitation. However, even with the beneficial ownership limitation, Aspire Capital may be in a position to exert influence over us

and there is no guarantee that the interests of Aspire Capital will align with the interests of other stockholders.

Our

stockholders are not entitled to dissenters' rights with respect to this proposal, and we will not independently provide stockholders with any such right.

The Board of Directors unanimously recommends that the stockholders vote "FOR" Proposal No. 3 to issue additional shares of our common stock to Aspire

Capital in accordance with the stockholder approval requirements of NASDAQ Listing Rule 5635(d).

14

CORPORATE GOVERNANCE

Director Independence

Our common stock is listed on The NASDAQ Capital Market. Under the NASDAQ rules, independent directors must comprise a majority of a listed

company's board of directors. In addition, NASDAQ rules require that, subject to specified exceptions, each member of a listed company's Audit, Compensation and Nominating Committee be independent.

Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Under the NASDAQ rules, a

director will only qualify as an "independent director" if, in the opinion of that company's board of directors, that person does not have a relationship that would interfere with the exercise of

independent judgment in carrying out the responsibilities of a director.

To

be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit

committee, our board of directors, or any other board committee (1) accept, directly or indirectly, any consulting, advisory, or

other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries.

In

February 2017, our board of directors undertook a review of its composition, the composition of its committees and the independence of our directors and considered whether any

director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested

from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our board of directors has determined that six of our seven directors

do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is "independent" as that

term is defined under the NASDAQ rules. Our board of directors also determined that Mr. Micek (chairperson), Mr. Bochnowski, Mr. Qiu, Dr. Yang and Dr. Azhir, who

comprise our Audit Committee, Mr. Bochnowski (chairperson), Mr. Kamphuis, Mr. Micek and Dr. Azhir, who comprise our Compensation Committee, and Mr. Bochnowski

(chairperson), Mr. Kamphuis and Mr. Micek, who comprise our Nominating Committee, satisfy the independence standards for those committees established by applicable SEC rules and the

NASDAQ rules and listing standards.

In

making this determination, our board of directors considered the relationships that each non-employee director has with us and all other facts and circumstances our board of directors

deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The members of our Audit Committee are Mr. Micek, Mr. Bochnowski, Mr. Qiu, Dr. Yang and Dr. Azhir.

Mr. Micek is the chairperson of the Audit Committee. Our Audit Committee's responsibilities include:

-

•

-

appointing, approving the compensation of, and assessing the independence of our registered public accounting firm;

-

•

-

overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from that

firm;

-

•

-

reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements

and related disclosures;

15

-

•

-

monitoring our internal control over financial reporting, disclosure controls and procedures and code of conduct;

-

•

-

discussing our risk management policies;

-

•

-

establishing policies regarding hiring employees from our independent registered public accounting firm and procedures for the receipt and

retention of accounting related complaints and concerns;

-

•

-

reviewing and approving or ratifying any related person transactions; and

-

•

-

preparing the Audit Committee report required by SEC rules.

All

audit and non-audit services, other than

de minimis

non-audit services, to be provided to us by our independent registered public

accounting firm must be approved in advance by our Audit Committee.

Our

board of directors has determined that each of Mr. Micek, Mr. Bochnowski, Mr. Qiu, Dr. Yang and Dr. Azhir is an independent director under NASDAQ

rules and under Rule 10A-3. All members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and NASDAQ. Our board of

directors has determined that Mr. Micek is an "audit committee financial expert," as defined by applicable SEC rules, and has the requisite financial sophistication as defined under the

applicable NASDAQ rules and regulations.

The

Audit Committee held one meeting in 2016. The audit committee has adopted a written charter approved by our Board of Directors, which is available on our website at:

http://phx.corporate-ir.net/phoenix.zhtml?c=253723&p=irol-govhighlights

The members of our Compensation Committee are Mr. Bochnowski, Mr. Kamphuis, Mr. Micek and Dr. Azhir.

Mr. Bochnowski is the chairperson of the Compensation Committee. Our Compensation Committee's responsibilities include:

-

•

-

determining, or making recommendations to our board of directors with respect to, the compensation of our Chief Executive Officer;

-

•

-

determining, or making recommendations to our board of directors with respect to, the compensation of our other executive officers;

-

•

-

overseeing and administering our cash and equity incentive plans;

-

•

-

reviewing and making recommendations to our board of directors with respect to director compensation;

-

•

-

reviewing and discussing at least annually with management our "Compensation Discussion and Analysis" disclosure if and to the extent then

required by SEC rules; and

-

•

-

preparing the Compensation Committee report and necessary disclosure in our annual proxy statement in accordance with applicable SEC rules.

Our

board has determined that each of Mr. Bochnowski, Mr. Kamphuis, Mr. Micek and Dr. Azhir is independent under the applicable NASDAQ rules and regulations,

is a "non-employee director" as defined in Rule 16b-3 promulgated under the Exchange Act, and is an "outside director" as that term is defined in Section 162(m) of the Internal Revenue

Code of 1986, as amended.

The

Compensation Committee held one meeting in 2016. All compensation-related matters were approved at the Board level. The Compensation Committee has adopted a written charter approved

by

16

the

Board of Directors, which is available on our website at: http://phx.corporate-ir.net/phoenix.zhtml?c=253723&p=irol-govhighlights

The members of our Nominating Committee are Mr. Bochnowski, Mr. Kamphuis and Mr. Micek. Mr. Bochnowski is the

chairperson of the Nominating Committee. Our Nominating Committee's responsibilities include:

-

•

-

identifying individuals qualified to become members of our board of directors;

-

•

-

evaluating qualifications of directors;

-

•

-

recommending to our board of directors the persons to be nominated for election as directors and to each of the committees of our board of

directors; and

-

•

-

overseeing an annual evaluation of our board of directors.

The

Nominating Committee held one meeting in 2016. All nomination-related matters were approved at the Board level. The Nominating Committee has adopted a written charter approved by the

Board of Directors, which is available on our website at: http://investors.jaguaranimalhealth.com/phoenix.zhtml?c=253723&p=irol-govhighlights.

Meetings and Attendance During 2016

The Board held ten meetings in 2016. With one exception (as described below), each director who served as a director during 2016 participated in

75% or more of the meetings of the Board and of the committees on which he or she served, if any, during the year ended December 31, 2016 (during the period that such director served).

Dr. Yang attended one of the ten meetings of the Board and all of the meetings of the Audit Committee on which he served during the year ended December 31, 2016.

We

do not have a written policy on board attendance at annual meetings of stockholders. We encourage, but do not require, our directors to attend the Annual Meeting.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our directors, officers and employees, including our President and Chief

Executive Officer, our Chief Financial Officer and other employees who perform financial or accounting functions. The Code of Business Conduct and Ethics sets forth the basic principles that guide the

business conduct of our employees. A current copy of the code is on our website at http://investors.jaguaranimalhealth.com/phoenix.zhtml?c=253723&p=irol-govhighlights. We intend to disclose future

amendments to certain provisions of our code of business conduct and ethics, or waivers of such provisions on our website to the extent required by applicable rules and exchange requirements. The

inclusion of our website address in this proxy statement does not incorporate by reference the information on or accessible through our website into this proxy statement.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee has ever been an officer or employee of our company. None of our executive officers currently

serves, or in the past year has served, as a member of the board of directors or Compensation Committee or other board committee performing equivalent functions of any entity that has one or more of

its executive officers serving on our board of directors or Compensation Committee.

17

Limitation of Liability and Indemnification

Our second amended and restated certificate of incorporation and amended and restated bylaws contain provisions that limit the personal

liability of our directors for monetary damages to the fullest extent permitted by Delaware law. Delaware law provides that directors of a corporation will not be personally liable to us or our

stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for:

-

•

-

any breach of the director's duty of loyalty to us or our stockholders;

-

•

-

any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

-

•

-

unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General

Corporation Law, or DGCL; or

-

•

-

any transaction from which the director derived an improper personal benefit.

Such

limitation of liability does not apply to liabilities arising under federal securities laws and does not affect the availability of equitable remedies, such as injunctive relief or

rescission.

Our

second amended and restated certificate of incorporation provides that we indemnify our directors to the fullest extent permitted by Delaware law. In addition, our amended and

restated bylaws provide that we indemnify our directors and officers to the fullest extent permitted by Delaware law. Our amended and restated bylaws also provide that we shall advance expenses

incurred by a director or officer in advance of the final disposition of any action or proceeding, and permit us to secure insurance on behalf of any officer, director, employee or other agent for any

liability arising out of his or her actions in that capacity, regardless of whether we would otherwise be permitted to indemnify him or her under the provisions of Delaware law. We have entered and

expect to continue to enter into agreements to indemnify our directors, executive officers and other employees as determined by our board of directors. With certain exceptions, these agreements

provide for indemnification for related expenses including, among others, attorneys' fees, judgments, fines and settlement amounts incurred by any of these individuals in any action or proceeding. We

believe that these bylaw provisions and indemnification agreements are necessary to attract and retain qualified persons as directors and officers. We also maintain directors' and officers' liability

insurance.

The

limitation of liability and indemnification provisions in our second amended and restated certificate of incorporation and amended and restated bylaws and our indemnification

agreements, may discourage stockholders from bringing a lawsuit against our directors for breach of their fiduciary duty of care. They may also reduce the likelihood of derivative litigation against

our directors and officers, even though an action, if successful, might benefit us and other stockholders. Furthermore, a stockholder's investment may be adversely affected to the extent that we pay

the costs of settlement and damage awards against directors and officers. There is no pending litigation or proceeding involving any of our directors, officers or employees for which indemnification

is sought, and we are not aware of any threatened litigation that may result in claims for indemnification.

Board Leadership Structure

Our second amended and restated bylaws and corporate governance guidelines provide our board of directors with flexibility in its discretion to

combine or separate the positions of Chairperson of the board and chief executive officer. As a general policy, our board of directors believes that separation of the positions of Chairperson and

chief executive officer reinforces the independence of the board of directors from management, creates an environment that encourages objective oversight of management's performance and enhances the

effectiveness of the board of directors as a whole. We

18

expect

and intend the positions of Chairperson of the board and chief executive officer to be held by two individuals in the future.

Risk Oversight

Our board of directors monitors our exposure to a variety of risks through our Audit Committee. Our Audit Committee charter gives the Audit

Committee responsibilities and duties that include discussing with management and the independent auditors our major financial risk exposures and the steps management has taken to monitor and control

such exposures, including our risk assessment and risk management policies.

Nomination of Directors

There have been no material changes to the procedures by which stockholders may recommend nominees to our Board of Directors. Recommendations to

the Board of Directors for election as directors of Jaguar at an annual meeting may be made only by the Nominating Committee or by the Company's stockholders (through the Nominating Committee) who

comply with the timing, informational, and other requirements of our Bylaws. Stockholders have the right to recommend persons for nomination by submitting such recommendation, in written form, to the

Nominating Committee, and such recommendation will be evaluated pursuant to the policies and procedures adopted by the Board. Such recommendation must be delivered to or mailed to and received by the

Secretary of the Company at the principal executive offices not later than 120 calendar days prior to the anniversary of the date the Company's prior year proxy statement was first made available to

stockholders, except that if no annual meeting of stockholders was held in the preceding year or if the date of the annual meeting of stockholders has been changed by more than 30 calendar days from

the date contemplated at the time of the preceding year's proxy statement, the notice shall be received by the Secretary at the Company's principal executive offices not less than 150 calendar days

prior to the date of the contemplated annual meeting or the date that is 10 calendar days after the date of the first public announcement or other notification to stockholders of the date of the

contemplated annual meeting, whichever first occurs. The deadline to submit recommendations for election as directors at the 2017 Annual Meeting has already passed. Stockholders who wish to present

proposals for inclusion in the proxy materials to be distributed in connection with next year's Annual Meeting proxy statement must submit their proposals so that they are received by the Company

before December [ ], 2017, which is 120 calendar days before April [ ], the date on which the

Company's prior

year's proxy statement

was first made available to the Company's stockholders. The Board of Directors has not yet determined the date of the 2018 Annual Meeting of the Company's Stockholders, but does not currently

anticipate that the date will be changed by more than 30 calendar days from the date of this year's annual meeting.

The

Nominating Committee, in accordance with the board's governance principles, seeks to create a board that has the ability to contribute to the effective oversight and management of

the Company, that is as a whole strong in its collective knowledge of and diversity of skills and experience with respect to accounting and finance, management and leadership, vision and strategy,

business judgment, biotechnology industry knowledge, corporate governance and global markets. When the Nominating Committee reviews a potential new candidate, the Nominating Committee looks

specifically at the candidate's qualifications in light of the needs of the Board and the Company at that time given the then current mix of director attributes.

General

criteria for the nomination and evaluation of director candidates include:

-

•

-

loyalty and commitment to promoting the long term interests of the Company's stockholders;

-

•

-

the highest personal and professional ethical standards and integrity;

19

-

•

-

an ability to provide wise, informed and thoughtful counsel to top management on a range of issues;

-

•

-

a history of achievement that reflects superior standards for themselves and others;

-

•

-

an ability to take tough positions in constructively-challenging the Company's management while at the same time working as a team player; and

-

•

-

individual backgrounds that provide a portfolio of personal and professional experience and knowledge commensurate with the needs of the

Company.

The

Nominating Committee must also ensure that the members of the board as a group maintain the requisite qualifications under the applicable NASDAQ Stock Market listing standards for

populating the Audit, Compensation and Nominating Committees.

Written

recommendations from a stockholder for a director candidate must include the following information:

-

•

-

the stockholder's name and address, as they appear on our corporate books;

-

•

-

the class and number of shares that are beneficially owned by such stockholder;

-

•

-

the dates upon which the stockholder acquired such shares; and

-

•

-

documentary support for any claim of beneficial ownership.

Additionally,

the recommendation needs to include, as to each person whom the stockholder proposes to recommend to the Nominating Committee for nomination to election or reelection as a

director, all information relating to the person that is required pursuant to Regulation 14A under the Exchange Act, as amended, and evidence satisfactory to us that the nominee has no

interests that would limit their ability to fulfill their duties of office.

Once

the Nominating Committee receives a recommendation, it will deliver a questionnaire to the director candidate that requests additional information about his or her independence,

qualifications and other information that would assist the Nominating Committee in evaluating the individual, as well as certain information that must be disclosed about the individual in the

Company's proxy statement, if nominated. Individuals must complete and return the questionnaire within the time frame provided to be considered for nomination by the Nominating Committee.

The

Nominating Committee will review the stockholder recommendations and make recommendations to the Board of Directors that the Committee feels are in the best interests of the Company

and its stockholders.

The

Nominating Committee has not received any recommendations from stockholders for the 2017 Annual Meeting.

Communications with the Board of Directors

Stockholders may contact an individual director or the Board as a group, or a specified Board committee or group, including the non-employee

directors as a group, by the following means:

|

|

|

|

|

|

|

Mail:

|

|

Attn: Board of Directors

Jaguar Animal Health, Inc.

201 Mission Street, Suite 2375

San Francisco, CA 94105

|

|

|

|

Email:

|

|

AskBoard@jaguaranimalhealth.com

|

|

|

20

Each

communication should specify the applicable addressee or addressees to be contacted as well as the general topic of the communication. We will initially receive and process

communications before forwarding them to the addressee. We also may refer communications to other departments within the Company. We generally will not forward to the directors a communication that is

primarily commercial in nature, relates to an improper or irrelevant topic, or requests the Company's general information.

Complaint and Investigation Procedures for Accounting, Internal Accounting Controls, Fraud or Auditing

Matters

We have created procedures for confidential submission of complaints or concerns relating to accounting or auditing matters and contracted with

NASDAQ to facilitate the gathering, monitoring and delivering reports on any submissions. As of the date of this report, there have been no submissions of complaints or concerns to NASDAQ. Complaints