Notice of Exempt Solicitation. Definitive Material. (px14a6g)

April 07 2017 - 4:38PM

Edgar (US Regulatory)

RE: Please Vote AGAINST the Say - on-Pay Proposal at Tenet Healthcare Corp. (NYSE: THC) on May 4, 2017

Dear Fellow Tenet Shareholder:

We urge you to Vote No on the advisory vote to Approve Executive Compensation ( Say- on-Pay ) at Tenet's annual shareholder meeting on May 4, 2017, due to troubling, regressive developments in the company s pay practices that undermine recent, purported reforms. Among other things:

-

Pay levels primed to rise again: A center piece of this year s CD&A, a reduction in targeted compensation, is set to be walked back in fiscal 2017 with Long-term Incentive (LTI) awards returning to prior, elevated levels.

-

New flawed, LTI award undercuts pay-for-performance reform: Despite significant market volatility, driven in part by the uncertainty over health care policy, the company has issued a new performance-based stock option award with a price hurdle that is less than 5% higher than where the stock was trading just two days earlier.

Tenet s stock price is down roughly 40% over the past year underperforming all but one of its direct publicly traded competitors. 1 And despite claims of meaningful reforms to executive pay practices after a significant number of shares were cast against say-on-pay in 2015, recent compensation decisions by the board suggest notable backsliding. With leading compensation research firm, Equilar, ranking the company s current three -year pay-for -performance profile in the 4th percentile of the Russell 3000, pay levels should be continuing to moderate, rather than rebounding to prior levels.

These changes also send the wrong message to shareholders about executive accountability; the company recently paid $513 million far more than the $20 million the company originally projected to settle criminal and civil claims accusing the chain of paying kickbacks to a pre-natal clinic for steering pregnant Medicaid patients to Tenet hospitals. This of course, unfortunately, marks just the latest in a string of costly fraud cases at Tenet, with the company having recorded more than $2.1 billion in legal settlement and investigative costs since 2003.

Teamster affiliated pension and benefit funds have more than $100 billion invested in the capital markets and have substantial holdings in Tenet.

1 As of April 4, 2017, Tenet shares were down 41% over the past year compared to an 11% gain for HCA Holdings, and declines of 2%, 8% and 54% at Universal Health Services, LifePoint Health and Community Health Systems, respectively collectively the company s direct peers, according to the proxy statement.

This is not a solicitation of authority to vote your proxy. Pleast DO NOT send us your proxy card as it will not be accepted.

April 2017

Page 2

Pay levels primed to rise again

|

The touted reduction in the target value of CEO Trevor Fetter s 2016 LTI award, $7.2 million, looks to be a one -time gesture, with fiscal 2017 grants set to again total around $ 9 million -- the target level in fiscal 2015.

Following criticism over its long-time practice of targeting above -median compensation for CEO Fetter and the company s pay-for -performance practices more generally, we note the Compensation Committee determined to set CEO Fetter s fiscal 2016 compensation opportunities at the 25 th percentile of the company s peer median. The reduction was largely accounted for by a smaller LTI award, which the proxy reports was also in response to Tenet s poor share performance in the second half of 2015 and first several months of 2016.

Despite a further 40% decline in the stock price over the intervening 12 months, however, CEO Fetter s fiscal 2017 LTI grants -- based on an analysis of Form 4 filings -- appear to be targeting an award opportunity of $9 million. We note that in a March 1, 2017, SEC filing, the company disclosed it had granted 157,978 restricted share units to CEO Fetter -- carrying a grant date value of just over $3 million. The award, as noted on page 32 of the proxy statement, represents one -third of his total fiscal 2017 LTI opportunity, suggesting a total LTI opportunity of at least $9 million.

New flawed, LTI award undercuts pay -for- performance reform

Critically, in rationalizing the increased LTI opportunity in 2017, the Compensation Committee refers to a greater emphasis on performance -based pay elements in 2017. What the committee appears to be referencing here is a new grant of performance -based stock options that supplements the existing use of performance -vesting and time -vesting restricted share units. Unfortunately, the fiscal 2017 option grant represents a far from robust pay-for -performance incentive vehicle.

According to the proxy statement, the new option award is contingent on the achievement of a 25% increase in the stock price anytime over a three -year period. For a stock that has given up more than 70% since September 2014, and has suffered significant volatility amid the uncertainty over health care reform, it is not clear this award is a particularly efficient or effective means of incentivizing and rewarding executive decision-making. Even more concerning is the fact that the award represents less than a 5% price hurdle to where the stock was trading just two days prior to the award.

Conclusion

In this year s proxy, the company touts a substantial redesign of its executive pay program and reductions in executive pay. Investors, however, have reason to be skeptical that this will address the company s poor pay-for -performance profile, given the size and structure of LTI awards granted in fiscal 2017. Accordingly, we urge shareholders to Vote No on Say-on -Pay on May 4.

For more information, please contact Carin Zelenko, Teamsters Capital Strategies at: (202) 624-6899 or by email at: czelenko@teamster. org .

Ken Hall

General Secretary-Treasurer

KH/cz

|

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy as it will not be accepted.

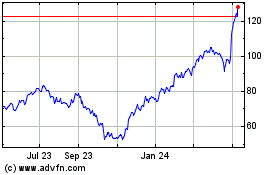

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Mar 2024 to Apr 2024

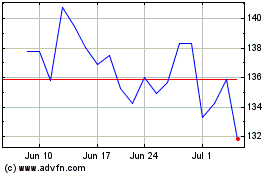

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Apr 2023 to Apr 2024