Current Report Filing (8-k)

April 07 2017 - 4:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington

, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

April

6

,

201

7

|

|

|

|

|

The First of Long Island Corporation

|

|

(Exact name of the registrant as specified in its charter)

|

|

|

|

|

|

New York

|

001-32964

|

11-

2672906

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

10 Glen Head Road

|

|

|

Glen Head

, New York

|

11

545

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(

516

)

671

-

49

00

(Registrant

’s telephone number)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

|

□

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

□

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

□

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

□

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c)

|

|

Item

5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(e)

On April 6, 2017, The First of Long Island Corporation (the “Company”) and The First National Bank of Long Island (the “Bank”) entered into an amended and restated employment agreement (the “Amended Agreement”) with Michael Vittorio, President and Chief Executive Officer of the Company and the Bank. The Amended Agreement replaces Mr. Vittorio’s existing employment agreement with the Company and the Bank dated January 3, 2005 and as amended December 15, 2008 (the “Prior Agreement”). The terms of the Amended Agreement are generally consistent with the Prior Agreement, except that certain provisions were revised to be more aligned with best practices for executive agreements. In addition, and to better reflect and accommodate ongoing succession planning, the term of the Amended Agreement has been fixed at three years, which can be extended for a year by the Company.

The term of the Amended Agreement is for three years, commencing retroactively as of January 1, 2017, and ending on December 31, 2019 (the “Employment Period”). Following the Employment Period, the Board of Directors may elect to extend the Amended Agreement for an additional year through December 31, 2020 (the “Extended Period”). During the Employment Period, Mr. Vittorio will continue to serve as President and Chief Executive Officer of the Company and the Bank, and will be proposed for election to the Board of Directors of the Company at each annual meeting of shareholders at which Executive must stand for election in order to continue as a director. During the Extended Period, Mr. Vittorio’s position (and related duties) with the Company and Bank may be modified by the Board of Directors to reflect the Board’s determinations as to CEO succession planning, provided that Mr. Vittorio’s base salary and benefits in effect as of such date remain the same.

If Mr. Vittorio’s employment is terminated without cause, including a resignation for good reason (as defined in the Amended Agreement) during the Employment or Extended Periods (including on or after the effective time of a change in control of the Company or the Bank), but excluding termination for cause or due to death or disability, Mr. Vittorio would be entitled to: (1) a cash lump sum payment equal to three times his annual base salary; and (2) a cash lump sum payment equal to 36 times the estimated monthly cost of the medical, dental and vision coverage maintained by the Bank for Mr. Vittorio prior to his date of termination (the “Severance Payment”). If the qualifying termination event is not in connection with a change in control, Mr. Vittorio’s outstanding restricted stock units would become vested and payable under the same terms and conditions as would apply upon his retirement as set forth in his underlying award agreements with the Company.

In the event that an excise tax under Sections 280G and 4999 of the Internal Revenue Code would be assessed on the payments or other benefits received under the agreement in connection with a change in control,

Mr. Vittorio would receive either (1) all the payments and benefits to which he is entitled under the Amended Agreement, subject to the excise tax; or (2) have such payments and benefits reduced by the minimum amount necessary so that excise tax will not apply, if such reduction would result in a greater net after-tax benefit to the executive.

In the event of Mr. Vittorio

’s termination of employment for any reason (including as a result of his retirement due to the expiration of the Employment Period or the Extended Period, as applicable), such termination shall also constitute Mr. Vittorio’s resignation from the Board of Directors of the Company and the Bank, effective as provided in the Amended Agreement. Following termination of employment, Mr. Vittorio is subject to certain non-compete and non-solicitation provisions.

The foregoing description of the

Amended Agreement does not purport to be complete and it is qualified in its entirety by reference to the copy of the Amended Agreement that is included as Exhibit 10.1 to this Current Report and incorporated by reference into this Item 5.02.

Item 9.01.

Financial Statements and Exhibits.

|

(a)

|

Financial Statements of Businesses Acquired.

|

Not Applicable.

|

|

|

|

|

|

(b)

|

Pro Forma Financial Information.

|

Not Applicable.

|

|

|

|

|

|

(c)

|

Shell Company Transactions.

|

Not Applicable.

|

|

|

|

|

|

(d)

|

Exhibits

|

Description

|

|

|

|

|

|

|

10.1

|

Employment

Agreement by and between Michael Vittorio, The First of Long Island Corporation and The First National Bank of Long Island, effective January 1, 2017.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

The First of Long Island Corporation

(Registrant)

By:

/s/

Mark D. Curtis

Mark D. Curtis

Senior Executive Vice President, Chief

Financial Officer & Treasurer

Dated:

April 7, 2017

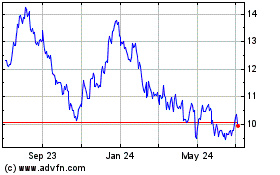

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Apr 2023 to Apr 2024