QuickLinks

-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

Filed by the Registrant

ý

|

Filed by a Party other than the Registrant

o

|

Check the appropriate box:

|

o

|

|

Preliminary Proxy Statement

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

ý

|

|

Definitive Proxy Statement

|

o

|

|

Definitive Additional Materials

|

o

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

|

|

Dillard's Inc.

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

ý

|

|

No fee required.

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Saturday, May 20, 2017

The

2017 Annual Meeting of Stockholders (the "

Annual Meeting

") of Dillard's, Inc. (the

"

Company

") will be held at the Company's Corporate Office, 1600 Cantrell Road, Little Rock, Arkansas 72201 on Saturday, May 20, 2017, at

9:00 a.m. CDT for the following purposes:

-

1.

-

To

elect as directors the twelve nominees named in the attached Proxy Statement (four of whom are to be elected by Class A stockholders and eight of whom are

to be elected by Class B stockholders).

-

2.

-

To

ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for fiscal 2017.

-

3.

-

To

approve an amendment to the Dillard's, Inc. 2005 Non-Employee Director Restricted Stock Plan to increase the number of shares available for issuance from

200,000 to 400,000 shares.

-

4.

-

To

conduct an advisory vote on the compensation of the Company's named executive officers.

-

5.

-

To

conduct an advisory vote on the frequency of future advisory votes on the compensation of the Company's named executive officers.

-

6.

-

To

consider and act upon a stockholder proposal to separate the positions of the Chairman and Chief Executive Officer of the Company, if properly presented at the

Annual Meeting.

-

7.

-

To

transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

Details

regarding the business to be conducted are more fully described in the accompanying Proxy Statement.

Only

stockholders of record at the close of business on March 23, 2017, will be entitled to notice of, and to vote at, the meeting or adjournments or postponements thereof.

Your

participation in the meeting is earnestly solicited. Even if you expect to attend the meeting, we encourage you to vote in advance by proxy. The giving of a proxy does not affect

your right to revoke it later or vote your shares in person in the event you should attend the Annual Meeting.

|

|

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

DEAN L. WORLEY

Vice President, General Counsel, Corporate Secretary

|

Little

Rock, Arkansas

April 7, 2017

Important notice regarding the availability of proxy materials for the 2017 Annual Meeting of Stockholders to be held on May 20, 2017. The accompanying Proxy Statement

and the Company's Annual Report on Form 10-K are available at http://investor.shareholder.com/dillards/annuals.cfm

DILLARD'S, INC.

1600 CANTRELL ROAD

LITTLE ROCK, ARKANSAS 72201

Telephone (501) 376-5200

PROXY STATEMENT

April 7, 2017

General

The enclosed proxy is solicited by and on behalf of the Board of Directors (the "

Board

") of

Dillard's, Inc., a Delaware corporation (the "

Company

," "

Dillard's

,"

"

we

," "

us

," or "

our

"), for use at the 2017 Annual

Meeting of Stockholders (the "

Annual Meeting

") to be held on Saturday, May 20, 2017, at 9:00 a.m. CDT, at our principal executive offices,

1600 Cantrell Road, Little Rock, Arkansas, 72201, or at any adjournments or postponements thereof.

Internet Availability of Proxy Materials

In accordance with the rules of the Securities and Exchange Commission (the "

SEC

"), we sent a

Notice of Internet Availability of Proxy Materials on or about April 7, 2017 to our stockholders of record as of the close of business on March 23, 2017. We also provided access to our

proxy materials via the Internet beginning on that date. If you received a Notice of Internet Availability of Proxy Materials by mail and did not receive, but would like to receive, a printed copy of

our proxy materials, you should follow the instructions for requesting such materials included in this proxy statement or in the Notice of Internet Availability of Proxy Materials.

Proxy Voting

The manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your shares are

represented by certificates or book entries in your name so that you appear as a stockholder on the records of our stock transfer agent, you may vote by proxy, meaning you authorize individuals named

on the proxy card to vote your shares. You may provide this authorization by voting via the Internet at www.proxyvote.com, by telephone by calling the toll-free telephone number provided in your

Notice of Internet Availability of Proxy Materials or (if you have requested paper copies of our proxy materials) by mail by simply signing, dating and mailing a proxy card. In these circumstances, if

you do not vote by proxy or in person at the Annual Meeting, your shares will not be voted.

If

you own your shares in "street name," that is, through a brokerage account or in another nominee form, you are a beneficial owner and not a stockholder of record, and therefore must

provide instructions to your broker or nominee as to how your shares held by them should be voted. Your ability to vote in person, via the internet, by mail, or by telephone depends on the voting

procedures of your broker or nominee. Please follow the directions that your broker or nominee provides. In these circumstances, if you do not provide voting instructions, the broker or nominee may

nevertheless vote your shares on your behalf with respect to the ratification of the appointment of KPMG LLP ("

KPMG

") as our independent auditors

for fiscal 2017, but not on any other matters being considered at the meeting.

All

proxies related to shares held of record as of March 23, 2017, other than those held through the Dillard's Stock Fund portion of the Dillard's, Inc. Investment &

Employee Stock Ownership Plan (the "

401(k) Plan

"), must be submitted no later than 11:59 p.m. EDT on May 19, 2017, and no proxy

1

received

after that date and time will be voted at the Annual Meeting. If a stockholder holds Company shares through the 401(k) Plan, such stockholder is entitled to instruct Evercore Trust Company,

N.A. ("

Evercore

"), Trustee for the 401(k) Plan ("

Trustee

"), on how to vote such shares, provided that

his or her voting instructions are submitted in accordance with the instructions on the proxy card and received by May 17, 2017 or submitted in accordance with the instructions on the Notice of

Internet Availability of Proxy Materials and received by no later than 11:59 p.m. EDT on May 17, 2017 in order to allow sufficient time for votes within the 401(k) Plan to be tabulated

by the Trustee. For any shares held through the 401(k) Plan for which timely voting instructions are not received from a 401(k) Plan participant or if no choice is specified on a particular proposal

in voting instructions that are timely submitted, such shares will be voted in accordance with the recommendations of the Board of Directors ("

Board

")

as described herein.

Revocation of Proxies

Any stockholder of record giving a proxy has the power to revoke it at any time before it is voted either by written revocation delivered to the

Corporate Secretary of the Company at our principal executive offices, by attending the Annual Meeting and voting in person, or by submitting a subsequent proxy by mail, over the Internet or by

telephone. To obtain directions to attend the Annual Meeting and vote in person, please call (501) 376-5965. Proxies solicited herein will be voted in accordance with any directions contained

therein, unless the proxy is received in such form or at such time as to render it ineligible to vote, or unless properly revoked. If no choice is specified by a stockholder in a returned proxy, the

shares will be voted in accordance with the recommendations of the Board as described herein. If matters of business other than those described in this proxy statement

properly come before the Annual Meeting, the persons named in the proxy will vote in accordance with their best judgment on such matters. The proxies solicited herein shall not confer any authority to

vote at any meeting of stockholders other than the Annual Meeting to be held on May 20, 2017, or any adjournments or postponements thereof.

Record Date; Outstanding Shares

The stock transfer books of the Company will not be closed, but only stockholders of record at the close of business on March 23, 2017

(the "

Record Date

"), will be entitled to notice of, and to vote at, the Annual Meeting or at any adjournments or postponements thereof. At that date,

there were 27,253,428 shares of the Company's Class A Common Stock outstanding ("

Class A Common Stock

") and 4,010,401 shares of the

Company's Class B Common Stock outstanding ("

Class B Common Stock

" and, together with Class A Common Stock,

"

Common Stock

").

Quorum; Vote Required

The presence, in person or by proxy, of the holders of a majority of the shares of Common Stock issued and outstanding as of the Record Date and

entitled to vote at the Annual Meeting is required to establish a quorum at the Annual Meeting.

If

a quorum is established, each holder of Class A Common Stock and each holder of Class B Common Stock shall be entitled to one vote on the matters presented at the

meeting for each share standing in such holder's name, except that the holders of Class A Common Stock are empowered as a class to elect one-third of the directors serving on the Company's

Board of Directors and the holders of Class B Common Stock are empowered as a class to elect two-thirds of the directors serving on the Company's Board of Directors. Stockholders will not be

allowed to vote for a greater number of nominees than those named in this proxy statement.

In

order to be elected, nominees for Director of each class must receive the affirmative vote of a majority of the shares of that respective class outstanding and eligible to vote in the

election.

2

Cumulative

voting for Directors is not permitted. The vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy and having voting power is required for

the ratification of KPMG as the Company's independent registered public accounting firm (Proposal No. 2), to approve an amendment to our 2005 Non-Employee Director Restricted Stock Plan

(the "Restricted Stock Plan") (Proposal No. 3), to approve the compensation paid to the Company's named executive officers in an advisory, non-binding vote (Proposal No. 4), and to

approve the stockholder proposal (Proposal No. 6). With regard to the advisory, non-binding vote on the frequency of holding future advisory votes on executive compensation (Proposal

No. 5), the frequency option receiving the most affirmative votes will be considered the advisory vote of the stockholders.

Abstentions and Broker Non-Votes

Abstentions will be counted for quorum purposes but will have the effect of a vote against each nominee in the election of directors (Proposal

No. 1) and a vote against each of Proposal No 2 (ratification of KPMG), Proposal No. 3 (Restricted Stock Plan amendment), Proposal No. 4 (advisory resolution on executive

compensation), and Proposal No. 6 (the stockholder proposal). Abstentions will have no impact on Proposal No. 5.

Brokers

holding shares for individual stockholders must vote according to specific instructions they receive from each such individual stockholder. If specific instructions are not

received, in some cases, brokers may vote these shares in their discretion. The New York Stock Exchange (the "NYSE"), however, precludes brokers from exercising voting discretion on certain proposals

designated under NYSE rules as being "non-routine" without specific instructions from the individual stockholder. This results in a "broker non-vote" on such a proposal. Proposal No. 1 (the

election of directors), Proposal No. 3 (Restricted Stock Plan amendment), Proposal No. 4 (advisory resolution on executive compensation), Proposal No. 5 (frequency of future

advisory votes on executive compensation) and Proposal No. 6 (the stockholder proposal) are considered non-routine matters under applicable NYSE rules. As such, a broker cannot vote on these

proposals without instructions from the individual stockholder and, therefore, an undetermined number of broker non-votes may occur with respect to these proposals. Broker non-votes will have the

effect of a vote against the nominees in the election of directors (Proposal No. 1), but will have no impact on Proposal No. 3 (Restricted Stock Plan amendment), Proposal No. 4

(advisory resolution on executive compensation), Proposal No. 5 (frequency of future advisory votes on executive compensation) or Proposal No. 6 (the stockholder proposal). Proposal

No. 2 (the ratification of the appointment of KPMG) is considered a routine matter under applicable NYSE listing rules. Therefore, brokers will be permitted to vote the shares of individual

stockholders who do not submit voting instructions for this proposal, and no broker non-votes will occur in connection with the ratification of the appointment of KPMG.

Costs of Solicitation

The cost of soliciting proxies will be borne by the Company. The Company will reimburse brokers, custodians, nominees and other fiduciaries for

their charges and expenses in forwarding proxy materials to beneficial owners of shares of the Company's Common Stock. In addition to solicitation by mail, certain officers and employees of the

Company may solicit proxies by telephone, fax, e-mail or other electronic means, or in person. These persons will receive no compensation other than their regular salaries.

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL HOLDERS

The following table sets forth certain information regarding persons known to the Company to beneficially own more than five percent of a class

of the Company's outstanding voting securities as of the close of business on March 23, 2017. Unless otherwise indicated, each such person has sole voting power and sole dispositive power over

the shares indicated below.

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner

|

|

Title of

Class

|

|

Amount and Nature

Of Beneficial

Ownership

|

|

Percent

Of Class(1)

|

|

|

Evercore Trust Company, N.A.

55 East 52

nd

Street, 36

th

Floor

New York, NY 10055

|

|

Class A

|

|

|

7,906,961

|

(2)

|

|

29.0

|

%

|

|

Dimensional Fund Advisors LP

6300 Bee Cave Road, Building One

Austin, TX 78746

|

|

Class A

|

|

|

1,575,313

|

(3)

|

|

5.8

|

%

|

|

Greenlight Capital, Inc.

140 East 45

th

Street, 24

th

Floor

New York, NY 10017

|

|

Class A

|

|

|

1,766,672

|

(4)

|

|

6.5

|

%

|

|

W.D. Company, Inc.(5)

|

|

Class A

|

|

|

41,496

|

|

|

0.2

|

%

|

|

1600 Cantrell Road

Little Rock, AR 72201

|

|

Class B

|

|

|

3,985,776

|

|

|

99.4

|

%

|

-

(1)

-

At

March 23, 2017, there were a total of 27,253,428 shares of the Company's Class A Common Stock and 4,010,401 shares of the Company's Class B

Common Stock outstanding.

-

(2)

-

Based

on information contained in Schedule 13G/A filed February 13, 2017 with the Securities and Exchange Commission, Evercore Trust Company, N.A. is

the beneficial owner of these shares in its capacity as Trustee of the 401(k) Plan. Evercore Trust Company, N.A. has no voting power and has shared dispositive power over these shares.

-

(3)

-

Based

on information contained in Schedule 13G filed February 9, 2017 with the Securities and Exchange Commission, Dimensional Fund Advisors LP

has sole voting power over 1,510,331 shares, sole dispositive power over 1,575,313 shares, and no shared voting or dispositive power with respect to any shares.

-

(4)

-

Based

on information contained in Schedule 13G/A filed February 14, 2017 with the Securities and Exchange Commission, Greenlight Capital, Inc.

has shared voting and dispositive power with respect to 974,242 shares and no sole voting or dispositive power with respect to any of the shares, DME Advisors, LP has shared voting and

dispositive power with respect to 237,400 shares and no sole voting or dispositive power with respect to any of the shares, DME Capital Management, LP has shared voting and dispositive power

with respect to 496,300 shares and no sole voting or dispositive power with respect to any of the shares, DME Advisors GP, LLC has shared voting and dispositive power with respect to

733,700 shares and no sole voting or dispositive power with respect to any of the shares and David Einhorn has shared voting and dispositive power with respect to 1,766,672 shares and no sole voting

or dispositive power with respect to any of the shares.

-

(5)

-

William

Dillard, II, Chairman and Chief Executive Officer of the Company, Alex Dillard, President of the Company, and Mike Dillard, Executive Vice President of the

Company, are officers and directors of W.D. Company, Inc. and own 27.4%, 27.9% and 26.3%, respectively, of the outstanding voting stock of W.D. Company, Inc.

4

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth the number of shares of Class A Common Stock and Class B Common Stock of the Company beneficially

owned by each director, each director nominee, each of the named executive officers identified under the section titled "Executive Compensation" in this proxy statement and the directors and executive

officers as a group, as of March 23, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Shares

|

|

Class B Shares

|

|

|

Name of Beneficial Owner

|

|

Amount(1)

|

|

% of Class

|

|

Amount(1)

|

|

% of Class

|

|

|

Robert C. Connor

|

|

|

63,009

|

(2)

|

|

*

|

|

|

—

|

|

|

—

|

|

|

Alex Dillard(3)

|

|

|

1,178,292

|

(4)

|

|

4.3

|

%

|

|

3,985,776

|

(4)

|

|

99.4

|

%

|

|

Mike Dillard(3)

|

|

|

661,919

|

(4)

|

|

2.4

|

%

|

|

3,985,776

|

(4)

|

|

99.4

|

%

|

|

William Dillard, II(3)

|

|

|

1,132,232

|

(4)

|

|

4.2

|

%

|

|

3,985,776

|

(4)

|

|

99.4

|

%

|

|

James I. Freeman

|

|

|

278,001

|

|

|

1.0

|

%

|

|

—

|

|

|

—

|

|

|

H. Lee Hastings, III

|

|

|

11,112

|

|

|

*

|

|

|

—

|

|

|

—

|

|

|

Chris B. Johnson

|

|

|

9,503

|

|

|

*

|

|

|

—

|

|

|

—

|

|

|

Drue Matheny

|

|

|

485,180

|

(5)

|

|

1.8

|

%

|

|

—

|

|

|

—

|

|

|

Frank R. Mori

|

|

|

18,072

|

|

|

*

|

|

|

—

|

|

|

—

|

|

|

Reynie Rutledge

|

|

|

9,400

|

|

|

*

|

|

|

—

|

|

|

—

|

|

|

Warren A. Stephens

|

|

|

132,638

|

(6)

|

|

*

|

|

|

—

|

|

|

—

|

|

|

J. C. Watts, Jr.

|

|

|

6,250

|

(7)

|

|

*

|

|

|

—

|

|

|

—

|

|

|

Phillip R. Watts

|

|

|

11,951

|

|

|

*

|

|

|

—

|

|

|

—

|

|

|

Nick White

|

|

|

48,102

|

|

|

*

|

|

|

—

|

|

|

—

|

|

|

All Directors & Executive Officers as a Group (a total of 21 persons)

|

|

|

4,342,567

|

(8)

|

|

15.9

|

%

|

|

3,985,776

|

(9)

|

|

99.4

|

%

|

-

*

-

Denotes

less than 1%

-

(1)

-

Based

on information furnished by the respective individuals.

-

(2)

-

Includes

nine shares owned by Mr. Connor's wife.

-

(3)

-

Alex

Dillard, Mike Dillard, and William Dillard, II are directors and officers of W.D. Company, Inc. and own 27.9%, 26.3%, and 27.4%, respectively, of the

outstanding voting stock of such company. See footnote (4) below.

-

(4)

-

Includes

41,496 shares of Class A Common Stock and 3,985,776 shares of Class B Common Stock owned by W.D. Company, Inc., in which Alex Dillard,

Mike Dillard, and William Dillard, II are each deemed to have a beneficial interest due to their respective relationships with W.D. Company, Inc. Alex Dillard, Mike Dillard, and William Dillard, II

share voting and dispositive power over these shares. See "Security Ownership of Certain Beneficial Holders." Alex Dillard and his wife individually own 1,008,944 and 36,000 shares, respectively, of

Class A Common Stock. Alex Dillard also has sole voting power with respect to 91,852 shares of Class A Common Stock held in trust. Mike Dillard individually owns 612,513 shares of

Class A Common Stock and is deemed to beneficially own 610 shares of Class A Common Stock held in trust over which his wife has sole voting power. He has sole voting power with respect

to 7,300 shares of Class A Common Stock held in trust. William Dillard, II individually owns 1,083,436 shares of Class A Common Stock and he has sole voting power with respect to 7,300

shares of Class A Common Stock held in trust.

-

(5)

-

Drue

Matheny and her husband individually own 477,730 and 150 shares, respectively, of Class A Common Stock. Mrs. Matheny also has sole voting power

with respect to 7,300 shares held in trust. She owns 7.3% of the outstanding voting stock of W.D. Company, Inc., but is not an officer or director of W.D. Company, Inc. Therefore, she is

not deemed to have a beneficial interest in any Dillard's, Inc. shares owned by W.D. Company, Inc.

5

-

(6)

-

Warren

Stephens individually owns 2,000 shares of Class A Common Stock, beneficially owns 9,102 shares held in trust and controls 121,536 shares held

by Stephens Investment Holdings LLC.

-

(7)

-

Includes

1,200 shares that are pledged as security for a personal loan.

-

(8)

-

The

shares in which Alex Dillard, Mike Dillard, and William Dillard, II are deemed to have a beneficial interest due to their respective relationships with W.D.

Company, Inc. have been included in this computation only once and were not aggregated for such purpose.

6

PROPOSAL NO. 1. ELECTION OF DIRECTORS

The number of directors that serve on the Company's Board is currently set at 12 but may be changed from time to time in the manner provided in

the Company's by-laws. Class A stockholders are entitled to vote for the election of four Directors and Class B stockholders are entitled to vote for the election of eight Directors.

Directors are to be elected at the Annual Meeting for a term of one year and until the election and qualification of their successors. Once elected, our Directors have no ongoing status as

"Class A" or "Class B" Directors and have the same duties and responsibilities to all stockholders.

The

Board recommends that each nominee identified below be elected at the Annual Meeting. Each of the nominees is currently serving as a director of the Company and was elected at the

2016 Annual Meeting of Stockholders. Set forth below are the principal occupation and public company directorships each nominee currently holds or has held during the last five years, as well as other

background information about the nominees, including a discussion of the specific experience, qualifications, attributes, and skills of each nominee that led to the Board's conclusion that each

nominee should serve as a director.

Class A Nominees

Frank R. Mori

, 76, has served as a Director of the Company since 2008. At all times during the

past five years, Mr. Mori has served as Co-Chief Executive Officer and President of Takihyo, LLC, a private investment firm headquartered in New York City. Takihyo, LLC is not a

subsidiary or other affiliate of the Company. He has previously served as Chief Executive Officer and Director of Donna Karan International, Inc. and Anne Klein & Co., Inc.

He also served on the Board of Directors of The Stride Rite Corporation until 2007. Mr. Mori currently serves as a director of Barington/Hilco Acquisition Corp. Mr. Mori offers the Board

the broad knowledge and perspective of a fashion vendor combined with overseas sourcing and manufacturing experience. Mr. Mori currently serves on the Board's Stock Option and Executive

Compensation Committee (the "

Compensation Committee

").

Reynie Rutledge

, 67, has served as a Director of the Company since 2013. Mr. Rutledge is the Chairman of First Security Bancorp, a

financial services holding company headquartered in Searcy, Arkansas. With over 40 years of experience in banking, Mr. Rutledge has been involved with all aspects of finance and

management while leading First Security Bancorp to become the fifth largest bank holding company based in Arkansas, with over $5.3 billion in assets and 75 locations throughout the state. First

Security Bancorp consists of First Security Bank, First Security Crews & Associates investment banking firm, and First Security Public Finance. First Security Bancorp is not a subsidiary or

other affiliate of the Company. He is a graduate of the University of Arkansas where he earned a degree in industrial engineering and a Master of Business Administration

("

MBA

"). Mr. Rutledge is a past Chairman of the Arkansas Bankers Association and the Business Advisory Board of Harding University. He is a

member of the Arkansas Academy of Industrial Engineering, a member and past chairman of the Dean's Executive Advisory Board for the Sam M. Walton College of Business, a member of the Campaign Arkansas

Executive Committee, a past chairman of the Arkansas Business Hall of Fame Selection Committee, the University of Arkansas 2000 Volunteer of the Year, a 2012 recipient of the University of Arkansas

Distinguished Alumni Award, and a member and former Chairman of the University of Arkansas Board of Trustees. Mr. Rutledge's extensive career in commercial banking provides insights into the

credit markets for the Board. Mr. Rutledge serves as Chairman of the Audit Committee.

J.C. Watts, Jr.

, 59, has served as a Director of the Company since August 2009 and previously served on the Board from 2003 until 2008 as

a member of the Audit Committee. He also serves on the Board of Directors of Paycom Software, Inc. He formerly served on the Boards of Directors of Burlington Northern Santa Fe Corporation,

Clear Channel Communications, Inc., CSX Corporation,

7

ITC

Holdings Corp., and Terex Corporation. At all times during the past five years, Mr. Watts has served as the Chairman of the J.C. Watts Companies, which provide both consulting and advocacy

services. The J.C. Watts Companies are not subsidiaries or other affiliates of the Company. Mr. Watts served in the U.S. Congress from the fourth district of Oklahoma from 1995-2003. In 1998,

he was elected chairman of the Republican Conference in the U.S. House of Representatives. He served for eight years on the House Armed Services Committee. He authored legislation to create the House

Select Committee on Homeland Security, a committee on which he later served. He also served on the House Transportation and Infrastructure Committee as well as the House Banking Committee. He led two

congressional trade missions to Africa. Mr. Watts co-authored the American Community Renewal and New Markets Act and authored the Community Solutions Act of 2001. He also crafted legislation

with Congressman John Lewis to establish the Smithsonian Museum of African American History and Culture. He has served as an analyst on television news programs nationally and internationally.

Mr. Watts led a U.S. delegation to Vienna, Austria, at the request of President George W. Bush and Secretary of State Colin Powell, to the Organization for Security and Cooperation in

Europe Conference on Racism, Discrimination and Xenophobia and accompanied President Bush on his historic trip to Africa. He co-founded the Coalition for AIDS Relief in Africa and served on the Board

of Africare. He has also created the J.C. and Frankie Watts Foundation to focus on urban renewal and other charitable initiatives. He is the Chairman of Watts Equipment and the President and CEO of

Feed the Children in Oklahoma City, Oklahoma. Mr. Watts brings to the Board not only an understanding and sensitivity to the political and cultural issues which the Company regularly faces but

also a wealth of knowledge of the regulatory environment which continues to change and affect the Company's operations. Mr. Watts currently serves on the Audit Committee.

Nick White

, 72, has served as a Director of the Company since 2008. Since 2000, Mr. White has served as Chief Executive Officer and

President of White and Associates, an international retail solutions firm offering retail clients consulting services encompassing strategy, partnerships, logistics and concepts. White and Associates

is not a subsidiary or other affiliate of the Company. Following a tour in Vietnam with the United States Marine Corps, Mr. White began his retail career in 1968 with Spartan-Atlantic

Department Stores while still attending college. In 1973, he joined Wal-Mart Stores, Inc. as an Assistant Store Manager. From 1985 to 1990, he was General Manager of Sam's Clubs, and in 1990,

he was named an Executive Vice President of Wal-Mart Stores, Inc. and General Manager of its Supercenter Division, positions he held until his retirement in 2000. While at Wal-Mart, he served

on both the Executive Committee and the Real Estate Committee. Mr. White has made significant contributions to the Board as a result of his extensive knowledge of sourcing, logistics, store

operations and merchandising. Mr. White currently serves on the Compensation Committee.

Class B Nominees

Robert C. Connor

, 75, has served as a Director of the Company since 1987. At all times during

the past five years, Mr. Connor's principal occupation is and has been a private investor

for his own account. He began his banking career in Dallas, Texas at the Mercantile National Bank and was elected Vice President of the Citizens Bank of Jonesboro, Arkansas in 1970. He was elected

President of The Union National Bank of Arkansas and The Union of Arkansas Corporation in 1976. He previously served on the Board of Sage Telecom in Allen, Texas. Mr. Connor's long career of

leadership in the banking industry makes him particularly well suited to serve on the Compensation Committee as well as to share his knowledge and insights concerning the credit markets with the

Board. Mr. Connor currently serves as Chairman of the Compensation Committee.

Alex Dillard

, 67, is President of the Company, has been a member of the Board since 1975, and serves on the Executive Committee of the

Board of Directors (the "

Executive Committee

"). This has been his principal occupation for the last five years. Mr. Dillard has been involved in

virtually every aspect of operations and merchandising for the Company for 45 years and previously served as

8

Executive

Vice President of the Company. He has served as a board member of the University of Arkansas for Medical Sciences Foundation Fund, Philander Smith College, Union Bank and Worthen Bank in

Little Rock, Arkansas and First National Bank of Ft. Worth, Texas. Mr. Dillard's understanding of both the merchandising and the operational aspects of the retail business has enabled the Board

to more effectively gain a broad overview of the day-to-day processes involved in the operation of the Company.

Mike Dillard

, 65, is an Executive Vice President of the Company and currently heads one of the largest merchandising portions of the

Company's business. This has been his principal occupation for the last five years. He has been a member of the Board since 1976. Mr. Dillard has played many roles for the Company, devoting his

entire professional career to Dillard's, Inc. His understanding of the unique regional characteristics of merchandising in the many different geographic regions of the country has assisted the

Board in its efforts to guide the business to meet the needs of its varied customer base.

William Dillard, II

, 72, is the Chairman of the Board and Chief Executive Officer of the Company, has been a member of the Board since

1967, and serves on the Executive Committee. This has been his principal occupation for the past five years. Mr. Dillard has been involved in almost every aspect of the Company's operations,

working part-time while in school and full-time for over 45 years. He was formerly President and Chief Operating Officer of the Company. Mr. Dillard also serves on the Boards of

Directors of Acxiom Corporation and Barnes & Noble, Inc. Through his numerous years of service to the Company, Mr. Dillard possesses an unmatched knowledge of the Company's

operations and the retail industry as a whole. This, combined with his service as a member of the boards of directors of other public companies, allows him to provide invaluable insight to the Board.

In addition, his expertise with respect to real estate matters and store location enables him to provide the Board with leadership and insight into this critical aspect of the Company's business.

James I. Freeman

, 67, was Senior Vice President and Chief Financial Officer of the Company until his retirement effective

February 1, 2015. During the past two years, his principal occupation is and has been a private investor for his own account. He has been a member of the Board since 1991. Mr. Freeman

joined the Company in 1988. He entered the accounting profession in 1972 and practiced as a certified public accountant. He formerly served as a member of the Management Committee of BKD, LLP,

one of the largest accounting firms in the nation. Having served as Chief Financial Officer of the Company, Mr. Freeman has extensive experience overseeing the Company's financial reporting

processes, internal accounting and financial controls, and independent auditor engagements. This unique experience provides Mr. Freeman the ability to regularly advise the Board regarding

current and proposed accounting issues, financial matters and regulations that affect the Company's operations.

H. Lee Hastings, III,

62, has served as a Director of the Company since 2010. At all times during the past five years, Mr. Hastings

has served as President and Chief Operating Officer of Hastings Holdings, Inc., a family holding company that operates several subsidiaries which are engaged in real estate, beverage

distribution, import/export and other businesses. For the past five years, Mr. Hastings has also served as President of Arkansas Bolt/ABC Logistics, a subsidiary of Hastings

Holdings, Inc. that sells and imports/exports industrial fasteners and stampings throughout the world. Since 2001, Mr. Hastings has also been a director of another family holding

company, State Holding Co. Inc., which owns and operates a bank holding company. None of these companies or their subsidiaries are subsidiaries or other affiliates of the Company.

Mr. Hastings has extensive experience in the international import/export market and contributes valuable advice to the Board with respect to the Company's international sourcing efforts.

Mr. Hastings currently serves on the Audit Committee.

Drue Matheny

, 70, has been a member of the Board since 1994. For the past five years, her principal occupation has been, and currently is,

an Executive Vice President of the Company. She is based in Ft. Worth, Texas and directs one of the largest merchandising portions of the Company. Since joining the Company in 1968, Ms. Matheny

has overseen every aspect of the Company's various merchandising functions. She brings to the Board a deep understanding of the exacting tastes and preferences of the Company's customers.

9

Warren A. Stephens

, 60, has served as a Director of the Company since 2002. At all times during the past five years, Mr. Stephens'

principal occupation has been Chairman, Chief Executive Officer, and President of Stephens Inc. He is also Co-Chairman of SF Holding Corporation. Stephens Inc. and SF Holding Corporation

are not subsidiaries or other affiliates of the Company. In 1981, Mr. Stephens joined Stephens Inc. In 2006, Mr. Stephens acquired 100% of the outstanding shares of

Stephens Inc. Stephens Inc. focuses on investment banking, wealth management, capital management, private equity, institutional sales and trading, research, and insurance.

Mr. Stephens' knowledge and understanding of sophisticated financial markets have been invaluable to the Board when dealing with a wide range of issues from investment decisions to credit and

finance matters to the strategic positioning of the Company.

Information regarding the Board and its Committees

Controlled Company.

The Company qualifies as a "controlled company" under the NYSE listing standards due to the ownership by W.D.

Company, Inc. of shares of Class B Common Stock allowing it to cast more than 50% of votes eligible to be cast for the election of two-thirds of the Directors of the Company. In

accordance with a provision in NYSE rules for controlled companies, the Company is not required to comply with NYSE listing standards that provide for (1) a majority of the Board of Directors

being composed of independent directors, (2) a nominating/corporate governance committee

composed solely of independent directors and (3) a compensation committee composed solely of independent directors. Notwithstanding that, all the members of the Company's Compensation Committee

are independent in accordance with the NYSE listing standards. This may change in the future, however, at the Company's discretion.

Director Independence.

The Board has determined that all of the Class A nominees listed above qualify as independent persons as

defined in the

Company's by-laws (discussed below). In addition, the Board has affirmatively determined that each of the Class A nominees, as well as Robert C. Connor and H. Lee Hastings, III, who are

Class B nominees, has no direct or indirect material relationship with the Company and qualifies as an independent director in accordance with the NYSE listing standards.

Family Relationships.

William Dillard, II, Drue Matheny, Alex Dillard, Mike Dillard and Denise Mahaffy are siblings. William Dillard,

III is the son

of William Dillard, II.

Director Nominations.

As provided in the Company's by-laws, the Executive Committee is responsible for nominating individuals to stand

for election

at each annual meeting of stockholders. Stockholders may also nominate a director nominee pursuant to the Company's by-laws.

The

Company's by-laws provide that nominees to represent Class A stockholders on the Company's Board shall be independent persons only. For these purposes, the Company's by-laws

define "independent" as a person who: (1) has not been employed by the Company or an affiliate in any executive capacity within the last five years; (2) was not, and is not, a member of

a corporation or firm that is one of the Company's paid advisors or consultants; (3) is not employed by a significant customer, supplier or provider of professional services; (4) has no

personal services contract with the Company; (5) is not employed by a foundation or university that receives significant grants or endowments from the Company; (6) is not a relative of

the management of the Company; (7) is not a stockholder who has signed stockholder agreements legally binding him or her to vote with management; and (8) is not the chairman of a company

on which Dillard's, Inc.'s Chairman or Chief Executive Officer is also a board member. These independence standards, found in our Corporate Governance Guidelines, are available on the investor

relations portion of the Company's website at www.dillards.com.

10

In

nominating a slate of directors, the objective is to select individuals with skills and experience that can be of assistance in operating the Company's business. The following core

criteria are considered in nominating each candidate:

-

•

-

Integrity.

Only persons who have demonstrated in their professional lives

the highest ethical standards, maturity and responsibility will be considered.

-

•

-

Experience.

A director should have business experience relevant to the

Company's business.

-

•

-

Judgment and Knowledge.

A director should have the ability to assess the

Company's strategy, business plan, and key issues to evaluate the performance of management and to evaluate the Company's financial and operating reports and to provide meaningful analysis of the

Company's financial position.

-

•

-

Time and Commitment.

Board members must have sufficient time available to

become acquainted with the Company, to prepare for Board and committee meetings, and to attend meetings.

Candidates

who individually possess knowledge, experience and skills in at least one of the following are sought: accounting and finance, business judgment, management, crisis response,

industry knowledge or strategy and vision. Diversity is an important consideration in Board composition and is discussed as a factor in connection with each candidate. The Executive Committee has not

adopted a formal policy with respect to diversity. The implementation of this consideration occurs when, in addition to the core criteria identified above, the Executive Committee informally discusses

whether a potential nominee might also bring to the Board diverse life experiences and perspectives but no single factor controls the determination process.

In

order for a Company stockholder to nominate an individual for election to the Board, the stockholder must provide written notice of such nomination to the Company's Corporate

Secretary and the notice must be received by the Company's Corporate Secretary at the principal executive offices of the Company no more than 90 days, and no less than 60 days, before

the annual meeting; provided, however, that in the event that less than 70 days' notice or prior public disclosure of the date of the meeting is given or made to stockholders, such nomination

must be received no later than the close of business on the 10

th

day following the day on which such notice of the date of the meeting was mailed or such public disclosure was

made. The notice must set forth as to each person whom the stockholder

proposes to nominate for election or re-election as a Director, (1) the name, age, business address and residence address of such person, (2) the principal occupation or employment of

such person, (3) the class and number of shares of the Company's Common Stock that are beneficially owned by such person and (4) any other information relating to such person that is

required, in each case, pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the "

Exchange Act

") (including without

limitation such persons' written consent to being named in the proxy statement as a nominee and to serve as a director if elected). Such notice must also set forth the name and address, as they appear

on the Company's books, of the stockholder giving the notice and the class and number of shares of the Company's Common Stock that are beneficially owned by such stockholder. In order for a Company

stockholder to recommend (as opposed to nominate) a director candidate, the stockholder must provide written notice of such recommendation to the Company's Corporate Secretary at the principal

executive offices of the Company. The Executive Committee will consider director candidates recommended by stockholders and will consider all candidates for director in the same manner regardless of

the source of the recommendation.

Director Meetings.

The Board of Directors met four times during the Company's last fiscal year. During the last fiscal year, all of the

individuals

serving as director attended at least 75% of the aggregate of (1) the total number of meetings of the Board and (2) the total number of meetings held by all committees of the Board on

which they served. The Company encourages each Board member to

11

attend

the Company's Annual Meeting. All individuals serving as director were in attendance at the Company's Annual Meeting held on May 21, 2016.

Executive Sessions; Presiding Director.

As required by the NYSE listing standards, our non-management directors meet on a regularly

scheduled basis

in executive session at which only non-management directors are present. Our non-management directors choose the presiding director by majority vote for each session. The presiding director is

responsible for, among other things, presiding at the executive session of the independent directors for which he or she is chosen to serve and apprising the Chairman of the issues considered at such

meetings.

Communications with Directors.

Security holders and other interested persons may contact individual directors, the presiding member of

the

non-management directors, non-management directors as a group or the Board as a whole, at any time. Your communication should be sent to the individual Director, the "Non-Management Members of the

Board of Directors," the "Presiding Member of

Non-Management Directors" or the "Board of Directors," as applicable, at 1600 Cantrell Road, Little Rock, Arkansas 72201. In general, any communications delivered to the principal executive offices

for forwarding to the Board or specified Board members will be forwarded in accordance with its instructions. However, prior to the communications being forwarded to the Board member, the Corporate

Secretary reviews communications and reserves the right not to forward to Board members any inappropriate materials.

Corporate Governance Guidelines and Code of Conduct.

The Board has adopted Corporate Governance Guidelines and a Code of Conduct that

applies to all

Company employees, including the Company's executive officers, and, when appropriate, the members of the Board. The current versions of these corporate governance documents are available free of

charge on the investor relations portion of the Company's website at www.dillards.com and each is available in print to any stockholder who requests copies by contacting Julie J. Bull, Director of

Investor Relations, at 1600 Cantrell Road, Little Rock, Arkansas 72201. The Company will promptly disclose to our stockholders, if required by applicable laws, any amendments to, or waivers

from, provisions of the Code of Conduct that apply to our principal executive officer, principal financial officers, principal accounting officer or controller, or persons performing similar

functions, by posting such information on our website (www.dillards.com) rather than by filing a Form 8-K.

Board Committees.

The Board has a standing Audit Committee and Compensation Committee. The Audit Committee and the Compensation

Committee have each

adopted a written charter, both of which are available on the investor relations portion of the Company's website at www.dillards.com. In addition, the Board has an Executive Committee that performs

various functions, including those similar to a standing nominating committee. The Executive Committee members are Alex Dillard and William Dillard, II.

The

Audit Committee members are H. Lee Hastings, III, Reynie Rutledge, Chairman, and J.C. Watts, Jr. The Board has determined that Reynie Rutledge is an "audit committee financial

expert" and Messrs. Hastings, Rutledge and Watts are independent of management in accordance with the requirements of the NYSE and the SEC for purposes of determining audit committee

independence. The Board has also determined that each of Messrs. Hastings, Rutledge and Watts is "financially literate" within the meaning of the listing standards of the NYSE. The Audit

Committee held twelve meetings during fiscal 2016.

The

Compensation Committee members are Robert C. Connor, Chairman, Frank R. Mori and Nick White. All members of the Compensation Committee are independent as defined by NYSE listing

standards. In addition all members of the Compensation Committee qualify as "non-employee directors" for purposes of Rule 16b-3 under the Exchange Act, and as "outside directors" for purposes

12

of

Section 162(m) of the Internal Revenue Code. The Compensation Committee held three meetings during fiscal 2016.

Board's Leadership Structure.

Pursuant to the Company's by-laws, the principal executive officer shall be the Chairman of the Board.

Accordingly, the

Board has elected William Dillard, II, the Company's CEO, to serve as its Chairman. The Board believes that this structure is best suited to the interests of the Company and the stockholders at this

time because it enables Mr. Dillard to be personally involved in every aspect of leading the Company. The Board believes that Mr. Dillard is uniquely qualified to serve as Chairman

because his extensive experience with the Company (over 45 years of service) provides him with the long-term perspective that builds stockholder value and aligns with the long-term interests of

the stockholders. In this capacity, he sets the Board agenda, regularly communicates with the other Board members and chairs Board meetings and the Annual Meeting.

Alex

Dillard, the Company's President and a fellow Board member, assists William Dillard, II in the day-to-day supervision of the Company's business, which provides other members of the

management team ready access to, and the benefit of, their combined deep understanding of the cycles and challenges of the retail industry. The close working relationship between the CEO and the

President also gives the Board and the Company's stockholders a veteran leadership team that can address issues quickly and seamlessly.

The

Company has no lead independent Director. However, the non-management directors designate one of the independent directors to preside over their executive sessions.

Board's Role in Risk Oversight.

While the Company's management has the primary responsibility for managing risks facing the Company,

the Board as a

whole is actively involved in and is responsible for the oversight of risk management. The Board's primary goal is to ensure that the risk management processes designed and implemented by the

Company's management are effective.

The

Audit Committee is responsible for oversight of the quality and integrity of the Company's financial statements, internal controls and compliance with legal and regulatory

requirements and reviews the annual risk assessment report prepared by the Company's internal audit group which reports directly to the Audit Committee. Based on the annual risk assessment, the Audit

Committee is charged with studying or investigating any matter of interest or concern that it deems appropriate. It also reviews reports describing any anonymous calls made to the Company's "Ethics

Hotline," together with any other reports of disciplinary or other action taken with respect to material breaches of the

Company's Code of Conduct. In its investigatory capacity, the Audit Committee has the authority to retain outside legal, accounting or other advisors, including the authority to approve the fees

payable to such advisors and any other terms of retention. The Audit Committee is also given unrestricted access to the Company's internal audit group, other Board members, executive officers and

independent accountants to the extent necessary to carry out its oversight responsibilities. While acting in this capacity, the Audit Committee has the full authority of the Board.

The

Compensation Committee is responsible for reviewing any risks arising from the Company's compensation policies, particularly with respect to the issue of encouraging inappropriate

risk taking by executive management. In assessing compensation-related risks, the Compensation Committee may investigate any matter related thereto, is given full access to all books, records,

facilities and personnel of the Company and, when appropriate, may hire outside legal, accounting or other experts or advisors to assist the Compensation Committee with its work.

The

Board's administration of its risk oversight function has not specifically affected the Board's leadership structure. The Board believes that its current leadership structure is

conducive to, and appropriate for, its oversight of risk management.

13

2016 Director Compensation

During fiscal 2016, non-management Directors received an annual cash retainer of $100,000 as well as 2,000 restricted shares of the Company's

Class A Common Stock. The restricted shares vest six months after their issuance. Committee chairmen received an additional annual cash retainer of $25,000. Directors who are also employees of

the Company are not compensated for their service on the Board.

In

2016, the Compensation Committee engaged Korn Ferry Hay Group ("Hay Group") as its independent compensation consultant. Hay Group provided the Committee with an analysis of director

compensation at the Company's peer group companies.

The

following table summarizes the compensation paid by the Company to non-management Directors for the fiscal year ended January 28, 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees

Earned or

Paid in

Cash ($)

|

|

Stock

Awards

($)(1)

|

|

Option

Awards

($)

|

|

Non-Equity

Incentive Plan

Compensation

($)

|

|

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($)

|

|

All Other

Compensation

($)

|

|

Total ($)

|

|

|

Robert C. Connor

|

|

$

|

125,000

|

|

$

|

114,150

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

239,150

|

|

|

Frank R. Mori

|

|

|

100,000

|

|

|

114,150

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

214,150

|

|

|

H. Lee Hastings, III

|

|

|

100,000

|

|

|

114,150

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

214,150

|

|

|

Reynie Rutledge

|

|

|

125,000

|

|

|

114,150

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

239,150

|

|

|

Warren A. Stephens

|

|

|

100,000

|

|

|

114,150

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

214,150

|

|

|

J.C. Watts, Jr.

|

|

|

100,000

|

|

|

114,150

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

214,150

|

|

|

Nick White

|

|

|

100,000

|

|

|

114,150

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

214,150

|

|

|

James I. Freeman

|

|

|

100,000

|

|

|

114,150

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

214,150

|

|

-

(1)

-

The

amounts in the "Stock Awards" column represent the grant date fair value of the annual stock award made in fiscal 2016, computed in accordance with Financial

Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation ("

FASB ASC Topic 718

"), and

is equal to the simple average market price of 2,000 shares on the date of grant. All grants of restricted shares were vested as of January 28, 2017.

Vote Required

A majority of the shares of the respective class of the Common Stock outstanding and eligible to vote in the election shall elect each Director

for such class.

Recommendation of the Board

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE

FOR

EACH

OF THE DIRECTOR NOMINEES NOMINATED BY THE BOARD. PROXIES SOLICITED BY THE BOARD WILL BE VOTED

FOR

EACH NOMINEE UNLESS STOCKHOLDERS SPECIFY A CONTRARY VOTE.

Management does not know of any

nominee who will be unable to serve, but should any nominee be unable or decline to serve, the discretionary authority provided in the Proxy will be exercised to vote for a substitute or substitutes.

14

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis ("

CD&A

") provides information regarding the

compensation paid to our Chief Executive Officer, Co-Principal Financial Officers and our three most highly compensated other executive officers in fiscal 2016. These individuals are referred to as

"named executive officers" or "NEOs." This section should be read in conjunction with the detailed tables and narrative descriptions under the section titled "Executive Compensation" in this proxy

statement.

Executive Summary

We are committed to a pay-for-performance culture. The compensation program is reviewed annually in order to assure that its objectives and

components are aligned with the Company's goals and culture, and also that it incentivizes short-term and long-term profitable growth.

At

the 2014 Annual Meeting of Stockholders, in our last stockholder advisory vote, 98% of the votes cast on executive compensation were voted to approve the compensation of the Company's

named executive officers. There have been no material changes to our compensation programs during the fiscal year.

The

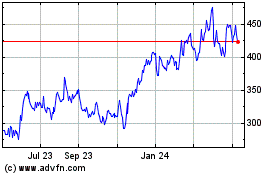

graph below demonstrates our performance in comparison to the Standard & Poor's 500 Index and the Standard & Poor's 500 Department Stores Index. The graph shows the

relative return of $100 invested in Dillard's, Inc. Class A Common Stock and each of the indices as of January 27, 2012 (the last trading day prior to the start of fiscal 2012)

and assumes reinvestment of dividends.

15

Total Stockholder Return

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012

|

|

2013

|

|

2014

|

|

2015

|

|

2016

|

|

|

Dillard's, Inc.

|

|

$

|

196.81

|

|

$

|

201.69

|

|

$

|

263.02

|

|

$

|

163.49

|

|

$

|

127.44

|

|

|

S&P 500

|

|

|

117.61

|

|

|

141.48

|

|

|

161.60

|

|

|

160.52

|

|

|

194.02

|

|

|

S&P 500 Department Stores

|

|

|

103.09

|

|

|

119.64

|

|

|

149.27

|

|

|

107.64

|

|

|

86.82

|

|

Compensation Philosophy

The core elements of our compensation philosophy are to align each executive's compensation with the Company's short-term and long-term

performance, promote a pay-for-performance culture and provide compensation and incentives needed to attract, retain and motivate key executives who are crucial to the Company's long-term success. We

seek to implement our philosophy by following three key principles:

-

•

-

Providing compensation opportunities that are equivalent to those offered by comparable companies, thereby allowing the Company to compete for

and retain talented executives who are critical to our long-term success;

-

•

-

Motivating executive officers by rewarding them for attainment of Company profitability on an annual basis; and

-

•

-

Aligning the interests of our executives with the long-term interests of our stockholders by awarding equity-based compensation and by offering

participation in retirement, stock purchase and stock bonus plans that encourage stock ownership by our executives.

16

Further

details concerning how we implement our philosophy, and how we apply the above principles to our compensation program, are provided throughout this CD&A.

Elements of Compensation

Our compensation program consists of the following elements: Base Salary, Annual Cash Performance Bonuses, Equity-Based Compensation Awards and

Pension Plan Benefits. We choose to pay each separate element with the intent of rewarding performance believed to be beneficial to the Company and accomplishing specific purposes, as described below.

Within each element of compensation (other than those based on a pre-established formula), the Compensation Committee considers appropriate ranges for the amount awarded given the level of position

and performance of the individual and the Company for the period under consideration.

Base Salary

is designed to:

-

•

-

Reward the proficiency of our executives relative to their skills, position and contributions to the success of the Company; and

-

•

-

Provide a level of annual cash compensation competitive with the marketplace that recognizes contributions to the overall success of the

Company and provides the potential for annual increases reflecting those contributions.

Annual Cash Performance Bonuses

are designed to:

-

•

-

Motivate executives to assist in the attainment of Company profitability on an annual basis; and

-

•

-

Foster a pay-for-performance culture that aligns our overall compensation programs with our business strategy and rewards executives for their

contributions toward our goal of increasing profitability.

Equity-Based Compensation Awards

are designed to:

-

•

-

Link compensation rewards to the creation of stockholder wealth; and

-

•

-

Encourage our executives to work together in the interest of stockholders by associating a portion of compensation with the long-term value of

our common stock.

Pension Plan Benefits

are designed to:

-

•

-

Provide competitive incentives to our executive officers to focus on the long-term success of the Company; and

-

•

-

Provide a secure retirement after a long and productive career with the Company.

The

Compensation Committee believes that the combination of these elements provides an appropriate mix of fixed and variable pay which balances short-term operational performance with

long-term stockholder value. The Committee also believes that our compensation program enables us to reinforce our pay-for-performance philosophy as well as strengthen our ability to attract and

retain highly qualified executives by providing benefits equivalent to those offered by our leading competitors.

Allocation of Total Direct Compensation

The table below illustrates the allocation of total direct compensation for each NEO in fiscal 2016. Base salary, annual cash performance

bonuses, equity-based compensation awards and other compensation (consisting of perquisites, insurance premiums and retirement plan contributions) compose each NEO's total direct compensation. Total

direct compensation is different from the "Total Compensation" column of the Summary Compensation Table appearing on page 26 in that it excludes changes in pension value. We disclose the

allocation of total direct compensation to provide insight into

17

the

Compensation Committee's decision-making process when establishing NEO compensation. The Compensation Committee does not consider changes in pension value when establishing NEO compensation

because pension amounts are earned each year based on a pre-established formula set forth in the Company's pension plan relating to compensation previously received by a NEO and the NEO does not

receive the amount until after retirement from the Company. As such, the amounts are excluded from the table below.

As

shown in the table below, the Compensation Committee determined that a slightly higher portion of total direct compensation paid to Messrs. William Dillard, II and Alex

Dillard, our Chief Executive Officer and President, respectively, should be performance based, than that of the other NEOs, given their ability to affect stockholder value relative to the other NEOs.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allocation of Total Direct Compensation

|

|

|

NEO

|

|

Base Salary

|

|

Annual Cash

Performance

Bonuses

|

|

Equity-Based

Compensation

Awards

|

|

Other

Compensation

|

|

|

William Dillard, II ,

|

|

|

39.5

|

%

|

|

44.3

|

%

|

|

6.6

|

%

|

|

9.6

|

%

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alex Dillard,

|

|

|

39.5

|

%

|

|

44.3

|

%

|

|

6.6

|

%

|

|

9.6

|

%

|

|

President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mike Dillard,

|

|

|

50.4

|

%

|

|

34.4

|

%

|

|

6.2

|

%

|

|

9.0

|

%

|

|

Executive Vice President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drue Matheny,

|

|

|

51.4

|

%

|

|

35.2

|

%

|

|

6.4

|

%

|

|

7.0

|

%

|

|

Executive Vice President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chris B. Johnson,

|

|

|

62.2

|

%

|

|

19.2

|

%

|

|

5.5

|

%

|

|

13.1

|

%

|

|

Senior Vice President and Co-Principal Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phillip R. Watts,

|

|

|

63.7

|

%

|

|

19.7

|

%

|

|

5.6

|

%

|

|

11.0

|

%

|

|

Senior Vice President, Co-Principal Financial Officer and Principal Accounting Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How We Determine Compensation

Role of the Compensation Committee.

The Compensation Committee has responsibility for establishing, implementing and monitoring

adherence to our

compensation philosophy. In carrying out this function, the committee strives to ensure that total compensation paid to named executive officers is fair, reasonable and competitive.

The

Compensation Committee regularly reviews and evaluates our compensation program to ensure that it:

-

•

-

Promotes our ability to attract and retain qualified management personnel by providing compensation that is competitive relative to that paid

by our competitors. To this end, the Compensation Committee regularly reviews and evaluates compensation packages and amounts paid by our primary competitors and other family-founded and

family-managed companies.

-

•

-

Fosters a pay-for-performance culture providing executives with the opportunity to increase their level of overall compensation based on the

financial performance of the Company. To this end, the Compensation Committee regularly reviews and evaluates individual performance to ensure that employees are rewarded for their contributions to

Company goals and stockholder value.

These

evaluations, along with the independent judgment exercised by members of the Compensation Committee, guides the committee's decisions in structuring compensation elements,

determining compensation amounts, allocating between long-term and currently paid compensation and allocating between cash and non-cash amounts. The Compensation Committee also takes into account how

competitive pressures and economic conditions over which our named executive officers may have little or no control can have a negative impact on the Company's financial performance.

18

Role of Compensation Consultant in Compensation Decisions.

During the year, in accordance with the Compensation Committee's

instructions, Hay Group,

the Compensation Committee's independent consultant, provided the Compensation Committee with an analysis of NEO compensation at the Company's peer group companies, as well as information on trends

and best practices in executive compensation. In addition, Hay Group provided the Committee with an analysis of director compensation at the Company's peer group companies. Hay Group and its