Initial Statement of Beneficial Ownership (3)

April 06 2017 - 10:40AM

Edgar (US Regulatory)

|

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Hutchison Colin A

|

2. Date of Event Requiring Statement (MM/DD/YYYY)

4/4/2017

|

3. Issuer Name

and

Ticker or Trading Symbol

EDGEWELL PERSONAL CARE Co [EPC]

|

|

(Last)

(First)

(Middle)

C/O EDGEWELL PERSONAL CARE, 6 RESEARCH DRIVE

|

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director

_____ 10% Owner

___

X

___ Officer (give title below)

_____ Other (specify below)

Chief Operating Officer /

|

|

(Street)

SHELTON, CT 06484

(City)

(State)

(Zip)

|

5. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4)

|

2. Amount of Securities Beneficially Owned

(Instr. 4)

|

3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5)

|

4. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Common Stock

|

19187

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4)

|

2. Date Exercisable and Expiration Date

(MM/DD/YYYY)

|

3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4)

|

4. Conversion or Exercise Price of Derivative Security

|

5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5)

|

6. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Non-Qualified Stock Option 7-6-2015

|

(1)

|

(1)

|

Common Stock

|

17379

|

$100.68

|

D

|

|

|

Restricted Stock Equivalent 7-8-2015

|

(2)

|

(2)

|

Common Stock

|

3336

|

$0.00

|

D

|

|

|

Non-Qualified Stock Option 11-3-2016

|

(3)

|

(3)

|

Common Stock

|

14695

|

$74.70

|

D

|

|

|

Restricted Stock Equivalent 11-3-2016

|

(4)

|

(4)

|

Common Stock

|

3927

|

$0.00

|

D

|

|

|

Performance Stock Equivalent 11-3-2016

|

(5)

|

(5)

|

Common Stock

|

5892

|

$0.00

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

One-third of the Options became exercisable on 7/6/2016 and remain unexercised. One-half of the remaining options will become exercisable on each of 7/6/2017 and 7/6/2018, as long as the Reporting Person is employed on said dates, or all or a portion may vest upon death, disability, change in control or certain termination events.

|

|

(2)

|

One-half of the RSEs will become vested and convert into shares of Edgewell common stock on each of 7/8/2017 and 7/8/2018, as long as the Reporting Person is employed on said dates, or all or a portion may vest upon death, disability, change in control or certain termination events.

|

|

(3)

|

One-third of the RSEs will become exercisable on each of 11/3/2017, 11/3/2018 and 11/3/2019, as long as the Reporting Person is employed on said dates, or all or a portion may vest upon death, disability, change in control or certain termination events.

|

|

(4)

|

One-third of the RSEs will become vested and convert into shares of Edgewell common stock on each of 11/3/2017, 11/3/2018 and 11/3/2019, as long as the Reporting Person is employed on said dates, or all or a portion may vest upon death, disability, change in control or certain termination events.

|

|

(5)

|

The PSE will vest and convert into shares of Edgewell common stock on the date that Edgewell releases its earnings for the fiscal year ending September 30, 2019 if specified performance criteria are met, subject to the exercise of negative discretion by the Nominating and Executive Compensation Committee of Edgewell's Board of Directors. The performance goal for the PSEs is the adjusted earnings per share of the Company for its 2019 fiscal year. The percentage of the PSEs vesting will range from 0% to 100% based on performance.

|

Remarks:

I, Colin Hutchison, Chief Operating Officer of Edgewell Personal Care Company, hereby authorize and designate Manish Shanbhag and Jeffrey Gershowitz to sign and file all Forms 3, 4 and 5 which I may be required to file with the Securities and Exchange Commission pursuant to Section 16(a) of the Securities Exchange Act of 1934. Such authority shall continue indefinitely until such time as I revoke such authority in writing. Their authority shall not be exclusive and nothing herein shall serve to prohibit me from designating other persons to sign and file my Forms 3, 4 and 5, or from so signing and filing such Forms myself.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Hutchison Colin A

C/O EDGEWELL PERSONAL CARE

6 RESEARCH DRIVE

SHELTON, CT 06484

|

|

|

Chief Operating Officer

|

|

Signatures

|

|

s/ Colin A. Hutchison

|

|

4/5/2017

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 5(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

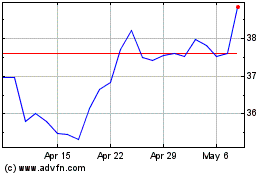

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

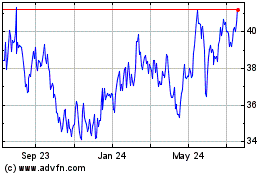

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Apr 2023 to Apr 2024