Current Report Filing (8-k)

April 06 2017 - 10:38AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 5, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

Station Casinos LLC

|

|

Red Rock Resorts, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada

|

|

000-54193

|

|

27-3312261

|

|

Delaware

|

|

001-37754

|

|

47-5081182

|

|

(State or other

jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer Identification No.)

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer Identification No.)

|

1505 South Pavilion Center Drive, Las Vegas, Nevada 89135

(Address of principal executive offices)

Registrant’s telephone number, including area code: (702)

495-3000

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the

Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to

Rule 14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 14d-2(b) under

the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 13e-4(c) under

the Exchange Act (17 CFR

240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On April 5, 2017, Station Casinos LLC

(“Station”), Red Rock Resorts, Inc., Station Holdco LLC, the guarantor subsidiaries of Station, Deutsche Bank AG Cayman Islands Branch, as administrative agent, and the lenders party to that certain Credit Agreement dated as of

June 8, 2016 (the “Credit Agreement”) entered into a second amendment to the Credit Agreement (the “Amendment”) pursuant to which the Credit Agreement was amended to, among other things, (a) reduce the top level

applicable margin for LIBOR loans from 2.75% to 2.0% and the top level applicable margin for ABR loans from 1.75% to 1.0% with respect to $150.8 million in aggregate principal amount of Term A Facility loans held by consenting lenders and all

$685.0 million in revolving loan commitments and (b) provide that the financial maintenance covenant related to Consolidated Total Leverage Ratio would be computed after subtracting unrestricted cash from the debt calculation.

The foregoing summary of the Amendment is not intended to be complete and is qualified in its entirety by reference to the full text of the

Amendment, copies of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

10.1

|

|

Second Amendment to Credit Agreement dated as of April 5, 2017, by and among Station, the other Station Parties, the lenders party thereto, and Deutsche Bank AG Cayman Islands Branch, as administrative agent.

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: April 5, 2017

|

|

|

|

|

|

|

|

|

|

|

Station Casinos LLC

|

|

|

|

Red Rock Resorts, Inc.

|

|

|

|

|

|

/s/ Marc J. Falcone

|

|

|

|

/s/ Marc J. Falcone

|

|

By:

|

|

Marc J. Falcone

|

|

|

|

By:

|

|

Marc J. Falcone

|

|

|

|

Executive Vice President, Chief Financial Officer and Treasurer

|

|

|

|

|

|

Executive Vice President, Chief Financial Officer and Treasurer

|

3

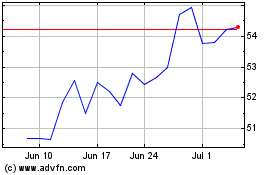

Red Rock Resorts (NASDAQ:RRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Red Rock Resorts (NASDAQ:RRR)

Historical Stock Chart

From Apr 2023 to Apr 2024