Today's Top Supply Chain and Logistics News From WSJ

April 06 2017 - 7:11AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

Costco Wholesale Corp. admits to being slow to embrace online

sales, but anyone who has shipped a one-gallon jug of mayonnaise

can understand why. The wholesaling giant is taking a contrarian

stance on e-commerce, the WSJ's Sarah Nassauer and Laura Stevens

report, even as competitive threats push the company to respond

more aggressively to the changes coursing through retail markets.

Costco's measured stance is backed by strong store sales that come

even as many brick-and-mortar chains falter, and by the tough

financial equation that online sales bring to its business.

Shipping the hefty-size goods that consumers buy from Costco in

bulk could eat into profit margins that are already low for most

household staples -- particularly as carriers move to charge by

dimension as well as weight. Costco is adding products to its

website and investing in distribution centers to speed deliveries,

but its online sales growth is slowing and that may leave Costco

wondering whether it's moving fast enough.

The West Coast ports labor slowdown is still echoing across the

retail world, at least according to one struggling importer.

Payless ShoeSource Inc. says the labor woes two years ago helped

push the company into chapter 11 bankruptcy protection this week,

the WSJ's Jacquiline Palank reports. In a filing that details steep

losses and plans to close some 400 stores, the largest footwear

chain in the U.S. says its troubles in a changing retail market

worsened in 2015. It says the labor dispute that backed up cargo

flows kept the company from stocking its shelves during the crucial

Easter selling season. By the time delayed inventory arrived,

Payless had to sell the shoes at a deep discount "in order to

realign inventory and product mix." That left the company without

the cash it needed to respond to the growing dominance of

e-commerce in consumer markets, a competitive force that is still

weighing on the company as it prepares to shutter outlets.

When commodities-trading house Mercuria Investment Co., ING and

Société Générale SA in February executed the first delivery of

crude oil to run entirely on a blockchain platform, they cut the

costs and time needed for the transaction significantly. The banks

are now talking about a similar trade in liquefied natural gas, the

WSJ's Stephanie Yang reports, part of a growing effort to test

whether the technology can solve longstanding problems in the

trading of physical commodities. Traders in goods, including a

cotton consortium that includes Cargill Inc. and Louis Dreyfus Co.,

are evaluating how the technology, which records each transaction

in an electronic ledger that provides an identical copy to every

computer, tracks goods and financial actions through the supply

chain. Mallory Alexander International Logistics Chief Executive

Neely Mallory remains skeptical after two shipping trials this

year, however, saying many U.S. export markets aren't ready to

embrace the technology.

E-COMMERCE

Amazon.com Inc. is getting even deeper into warehouse

technology. The e-commerce giant is taking a big stake in fuel-cell

maker Plug Power Inc. that could make it one of the largest

shareholders in a company that helps power material-handling

equipment, the WSJ's Imani Moise and Laura Stevens report. Plug

Power is a relatively small operation, generating $85.9 million in

revenue last year and no annual profits in its 20 years of

existence, but its place in warehouses highlights the relentless

push Amazon is undertaking to control its supply-chain operations

-- and to make its distribution centers more efficient. The tie-up

recalls Amazon's $775 million acquisition in 2012 of Kiva Systems

Inc., bringing into the company a central player in robotics for

warehouse operations. It also puts Amazon in an interesting

competitive position. Plug Power's biggest customer last year was

Amazon's top rival in the retail business, Wal-Mart Stores Inc.

QUOTABLE

IN OTHER NEWS

General Electric Co. is weighing the sale of its

consumer-lighting business, solidifying the industrial giant's move

away from consumer businesses. (WSJ)

Private-sector payrolls rose by 263,000 last month. (WSJ)

European investment fund JAB Holding Co., will pay roughly $7.16

billion to acquire food chain Panera Bread Co. (WSJ)

European regulators added their conditional approval to the U.S.

nod to China National Chemical Corp.'s takeover of Swiss seed and

pesticide maker Syngenta AG. (WSJ)

Gillette is slashing prices for its razors under heavy

competition from online retailers. (WSJ)

Government inspections of railroads that haul crude oil found

almost 24,000 safety defects, including problems like those blamed

in recent derailments. (Associated Press)

China became the biggest buyer of U.S. crude oil in February,

surpassing Canada. (Bloomberg)

California's merchandise exports expanded 11% in February.

(Sacramento Bee)

Authorities in Aurora, Colo., outside Denver, approved $1.18

million in incentives for an Amazon distribution center. (Denver

Post)

India will allow imports of 500,000 metric tons of duty-free raw

sugar, as a drought cuts output below consumption levels.

(Reuters)

Malaysia is emphasizing e-commerce in its efforts to build up

exports of halal products. (Nikkei Asian Review)

Insurers in London issued a guide to potential liquefaction of

bulk cargo following the apparent sinking of the ore carrier

Stellar Daisy. (Maritime Executive)

German shipping investment house Marenave Schiffahrts will sell

its fleet under a liquidation agreement with banks that finance the

single-ship companies that legally own the vessels. (Lloyd's

List)

Wallenius Wilhelmsen Logistics ASA began trading on the Oslo

stock exchange. (Automotive Logistics)

German logistics company Rhenus Group acquired British last-mile

operator Network 4 Home Deliver. (Forwarder Magazine)

An enormous tunnel-boring machine called Bertha finished nearly

four years of drilling in Seattle to create an underground highway.

(Seattle Times)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

April 06, 2017 06:56 ET (10:56 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

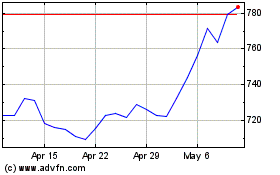

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

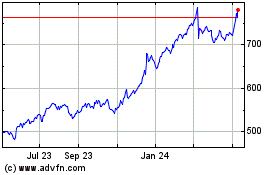

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024