- Sales increase 3% to third-quarter

record level

- Diluted EPS of $0.09 compares to $0.14

a year ago

- Impairment and restructuring charges

reduced diluted EPS by $0.05 per share

- Full-year EPS guidance maintained at

$1.54 to $1.64 per diluted share; as-adjusted guidance revised to

$2.57 to $2.67, from $2.62 to $2.72 due to impairment and

restructuring charges

- Third-quarter acquisitions add

approximately $170 million in annualized revenue

RPM International Inc. (NYSE: RPM) today reported record sales

for its fiscal 2017 third quarter ended February 28, 2017.

Third-quarter net income declined versus the prior-year period

primarily due to a pre-tax charge of $4.9 million for an intangible

impairment on the Restore product line and a pre-tax charge of

$4.2 million for the closing of a European manufacturing

facility.

Third-Quarter Results

Net sales grew 3.4% to $1.0 billion in the fiscal 2017 third

quarter from $988.6 million in the fiscal 2016 third quarter. Net

income of $11.9 million in the fiscal 2017 third quarter decreased

35.8% from $18.6 million reported a year ago. Third-quarter

earnings per share were $0.09, down 35.7% from the $0.14 reported

last year. Income before income taxes (IBT) was $17.0 million, down

22.4% from year-ago IBT of $21.9 million. Consolidated earnings

before interest and taxes (EBIT) were $37.1 million, down

11.9% from year-ago EBIT of $42.1 million. The impairment and

restructuring charges reduced both IBT and EBIT by $9.1 million in

the quarter.

During the current quarter, certain negative trends in the

Restore product line led to a loss of market share, resulting in a

downward revision to its long-term forecast. This was determined to

represent an impairment triggering event and, after additional

testing, resulted in a pre-tax impairment charge of

$4.9 million. Also during the quarter, as previously

discussed, an unprofitable operation in Europe was closed that

resulted in a pre-tax charge of $4.2 million.

“We were pleased with our consolidated sales growth during the

third quarter, which is typically slow due to cold winter weather

that limits outdoor repair, maintenance and construction

activities. Our earnings were negatively impacted by approximately

$0.05 per share due to the Restore intangible impairment charge and

the charge for the closure of a European manufacturing facility,

which is consistent with our strategy to close underperforming

operations. On the acquisition front, we completed five

transactions during the quarter, which will add approximately $170

million in annualized sales,” stated Frank C. Sullivan, RPM

chairman and chief executive officer. “Costs associated with

completing these acquisitions, as well as the associated impact on

cost of sales resulting from the step-up in inventory, further

reduced EPS by approximately $0.03 per share.”

Third-Quarter Segment Sales and Earnings

Industrial segment sales increased 5.8% to $521.4 million from

$492.7 million in the fiscal 2016 third quarter. Organic sales

improved 2.5%, while acquisitions added 4.1%. Foreign currency

translation negatively impacted sales by 0.8%. IBT was $11.7

million, compared to year-ago IBT of $0.5 million. Industrial

segment EBIT for the quarter of $14.6 million was up sharply

from last year’s EBIT of $2.0 million.

“Our businesses serving the U.S. commercial construction market

again experienced solid organic growth. Most businesses in Europe

were up in the low- to mid-single-digit range in local currencies

and current-year acquisitions contributed nicely to the segment’s

overall sales growth. We were very pleased with the strong EBIT

leverage achieved on solid top-line sales,” stated Sullivan.

Third-quarter sales in the company’s specialty segment increased

1.8% to $159.7 million from $156.9 million a year ago. Organic

sales decreased 0.6% and acquisitions added 3.8%. Foreign currency

translation negatively impacted sales by 1.4%. IBT was $15.0

million, down 31.0% from year-ago IBT of $21.7 million. Specialty

segment EBIT declined 30.8% to $14.9 million from $21.5 million in

the fiscal 2016 third quarter.

“Sales were soft for nearly all of our specialty segment

businesses, which cut across a broad range of industries, and

earnings were negatively impacted by the European facility closure

amounting to $4.2 million. In this traditionally slow quarter, the

segment didn’t generate enough top-line momentum to create positive

leverage through its fixed operating cost structure,” stated

Sullivan.

Sales in RPM’s consumer segment increased 0.7% to $341.4 million

from $339.0 million in the fiscal 2016 third quarter. Organic sales

declined 3.6%, while acquisitions added 5.1%. Foreign currency

translation negatively impacted sales by 0.8%. IBT was $29.8

million, down 23.2% from year-ago IBT of $38.8 million. Consumer

segment EBIT declined 22.9% to $29.9 million from $38.8

million a year ago.

“Excluding our Kirker nail enamel business, the consumer segment

produced modest sales growth, primarily driven by acquisitions. The

decline in organic sales was driven by the timing of orders from

our retail customers during the quarter. Impacting segment earnings

for the quarter was the Restore impairment charge, along with

acquisition-related expenses and the impact on cost of sales

relating to the step-up in inventory. Looking ahead, we are

encouraged by housing market activity, retail customer results and

the acceptance of recently introduced new products,” stated

Sullivan.

Cash Flow and Financial Position

For the first nine months of fiscal 2017, cash from operations

was $173.5 million, compared to $223.8 million in the first

nine months of fiscal 2016. Capital expenditures during the current

nine-month period of $80.1 million compare to $54.8 million over

the same time in fiscal 2016. Cash invested in acquisitions totaled

$247 million. Total debt at the end of the first nine months of

fiscal 2017 was $1.98 billion, compared to $1.74 billion a year ago

and $1.64 billion at the end of fiscal 2016. RPM’s net (of

cash) debt-to-total capitalization ratio was 58.0%, compared to

55.1% at February 29, 2016 and 50.0% at May 31, 2016.

“At February 28, 2017, RPM’s total liquidity, including cash and

long-term committed available credit, was $620.0 million. Building

upon this year’s strong pace of acquisitions, we continue our

search for entrepreneurial acquisition candidates and to invest in

our internal growth initiatives. In March 2017, we issued $450

million in bonds to pay down existing balances and free up

available borrowings on our revolving credit facility,” stated

Sullivan.

Nine-Month Results

Nine-month net sales grew 2.3% to $3.47 billion from $3.39

billion a year ago. Net income of $53.8 million declined 73.4%

from net income of $201.8 million in the year-ago period. Diluted

earnings per share declined 72.7% to $0.41 from $1.50 in the first

nine months of fiscal 2016. IBT was $58.6 million, down 79.4%

from year-ago IBT of $284.4 million. Consolidated EBIT was

$118.2 million, down 65.7% from year-ago EBIT of

$344.4 million.

The fiscal 2017 nine month results included a $188.3 million

Kirker impairment charge and a $12.3 million charge related to the

decision to exit Flowcrete Middle East, while the fiscal 2016

nine-month results included a $14.5 million reversal of Kirker's

final earnout accrual into income. Excluding these items, earnings

per diluted share increased from $1.43 per share to $1.44 per

share, while consolidated EBIT was $318.8 million, down 3.4% from

year-ago EBIT of $329.9 million.

Nine-Month Segment Sales and Earnings

Sales for RPM’s industrial segment increased 2.1%, to $1.83

billion from $1.79 billion in the fiscal 2016 first nine months.

Organic sales increased 1.9%, while acquisitions added 2.3%.

Foreign currency translation negatively impacted sales by 2.1%. IBT

was $151.3 million, up 1.5% from year-ago IBT of $149.0 million.

Industrial segment EBIT of $158.0 million was up 2.9% from EBIT of

$153.5 million in the first nine months of fiscal 2016. Excluding

the current-year Flowcrete Middle East charge, EBIT was $170.2

million, up 10.9% from year-ago EBIT of $153.5 million.

Specialty segment sales increased 3.8% to $519.6 million from

$500.4 million in the first nine months a year ago. Organic sales

increased 2.5% and acquisitions added 3.0%. Foreign currency

translation negatively impacted sales by 1.7%. IBT was $76.7

million, up 0.2% from year-ago IBT of $76.5 million. Specialty

segment EBIT improved 0.5% to $76.3 million from $75.8 million in

the same period a year ago.

In the consumer segment, nine-month sales were up 2.0% to $1.12

billion from $1.09 billion in the first nine months of fiscal 2016.

Organic sales improved 1.4%, while acquisitions added 2.1%. Foreign

currency negatively impacted sales by 1.5%. Loss before income

taxes was $40.7 million, compared to year-ago IBT of $170.3

million. Consumer segment EBIT was a negative $40.6 million

compared to EBIT of $170.2 million in the first nine months a year

ago. Excluding the current-year Kirker impairment charge and the

prior year’s Kirker earnout reversal, EBIT was $147.7 million, down

5.1% from year-ago EBIT of $155.7 million.

Business Outlook

“As we look ahead, we expect that recent expense-reduction

initiatives, along with the $220 million in revenue added via nine

acquisitions this fiscal year, have RPM well positioned for solid

performance in the fourth quarter and into fiscal 2018,” Sullivan

stated.

“In our industrial segment, we expect mid-single-digit sales

growth during the fourth quarter. This is predicated on continued

strength in our businesses serving U.S. commercial construction

markets and steady progress in Europe. Also, contributing to growth

will be approximately $80 million in annualized sales from six

industrial acquisitions completed this fiscal year,” stated

Sullivan.

“The specialty segment is expected to grow in the low- to

mid-single-digit range during the fourth quarter, driven by a

balance between organic and acquisition growth,” Sullivan

stated.

“Our consumer segment’s fourth-quarter sales should increase in

the mid-single-digit range. Third-quarter acquisitions in the

segment will help balance out underperformance at our Kirker

business, which remains challenged,” Sullivan stated.

“As-reported EPS guidance for the full fiscal year of $1.54 to

$1.64 remains unchanged. In January, we provided full-year

as-adjusted EPS guidance of $2.62 to $2.72. As-adjusted EPS

guidance is being reduced by $0.05 per share to $2.57 to $2.67 for

the combined third quarter charges for the Restore intangible

impairment and the European facility closure,” stated Sullivan.

Webcast and Conference Call Information

Management will host a conference call to discuss these results

beginning at 10:00 a.m. EDT today. The call can be accessed by

dialing 888-771-4371 or 847-585-4405 for international callers.

Participants are asked to call the assigned number approximately 10

minutes before the conference call begins. The call, which will

last approximately one hour, will be open to the public, but only

financial analysts will be permitted to ask questions. The media

and all other participants will be in a listen-only mode.

For those unable to listen to the live call, a replay will be

available from approximately 12:30 p.m. EDT today until 11:59

p.m. EDT on April 13, 2017. The replay can be accessed by dialing

888-843-7419 or 630-652-3042 for international callers. The access

code is 43815401. The call also will be available both live and for

replay, and as a written transcript, via the RPM web site at

www.rpminc.com.

About RPM

RPM International Inc. owns subsidiaries that are world leaders

in specialty coatings, sealants, building materials and related

services across three segments. RPM’s industrial products include

roofing systems, sealants, corrosion control coatings, flooring

coatings and other construction chemicals. Industrial companies

include Stonhard, Tremco, illbruck, Carboline, Flowcrete, Euclid

Chemical and RPM Belgium Vandex. RPM's consumer products are used

by professionals and do-it-yourselfers for home maintenance and

improvement and by hobbyists. Consumer brands include Rust-Oleum,

DAP, Zinsser, Varathane and Testors. RPM’s specialty products

include industrial cleaners, colorants, exterior finishes,

specialty OEM coatings, edible coatings, restoration services

equipment and specialty glazes for the pharmaceutical and food

industries. Specialty segment companies include Day-Glo, Dryvit,

RPM Wood Finishes, Mantrose-Haeuser, Legend Brands, Kop-Coat and

TCI. Additional details can be found at www.RPMinc.com and by

following RPM on Twitter at www.twitter.com/RPMintl.

For more information, contact Barry M. Slifstein, vice president

– investor relations, at 330-273-5090 or bslifstein@rpminc.com.

Use of Non-GAAP Financial Information

To supplement the financial information presented in accordance

with Generally Accepted Accounting Principles in the United States

(“GAAP”) in this earnings release, we use EBIT, a non-GAAP

financial measure. EBIT is defined as earnings (loss) before

interest and taxes. We evaluate the profit performance of our

segments based on income before income taxes, but also look to EBIT

as a performance evaluation measure because interest expense is

essentially related to acquisitions, as opposed to segment

operations. For that reason, we believe EBIT is also useful to

investors as a metric in their investment decisions. EBIT should

not be considered an alternative to, or more meaningful than,

income before income taxes as determined in accordance with GAAP,

since EBIT omits the impact of interest in determining operating

performance, which represent items necessary to our continued

operations, given our level of indebtedness. Nonetheless, EBIT is a

key measure expected by and useful to our fixed income investors,

rating agencies and the banking community all of whom believe, and

we concur, that this measure is critical to the capital markets'

analysis of our segments' core operating performance. We also

evaluate EBIT because it is clear that movements in EBIT impact our

ability to attract financing. Our underwriters and bankers

consistently require inclusion of this measure in offering

memoranda in conjunction with any debt underwriting or bank

financing. EBIT may not be indicative of our historical operating

results, nor is it meant to be predictive of potential future

results. See the last page of this earnings release for a

reconciliation of EBIT to income before income taxes.

Forward-Looking Statements

This press release contains “forward-looking statements”

relating to our business. These forward-looking statements, or

other statements made by us, are made based on our expectations and

beliefs concerning future events impacting us, and are subject to

uncertainties and factors (including those specified below) which

are difficult to predict and, in many instances, are beyond our

control. As a result, our actual results could differ materially

from those expressed in or implied by any such forward-looking

statements. These uncertainties and factors include (a) global

markets and general economic conditions, including uncertainties

surrounding the volatility in financial markets, the availability

of capital and the effect of changes in interest rates, and the

viability of banks and other financial institutions; (b) the

prices, supply and capacity of raw materials, including assorted

pigments, resins, solvents and other natural gas- and oil-based

materials; packaging, including plastic containers; and

transportation services, including fuel surcharges; (c) continued

growth in demand for our products; (d) legal, environmental and

litigation risks inherent in our construction and chemicals

businesses and risks related to the adequacy of our insurance

coverage for such matters; (e) the effect of changes in interest

rates; (f) the effect of fluctuations in currency exchange rates

upon our foreign operations; (g) the effect of non-currency risks

of investing in and conducting operations in foreign countries,

including those relating to domestic and international political,

social, economic and regulatory factors; (h) risks and

uncertainties associated with our ongoing acquisition and

divestiture activities; (i) risks related to the adequacy of our

contingent liability reserves; and (j) other risks detailed in our

filings with the Securities and Exchange Commission, including the

risk factors set forth in our Annual Report on Form 10-K for the

year ended May 31, 2016, as the same may be updated from

time to time. We do not undertake any obligation to publicly update

or revise any forward-looking statements to reflect future events,

information or circumstances that arise after the date of this

release.

CONSOLIDATED STATEMENTS OF INCOME IN THOUSANDS, EXCEPT PER

SHARE DATA (Unaudited)

Three Months

Ended Nine Months Ended February

28, February 29, February 28,

February 29, 2017

2016 2017 2016 Net

Sales $ 1,022,496 $ 988,555 $ 3,465,329 $ 3,387,065 Cost of

sales 593,923 575,593 1,963,033

1,947,211 Gross profit 428,573 412,962 1,502,296 1,439,854 Selling,

general & administrative expenses 386,032 370,913 1,189,611

1,096,361 Goodwill and other intangible asset impairments 4,900

193,198 Interest expense 23,769 23,140 69,452 68,078 Investment

(income), net (3,627) (2,909) (9,881) (8,077) Other expense

(income), net 502 (88) 1,301 (876)

Income before income taxes 16,997 21,906 58,615 284,368 Provision

for income taxes 4,313 2,613 2,793

80,564

Net income 12,684 19,293 55,822 203,804 Less: Net

income attributable to noncontrolling interests 756

711 2,051 1,974

Net income attributable to

RPM International Inc. Stockholders $ 11,928 $ 18,582 $ 53,771

$ 201,830

Earnings per share of common stock attributable

to RPM International Inc. Stockholders: Basic $

0.09 $ 0.14 $ 0.41 $ 1.53

Diluted $ 0.09 $ 0.14 $ 0.41 $

1.50 Average shares of common stock outstanding - basic

130,677 129,068 130,657 129,506 Average

shares of common stock outstanding - diluted 130,677

129,068 130,657 136,848

SUPPLEMENTAL

SEGMENT INFORMATION

IN THOUSANDS (Unaudited)

Three Months Ended Nine Months Ended February

28, February 29, February 28, February 29,

2017 2016 2017

2016 Net Sales: Industrial Segment $ 521,403 $

492,662 $ 1,830,672 $ 1,793,075 Specialty Segment 159,659 156,909

519,562 500,395 Consumer Segment 341,434 338,984

1,115,095 1,093,595

Total $ 1,022,496 $

988,555 $ 3,465,329 $ 3,387,065

Income Before Income

Taxes (a): Industrial Segment Income Before Income Taxes (b) $

11,705 $ 486 $ 151,262 $ 148,962 Interest (Expense), Net (c)

(2,929) (1,468) (6,672) (4,549) EBIT (d)

14,634 1,954 157,934 153,511 Charge to exit Flowcrete Middle East

(e) 12,275 Adjusted EBIT $ 14,634 $

1,954 $ 170,209 $ 153,511 Specialty Segment Income Before

Income Taxes (b) $ 15,000 $ 21,729 $ 76,664 $ 76,496 Interest

Income, Net (c) 116 208 406 650 EBIT

(d) $ 14,884 $ 21,521 $ 76,258 $ 75,846 Consumer Segment

(Loss) Income Before Income Taxes (b) $ 29,802 $ 38,785 $ (40,685)

$ 170,337 Interest (Expense) Income, Net (c) (92) 16

(114) 116 EBIT (d) 29,894 38,769 (40,571) 170,221

Goodwill and intangible impairments (f) 188,298 Reversal of Kirker

earnout (g) (14,500) Adjusted EBIT $

29,894 $ 38,769 $ 147,727 $ 155,721 Corporate/Other

(Expense) Before Income Taxes (b) $ (39,510) $ (39,094) $ (128,626)

$ (111,427) Interest (Expense), Net (c) (17,237)

(18,987) (53,191) (56,218) EBIT (d) $ (22,273) $

(20,107) $ (75,435) $ (55,209)

Consolidated (Loss)

Income Before Income Taxes (b) $ 16,997 $ 21,906 $ 58,615 $ 284,368

Interest (Expense), Net (c) (20,142) (20,231)

(59,571) (60,001) EBIT (d) 37,139 42,137 118,186 344,369

Charge to exit Flowcrete Middle East (e) 12,275 Goodwill and

intangible impairments (f) 188,298 Reversal of Kirker earnout (g)

(14,500) Adjusted EBIT $ 37,139 $

42,137 $ 318,759 $ 329,869 (a) Prior period

information has been recast to reflect the current period change in

reportable segments. (b) The presentation includes a reconciliation

of Income (Loss) Before Income Taxes, a measure defined by

Generally Accepted Accounting Principles in the United States

(GAAP), to EBIT. (c) Interest income (expense), net includes the

combination of interest income (expense) and investment income

(expense), net. (d)

EBIT is defined as earnings (loss) before

interest and taxes. We evaluate the profit performance of our

segments based on income before income taxes, but also look to EBIT

as a performance evaluation measure because interest expense is

essentially related to acquisitions, as opposed to segment

operations. For that reason, we believe EBIT is also useful to

investors as a metric in their investment decisions. EBIT should

not be considered an alternative to, or more meaningful than,

income before income taxes as determined in accordance with GAAP,

since EBIT omits the impact of interest in determining operating

performance, which represent items necessary to our continued

operations, given our level of indebtedness. Nonetheless, EBIT is a

key measure expected by and useful to our fixed income investors,

rating agencies and the banking community all of whom believe, and

we concur, that this measure is critical to the capital markets'

analysis of our segments' core operating performance. We also

evaluate EBIT because it is clear that movements in EBIT impact our

ability to attract financing. Our underwriters and bankers

consistently require inclusion of this measure in offering

memoranda in conjunction with any debt underwriting or bank

financing. EBIT may not be indicative of our historical operating

results, nor is it meant to be predictive of potential future

results.

(e) Charges related to Flowcrete decision to exit the Middle East.

(f) Reflects the impact of goodwill and other intangible asset

impairment charges of $188.3 million related to our Kirker

reporting unit. (g) Reflects the reversal of contingent obligations

for earnout targets that were not met at our Kirker reporting unit.

SUPPLEMENTAL INFORMATION RECONCILIATION OF

"REPORTED" TO "ADJUSTED" AMOUNTS (Unaudited)

Three Months Ended Nine Months Ended February

28, February 29, February 28, February 29,

2017 2016 2017 2016

Reconciliation of

Reported Earnings (Loss) per Diluted Share to Adjusted

Earnings per Diluted Share:

Reported (Loss) Earnings per Diluted Share $ 0.09 $ 0.14 $

0.41 $ 1.50 Charge to exit Flowcrete Middle East (e) 0.09 Goodwill

and intangible impairments (f) 0.94 Reversal of Kirker earnout (g)

(0.07) Adjusted Earnings per Diluted

Share $ 0.09 $ 0.14 $ 1.44 $ 1.43 (e) Charges related

to Flowcrete decision to exit the Middle East. (f) Reflects the

impact of goodwill and other intangible asset impairment charge of

$188.3 million related to our Kirker reporting unit. (g) Reflects

the reversal of contingent obligations for earnout targets that

were not met at our Kirker reporting unit.

CONSOLIDATED

BALANCE SHEETS

IN THOUSANDS (Unaudited)

February 28,

2017

February 29,

2016

May 31,

2016

Assets Current Assets Cash and cash

equivalents

$

210,796 $ 220,712 $ 265,152 Trade accounts receivable 829,632

769,003 987,692 Allowance for doubtful accounts

(41,357)

(22,450)

(24,600)

Net trade accounts receivable 788,275 746,553 963,092 Inventories

856,461 739,716 685,818 Deferred income taxes - 29,042 - Prepaid

expenses and other current assets 224,347 191,291

221,286

Total current assets 2,079,879

1,927,314 2,135,348

Property, Plant and Equipment,

at Cost 1,433,413 1,278,553 1,344,830 Allowance for

depreciation (731,279) (698,902) (715,377)

Property, plant and equipment, net 702,134

579,651 629,453

Other Assets Goodwill 1,133,013

1,182,293 1,219,630 Other intangible assets, net of amortization

579,237 566,977 575,401 Deferred income taxes, non-current 25,872

2,237 19,771 Other 212,084 177,778 185,366

Total other assets 1,950,206 1,929,285

2,000,168

Total Assets $ 4,732,219 $ 4,436,250 $

4,764,969

Liabilities and Stockholders' Equity

Current Liabilities Accounts payable $ 417,730 $ 367,038 $

500,506 Current portion of long-term debt 383,980 3,405 4,713

Accrued compensation and benefits 133,588 129,105 183,768 Accrued

losses 37,123 27,581 35,290 Other accrued liabilities

258,102 255,274 277,914

Total current

liabilities 1,230,523 782,403 1,002,191

Long-Term Liabilities Long-term debt, less current

maturities 1,597,553 1,737,984 1,635,260 Other long-term

liabilities 569,859 609,952 702,979 Deferred income taxes

48,557 65,391 49,791

Total long-term

liabilities 2,215,969 2,413,327 2,388,030

Total liabilities 3,446,492 3,195,730

3,390,221 Commitments and contingencies

Stockholders' Equity

Preferred stock; none issued Common stock (outstanding 133,583;

132,846; 132,944) 1,336 1,328 1,329 Paid-in capital 946,955 895,131

921,956 Treasury stock, at cost (216,366) (191,693) (196,274)

Accumulated other comprehensive (loss) (533,165) (497,754)

(502,047) Retained earnings 1,084,462 1,031,020

1,147,371

Total RPM International Inc. stockholders'

equity 1,283,222 1,238,032 1,372,335 Noncontrolling interest

2,505 2,488 2,413

Total equity

1,285,727 1,240,520 1,374,748

Total

Liabilities and Stockholders' Equity $ 4,732,219 $ 4,436,250 $

4,764,969

CONSOLIDATED STATEMENTS OF CASH

FLOWS IN THOUSANDS

(Unaudited)

Nine Months Ended February 28,

February 29, 2017 2016

Cash Flows From Operating Activities: Net income $ 55,822 $

203,804 Adjustments to reconcile net income to net cash provided by

(used for) operating activities: Depreciation 53,343 49,980

Amortization 33,497 33,151 Goodwill and other intangible asset

impairments 193,198 Reversal of contingent consideration

obligations (14,500) Deferred income taxes (26,996) (18,556)

Stock-based compensation expense 25,005 23,000 Other non-cash

interest expense 7,149 7,305 Realized (gain) on sales of marketable

securities (5,338) (5,438) Other 136 1,994 Changes in assets and

liabilities, net of effect from purchases and sales of businesses:

Decrease in receivables 190,423 179,003 (Increase) in inventory

(143,409) (81,837) (Increase) in prepaid expenses and other current

and long-term assets (26,698) (13,347) (Decrease) in accounts

payable (95,727) (133,841) (Decrease) in accrued compensation and

benefits (50,425) (35,202) Increase in accrued losses 2,247 5,948

(Decrease) increase in other accrued liabilities (35,135) 4,696

Other (3,613) 17,659 Cash Provided By Operating

Activities 173,479 223,819

Cash Flows From

Investing Activities: Capital expenditures (80,110) (54,819)

Acquisition of businesses, net of cash acquired (246,874) (28,926)

Purchase of marketable securities (36,418) (21,981) Proceeds from

sales of marketable securities 36,696 18,722 Other 1,493

7,430 Cash (Used For) Investing Activities (325,213)

(79,574)

Cash Flows From Financing Activities:

Additions to long-term and short-term debt 422,521 116,578

Reductions of long-term and short-term debt (78,654) (19,419) Cash

dividends (116,680) (107,806) Shares of common stock repurchased

and returned for taxes (20,092) (66,765) Payments of

acquisition-related contingent consideration (4,206) (2,006)

Payments for 524(g) trust (102,500) Other (2,009)

(1,239) Cash Provided By (Used For) Financing Activities

98,380 (80,657)

Effect of Exchange Rate Changes on

Cash and Cash Equivalents (1,002) (17,587)

Net Change in Cash and Cash Equivalents (54,356)

46,001

Cash and Cash Equivalents at Beginning of

Period 265,152 174,711

Cash and Cash

Equivalents at End of Period $ 210,796 $ 220,712

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170406005354/en/

RPM International Inc.Barry M. Slifstein, 330-273-5090Vice

President – Investor Relationsbslifstein@rpminc.com

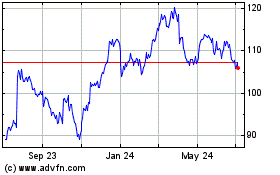

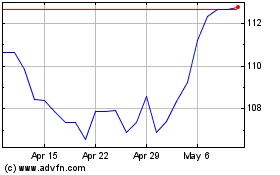

RPM (NYSE:RPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

RPM (NYSE:RPM)

Historical Stock Chart

From Apr 2023 to Apr 2024