Proto Labs, Inc.

5540 Pioneer Creek Drive

Maple Plain, Minnesota 55359

(763) 479-3680

Fax: (763) 479-2679

April

7, 2017

Dear Fellow Shareholder:

The Board of Directors of Proto Labs, Inc. joins me in extending a cordial invitation to attend our 2017 Annual Meeting of Shareholders (the “Annual Meeting”), which will be held at our headquarters, 5540 Pioneer Creek Drive, Maple Plain, Minnesota 55359, on Thursday, May 18, 2017 at 8:30 a.m. local time.

We will be using the “Notice and Access” method of furnishing proxy materials via the Internet to our shareholders. We believe that this process will provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to reduce the environmental impact of our Annual Meeting and the costs of printing and distributing the proxy materials. On or about

April 7, 2017, we will mail to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and Annual Report on Form 10-K and vote electronically via the Internet. The Notice also contains instructions on how to receive a paper copy of your proxy materials.

It is important that your shares be represented at the Annual Meeting whether or not you plan to attend in person. Please vote electronically via the Internet or, if you receive a paper copy of the proxy card by mail, you may vote by Internet or telephone or by returning your signed proxy card in the envelope provided. If you do attend the Annual Meeting and desire to vote in person, you may do so by following the procedures described in the Proxy Statement even if you have previously sent a proxy.

We hope that you will be able to attend the Annual Meeting and we look forward to seeing you.

Very truly yours,

Lawrence J. Lukis

Chairman of the Board

PROTO LABS, INC.

5540 Pioneer Creek Drive

Maple Plain, Minnesota 55359

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 18, 2017

Proto Labs, Inc. will hold its 201

7 Annual Meeting of Shareholders at its headquarters, 5540 Pioneer Creek Drive, Maple Plain, Minnesota 55359, on Thursday, May 18, 2017. The Annual Meeting will begin at 8:30 a.m. local time. The proxy materials were made available to you via the Internet or mailed to you beginning on or about April 7, 2017. At the Annual Meeting, our shareholders will:

|

|

1.

|

Elect seven directors to hold office until the next Annual Meeting of Shareholders or until their successors are duly elected.

|

|

|

2.

|

Vote on the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 201

7.

|

|

|

3.

|

Vote on an advisory basis to approve the compensation of the officers disclosed in the accompanying Proxy Statement, which we refer to as a “say-on-pay” vote.

|

|

|

4

.

|

Act on any other matters that may properly come before the Annual Meeting, or any adjournment or postponement thereof.

|

The board of directors recommends that shareholders vote

FOR

each of the following:

|

|

1.

|

The director nominees named in the accompanying Proxy Statement.

|

|

|

2.

|

The ratification of the selection of Ernst & Young LLP as our independent registered public

accounting firm for fiscal 2017.

|

|

|

3.

|

The approval of the say-on-pay proposal.

|

Only shareholders of record at the close of business on

March 23, 2017 may vote at the Annual Meeting or any adjournment or postponement thereof.

By Order of the Board of Directors

William R. Langton

Secretary

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the Annual Meeting, we urge you to vote as soon as possible. If you received the Notice of Internet Availability of Proxy Materials (the “Notice”), you may vote via the Internet as described in the Notice. If you received a copy of the proxy card by mail, you may vote by Internet or telephone as instructed on the proxy card, or you may sign, date and mail the proxy card in the envelope provided.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 201

7

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 1

8

, 201

7

.

Our Proxy Statement for the 201

7

Annual Meeting of Shareholders and our Annual Report on Form 10-K for the fiscal year ended December 31, 201

6

are available

at

www.proxyvote.com

.

TABLE OF CONTENTS

|

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

|

1

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

6

|

|

CORPORATE GOVERNANCE

|

8

|

|

Board Leadership Structure

|

8

|

|

Risk Oversight

|

8

|

|

Nominating Process and Board Diversity

|

8

|

|

Proxy Access

|

9

|

|

Director Independence

|

9

|

|

Code of Business Conduct and Ethics

|

9

|

|

Communications with the Board and Corporate Governance Guidelines

|

9

|

|

Board Meetings

|

10

|

|

Committees of the Board

|

10

|

|

Certain Relationships and Related Party Transactions

|

11

|

|

Compensation Committee Interlocks and Insider Participation

|

12

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

|

12

|

|

PROPOSAL 1 ELECTION OF DIRECTORS

|

13

|

|

General Information

|

13

|

|

Nominees

|

13

|

|

Voting Information and Board Voting Recommendation

|

15

|

|

COMPENSATION DISCUSSION AND ANALYSIS

|

16

|

|

Named Executive Officers

|

16

|

|

Summary of Proto Labs

’ Performance and Organizational Changes

|

16

|

|

Executive Compensation Philosophy and Objectives

|

18

|

|

Compensation Decisions and Processes

|

18

|

|

Peer Group

|

19

|

|

Elements of Executive Compensation

|

20

|

|

Severance and Change in Control Benefits

|

25

|

|

Other Compensation and Equity-Related Policies

|

25

|

|

Summary Compensation Table

|

27

|

|

Grants of Plan-Based Awards

|

28

|

|

Outstanding Equity Awards at 2016 Year-End

|

29

|

|

Option Exercises and Stock Vested in 2016

|

30

|

|

Pension Benefits

|

30

|

|

Nonqualified Deferred Compensation

|

30

|

|

Potential Payments upon Termination or Change in Control

|

30

|

|

COMPENSATION COMMITTEE REPORT

|

36

|

|

Compensation Risk Assessment

|

36

|

|

Conflict of Interest Analysis

|

36

|

|

DIRECTOR COMPENSATION

|

37

|

|

Non-Employee Director Compensation for 2016

|

37

|

|

Non-Employee Directors - Outstanding Equity Awards at 2016 Fiscal Year-End

|

38

|

|

PROPOSAL 2 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

39

|

|

AUDIT COMMITTEE REPORT

|

40

|

|

FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

41

|

|

PROPOSAL 3 ADVISORY VOTE ON EXECUTIVE COMPENSATION

|

42

|

|

OTHER MATTERS

|

43

|

|

SUBMISSION OF SHAREHOLDER PROPOSALS AND NOMINATIONS

|

43

|

|

Proposals Included in the Proxy Statement

|

43

|

|

Proposals Not Included in the Proxy Statement

|

43

|

|

ADDITIONAL INFORMATION

|

43

|

PROTO LABS, INC.

5540 Pioneer Creek Drive

Maple Plain, Minnesota 55359

PROXY STATEMENT

The board of directors of Proto Labs, Inc. is soliciting proxies for use at the Annual Meeting to be held on May 1

8, 2017, and at any adjournment or postponement of the meeting.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

|

A:

|

You can vote if you were a shareholder at the close of business on the record date of

March 23, 2017 (the “Record Date”). There were a total of 26,538,649 shares of our common stock outstanding on the Record Date. The Notice of Internet Availability of Proxy Materials (the “Notice”), notice of annual meeting, this Proxy Statement and accompanying proxy card and the Annual Report on Form 10-K for 2016 were first mailed or made available to you beginning on or about April 7, 2017. This Proxy Statement summarizes the information you need to vote at the Annual Meeting.

|

|

Q:

|

Who can attend the Annual Meeting?

|

|

A:

|

All shareholders as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting. If you hold your shares in street name, then you must request a legal proxy from your broker or nominee to attend and vote at the Annual Meeting.

|

|

|

•

|

Election of seven nominees as directors to hold office until the next Annual Meeting of Shareholders or until their successors are duly elected.

|

|

|

•

|

Ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 201

7.

|

|

|

•

|

Approval on an advisory basis of the compensation of our officers disclosed in this Proxy Statement, which we refer to as a “say-on-pay” vote.

|

|

Q:

|

How does the board of directors recommend I vote on the proposals?

|

|

A:

|

The board is soliciting your proxy and recommends you vote:

|

|

|

•

|

FOR

the director nominees;

|

|

|

•

|

FOR

the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2017; and

|

|

|

•

|

FOR

the say-on-pay proposal.

|

|

Q:

|

Why did I receive a notice in the mail regarding the

Internet availability of proxy materials instead of a

paper copy of the proxy materials?

|

|

A:

|

“Notice and Access” rules adopted by the United States Securities and Exchange Commission (the “SEC”) permit us to furnish proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for 201

6, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Shareholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice. Any request to receive proxy materials by mail will remain in effect until you revoke it.

|

|

Q:

|

How many shares must be voted to approve each proposal?

|

|

A:

|

Quorum.

A majority of the shares entitled to vote, represented in person or by proxy, is necessary to constitute a quorum for the transaction of business at the Annual Meeting. As of the Record Date, 26,538,649 shares of our common stock were issued and outstanding. A majority of those shares will constitute a quorum for the purpose of electing directors and adopting proposals at the Annual Meeting. If you submit a valid proxy or attend the Annual Meeting, your shares will be counted to determine whether there is a quorum.

|

|

|

Vote Required.

Generally, directors are elected by a majority of the votes cast with respect to the director, meaning that the votes cast “for” a director must exceed the votes cast “against” the director. However, in a contested election of directors in which the number of nominees exceeds the number of directors to be elected, the directors are elected by a plurality of the votes present in person or by proxy at the meeting. A plurality means that the nominees with the greatest number of votes are elected as directors up to the maximum number of directors to be chosen at the Annual Meeting. The proposal to ratify the selection of our independent registered public accounting firm and, other than the say-on-pay proposal, all other items that are properly presented at the Annual Meeting, will be determined by the affirmative vote of the greater of (a) the holders of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote or (b) a majority of the minimum number of shares of common stock entitled to vote that would constitute a quorum. If the advisory say-on-pay resolution in this Proxy Statement receives more votes “for” than “against,” then it will be deemed to be approved. The say-on-pay vote is advisory and is not binding on the board of directors.

|

|

Q:

|

What is the effect of broker non-votes and abstentions?

|

|

A:

|

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have or does not exercise discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. If a broker returns a “non-vote” proxy indicating a lack of authority to vote on a proposal, then the shares covered by such a “non-vote” proxy will be deemed present at the Annual Meeting for purposes of determining a quorum, but not present for purposes of calculating the vote with respect to any non-discretionary proposals. Nominees will not have discretionary voting power with respect to any matter to be voted upon at the Annual Meeting, other than the ratification of the selection of our independent registered public accounting firm. Broker non-votes will have no effect on the election of directors, the ratification of the independent registered accounting firm, approval of the

advisory say-on-pay resolution, or any other item properly presented at the Annual Meeting.

|

|

|

A properly executed proxy marked “ABSTAIN” with respect to a proposal will be counted for purposes of determining whether there is a quorum and will be considered present in person or by proxy and entitled to vote, but will not be deemed to have been voted in favor of such proposal. Abstentions will have no effect on the voting for the election of directors or approval of the advisory say-on-pay resolution. Abstentions will have the same effect as voting against the proposal to ratify the selection of our independent registered public accounting firm and any other item properly presented at the Annual Meeting.

|

|

Q:

|

How will the proxies vote on any other business brought

up at the Annual Meeting?

|

|

A:

|

By submitting your proxy, you authorize the proxies to use their judgment to determine how to vote on any other matter brought before the Annual Meeting, or any adjournments or postponements thereof. We do not know of any other business to be considered at the Annual Meeting. The proxies

’ authority to vote according to their judgment applies only to shares you own as the shareholder of record.

|

|

Q:

|

How do I cast my vote?

|

|

A:

|

If you are a shareholder whose shares are registered in your name, you may vote using any of the following methods:

|

|

|

•

|

Internet.

You may vote by going to the web address

www.proxyvote.com

24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on May 17, 2017 and following the instructions for Internet voting shown on your proxy card.

|

|

|

•

|

Telephone.

You may vote by dialing 1-800-690-6903 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on May 17, 2017 and following the instructions for telephone voting shown on your proxy card.

|

|

|

•

|

Mail.

If you requested printed proxy materials and you receive a paper copy of the proxy card, then you may vote by completing, signing, dating and mailing the proxy card in the envelope provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. If you vote by Internet or telephone, please do not mail your proxy card.

|

|

|

•

|

In person at the Annual Meeting.

If you are a shareholder whose shares are registered in your name, you may vote in person at the Annual Meeting.

|

|

|

If your shares are held on account at a brokerage firm, bank or similar organization you will receive voting instructions from your bank, broker or other nominee describing how to vote your shares. You must follow those instructions to vote your shares. You will receive the Notice that will tell you how to access our proxy materials on the Internet and vote your shares via the Internet. It will also tell you how to request a paper copy of our proxy materials.

|

|

|

Proxies that are voted via the Internet or by telephone in accordance with the voting instructions provided, and proxy cards that are properly signed, dated and returned, will be voted in the manner specified.

|

|

Q:

|

Can I vote my shares by filling out and returning the

Notice?

|

|

|

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote by Internet, by requesting and returning a paper proxy card or voting instruction card, or by submitting a ballot in person at the Annual Meeting.

|

|

Q:

|

Can I revoke or change my vote?

|

|

A:

|

You can revoke your proxy at any time before it is voted at the Annual Meeting by:

|

|

|

•

|

submitting a new proxy with a more recent date than that of the first proxy given before 11:59 P.M. Eastern Time on May 1

7, 2017 by (1) following the Internet voting instructions or (2) following the telephone voting instructions;

|

|

|

•

|

completing, signing, dating and returning a new proxy card to us, which must be received by us before the time of the Annual Meeting; or

|

|

|

•

|

if you are a registered shareholder, by attending the Annual Meeting in person and delivering a proper written notice of revocation of your proxy.

|

|

|

Attendance at the Annual Meeting will not by itself revoke a previously granted proxy. Unless you decide to vote your shares in person, you should revoke your prior proxy in the same

way you initially submitted it—that is, by Internet, telephone or mail.

|

|

Q:

|

Who will count the votes?

|

|

A:

|

Broadridge Financial Solutions, Inc., our independent proxy tabulator, will count the votes. John Way, our Chief Financial Officer, will act as inspector of election for the Annual Meeting.

|

|

Q:

|

Is my vote confidential?

|

|

A:

|

All proxies and all vote tabulations that identify an individual shareholder are confidential. Your vote will not be disclosed except:

|

|

|

•

|

To allow Broadridge Financial Solutions, Inc. to tabulate the vote;

|

|

|

•

|

To allow John Way to certify the results of the vote; and

|

|

|

•

|

To meet applicable legal requirements.

|

|

Q:

|

What shares are included on my proxy?

|

|

A:

|

Your proxy will represent all shares registered to your account in the same social security number and address.

|

|

Q:

|

What happens if I don

’t vote shares that I own?

|

|

A:

|

For shares registered in your name.

If you do not vote shares that are registered in your name by voting in person at the Annual Meeting or by proxy through the Internet, telephone or mail, your shares will

not

be counted in determining the presence of a quorum or in determining the outcome of the vote on the proposals presented at the Annual Meeting.

|

|

|

For shares held in street name.

If you hold shares through a broker, you will receive voting instructions from your broker. If you do not submit voting instructions to your broker and your broker does not have discretion to vote your shares on a particular matter, then your shares will

not

be counted in determining the outcome of the vote on that matter at the Annual Meeting. See “What is the effect of broker non-votes and abstentions?” as described above. Your broker will not have discretion to vote your shares for any matter to be voted upon at the Annual Meeting other than the ratification of the selection of our independent registered public accounting firm. Accordingly, it is important that you provide voting instructions to your broker for the matters to be voted upon at the Annual Meeting.

|

|

Q:

|

What if I do not specify how I want my shares voted?

|

|

A:

|

If you are a registered shareholder and submit a signed proxy card or submit your proxy by Internet or telephone but do not specify how you want to vote your shares on a particular matter, we will vote your shares as follows:

|

|

|

•

|

FOR

all of the director nominees;

|

|

|

•

|

FOR

the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2017; and

|

|

|

•

|

FOR

the say-on-pay proposal.

|

|

|

If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described under “Can I revoke or change my vote?”

|

|

|

If you hold shares through a broker, please see above under “What happens if I don

’t vote shares that I own?”

|

|

Q:

|

What does it mean if I get more than one Notice or proxy

card?

|

|

A:

|

Your shares are probably registered in more than one account. You should provide voting instructions for all Notices and proxy cards you receive.

|

|

Q:

|

How many votes can I cast?

|

|

A:

|

You are entitled to one vote per share on all matters presented at the Annual Meeting or any adjournment or postponement thereof. There is no cumulative voting.

|

|

Q:

|

When are shareholder proposals and nominees due for the

201

8

Annual Meeting of Shareholders?

|

|

A:

|

If you want to submit a shareholder proposal or nominee for the 201

8 Annual Meeting of Shareholders, you must submit the proposal in writing to our Secretary, Proto Labs, Inc., 5540 Pioneer Creek Drive, Maple Plain, Minnesota 55359, so it is received by the relevant dates set forth below under “

Submission of Shareholder Proposals and Nominations

.”

|

|

Q:

|

What is “householding”?

|

|

A:

|

We may send a single Notice, as well as other shareholder communications, to any household at which two or more shareholders reside unless we receive other instruction from you. This practice, known as “householding,” is designed to reduce duplicate mailings and printing and postage costs, and conserve natural resources. If your Notice is being householded and you wish to receive multiple copies of the Notice, or if you are receiving multiple copies and would like to receive a single copy, or if you would like to opt out of this practice for future mailings, you may contact:

|

Broadridge Financial Solutions, Inc.

Householding Department

51 Mercedes Way

Edgewood, New York 11717

1-800-542-1061

|

|

Broadridge will deliver the requested documents to you promptly upon receipt of your request.

|

|

Q:

|

How is this proxy solicitation being conducted?

|

|

A:

|

We will pay for the cost of soliciting proxies and we will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our shareholders. In addition, some of our employees may solicit proxies. We may solicit proxies in person, via the Internet, by telephone and by mail. Our employees will not receive special compensation for these services, which the employees will perform as part of their regular duties.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of March 2

3, 2017 regarding the beneficial ownership of our common stock by:

|

|

•

|

each person or group who is known by us to own beneficially more than 5% of our outstanding shares of common stock;

|

|

|

•

|

each of our named executive officers named in the Summary Compensation Table below;

|

|

|

•

|

each of our directors and each director nominee; and

|

|

|

•

|

all of the executive officers, directors and director nominees as a group.

|

The percentage of beneficial ownership is based on

26,538,649 shares of common stock outstanding as of March 23, 2017. Except as disclosed in the footnotes to this table and subject to applicable community property laws, we believe that each shareholder identified in the table possesses sole voting and investment power over all shares of common stock shown as beneficially owned by the shareholder. Unless otherwise indicated in the table or footnotes below, the address for each beneficial owner is c/o Proto Labs, Inc., 5540 Pioneer Creek Drive, Maple Plain, Minnesota 55359.

|

|

Beneficial Ownership on March 2

3

,

201

7

|

|

|

Name and Address of Beneficial Owner

|

Number

|

|

Percent

|

|

|

Greater than 5% shareholders:

|

|

|

|

|

|

|

|

Brown Capital Management, LLC

1201 N. Calvert Street

Baltimore, Maryland 21202

|

|

3,694,345

|

(1)

|

|

13.92

|

%

|

|

BlackRock, Inc.

55 East 52

nd

Street

New York, NY 10055

|

|

2,729,021

|

(2)

|

|

10.28

|

%

|

|

The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355

|

|

2,015,671

|

(3)

|

|

7.60

|

%

|

|

Riverbridge Partners LLC

80 South Eighth St., Suite 1200

Minneapolis, MN 55402

|

|

1,996,928

|

(4)

|

|

7.52

|

%

|

|

TimesSquare Capital Management, LLC

55 East 52

nd

Street

New York, NY 10055

|

|

1,547,950

|

(5)

|

|

5.

83

|

%

|

|

Directors and named executive officers:

|

|

|

|

|

|

|

|

Lawrence J. Lukis

|

|

1,881,840

|

(6)

|

|

7.09

|

%

|

|

Archie C. Black

|

|

3,151

|

(7)

|

|

*

|

|

|

Rainer Gawlick

|

|

27,989

|

(

7

)

|

|

*

|

|

|

John B. Goodman

|

|

14,983

|

(

7

)

|

|

*

|

|

|

Brian K. Smith

|

|

10,833

|

(

7

)

|

|

*

|

|

|

Sven A. Wehrwein

|

|

23,045

|

(

7

)

|

|

*

|

|

|

Arthur R. Baker III

|

|

5,558

|

(

8

)

|

|

*

|

|

|

Robert Bodor

|

|

27,019

|

(9

)

|

|

*

|

|

|

David M. Fein

|

|

0

|

|

|

*

|

|

|

Victoria M. Holt

|

|

30,387

|

(1

0

)

|

|

*

|

|

|

John B. Tumelty

|

|

27,253

|

(1

1

)

|

|

*

|

|

|

John A. Way

|

|

13,815

|

(1

2

)

|

|

*

|

|

|

All directors and executive officers as a group (12 persons)

|

|

2,065,873

|

(1

3

)

|

|

7.78

|

%

|

|

|

*

|

Represents beneficial ownership of less than one percent.

|

|

|

(1)

|

Information is based on a Schedule 13G/A filed with the SEC by Brown Capital Management LLC (“Brown”) on February

9, 2017. Brown has sole voting power over 2,227,069 shares of our common stock and sole dispositive power over 3,694,345 shares of our common stock.

|

|

|

(2)

|

Information is based on a Schedule 13G filed with the SEC by BlackRock, Inc. (“BlackRock”) on January 9, 2017. BlackRock has sole voting power over 2,638,132 shares of our common stock and sole dispositive power over 2,729,021 shares of our common stock.

|

|

|

(3)

|

Information is based on a Schedule 13G/A filed with the SEC by Vanguard Group Inc. (“Vanguard”) on February 13, 2017. Vanguard has sole voting power over 48,657 shares of our common stock, shared voting power over 2,528 shares of our common stock, sole dispositive power over 1,965,658 shares of our common stock and shared dispositive power over 50,013 shares of our common stock.

|

|

|

(4)

|

Information is based on a Schedule 13G/A filed with the SEC by Riverbridge Partners LLC (“Riverbridge”) on January 24, 2017. Riverbridge has sole voting power over 1,558,425 shares of our common stock and sole dispositive power over 1,996,928 shares of our common stock.

|

|

|

(5)

|

Information is based on a Schedule 13G filed with the SEC by TimesSquare Capital Management, LLC (“TimesSquare”) on February 13, 2017. TimesSquare has sole voting power over 1,378,750 shares of our common stock and sole dispositive power over 1,547,950 shares of our common stock.

|

|

|

(

6)

|

Information is based on a Schedule 13G/A filed with the SEC by Lawrence J. Lukis on February 16, 2016. Mr. Lukis has sole voting power over 1,881,840 shares of our common stock and sole dispositive power over 1,881,840 shares of our common stock.

|

|

|

(

7)

|

Includes 1,665 shares of restricted stock

units that vest on May 19, 2017.

|

|

|

(8)

|

Includes 1,737 shares that Mr. Baker has the right to acquire from us within 60 days of the date of the table pursuant to the exercise of stock options and 821 shares of restricted stock units that vest on May 4, 2017.

|

|

|

(9)

|

Includes 22,785 shares that Dr. Bodor has the right to acquire from us within 60 days of the date of the table pursuant to the exercise of stock options.

|

|

|

(10

)

|

Includes 10,978 shares that Ms. Holt has the right to acquire from us within 60 days of the date of the table pursuant to the exercise of stock options.

|

|

|

(1

1)

|

Includes 23,026 shares that Mr. Tumelty has the right to acquire from us within 60 days of the date of the table pursuant to the exercise of stock options.

|

|

|

(1

2)

|

Includes 9,443 shares that Mr. Way has the right to acquire from us within 60 days of the date of the table pursuant to the exercise of stock options.

|

|

|

(1

3)

|

Includes

114,213 shares held by our executive officers and directors, in the aggregate, that can be acquired from us within 60 days of the date of the table pursuant to the exercise of stock options, 8,325 shares of restricted stock units, in the aggregate, that vest on May 19, 2017, and 821 shares of restricted stock units, in the aggregate, that vest on May 4, 2017.

|

CORPORATE GOVERNANCE

Board Leadership Structure

Larry Lukis is our founder and former Chief Technology Officer, or CTO, and

leads our board of directors in his role as Chairman. Mr. Lukis ceased serving as our CTO in July 2013, has decided not to seek reelection at the Annual Meeting and will cease serving as Chairman and as a director upon conclusion of the Annual Meeting. Our board has nominated Sven Wehrwein to serve as Chairman beginning at the conclusion of the Annual Meeting. Mr. Wehrwein is currently designated as the lead independent director to complement the Chairman’s role and to serve as the principal liaison between the independent directors and the Chairman. With the nomination of Mr. Wehrwein to serve as Chairman, our board will cease to have a lead independent director at the conclusion of the Annual Meeting. Our board of directors believes that its proposed leadership structure is the appropriate one for our company in light of Mr. Lukis’s upcoming departure from the board and Mr. Wehrwein’s experience as lead independent director.

In his current role as

lead independent director, Mr. Wehrwein:

|

|

•

|

presides at all meetings of the board of directors at which the Chairman is not present, including executive sessions of the independent directors;

|

|

|

•

|

acts as the principal liaison between the Chairman and the independent directors;

|

|

|

•

|

conducts the annual performance review of the Chief Executive Officer, with input from the other independent directors;

|

|

|

•

|

assists the Chairman in setting the board agenda and frequency of meetings, in consultation with the committee chairs as applicable; and

|

|

|

•

|

has the authority to convene meetings of the independent directors at every meeting.

|

Risk Oversight

Our management is responsible for defining the various risks facing our company, formulating risk management policies and procedures, and managing our risk exposures on a day-to-day basis. The board

’s responsibility is to monitor our risk management processes by using board meetings, management presentations and other opportunities to educate itself concerning our material risks and evaluating whether management has reasonable controls in place to address the material risks; the board is not responsible, however, for defining or managing our various risks. The full board is responsible for monitoring management’s responsibility in the area of risk oversight. In addition, the audit committee and compensation committee have risk oversight responsibilities in their respective areas of focus, on which they report to the full board. Management reports from time to time to the full board, audit committee and compensation committee on risk management. The board focuses on the material risks facing our company, including operational, credit, liquidity, legal and cybersecurity risks, to assess whether management has reasonable controls in place to address these risks.

Nominating Process and Board Diversity

In consultation with other members of the board of directors, the nominating and governance committee is responsible for identifying individuals who it considers qualified to become board members. The nominating and governance committee will screen potential director candidates, including those recommended by shareholders, and recommend to the board of directors suitable nominees for the election to the board of directors. The nominating and governance committee uses a variety of methods for identifying and evaluating nominees for directors. The nominating and governance committee regularly assesses the appropriate size and composition of the board of directors, the needs of the board of directors and the respective committees of the board of directors, and the qualifications of candidates in light of these needs. Candidates may come to the attention of the nominating and governance committee through shareholders, management, current members of the board of directors, or search firms. The evaluation of these candidates may be based solely upon information provided to the committee or may include discussions with persons familiar with the candidate, an interview of the candidate or other actions the committee deems appropriate, including the use of third parties to review candidates.

In considering whether to recommend an individual for election to the board, the nominating and governance committee considers, as required by the corporate governance guidelines and its charter, the board

’s overall balance of diversity of perspectives, backgrounds and experiences, although it does not have a formal policy regarding the consideration of diversity of board members. The nominating and governance committee views diversity expansively and considers among other things, breadth and depth of relevant business and board skills and experiences, educational background, employment experience and leadership performance as well as those intangible factors that it deems appropriate to develop a heterogeneous and cohesive board such as integrity, achievements, judgment, intelligence, personal character, the interplay of the candidate’s relevant experience with the experience of other board members, the willingness of the candidate to devote sufficient time to board duties, and likelihood that he or she will be willing and able to serve on the board for an extended period of time.

The nominating and governance committee will consider a recommendation by a shareholder of a candidate for election as a Proto Labs director. Shareholders who wish to recommend individuals for consideration by the nominating and governance committee to become nominees for election to the board may do so by submitting a written recommendation to our Secretary. Recommendations must be received by the Secretary within the timelines specified in our by-laws to be considered by the nominating and governance committee for possible nomination at our Annual Meeting of Shareholders the following year. Our by-laws provide that such notice should be received no less than 90 days prior to the first anniversary of the preceding year

’s Annual Meeting, except in certain circumstances. All recommendations must contain the information required in our by-laws and corporate governance guidelines, including, among other things, the identification of the nominee, a written consent by the recommended individual to agree to be named in our proxy statement and to serve as director if elected, and the name and address of the shareholder submitting the nomination. Shareholders may also have the opportunity to include nominees in our proxy statement by complying with the requirements set forth in Section 2.17 of our by-laws. Recommendations must be received by the Secretary within the timeframes noted under “Proposals Not Included in the Proxy Statement.”

Proxy Access

In

November 2016, our board amended our by-laws to include a “proxy access” provision for director nominations under which eligible shareholders may nominate candidates for election to our board and inclusion in our proxy statement. The “proxy access” provision permits an eligible shareholder, or an eligible group of up to 20 shareholders, owning continuously for at least three years shares of our company representing an aggregate of at least three percent of the voting power entitled to vote in the election of directors, to nominate and include in our annual meeting proxy materials director nominees not to exceed the greater of (i) two or (ii) 25 percent of the number of directors then serving on our board, or, if such amount is not a whole number, the closest whole number below 25 percent, but not less than two. Such nominations are subject to certain eligibility, procedural, and disclosure requirements set forth in section 2.17 of our by-laws, including the requirement that our company must receive notice of such nominations not less than 120 calendar days prior to the anniversary date of the prior year’s annual proxy materials mailing, except as otherwise provided in section 2.17 of our by-laws.

Director Independence

Our board of directors has reviewed the materiality of any relationship that each of our directors has with us, either directly or indirectly. Based on this review, our board has determined that, with the exception of Victoria M. Holt, our current Chief Executive Officer, and Mr. Lukis, our founder and former CTO, all of the directors are “independent directors” as defined by Section 303A.02 of the New York Stock Exchange Listed Company Manual.

Code of Business Conduct and Ethics

We have adopted a code of ethics and business conduct relating to the conduct of our business by our employees, officers and directors, which is posted on our website at

www.protolabs.com

under the investor relations section. We plan to post to our website at the address described above any future amendments or waivers to our code of ethics and business conduct.

Communications with the Board and Corporate Governance Guidelines

Under our Corporate Governance Guidelines, a process has been established by which shareholders and other interested parties may communicate with members of the board of directors. Any shareholder or other interested party who desires to communicate with the board, individually or as a group, may do so by writing to the intended member or members of the board, c/o Secretary, Proto Labs, Inc., 5540 Pioneer Creek Drive, Maple Plain, Minnesota 55359. A copy of our Corporate Governance Guidelines is available at

www.protolabs.com

under the investor relations section.

All communications received in accordance with these procedures will initially be received and processed by the office of our Secretary to determine that the communication is a message to one or more of our directors and will be relayed to the appropriate director or directors. The director or directors who receive any such communication will have discretion to determine whether the subject matter of the communication should be brought to the attention of the full board or one or more of its committees and whether any response to the person sending the communication is appropriate.

Board Meetings

During 201

6, the full board of directors met five times in person and held two meetings via teleconference. Four of the in-person meetings were preceded and/or followed by an executive session of the independent directors, chaired by Mr. Wehrwein. Each of our incumbent directors attended at least 75% percent of the meetings of the board and any committee on which they served in 2016. We do not maintain a formal policy regarding the board’s attendance at annual shareholder meetings; however, board members are expected to regularly attend all board meetings and meetings of the committees on which they serve and are encouraged to make every effort to attend the Annual Meeting of Shareholders. All of our directors at the time of the 2016 Annual Meeting of Shareholders attended the meeting.

Committees of the Board

Our board of directors has established an audit committee, a compensation committee and a nominating and governance committee. The charters of these committees are posted on our website at

www.protolabs.com

under the investor relations section.

The current composition and responsibilities of each committee, as well as the number of times it met during 201

6, are described below.

|

Audit Committee

|

|

Compensation Committee

|

|

Nominating and

Governance Committee

|

|

Sven A. Wehrwein (chair)

|

|

Rainer Gawlick (chair)

|

|

John B. Goodman (chair)

|

|

Rainer Gawlick

|

|

Archie C. Black

|

|

Brian K. Smith

|

|

John B. Goodman

|

|

Brian K. Smith

|

|

Sven A. Wehrwein

|

Audit Committee

Among other matters, our audit committee:

|

|

•

|

oversees management

’s processes for ensuring the quality and integrity of our consolidated financial statements, our accounting and financial reporting processes, and other financial information provided by us to any governmental body or to the public;

|

|

|

•

|

oversees our accounting and financial reporting processes;

|

|

|

•

|

evaluates the qualifications, independence and performance of our independent auditor and internal audit function;

|

|

|

•

|

oversees the resolution of any disagreements between management and the auditors regarding financial reporting;

|

|

|

•

|

oversees our investment and cash management policies; and

|

|

|

•

|

supervises management

’s processes for ensuring our compliance with legal, ethical and regulatory requirements as set forth in policies established by our board of directors.

|

Each of the members of our audit committee meets the requirements for independence and financial literacy under the applicable rules and regulations of the SEC and the NYSE. Our board of directors has determined that Sven A. Wehrwein is an audit committee financial expert, as defined under the applicable rules of the SEC. The audit committee met

nine times in 2016. Effective upon the election of directors at the 2017 Annual Meeting of Shareholders, our audit committee will consist of Sven A. Wehrwein, Rainer Gawlick and John B. Goodman.

Nominating and Governance Committee

Among other matters, our nominating and governance committee:

|

|

•

|

identifies qualified individuals to become board members, consistent with criteria approved by the board;

|

|

|

•

|

selects director nominees for the next Annual Meeting of Shareholders;

|

|

|

•

|

determines the composition of the board

’s committees and evaluates and enhances the effectiveness of the board and individual directors and officers;

|

|

|

•

|

develops and implements the corporate governance guidelines for our company; and

|

|

|

•

|

ensures that succession planning takes place for critical senior management positions.

|

Each member of our nominating and governance committee satisfies the NYSE independence standards. The nominating and governance committee met

four times in 2016. Effective upon the election of directors at the 2017 Annual Meeting of Shareholders, our nominating and governance committee will consist of John B. Goodman, Sujeet Chand and Sven A. Wehrwein.

Compensation Committee

Among other matters, our compensation committee:

|

|

•

|

reviews and approves compensation programs, awards and employment arrangements for executive officers;

|

|

|

•

|

administers compensation plans for employees;

|

|

|

•

|

reviews our programs and practices relating to leadership development and continuity; and

|

|

|

•

|

determines the compensation of non-employee directors.

|

In addition, the compensation committee has the authority to select, retain and compensate compensation consulting firms and other experts as it deems necessary to carry out its responsibilities.

Each member of our compensation committee satisfies current NYSE independence standards, is a “non-employee director” as that term is defined in Rule 16b-3 under the Securities Exchange Act of 1934, and is an “outside director” as that term is used in Section 162(m) of the Internal Revenue Code. The compensation committee met

nine times in 2016. Effective upon the election of directors at the 2017 Annual Meeting of Shareholders, our compensation committee will consist of Rainer Gawlick, Archie C. Black and Sujeet Chand.

Certain Relationships and Related Party Transactions

Since the beginning of 201

6, we have engaged in the following transactions with certain of our executive officers, directors, holders of more than 5% of our voting securities and their affiliates and immediate family members:

Karbon Kinetics Limited

During the year ended December 31, 201

6, we made sales to our customer Karbon Kinetics Limited (“KKL”) on terms consistent with the terms we provide to our other customers. Mr. Lukis is a director, our former Chief Technology Officer and a 64% shareholder of KKL. Our revenues from sales to KKL did not exceed $120,000 during the year ended December 31, 2016.

Employment of Related Person

Scott

Goodman, the son of Mr. Goodman, a director and member of our compensation committee, is employed by us as an Associate Software Developer. He is entitled to receive a base salary, incentive compensation and other employee benefits that are offered to similarly situated employees of our company. Scott Goodman’s compensation during the year ended December 31, 2016 did not exceed $120,000.

Related Person Transaction Approval Policy

Our board of directors has adopted a written statement of policy regarding transactions with related persons, which we refer to as our related person policy. Subject to the exceptions described below, our related person policy requires our audit committee to review and approve any proposed related person transaction and all material facts with respect thereto. In reviewing a transaction, our audit committee will consider all relevant facts and circumstances, including (1) whether the terms are fair to us, (2) whether the transaction is material to us, (3) the role the related person played in arranging the transaction, (4) the structure of the transaction, (5) the interests of all related persons in the transaction, and (6) whether the transaction has the potential to influence the exercise of business judgment by the related person or others. Our audit committee will not approve or ratify a related person transaction unless it determines that, upon consideration of all relevant information, the transaction is beneficial to us and our shareholders and the terms of the transaction are fair to us. No related person transaction will be consummated without the approval or ratification of our audit committee. Under our related person policy, a related person includes any of our directors, director nominees, executive officers, any beneficial owner of more than 5% of our common stock and any immediate family member of any of the foregoing. Related party transactions exempt from our policy include payment of compensation by us to a related person for the related person

’s service to us as an employee, director or executive officer, transactions available to all of our employees and shareholders on the same terms and transactions between us and the related person that, when aggregated with the amount of all other transactions between us and the related person or its affiliates, involve $120,000 or less in a year.

Compensation Committee Interlocks and Insider Participation

During 201

6, Dr. Gawlick, Mr. Black, and Mr. Smith served as the members of our compensation committee. No current member of our compensation committee has ever been an officer or employee of our company or any of our subsidiaries and affiliates or has had any relationship with our company requiring disclosure in our proxy statement other than service as a director. None of our executive officers has served on the board of directors or on the compensation committee of any other entity, any officer of which served either on our board of directors or on our compensation committee.

Section 16(a) Beneficial Ownership Reporting Compliance

The rules of the SEC require us to disclose the identity of directors, executive officers and beneficial owners of more than 10% of our common stock who did not file on a timely basis reports required by Section 16(a) of the Securities Exchange Act of 1934. Based solely on a review of copies of such reports and written representations from reporting persons, we believe that all directors and executive officers complied with all filing requirements applicable to them during fiscal 201

6.

PROPOSAL 1

ELECTION OF DIRECTORS

General Information

Seven directors will be elected at the Annual Meeting. Upon the recommendation of the nominating and governance committee, the board of directors has nominated for election the seven persons named below. Each has consented to being named a nominee and will, if elected, serve until the next Annual Meeting of Shareholders or until a successor is duly elected. There are no family relationships between any director and any executive officer.

Other than Sujeet Chand and Donald G. Krantz, each nominee listed below is currently a director of Proto Labs and has been duly elected by the shareholders. Mr. Chand and Dr. Krantz were nominated by the board of directors in March 2017 to stand for election at the Annual Meeting. Lawrence J. Lukis and Brian K. Smith, who currently serves as directors, have decided not to seek reelection at the Annual Meeting and will cease serving as directors upon conclusion of the Annual Meeting.

Nominees

The names of the nominees and other information are set forth below:

|

Victoria M. Holt - Age 5

9

Director since 2014

|

Ms. Holt has served as our President and Chief Executive Officer since February 2014. Prior to joining us, Ms. Holt served as President and Chief Executive Officer of Spartech Corporation, a leading producer of plastic sheet, compounds and packaging products, from September 2010 until Spartech was purchased by PolyOne Corporation in March 2013. Prior to Spartech, Ms. Holt worked at PPG Industries, a leading coatings and specialty products company, serving as Senior Vice President, Glass and Fiber Glass, from May 2005 until September 2010. Ms. Holt also is a member of the board of directors of Waste Management, Inc., and she served as a director of Spartech while she was Chief Executive Officer.

|

|

|

|

|

|

Ms. Holt

’s leadership, strategic planning, operational and international experience provide valuable insights to our board of directors. As Chief Executive Officer, she also is responsible for determining our strategy, articulating priorities and managing our continued growth.

|

|

|

|

|

Archie C. Black - Age 5

5

Director since 2016

|

Mr. Black has served as a director of our company since March 2016 and serves as a member of the compensation committee. Since 2001, Mr. Black has served as the President and Chief Executive Officer of SPS Commerce, Inc., a provider of cloud-based supply chain management solutions. Mr. Black also serves on the Board of Directors of SPS Commerce, Inc. Prior to joining SPS Commerce, Inc., Mr. Black was a Senior Vice President and Chief Financial Officer at Investment Advisors, Inc. Prior to his time at Investment Advisors, Inc., Mr. Black spent three years at Price Waterhouse.

|

|

|

|

|

|

Mr. Black is qualified to serve on our board because of his extensive management, financial, and operational experience at SPS Commerce, Inc., during which he led the transformation of a tech-driven startup company into a global business and developed a deep knowledge of the requirements involved with being a public company.

|

|

Sujeet Chand - Age

59

|

Mr. Chand has been the Senior Vice President and Chief Technology Officer at Rockwell Automation, Inc. since 2005. Prior to taking on his current role, Mr. Chand served in various leadership positions at Rockwell. Mr. Cha

nd has sat on multiple government, industry, and higher education advisory boards, and has long had significant interaction with the Board of Directors of Rockwell. Mr. Chand earned a Doctor of Philosophy degree in electrical and computer engineering and a master's degree in electrical engineering from the University of Florida.

Mr. Chand

’s qualifications to serve on our board of directors include, among other skills and qualifications, his deep technical expertise and industry knowledge, particularly his experience at Rockwell. Mr. Chand brings a highly effective balance of strategic insight and technical engineering skills, as well as a unique perspective on technology, innovation and customer needs. He has served on the boards of the National Institute for Standards and Technology (NIST), National Electrical Manufacturers Association (NEMA), FIRST Robotics, Wisconsin Technology Council, University of Wisconsin Foundation, and Robert W. Baird Venture Partners. He has also represented the U.S. as the head of a delegation to Intelligent Manufacturing Systems, a worldwide consortium on manufacturing technology.

|

|

Rainer Gawlick - Age 4

9

Director since 2008

|

Dr. Gawlick has served as a director of our company since September 2008 and serves as a member of the audit committee and as the chair of the compensation committee.

Dr. Gawlick is also a director at Newforma and Operating Affiliate at Vector Capital. Previously Dr. Gawlick was President of Perfecto Mobile, Ltd., a leader in mobile testing. Prior to that he was with IntraLinks, Inc. where he was Executive Vice President of Global Sales. IntraLinks, Inc. is a computer software company providing virtual data rooms and other content management services. From August 2008 to April 2012, Dr. Gawlick served as Chief Marketing Officer of Sophos Ltd, a computer security company providing endpoint, network and data protection software. From April 2005 to August 2008, Dr. Gawlick served as Vice President of Worldwide Marketing and Strategy at SolidWorks Corp., a CAD software company. He also has held a variety of executive positions in other technology businesses and was a consultant with McKinsey & Company.

|

|

|

|

|

|

Dr. Gawlick has extensive sales, marketing and product-management experience in the technology industry. Dr. Gawlick offers expertise in building brand awareness, managing marketing on a global scale and developing growth strategies, which enables him to counsel our company on its global expansion.

|

|

|

|

|

John B. Goodman - Age 5

7

Director since 2001

|

Mr. Goodman has served as a director of our company since 2001 and serves as a member of the audit committee and as chair of the nominating and governance committee. Mr. Goodman currently serves

as Executive Chairman and is on the board of advisors of TPG (The Plastics Group) and the board of directors of Inclined Biomedical Technologies, Inc. d/b/a Dribank Labs. From December 1982 to October 2010, Mr. Goodman held various positions at Entegris, Inc., a materials supplier, most recently as Senior Vice President and Chief Technology & Innovation Officer.

|

|

|

|

|

|

Mr. Goodman

’s technical background and experiences in supply chain networks, logistics and financial planning and reviews enable Mr. Goodman to provide guidance and counsel on our strategic plan, research and development, supplier relationships and finance functions.

|

|

|

|

|

Donald G. Krantz

- Age

62

|

Dr.

Krantz served as our Executive Vice President and Technology Officer from January 2015 until his retirement in June 2016. From January 2007 to January 2015, Dr. Krantz served as our Chief Operating Officer. From November 2005 to January 2007, Dr. Krantz served as our Vice President of Development. Prior to joining our company, Dr. Krantz served in various roles at MTS Systems, Inc., a builder of custom precision testing and advanced manufacturing systems, including as a business unit Vice President, Vice President of Engineering and Chief Technology Officer. Dr. Krantz was an Engineering Fellow at Alliant Techsystems and Honeywell, Inc., and was named the 2005 Distinguished Alumnus of the Department of Computer Science and Engineering at the University of Minnesota. Dr. Krantz also serves on the board of advisors of Activated Research Company, LLC.

|

|

|

|

|

|

Dr. Krantz

has knowledge of and experience in leadership positions within multiple departments of our company, as well as his education and experience, enable him to provide guidance and counsel on strategy, relationships, general business matters and risk management.

|

|

Sven A. Wehrwein - Age 6

6

Director since 2011

|

Mr. Wehrwein has served as a director of our company since June 2011 and serves as lead director, as chair of the audit committee, and as a member of the nominating and governance committee. Mr. Wehrwein has been an independent financial consultant to emerging companies since 1999. During his 35-plus years in accounting and finance, he has experience as a certified public accountant (inactive)

, investment banker to emerging growth companies, chief financial officer and audit committee chair. Mr. Wehrwein currently serves on the board of directors of AtriCure, Inc., a medical device company, and SPS Commerce, Inc., a supply-chain management software company, both of which are publicly traded companies. Mr. Wehrwein also served on the board of directors of Compellent Technologies, Inc. from 2007 until its acquisition by Dell Inc. in 2011, on the board of Vital Images, Inc. from 1997 until its acquisition by Toshiba Medical in 2011, on the board of Synovis Life Technologies, Inc. from 2004 until its acquisition by Baxter International, Inc. in 2012, on the board of directors of Image Sensing Systems, Inc. from 2006 to 2012, and on the board of Cogentix Medical, Inc. from 2006 to 2016.

|

|

|

|

|

|

Mr. Wehrwein

’s qualifications to serve on our board of directors include, among other skills and qualifications, his capabilities in financial understanding, strategic planning, and auditing expertise, given his experiences in investment banking and in financial leadership positions. As chairman of the audit committee, Mr. Wehrwein also keeps the board abreast of current audit issues and collaborates with our independent auditors and senior management team.

|

Voting Information and Board Voting Recommendation

As set forth in our Third Amended and Restated Articles of Incorporation, as amended, each director shall be elected by the vote of the majority of the votes cast with respect to the director, provided that directors shall be elected by a plurality of the votes present and entitled to vote on the election of directors at any such meeting for which the number of nominees (other than nominees withdrawn on or prior to the day preceding the date we first mail our notice for such meeting to the shareholders) exceeds the number of directors to be elected. A majority of the votes cast means that the votes cast “for” a director nominee must exceed the votes that are voted “against” that director.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” EACH NOMINEE LISTED

.

COMPENSATION DISCUSSION AND ANALYSIS

Named Executive Officers

The compensation provided to our named executive officers for 2016 is set forth in detail in the Summary Compensation Table and the other tables, accompanying footnotes and narrative that follow this section. This Compensation Discussion and Analysis explains our executive compensation philosophy, objectives and design, our compensation-setting process, our executive compensation program components and the decisions made in 2016 affecting the compensation of our named executive officers.

Throughout this section, we refer to the following individuals as our “named executive officers”:

|

|

●

|

Victoria M. Holt, our President and Chief Executive Officer, or CEO;

|

|

|

●

|

John A. Way, our Chief Financial Officer, or CFO, and Executive Vice President of Development;

|

|

|

●

|

Robert Bodor, our Vice President/General Manager

– Americas;

|

|

|

●

|

John B. Tumelty, our Vice President/General Manager and Managing Director

– Europe, Middle East and Africa; and

|

|

|

●

|

Arthur R. Baker III, our Chief Technology Officer since May 2016.

|

Summary of Proto Labs

’ Performance and Organizational Changes

2016 Company Performance

2016 was a challenging year for

our company, with general economic conditions affecting the research and development spending in certain industries. Despite these challenges, our revenues increased by 13% and our net cash provided by operating activities was $75 million. We achieved several important milestones during 2016, including strengthening our management team, integrating our acquisition in Germany to enhance our 3D printing operations in Europe, the successful launch of overmolding and the expansion of our Liquid Silicone Rubber and lathe offerings, and the expansion to new manufacturing facilities in North Carolina and Japan. In addition, we laid the foundation to execute enhancements in our go-to-market models in 2017 with the goal of delivering sustainable revenue growth over the long term. The investment in this foundation impacted our profitability in the short term but is consistent with our commitment to long-term revenue growth.

|

Growth

|

Profitability

|

Cash Generation

|

|

+13%

Revenue increased to

$298.1 million in 2016 compared with $264.1 million in 2015.

|

-8%

Net income for 2016

decreased to $42.7 million, from $46.5

million in 2015.

|

$75.0m

Cash generated from

operations during the year totaled $75.0

million.

|

Shareholder Value Creation

Since

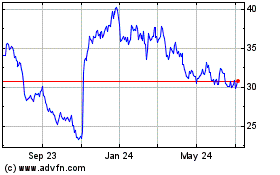

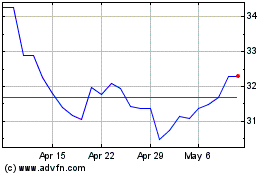

our IPO in February 2012, we have delivered higher total shareholder returns (TSR) than companies in our compensation peer group, the S&P 500 and the Russell 2000 Index. Our three-year TSR and one-year TSR have each underperformed our compensation peer group, the S&P 500 and the Russell 2000. Our board of directors and senior management are strongly committed to returning our company to long-term sustainable growth. Near-term earnings challenges have adversely affected our TSR over shorter time periods relative to our peers.

The “Peer Group” reflected in the chart above represents the current compensation peer group developed by Pearl Meyer in late 2016 for 2017 compensation planning purposes. The group includes the following companies: 3D Systems Corporation, Cognex Corporation, Coherent, Inc., FARO Technologies Inc., Gogo Inc., InvenSense Inc., Monotype Imaging Holdings, Inc., NN Inc., Power Integrations Inc., Shutterstock Inc., SPS Commerce, Inc., Sun Hydraulics Corporation, Tessera Technologies Inc., Ultimate Software Group Inc., Ultratech, Inc., and Universal Display Corp. The Peer Group reflected in the chart above is different from the peer group referenced below, which was developed by Pearl Meyer in late 2015 for 2016 compensation planning purposes. See the “Peer Group” section of this Compensation Discussion & Analysis for further details on the peer group developed by Pearl Meyer in late 2015 when establishing base salaries, annual equity awards and target annual incentive compensation for 2016.

Organizational Changes

In May 2016, we hired Dr. Baker as our Chief Technology Officer in anticipation of the retirement of Donald G. Krantz, our former Executive Vice President and Technology Officer, which took place in June 2016. Also in May 2016, Jacqueline D. Schneider, our former Vice President of Global Sales, resigned from our Company to pursue other opportunities. In December 2016, we hired David M. Fein as our Chief Revenue Officer. We negotiated arms

’-length compensation arrangements with Dr. Baker and Mr. Fein that we believe are competitive when compared with the compensation offered by similar growth companies in our industry and that were necessary to induce them to join our company in light of the other employment opportunities available to them.

Executive Compensation Philosophy and Objectives

We believe our success depends in large measure on our ability to attract, retain and motivate a talented senior management team to effectively lead our company in a dynamic and changing business environment, and that a competitive executive compensation program is essential to that effort. We believe that our executive compensation program should support our short- and long-term strategic and operational objectives, and reward corporate and individual performance that contributes to creating value for our shareholders.

Consistent with this philosophy, our executive compensation program incorporates the following key principles and objectives:

|

|

●

|

Structure the compensation program so as to align the interests of our executive officers with those of our customers, employees, and shareholders generally;

|

|

|

●

|

Provide a competitive total cash compensation opportunity that includes target incentive goals that are reasonably achievable yet represent appreciable and appropriate improvement over prior periods;

|

|

|

●

|

Utilize equity-based awards in a manner designed to emphasize their long-term retentive function;

|

|

|

●

|

Recognize and reward the achievement of company and business unit goals as well as individual performance;

|

|

|

●

|

Provide compensation commensurate with the level of business performance achieved;

|

|

|

●

|

Provide greater compensation opportunities for individuals who have the most significant responsibilities and therefore the greatest ability to influence our achievement of strategic and operational objectives;

|

|

|

●

|

Structure the compensation program so that it is understandable and easily communicated to executives, shareholders and other constituencies;

|

|

|

●

|

Place increasing emphasis on incentive/variable compensation for positions of increasing responsibility; and

|

|

|

●

|

Make benefit programs available to executive officers consistent with those provided to salaried employees.

|

Compensation Decisions and Processes

The compensation committee of our board of directors, which consists solely of independent directors, generally has been responsible for overseeing our executive compensation program, including annually reviewing the ongoing compensation arrangements for each of our executive officers, including our CEO, and reporting those arrangements to our board.

Our compensation committee regularly receives and considers input from our CEO regarding the compensation and performance of the other executive officers, including recommendations as to compensation levels that the CEO believes are commensurate with an individual

’s job performance, skills, experience, qualifications, criticality to our company and development/career opportunities, as well as with our compensation philosophy, external market data and considerations of internal equity. With the assistance of our CFO, our CEO also has provided recommendations to the compensation committee regarding the establishment of performance goals for the annual cash incentive plan based on the operating budget approved by our board of directors. Our CEO regularly attends meetings of our compensation committee, except where the CEO’s own compensation is being considered or times when the committee meets in executive session. Our CEO makes no recommendations to the compensation committee regarding her own compensation. The compensation committee communicates its views and decisions regarding compensation arrangements for our executive officers to our CEO, who generally has been responsible for implementing the arrangements.

In determining executive compensation, our compensation committee reviews and considers a number of factors, including individual and corporate performance, input from our CEO, compensation market data from th

ird party compensation surveys (including Pearl Meyer, our compensation consultant), our compensation philosophy and key principles, the pay practices of a set of comparable companies, feedback received from shareholders concerning say-on-pay, and the committee’s collective experience and knowledge. We have used market data primarily as a reference point to assess whether our compensation practices are reasonable, competitive and likely to achieve our objectives, and actually deliver compensation in amounts that are consistent with the compensation committee’s assessment of our company’s relative performance. As part of these assessments, we assumed that base salary and target total cash compensation levels were likely to be reasonable and competitive if together they approximated the market median we calculated from the surveys and other compensation data we utilized which for us generally meant a range between 80% and 125% of the market median. The utilization of a range is largely in recognition of the limitations of the survey data that include companies with limited degrees of comparability to our company and position titles that may encompass positions with responsibilities that differ to varying degrees from the responsibilities of a similarly titled position within our company. As a result, we did not establish specific compensation amounts or parameters for any executive officer position based on market data in 2016, recognizing that factors unique to each individual will ultimately determine that individual’s compensation, which may not necessarily be within the median range.

Our compensation committee also approves all awards to our executive officers under our 2012 Long-Term Incentive Plan (the “LTIP”), including the award of performance stock units to our CEO as summarized below in “Elements of Executive Compensation