UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

|

|

x

|

Preliminary Information Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted

by Rule 14A-6(e)(2))

|

|

|

¨

|

Definitive Information Statement

|

HPIL HOLDING

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g)

and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:___________

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:___________

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined):____________

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:____________

|

|

|

(5)

|

Total fee paid:____________

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

¨

Check box if any part of the fee is offset as provided by

Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing

.

|

|

(1)

|

Amount Previously Paid:___________

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:___________

|

|

|

(3)

|

Filing Party:___________

|

|

|

(4)

|

Date Filed:___________

|

HPIL HOLDING

3738 Coach Cove

Sanford, MI 48657

NOTICE OF ACTION BY WRITTEN CONSENT OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the holders of more than a

majority of the voting power of the shareholders of HPIL Holding, a Nevada

corporation (the “Company” “we,” “us,” or “our”), have approved the following

action without a meeting of shareholders in accordance with Section 78.320 of

the Nevada Revised Statutes:

The approval of an amendment to our articles of incorporation

to increase our authorized shares of capital stock from 400,000,000 shares to

10,703,000,000 shares, which shall consist to increase our authorized shares of

common stock from 400,000,000 to 10,699,999,990, and to increase our authorized

shares of preferred stock from 0 to 3,000,010. The action will become effective

on or about the 20

th

day after the

definitive information statement is mailed to our shareholders.

Shareholders of record at the close of business on March 28,

2017 (the “Record Date”), are entitled to receive a copy of this information

statement.

The

enclosed information statement contains information pertaining to the matters

acted upon.

WE ARE NOT ASKING YOU FOR A

PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY

By Order of the Board of Directors of

HPIL Holding

April 3, 2017

/s/

Nitin Amersey

By: Nitin

Amersey

Its: Director,

Chief Financial Officer (principal financial officer and principal accounting

officer), Corporate Secretary and Treasurer

HPIL HOLDING

3738 Coach Cove

Sanford, MI

48657

____________________

INFORMATION

STATEMENT

PURSUANT TO

SECTION 14 OF THE

SECURITIES AND

EXCHANGE ACT OF 1934 AND

REGULATION 14C

AND SCHEDULE 14C THEREUNDER

____________________

WE ARE NOT

ASKING YOU FOR A PROXY AND

YOU ARE

REQUESTED NOT TO SEND US A PROXY.

____________________

This information statement is being furnished in connection

with the action by written consent of shareholders taken without a meeting of a

proposal to approve the actions described in this information statement. We are

mailing this information statement to our shareholders of record on March 28,

2017 (the “Record Date”).

What action was taken by written consent?

We obtained shareholders consent for the approval of an

amendment to our articles of incorporation to increase our authorized shares capital

stock from 400,000,000 shares to 10,703,000,000 shares as follows:

(1) an increase to the Company’s authorized shares

of common stock, par value $0.0001 (“Common Stock”), from 400,000,000 shares to

10,699,999,990 shares; and

(2) an increase to the Company’s authorized

shares of preferred stock, par value $0.0001, from 0 shares to 3,000,010 shares

and designation of a Series A class of preferred stock with 10 authorized

shares, and a Series B class of preferred stock with 3,000,000 authorized

shares.

How many shares of voting stock were outstanding on the

Record Date?

On the Record Date, the date we received the consent of the

holders of a majority of the voting power of our shareholders, there were 50,969,150

shares of Common Stock issued and outstanding and no shares of Preferred Stock.

What vote was obtained to approve the amendment to the

articles of incorporation described in this information statement?

We obtained the approval of the holders of 43,231,600 shares

of Common Stock, or approximately 84.82% of the voting power of our shareholders

and 84.82% of the voting power eligible to vote on the amendment to our

articles of incorporation.

Why am I not being asked to vote?

The shareholder of a majority of the shares of voting stock

issued and outstanding of the Company have already ratified, approved or

adopted the Corporate Action pursuant to written consents in lieu of a special

meeting of stockholders. Such ratification, approval or adoption is sufficient

under Nevada law, and no further approval by the Company’s stockholders is

required to effect the Corporate Action.

What do I need to do now?

Nothing. This Information Statement is purely for your

information and does not require or request you to do anything.

Whom can I call with questions?

If you have any questions about the Corporate Action, please

contact our office Investor Relation Department at +1 (248) 750-1015.

AMENDMENT TO THE ARTICLES OF INCORPORATION

TO INCREASE AUTHORIZED SHARES OF CAPITAL STOCK FROM 400,000,000

TO 10,703,000,000

Our board of directors and the holders of a majority of the

voting power of our shareholders have approved an amendment to our articles of

incorporation to increase our authorized shares of Capital Stock from 400,000,000

to 10,703,000,000, including the authorization of 3,000,010 shares of Preferred

Stock. The increase in our authorized shares of Capital Stock will become

effective upon the filing of the amendment to our articles of

incorporation with the Secretary of State of the State of

Nevada. We will file the amendment to our articles of incorporation to

effectuate the increase in our authorized shares of Capital Stock (the “Amendment”)

approximately (but not less than) 20 days after the definitive information

statement is mailed to shareholders.

The form of certificate of amendment to be filed with the

Secretary of State of the State of Nevada is set forth as Appendix A to this

information statement.

Outstanding Shares and Purpose of the Amendment

Our articles of incorporation currently authorize us to issue

a maximum of 400,000,000 shares of Capital Stock, consisting solely of Common

Stock, par value $0.0001 per share. As of the Record Date, we had 50,969,150 shares

of Common Stock issued, outstanding and no shares of Preferred Stock authorized,

issued or outstanding.

The board of directors believes that the increase in our

authorized Capital Stock will enhance our ability to finance the development

and operation of our business and will allow for more flexibility regarding additional

equity financings.

Effects of the Increase in Authorized Capital Stock

Potential uses of the additional authorized shares of Capital

Stock may include public or private offerings, conversions of convertible

securities, issuance of stock or stock options to employees, acquisition

transactions and other general corporate purposes. Increasing the authorized

number of shares of the Capital Stock will give the us greater flexibility and

will allow the Company to issue such shares, in most cases, without the expense

or delay of seeking stockholder approval. The Company may issue shares of its Capital

Stock in connection with financing transactions and other corporate purposes

which the Board of Directors believes will be in the best interest of the

Company’s stockholders. The additional shares of Common Stock will have the

same rights as the presently authorized shares, including the right to cast one

(1) vote per share of Common Stock. The additional shares of Series A Preferred

Stock have will carry enhanced voting rights as set forth in the amended

Articles of Incorporation. The additional shares of Series B Preferred Stock

will carry no voting rights, but each share of Series B Preferred Stock is convertible

into fifty (50) shares of Common Stock. Although the authorization of

additional shares will not, in itself, have any effect on the rights of any

holder of our Common Stock, the future issuance of additional shares of Common

Stock and Preferred Stock (other than by way of a stock split or dividend)

would have the effect of diluting the voting rights and could have the effect

of diluting earnings per share and book value per share of existing

shareholders.

BENEFICIAL OWNERSHIP OF SECURITIES AND SECURITY OWNERSHIP OF

MANAGEMENT

The following table lists, as of the Record Date, the number

of shares of our common stock that are beneficially owned by (i) each person or

entity known to us to be the beneficial owner of more than 5% of the

outstanding common stock; (ii) each officer and director of our Company; and

(iii) all officers and directors as a group. Information relating to

beneficial ownership of common stock by our principal shareholders and

management is based upon information furnished by each person using “beneficial

ownership” concepts under the rules of the Securities and Exchange Commission.

Under these rules, a person is deemed to be a beneficial owner of a security if

that person has or shares voting power, which includes the power to vote or

direct the voting of the security, or investment power, which includes the

power to vote or direct the voting of the security. The person is also deemed

to be a beneficial owner of any security of which that person has a right to

acquire beneficial ownership within 60 days. Under the Securities and Exchange

Commission rules, more than one person may be deemed to be a beneficial owner

of the same securities, and a person may be deemed to be a beneficial owner of

securities as to which he or she may not have any pecuniary beneficial

interest. Except as noted below, each person has sole voting and investment

power.

The percentages below are calculated based on 50,969,150

shares of our common stock and issued and outstanding as of the Record Date.

|

Named Executives, Directors and 5% Shareholders

|

Number of Shares of Common Stock Beneficially Owned

|

Percent of Class Beneficially Owned

|

|

Louis Bertoli (1)

|

43,220,000

|

84.80%

|

|

Nitin M. Amersey (2)

|

10,600

|

*

|

|

John B. Mitchell (4)

|

500

|

*

|

|

John D. Dunlap, III (5)

|

500

|

*

|

|

All Directors and Executive Officers as a group (4 people)

|

43,231,600

|

84.82%

|

* Less than 1%

(1)

Mr. Bertoli is our Chairman of the Board and President, Chief

Executive Officer of HPIL Holding;

(2)

Mr. Amersey is a Director and Chief Financial

Officer, Corporate Secretary and Treasurer of HPIL Holding, 5,000 shares owned

directly and 5,600 shares owned indirectly through Amersey Investments LLC.;

(3)

Mr. Mitchell is a Director of HPIL Holding;

(4)

Mr. Dunlap is a Director of HPIL Holding.

DESCRIPTION OF SECURITIES

Common Stock

We are authorized to issue 400,000,000 shares of Common Stock

with a par value of $0.0001, of which 50,969,150 shares are issued and

outstanding as of the Record Date. Each holder of our shares of our Common

Stock is entitled to one (1) vote per share on all matters to be voted upon by

the stockholders, including the election of Directors. The holders of shares of

Common Stock have no preemptive, conversion, subscription or cumulative voting

rights. There is no provision in our Articles of Incorporation or By-laws that

would delay defer or prevent a change in control of our Company.

Preferred Stock

We currently have no shares of preferred stock authorized or issued.

DISSENTER’S RIGHTS

Under the Nevada Revised Statutes, holders of shares of

Common Stock are not entitled to dissenters’ rights with respect to any aspect

of the Amendment, and we will not independently provide holders with any such

right.

INTEREST OF CERTAIN PERSONS IN THE AMENDMENT

No

Director, Executive Officer, nominee for election as a Director, associate of

any Director, Executive Officer or nominee or any other person has any

interest, direct or indirect, by security holdings or otherwise, in the

Corporate Action which is not shared by all other stockholders.

RELIANCE ON INFORMATION

You should

rely only on the information the Company has provided in this Information

Statement. The Company has not authorized any person to provide

information other than that provided herein. The Company has not authorized

anyone to provide you with different information. You should not

assume that the information in this Information Statement is accurate as of any

date other than the date on the front of the document.

AVAILABLE INFORMATION

We are subject to the information and reporting requirements

of the Exchange Act and in accordance with such Act we file periodic reports,

documents and other information with the Securities and Exchange Commission

relating to our business, financial statements and other matters. Such reports

and other information may be inspected and are available for copying at the

public reference facilities of the Securities and Exchange Commission at 100 F

Street, N.E., Washington D.C. 20549 or may be accessed at www.sec.gov.

PLEASE NOTE THAT THIS IS NEITHER A REQUEST FOR YOUR VOTE NOR

A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU

OF THE CORPORATE ACTION THAT HAS BEEN APPROVED AND TO PROVIDE YOU WITH

INFORMATION ABOUT THE CORPORATE ACTION AND OTHER RELEVANT BACKGROUND

INFORMATION.

By order of

the Board of Directors

April 3,

2017

/s/

Nitin

Amersey

Nitin

Amersey

Director, Chief

Financial Officer

Corporate

Secretary and Treasurer

Appendix A

CERTIFICATE OF AMENDMENT

TO ARTICLES OF INCORPORATION FOR NEVADA PROFIT CORPORATIONS

(Pursuant to NRS 78.385 and 78.390 – After Issuance of Stock)

1. Name of Corporation: HPIL

Holding

2. The articles have been

amended as follows:

Article IV has been amended and restated as set forth

on

Exhibit 1

attached hereto.

3. The vote by which the

shareholders holding shares in the Corporation entitling them to exercise at

least a majority of the voting power, or such greater proportion of the voting

power as may be required in the case of a vote by classes or series, or as may

be required by the provisions of the articles of incorporation have voted in

favor of the amendment is 84.82%

4. Effective

date of filing: _____________

5. Signature:

/s/ Nitin Amersey, Director, Chief Financial Officer

EXHIBIT 1

Article

IV - Capital Stock

The total number

of shares of stock which the Corporation shall have authority to issue is ten billion,

seven hundred three million (

10,703,000,000

) which shall

consist of:

A.

Three Million

Ten (3,000,010) shares of preferred stock, par value $0.0001 per share (the “Preferred

Stock”); and

B.

Ten billion, six

hundred ninety-nine million, nine hundred ninety-nine thousand, nine hundred

ninety (

10,699,999,990

) shares of common stock, par value

$0.0001 per share (the “Common Stock”).

The voting powers, designations, preferences,

privileges and relative, participating, optional or other special rights, and

the qualifications, limitations or restrictions of each class or series of

capital stock of the Corporation, shall be as provided in this Article IV.

Unless otherwise indicated, all Section references in this Article IV shall

refer to the corresponding Sections in said Article.

A. “PREFERRED STOCK”.

1.

Designation.

(a)

Series A

Preferred.

A

total of 10 shares of the Corporation’s Preferred Stock shall be authorized as

a series known as Series A Preferred Stock, par value $0.0001 per share (the “Series

A Stock”).

(b)

Series B

Preferred.

A

total of 3,000,000 shares of the Corporation’s Preferred Stock shall be

authorized as a series known as Series B Preferred Stock, par value $0.0001 per

share (the “Series B Stock”).

2.

Voting.

(a)

Series

A Stock.

The

holders of Series A Stock shall be entitled to notice of any stockholders’

meeting in accordance with the Bylaws of the Corporation and shall vote with

holders of Common Stock, voting together as a single class upon all matters

submitted to a vote of stockholders, excluding those matters required to be

submitted to a class or series vote pursuant to the terms hereof or by law.

If at least one (1) share of Series A Stock is

issued and outstanding, then the total aggregate issued shares of Series A

Stock at any given time, regardless of their number, shall have voting rights

equal to four times the total number of shares of Common Stock which are issued

and outstanding at the time of voting.

Each individual share of Series A Stock shall have

the voting rights equal to four (4) times the sum of all shares of Common Stock

issued and outstanding at the time of voting divided by the number of shares of

Series A Stock issued and outstanding at the time of voting, upon any items

submitted to a vote of stockholders, except with respect to matters requiring a

separate series or class vote.

(b)

Series

B Stock.

Series

B Stock shall have no voting rights.

3.

Dividends.

The holders of

shares of Series A Stock and Series B Stock shall be entitled to receive

dividends, out of funds legally available therefor, at such times and in such

amounts as the board of directors may determine in its sole discretion.

4.

Conversion.

The holders of

the shares of Preferred Stock shall have the following conversion rights:

(a)

Series A Stock.

Each individual

share of Series A Preferred Stock shall be convertible into the number of shares

of Common Stock equal to: [all shares of Common Stock issued and outstanding at

time of conversion, plus all shares of Series B Preferred Stocks issued and

outstanding at time of conversion] divided by four (4) and divided again by the

total number of shares of Series A Preferred Stock issued and outstanding at

the time of conversion.

(b)

Series B Stock.

A holder of

shares of Series B Stock shall be entitled at any time, upon written election

to the Corporation, without payment of any additional consideration, to cause

any or all of its shares of Series B Stock to be converted on a fifty (50) for one

(1) basis into Common Stock.

(c)

Method of

Conversion.

Upon

the election by a holder of shares of Preferred Stock to effect a conversion,

such holder shall surrender the certificate or certificates representing the

shares of Preferred Stock being converted, duly assigned or endorsed for

transfer to the Corporation (or accompanied by duly executed stock powers

relating thereto), at the principal executive office of the Corporation or the

offices of the transfer agent for the Preferred Stock or such office or offices

in the continental United States of an agent for conversion as may from time to

time be designated by notice to the holders of the Preferred Stock by the

Corporation, or in the event the certificate or certificates are lost, stolen

or missing, shall deliver an Affidavit of Loss with respect to such certificates.

The issuance by the Corporation of shares of Common Stock upon such a

conversion shall be effective as of the surrender of the certificate or

certificates for the shares of Preferred Stock to be converted, duly assigned

or endorsed for transfer to the Corporation (or accompanied by duly executed

stock powers relating thereto), or as of the delivery of an Affidavit of Loss.

(d)

Fractional

Shares.

The

Corporation shall not be obligated to deliver to any holder of shares of

Preferred Stock any fractional share of Common Stock issuable upon any

conversion of such shares (after aggregating all shares of Common Stock into

which shares of Preferred Stock held by each holder could be converted), but in

lieu thereof may make a cash payment in respect thereof in any manner permitted

by law.

(e)

Reservation of

Stock Issuable Upon Conversion.

The Corporation shall at all times

reserve and keep available out of its authorized but unissued shares of Common

Stock solely for the purpose of effecting the conversion of the shares of

Preferred Stock such number of its shares of Common Stock as shall from time to

time be sufficient to effect the conversion of all outstanding shares of

Preferred Stock; and if at any time the number of authorized but unissued

shares of Common Stock shall not be sufficient to effect the conversion of all

then outstanding shares of Preferred Stock, the Corporation will take such

corporate action as may be necessary to increase its authorized but unissued

shares of Common Stock to such number of shares as shall be sufficient for such

purpose.

(f)

No Closing of

Transfer Books.

The

Corporation shall not close its books against the transfer of shares of

Preferred Stock in any manner which would interfere with the timely conversion

of any shares of Preferred Stock.

(g)

Issuance Tax.

The issuance of

certificates for shares of Common Stock upon conversion of shares of the

applicable series of Preferred Stock will be made without charge to the holders

of such shares for any issuance tax in respect thereof or other costs incurred

by the Corporation in connection with such conversion and the related issuance

of such stock.

5.

Dividends and

Stock Splits.

If

the number of shares of Common Stock outstanding is increased by a stock

dividend payable in shares of Common Stock or by a subdivision or split-up of

shares of Common Stock, then, on the date such payment is made or such change

is effective, the conversion ratio shall be appropriately adjusted so that the

number of shares of Common Stock issuable on conversion of any shares of

Preferred Stock shall be increased in proportion to such increase of

outstanding shares of Common Stock.

B. “Common Stock”.

1.

Designation.

A total of 10,699,999,990

shares of the Corporation’s capital stock shall be designated as common stock,

par value $0.0001 per share.

2.

Voting.

The holder of

each share of Common Stock shall be entitled to one (1) vote for each such

share as determined on the record date for the vote or consent of stockholders

and, for so long as any share of Series A Stock remains outstanding, shall vote

together with the holders of Series A Stock, as a single class, upon any items

submitted to a vote of stockholders, except with respect to matters requiring a

separate series or class vote.

3.

Dividends.

Subject to the

rights of holders of Preferred Stock, the holders of Common Stock shall be

entitled to receive dividends out of funds legally available therefor at such

times and in such amounts as the board of directors may determine in its sole

discretion.

4.

Liquidation.

Upon any

Liquidation Event, after the payment or provision for payment of all debts and

liabilities of the Corporation and all preferential amounts to which the

holders of shares of Preferred Stock are entitled with respect to the

distribution of assets, the holders of shares of Common Stock shall be entitled

to share ratably in the remaining assets of the Corporation available for

distribution.

5.

Fractional

Shares.

The

Corporation may not issue fractional shares of Common Stock or Preferred Stock.

HPIL (CE) (USOTC:HPIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

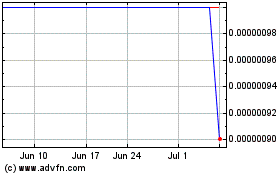

HPIL (CE) (USOTC:HPIL)

Historical Stock Chart

From Apr 2023 to Apr 2024