As filed with the Securities and Exchange Commission on April 3, 2017

Registration No. 333 -215331

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IMMUNOCELLULAR THERAPEUTICS, LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

2834

|

|

93-1301885

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

23622 Calabasas Road, Suite 300

Calabasas, California 91302

(818) 264-2300

(Address, including zip code and telephone number, including area code, of registrant’s principal place of business)

Anthony Gringeri, Ph.D.

ImmunoCellular Therapeutics, Ltd.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

(818) 264-2300

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

|

|

|

|

|

|

|

Glen Y. Sato

John T. McKenna

J. Carlton Fleming

Cooley LLP

3175 Hanover Street

Palo Alto, California 94304

(650) 843-5000

|

|

Barry I. Grossman

Sarah E. Williams

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas, 11

th

Floor

New York, New York 10105

(212) 370-1300

|

|

|

|

|

Approximate date of commencement of proposed sale to the public

: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box:

¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective Registration Statement for the same offering:

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering:

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering:

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

¨

|

|

Accelerated filer

|

|

¨

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

þ

|

__________________________________________________________________________________________

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

Proposed

maximum

aggregate

offering price(1)

|

|

Amount of

registration fee(6)

|

|

Units, each consisting of (a) one share of Series B 6.0% Mandatorily Convertible Preferred Stock, par

value $0.0001, stated value $1,000 per share, and (b) one Series A Warrant to purchase shares of Common

Stock, par value $0.0001 per share

|

$10,000,000

|

|

$1,159

|

|

Series B 6.0% Mandatorily Convertible Preferred Stock, par value $0.0001, stated value $1,000 per share(2)(3)

|

—

|

|

—

|

|

Series A Warrants to Purchase Common Stock, par value $0.0001 per share(2)(3)

|

—

|

|

—

|

|

Common Stock, par value $0.0001 per share, issuable under the Series B 6.0% Mandatorily Convertible Preferred Stock(2)(3)

|

—

|

|

—

|

|

Common Stock, par value $0.0001 per share, issuable under the Series A Warrants(3)(4)(5)

|

$9,330,000

|

|

$1,082

|

|

Total:

|

$19,330,000

|

|

$2,241

|

|

|

|

(1)

|

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (Securities Act).

|

|

(2)

|

Pursuant to Rule 457(i) of and existing interpretations under the Securities Act, no separate registration fee is required for the Preferred Stock, Series A Warrants and Common Stock because the Preferred Stock, Series A Warrants and Common Stock are being registered at the same time as the Units.

|

|

(3)

|

Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issuable to prevent dilution resulting from stock splits, stock dividends or similar transactions.

|

|

(4)

|

No fee pursuant to Rule 457(g).

|

|

(5)

|

Estimated in accordance with Rule 457(c) under the Securities Act solely for the purpose of calculating the registration fee on the basis of $3.11, the average of the high and low prices of the Registrant’s Common Stock as reported on the NYSE MKT on March 30, 2017.

|

|

(6)

|

Calculated pursuant to Rule 457(o) based on an estimate of the total proposed maximum aggregate offering price. The Registrant previously paid $2,318 with the initial filing of this registration statement.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant files a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to purchase these securities in any jurisdiction where the offer or sale is not permitted.

Preliminary Prospectus

SUBJECT TO COMPLETION, DATED APRIL 3, 2017

10,000 Units

Each Consisting of

One Share of Series B 6.0% Mandatorily Convertible Preferred Stock and

Series A Warrants to Purchase 300 Shares of Common Stock

We are offering up to 10,000 units, or “Units,” each consisting of: (i) one share of our Series B 6.0% Mandatorily Convertible Preferred Stock, par value $0.0001 per share, with a stated value of $1,000.00 per share, or “Preferred Stock,” which is initially convertible into 4,329,004 shares of our common stock, par value $0.0001 per share, or “Common Stock;” assuming a conversion price of $2.31, which is equal to 87.5% of the lowest volume weighted average trading price of the Common Stock during the five trading days ending March 29, 2017, and (ii) one Series A Warrant to purchase 300 shares of our Common Stock. The Units will not be issued or certificated. The Preferred Stock and Series A Warrants are immediately separable and will be issued separately, but will be purchased together as a unit in this offering. Each Series A Warrant will have an initial exercise price per share equal to the last reported sale price of our Common Stock as of the closing of the trading day immediately preceding the pricing of this offering, will be exercisable immediately after issuance and will expire five years from the date of issuance. The exercise price of the Series A Warrants is subject to weighted-average anti-dilution adjustments if we issue or are deemed to issue additional shares of our common stock at a price per share less than the then effective exercise price, subject to certain exceptions. Such adjustment will not affect the number of shares of our common stock issuable upon the exercise of the Series A Warrants.

The Preferred Stock is convertible into shares of Common Stock by dividing the stated value of the Preferred Stock by the conversion price. The conversion price is equal to the lesser of: (i) $ per share of Common Stock, referred to as the “Set Price;” and (ii) 87.5% of the lowest volume weighted average trading price of the Common Stock during the five trading days ending on, and including the date of delivery of a notice of conversion, subject to adjustment as provided for in the Certificate of Designation.

Investing in our securities involves a high degree of risk. See the section titled "

Risk Factors

" beginning on page 8 of this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before you invest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

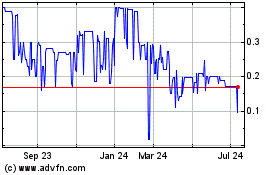

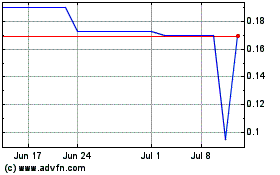

Our Common Stock is listed on the NYSE MKT under the symbol “IMUC.” The last reported sale price of our Common Stock on March 29, 2017 was $3.08 per share. There is no established public trading market for the Units, the Series B Preferred Stock or the Series A Warrants and we do not expect a market to develop. In addition, we do not intend to list the Units, the

Series B Preferred Stock or the Series A Warrants on the NYSE MKT, any other national securities exchange or any other nationally recognized trading system.

Maxim Group LLC, which we refer to as the “representative,” has agreed to act as the representative of the underwriters in connection with this offering. The underwriters may engage one or more selected dealers in this offering.

|

|

|

|

|

|

|

|

|

|

|

Per Unit

|

|

Total

|

|

Public offering price

|

$

|

|

|

|

|

Underwriter discount

|

$

|

|

|

|

|

Proceeds, before expenses, to us(1)

|

$

|

|

|

|

|

|

|

|

(1)

|

We estimate the total expenses of this offering payable by us, excluding the underwriting discount, will be approximately $ .

|

The above summary of offering proceeds to us does not give effect to any exercise of the warrants being issued in this offering. Delivery of the Preferred Stock and the Series A Warrants is expected to be made on or before , 2017 subject to customary closing conditions.

Sole Book-Running Manager

Maxim Group LLC

The date of this prospectus is , 2017.

TABLE OF CONTENTS

We and the underwriter have not authorized anyone to provide any information or to make any representations other than those contained in or incorporated by reference in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated by reference in this prospectus is accurate only as of its date regardless of the time of delivery of this prospectus or of any sale of Units, Preferred Stock, Series A Warrants or Common Stock.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the Securities and Exchange Commission (SEC) before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

Neither we nor the underwriter has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who come into possession of this prospectus and any free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any free writing prospectus applicable to that jurisdiction.

This prospectus and the documents incorporated by reference in this prospectus contain market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe that these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. Although we are not aware of any misstatements regarding the market and industry data presented or incorporated by reference in this prospectus, these estimates involve risks and uncertainties and are subject to change based on

various factors, including those discussed under the heading “Risk Factors” and any related free writing prospectus. Accordingly, investors should not place undue reliance on this information.

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus and in the documents incorporated by reference. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our securities. For a more complete understanding of our company and this offering, we encourage you to read and consider carefully the more detailed information contained in or incorporated by reference in this prospectus, including the information contained under the heading “Risk Factors” beginning on page 8 of this prospectus, and the information included in any free writing prospectus that we have authorized for use in connection with this offering.

Throughout this prospectus, the terms “we,” “us,” “our,” and “our company” refer to ImmunoCellular Therapeutics, Ltd.

Company Overview

ImmunoCellular Therapeutics, Ltd. is a clinical-stage biotechnology company that is developing immune-based therapies for the treatment of cancers. Immunotherapy is an emerging approach to treating cancer in which a patient’s own immune system is stimulated to target tumor antigens, which are molecular signals that the immune system uses to identify foreign bodies. While some other cancer immunotherapies target only a single cancer antigen, our technology can elicit an immune response against several antigens. Our clinical stage cancer immunotherapy programs are also distinguished by the fact that they target cancer stem cells (CSCs), which are the primary drivers of tumor growth and disease recurrence. Our most advanced product candidate, ICT-107, recently began phase 3 testing in which we anticipate randomizing approximately 542 patients at approximately 120 clinical sites in the U.S., Canada and Europe. In addition, we have a portfolio of other potential therapeutic immunotherapies using our proprietary approach to treating cancer.

ICT-107, our lead product candidate, is a dendritic cell (DC) immunotherapy for the treatment of newly diagnosed glioblastoma multiforme (GBM), the most common and lethal type of brain cancer. ICT-107 is designed to activate a patient’s immune system to target six different tumor-associated antigens. ICT-107 has completed phase 2 testing with results reported in December 2013. Additional updated results were reported in June 2014 and November 2014. In November 2015, overall survival (OS) was additionally updated and reported. The phase 2 clinical trial was designed as a double-blind, placebo-controlled (2:1 randomized), multicenter evaluation of the safety and efficacy of ICT-107 in patients with newly diagnosed GBM. From January 2011 until September 2012, 124 patients were randomized to standard of care treatment plus ICT-107 or standard of care plus placebo (i.e. control). The most recent results are summarized in Table 1.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Overall Survival*

|

|

|

|

Median Overall Survival - in Months

|

|

|

|

|

|

Population

|

|

Patients Randomized

|

|

Treatment Group

|

|

Placebo Group

|

|

Difference

|

|

P Value

|

|

|

|

Intent to treat (ITT)

|

|

124

|

|

|

18.3

|

|

|

16.7

|

|

|

1.6

|

|

|

0.436

|

|

|

|

|

|

Per Protocol (PP) HLA-A2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MGMT Methylated

|

|

31

|

|

|

37.7

|

|

|

23.9

|

|

|

13.8

|

|

|

0.645

|

|

|

|

|

|

MGMT Unmethylated

|

|

38

|

|

|

15.8

|

|

|

11.8

|

|

|

4.0

|

|

|

0.326

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Progression Free Survival*

|

|

|

Median Progression Free Survival - in Months

|

|

|

|

|

|

Population

|

|

Patients Randomized

|

|

Treatment Group

|

|

Placebo Group

|

|

Difference

|

|

P Value

|

|

|

|

ITT

|

|

124

|

|

11.4

|

|

10.1

|

|

1.3

|

|

0.033

|

|

|

|

PP HLA-A2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MGMT Methylated

|

|

31

|

|

24.1

|

|

8.5

|

|

15.6

|

|

0.004

|

|

|

|

MGMT Unmethylated

|

|

38

|

|

10.5

|

|

6.0

|

|

4.0

|

|

0.364

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Overall survival data from October 2015; progression free survival from October 2014.

As reported in November 2015, ICT-107 treated patients had a numerical advantage in median OS of 1.6 months more than control patients in the intent-to-treat (ITT) population but the difference in survival between ICT-107 and control treated patients (the primary efficacy endpoint of the trial) did not reach statistical significance (p-value = 0.44). For Progression-Free Survival (PFS), an important secondary efficacy endpoint, the most updated results were reported in November 2014 when ICT-107 treated patients had a 1.3 month advantage in median PFS compared with control treated patients in the ITT population. This difference in PFS between ICT-107 and control treated patients reached statistical significance (p-value = 0.03). ICT-107 was generally well tolerated, with no imbalance in adverse events between the treated and control groups.

Patients in the phase 2 study were HLA-A1, A2, or dual A1/A2. HLA type refers to a person’s human leukocyte antigen status which corresponds to a family of genes that regulate the immune system. Though the ICT-107 immunotherapy is designed for all three of these HLA types, the most benefit and best immune responses were observed in patients who were HLA-A2 positive (about 50% of the GBM population in the US and Europe). Thus, the phase 3 includes only patients who are HLA-A2 positive. We analyzed HLA-A2 positive patients according to their MGMT gene status (unmethylated or methylated) which is a known predictor of responsiveness to standard of care chemotherapy. MGMT is a gene involved with DNA repair. As the standard of care chemotherapy in GBM works by damaging DNA, an active repair mechanism diminishes or precludes benefit from chemotherapy. MGMT unmethylated tumor cells can repair DNA damage while MGMT methylated cells cannot. While the subgroups we analyzed were small in size, and not powered to show statistical significance, the numeric advantages in favor of the ICT-107 treated patients were shown to be large and potentially clinically meaningful. Median OS for the HLA-A2 methylated MGMT per protocol (PP) population was 37.7 months for the ICT-107 patients and 23.9 months for the control group, representing a 13.8 month median OS numeric benefit for the ICT-107 treated group while not achieving statistical significance (p-value = 0.65). Median OS for the HLA-A2 unmethylated MGMT PP population was 15.8 months for ICT-107 patients and 11.8 months for the control group, representing a 4 month median OS numeric benefit for the ICT-107 treated group while not achieving statistical significance (p-value = 0.33).

We decided to pursue phase 3 testing of ICT-107 in HLA-A2 patients on the basis of the updated phase 2 ICT-107 trial data, post-phase 2 discussions with U.S. and European regulators and consultation with GBM key opinion leaders.

In addition to focusing only on HLA-A2 patients, we made several changes to the phase 3 protocol based on the phase 2 results and analysis.

|

|

|

|

•

|

An anergy test was added to patient screening. This test seeks to identify patients with a properly functioning immune system, which is an important consideration when testing an immune-based therapy.

|

|

|

|

|

•

|

More doses are included in the phase 3 protocol. Patients are dosed until they progress or run out of treatment or placebo. In the first year, after standard of care surgery and chemoradiation, patients receive four induction doses in the first month and then monthly maintenance doses thereafter. The phase 3 design now includes 15 doses in the first year if the patient does not progress compared to seven doses in the phase 2 design. The intent is to give patients the opportunity to mount an immune response to treatment.

|

|

|

|

|

•

|

An updated progression assessment is included. Progression will now be assessed using the iRANO criteria. This methodology is an update from the RANO criteria utilized in the phase 2 trial. Because dosing stops once a patient has progressed, accurate progression assessment is important for keeping patients on the trial as long as possible.

|

|

|

|

|

•

|

Monocytes will be used as the control in phase 3. In the phase 2 trial, activated dendritic cells were used as the control. These cells are potentially more immunogenic than the precursor monocyte cells.

|

The phase 3 design was submitted to the U.S. FDA and we received Special Protocol Assessment (SPA) agreement in August 2015. The Company submitted a protocol amendment to FDA in December 2016 and plans to submit to regulatory agencies in Canada and the European countries participating in the trial during the first quarter of 2017. This amendment is designed to improve the speed of randomization from the original protocol by resolving certain issues identified in the first several months of operating the trial. In February 2017, the FDA responded to our protocol amendment, indicating that in order to proceed with the protocol amendment, we would not be able to take advantage of the benefits of the previously granted SPA. The FDA did not indicate that the trail would be placed on clinical hold if we implement the amended protocol and we intend to work with the FDA in an effort to clarify the rationale for the protocol amendment and attempt to maintain the SPA. In any event, based on the response we plan to implement the amended protocol and proceed with the Phase 3 trial of ICT-107, with or without the SPA in effect, as the FDA further indicated that we could re-propose a SPA for the amended study.

Patient screening began in November 2015 in the U.S. We anticipate that it will take until mid-2019 to randomize approximately 542 patients and that the trial will complete by about mid-2021. The final analysis will be performed after at least 387 OS events have been observed and at least 50% of subjects with the methylated MGMT gene have died. As of December 31, 2016, we had 59 active trial sites in the U.S. and two in Canada. The first patient in the trial was treated on June 6, 2016 and 14 patients have been randomized to date. In addition, our initial clinical trial applications have been approved by regulatory authorities in the Netherlands, the U.K., Spain, Austria and Switzerland, and we are in discussions with regulatory authorities in Germany, Italy and France.

There are currently two interim analyses to be conducted by the Independent Data Monitoring Committee (DMC). The first is a futility assessment that will occur when 30% of the required OS events have been observed. We estimate that the triggering condition for this assessment will occur approximately mid-2019. The second is an efficacy assessment that will occur when 67% of the required OS events have been observed. We estimate that the triggering condition for this assessment will occur approximately in the first quarter of 2020. The trial is being conducted in the U.S., Canada, and Europe and we are working with the major cancer cooperative groups in each region to ensure sufficient and timely access to qualifying patients.

In addition to ICT-107, we are also developing two other therapeutic DC immunotherapies: ICT-140 for ovarian cancer and ICT-121 for recurrent GBM. ICT-140 targets seven tumor-associated antigens expressed on ovarian cancer cells. Some of the antigens utilized in ICT-140 were also used in ICT-107. We filed an investigational new drug (IND) application for ICT-140 at the end of 2012 and the IND was allowed by the FDA in January 2013. We subsequently modified the design of the trial and amended the IND to reflect these changes in May 2013 and September 2014. These amendments were allowed by the FDA shortly after the submissions. During the interim time period, we upgraded our generalized DC immunotherapy manufacturing process to bring it to a phase 3 and commercial ready state. We plan to use this improved process to manufacture clinical supplies for the ICT-140 trial. Currently, we are holding the initiation of this trial until we can find a partner to share expenses or until we have secured sufficient financial resources to complete the ICT-107 phase 3 program.

ICT-121 specifically targets CD133, a CSC marker that is overexpressed in a wide variety of solid tumors, including ovarian, pancreatic, and breast cancers. We began screening patients in September 2013 for a single-site phase 1 trial in recurrent GBM. Originally it was our intention to enroll 20 patients at one site. However, during 2014, we determined that enrollment could be accelerated if additional sites were added to the study. In 2015 we added five sites and made modifications in the screening criteria to facilitate enrollment. As of July 21, 2016, the trial was fully enrolled. The trial was closed in March 2017 and the final results should be available within three to four months.

In September 2014, we licensed from the California Institute of Technology (Caltech) the exclusive rights to novel technology for the development of Stem-to-T-cell immunotherapies for the treatment of cancer. The technology originated from the labs of David Baltimore, Ph.D., Nobel Laureate and President Emeritus at Caltech, and utilizes the patient’s own hematopoietic stem cells to create antigen-specific killer T cells to treat cancer. We plan to utilize this technology to expand and

complement our DC-based cancer immunotherapy platform, with the goal of developing new immunotherapies that kill cancer cells in a highly directed and specific manner and that can function as monotherapies or in combination therapy approaches.

Caltech’s technology potentially addresses the challenge, and limitation, that TCR (T cell receptor) technologies have faced of generating a limited immune response and having an unknown persistence in the patient’s body. We believe that by inserting DNA that encodes T cell receptors into hematopoietic stem cells rather than into T cells, the immune response can be transformed into a durable and more potent response that could effectively treat solid tumors. This observation has been verified in animal models by investigators at Caltech and the National Cancer Institute.

In March 2017, we announced the successful completion of the first milestone of our Stem-to-T-cell program; the sequencing of a selected TCR, that will become the basis for the product development program. In November 2015, we entered into a sponsored research agreement with The University of Texas MD Anderson Cancer Center with the goal of identifying a TCR sequence. In addition, in 2015 we acquired an option from Stanford University to evaluate certain technology related to the identification of TCRs that could prove useful in supporting our Stem-to-T-Cell research efforts. In March 2017, a TCR sequence for our Stem-to-T-Cell program became available.

In January of 2016, we entered into a sponsored research agreement with the University of Maryland, Baltimore (UMB). As part of this collaboration, UMB researchers are undertaking three projects to explore potential enhancements to our dendritic cell and Stem-to-T-Cell immunotherapy platforms.

Autologous cell-based therapies must be manufactured separately for each patient. Consequently, the manufacturing costs are typically higher than other types of therapies that are not patient-specific. Our DC immunotherapy manufacturing process produces multiple doses for a patient from a single manufacturing run utilizing a single apheresis from the patient. Each manufacturing run takes three days to complete. In addition, the immunotherapy is stored frozen in liquid nitrogen making the logistics of shipping and administration to the patient easier than that for cell therapies that must be shipped fresh and administered to the patient within hours of manufacture.

While we believe that we have a promising technology portfolio of multiple clinical-stage candidates, we do not currently anticipate that we will generate any revenues from either product sales or licensing in the foreseeable future. We have financed the majority of our prior operations through the sales of securities and believe that we may access grants and awards to supplement future sales of securities. On September 18, 2015, the Company received an award in the amount of $19.9 million from the California Institute of Regenerative Medicine (CIRM) to partially fund our phase 3 trial of ICT-107. The award provided for a $4.0 million project initial payment, which was received during the fourth quarter of 2015, and up to $15.9 million in future milestone payments that are primarily dependent on patient enrollment and randomization in the ICT-107 phase 3 trial. In June 2016, the terms of the award from CIRM were amended to (i) increase the project initial payment by $1.5 million, which we received on July 18, 2016, and (ii) reduce the potential future milestone payments by a corresponding $1.5 million. The potential total amount of the award from CIRM remains at $19.9 million. Under the terms of the CIRM award, we are obligated to share future ICT-107 related revenue with CIRM. The percentage of revenue sharing is dependent on the amount of the award we receive and whether the revenue is from product sales or license fees. The maximum revenue sharing amount we may be required to pay to CIRM is equal to nine times the total amount awarded and received. We have the option to decline any and all amounts awarded by CIRM. As an alternative to revenue sharing, we have the option to convert the award to a loan, which option must be exercised on or before ten (10) business days after the FDA notifies us that it has accepted our application for marketing authorization. In the event we exercise our right to convert the award to a loan, we will be obligated to repay the loan within ten (10) business days of making such election, including interest at the rate of the three-month LIBOR rate (0.92% as of December 31, 2016) plus 25% per annum.

The estimated cost of completing the development of any of the current or potential immunotherapy candidates will require us to raise additional capital, generate additional capital from the uncertain exercise of outstanding warrants, or enter into collaboration agreements with third parties. There can be no assurances that we will be able to obtain any additional funding, or if such funding is available, that the terms will be favorable. In addition, collaborations with third parties may not be

available to us and may require us to surrender rights to many of our products, which may reduce the potential share of returns in any licensed products. If we are unable to raise sufficient capital or secure collaborations with third parties, we will not be able to further develop our product candidates.

Recent Developments

We are undertaking an evaluation of strategic alternatives for our immuno-oncology research and development pipeline and technology platform, which may include a potential merger, consolidation, reorganization or other business combination, as well as the sale of the company or the company’s assets. We engaged Roth Capital Partners, LLC as our exclusive advisor in connection with the strategic evaluation. While we evaluate strategic alternatives, we plan to continue to advance our research and development strategies, including the execution of our phase 3 registration trial for ICT-107 in patients with newly diagnosed glioblastoma.

In March 2017, we announced the signing of a non-binding letter of intent with Memgen, LLC to exclusively negotiate the terms to possibly establish an immuno-oncology strategic collaboration focused on conducting clinical trials combining the companies’ respective cancer immunotherapy product candidates. The discussions pertain to our DC-based immunotherapy product candidates, ICT-107 and ICT-140, and Memgen’s ISF35, a viral cancer immunotherapy encoding an optimized version of CD40 ligand. Combining DC-based and viral oncology immunotherapeutic approaches could provide a novel way to stimulate CD40 to possibly induce a potent, specific and effective anti-tumor response. Insights from these combination trials, if successful, could also lead to later combination trials with other immune-oncology technologies, including checkpoint inhibitors.

Company Information

We filed our original Certificate of Incorporation with the Secretary of State of Delaware on March 20, 1987 under the name Redwing Capital Corp. On June 16, 1989, we changed our name to Patco Industries, Ltd. and conducted an unrelated business under that name until 1994. On January 30, 2006, we amended our Certificate of Incorporation to change our name to Optical Molecular Imaging, Inc. in connection with our merger on January 31, 2006 with Spectral Molecular Imaging, Inc. The acquisition was accounted for as a reverse merger, with Spectral Molecular Imaging deemed to be the accounting acquirer and Optical Molecular Imaging deemed to be the legal acquirer. As such, the consolidated financial statements herein reflect the historical activity of Spectral Molecular Imaging since its inception on February 25, 2004. On November 2, 2006, we amended our Certificate of Incorporation to change our name to ImmunoCellular Therapeutics, Ltd. to reflect the disposition of our Spectral Molecular Imaging subsidiary and the acquisition of our cellular-based technology from Cedars-Sinai.

Our principal executive offices are located at 23622 Calabasas Road, Suite 300, Calabasas, California 91302, and our telephone number at that address is (818) 264-2300.

|

|

|

|

|

|

SUMMARY OF THE OFFERING

|

|

Units Offered

|

10,000 Units, each consisting of (i) one share of our Series B Preferred Stock and (ii) one Series A Warrant to purchase 300 shares of our Common Stock.

|

|

Description of Preferred Stock

|

For additional information see “Description of the Securities We Are Offering — Preferred Stock.”

|

|

Preferred Stock Outstanding Immediately Before this Offering

|

None.

|

|

Preferred Stock Outstanding Immediately After this Offering

|

10,000 shares of Series B Preferred Stock.

|

|

Certificate of Designation for Preferred Stock

|

We intend to file a certificate of designation setting forth the preferences, rights and limitations, or “Certificate of Designation,” pertaining to the Preferred Stock with the Delaware Secretary of State. The Certificate of Designation will be controlling with regard to the preferences, rights and limitations of the Preferred Stock holders for all purposes.

|

|

Ranking of Preferred Stock

|

The Preferred Stock will rank senior to our Common Stock and other classes of capital stock with respect to dividend, redemption and distributions of assets upon liquidation, dissolution or winding up, unless the holders of a majority of the outstanding shares of Preferred Stock consent to the creation of parity stock or senior preferred stock.

|

|

Liquidation Preference of Preferred Stock

|

In the event of our liquidation, dissolution or winding up, holders of the Preferred Stock will receive a payment equal to the stated value of the Preferred Stock plus any accrued but unpaid dividends thereon and all liquidated damages and other amounts then due and owing, before any proceeds are distributed to the holders of our common stock.

|

|

|

|

|

Dividends on Preferred Stock

|

Holders of Preferred Stock are entitled to receive cumulative dividends at the rate of 6.0% per annum, payable quarterly on January 1, April 1, July 1 and October 1, beginning on the first such date after the original issue date and on each conversion date. We have the right to pay dividends in cash or in shares of common stock. If we do not have funds legally available to pay cash dividends, such dividends accrete to and increase the outstanding stated value of the Preferred Stock.

|

|

Conversion Price

|

The Preferred Stock is convertible into shares of Common Stock by dividing the stated value of the Preferred Stock by the conversion price. The conversion price is equal to the lesser of: (i) $ per share of Common Stock, referred to as the “Set Price;” and (ii) 87.5% of the lowest volume weighted average trading price of the Common Stock during the five trading days ending on, and including the date of delivery of a notice of conversion, subject to adjustment as provided for in the Certificate of Designation. The conversion price is subject to a floor of $1.00.

|

|

Mandatory Conversion

|

If after the effective date of the registration statement to which this prospectus forms a part, (i) the VWAP for each of any 10 consecutive Trading Day period, which 10 consecutive Trading Day period shall have commenced only after the effective date (“

Threshold Period

”), exceeds 300% of the then effective Conversion Price and (ii) the volume for each Trading Day during any Threshold Period exceeds $300,000 per Trading Day, within 1 Trading Day after the end of any such Threshold Period, the Preferred Stock is subject to mandatory conversion into shares of our Common Stock at a conversion price equal to the lesser of (i) the then-Set Price, or (ii) 87.5% of the lowest volume weighted average trading price of the Common Stock during the five trading days ending on, and including the date on which we provide notice of such mandatory conversion, upon written demand from us. The conversion price is subject to a floor of $1.00.

|

|

Series A Warrant Terms

|

Each Unit contains one Series A Warrant to purchase 300 shares of Common Stock at an initial exercise price equal to the last reported sale price of our Common Stock as of the close of the trading day immediately preceding the pricing of this offering, will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The exercise price of the Series A Warrants is subject to weighted-average anti-dilution adjustments if we issue or are deemed to issue additional shares of our common stock at a price per share less than the then effective exercise price, subject to certain exceptions. Such adjustment will not affect the number of shares of our common stock issuable upon the exercise of the Series A Warrants. The Series A Warrants will be issued in certificated form. See “Description of the Securities We Are Offering —Series A Warrants.”

|

|

|

|

|

|

|

|

|

|

Use of Proceeds

|

We currently intend to use the net proceeds of this offering, exclusive of deferred offering costs, to continue enrollment in our phase 3 clinical trial of ICT-107 (approximately $6.9 million), to continue our Stem-to-T-cell research program (approximately $0.7 million), to continue development of ICT-121 (approximately $0.1 million) and for working capital and general corporate purposes (approximately $1.1 million) as we work to evaluate strategic alternatives for our immuno-oncology research and development pipeline and technology platform, which may include a potential merger, consolidation, reorganization or other business combination, as well as the sale of the company or the company’s assets. We may use a portion of the net proceeds of this offering to acquire additional technologies.

|

|

|

|

|

Risk Factors

|

See “Risk Factors” beginning on page 8 of this prospectus, as well as other information included in this prospectus, for a discussion of factors you should read and consider carefully before investing in our securities.

|

|

|

|

|

Market Symbol and Trading

|

Our Common Stock is listed on the NYSE MKT under the symbol “IMUC.” We do not intend to list the Units, the Preferred Stock or the Series A Warrants on the NYSE MKT, any other national securities exchange or any other nationally recognized trading system.

|

|

Common Stock Outstanding Immediately After This Offering

|

10,773,863 shares, based on 7,329,004 shares of Common Stock are issuable upon the conversion of the Preferred Stock, assuming a conversion price of $2.31, which is equal to 87.5% of the lowest volume weighted average trading price of the Common Stock during the five trading days ending March 29, 2017, and the exercise of the Series A Warrants offered by this prospectus, based on their respective initial exercise prices.

|

The number of shares of our Common Stock to be outstanding after this offering as shown above is based on 3,444,859 shares outstanding as of December 31, 2016 and excludes as of that date:

|

|

|

|

•

|

162,665 shares of our Common Stock issuable upon exercise of outstanding options at a weighted average exercise price of $43.11 per share;

|

|

|

|

|

•

|

7,301 shares of our Common Stock issuable upon the settlement of outstanding restricted stock units;

|

|

|

|

|

•

|

1,708,557 shares of our Common Stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $18.02 per share (without giving effect to any of the anti-dilution adjustment provisions thereof); and

|

|

|

|

|

•

|

199,197 shares of our Common Stock to be reserved for potential future issuance pursuant to our 2016 Equity Incentive Plan.

|

The number of shares of our Common Stock to be outstanding immediately after this offering as shown above does not include up to approximately $14.3 million of shares of our Common Stock that remained available for sale at December 31, 2016 under our Controlled Equity Offering

SM

Sales Agreement (Sales Agreement) with Cantor Fitzgerald & Co., as agent. Between December 31, 2016 and the date of this prospectus, no shares were sold under the Sales Agreement.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risks described under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, as filed with the SEC on March 9, 2017, which description is incorporated in this prospectus by reference in its entirety and the risks described below, as well as in any prospectus supplement hereto, and other information in this prospectus before deciding to invest in or maintain your investment in our company. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below titled “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related To Our Business

The estimated cost of completing the development of any of our current immunotherapy product candidates and of obtaining all required regulatory approvals to market any of those product candidates is substantially greater than the amount of funds we currently have available. We will not have enough cash resources to fund the business for the next 12 months and successful completion of our research and development activities, and our transition to attaining profitable operations, is dependent upon obtaining financing.

As of December 31, 2016, we had working capital of $10,175,846, compared to working capital of $22,291,140 as of December 31, 2015. The estimated cost of completing the development of any of our current immunotherapy product candidates and of obtaining all required regulatory approvals to market any of those product candidates is substantially greater than the amount of funds we currently have available. We expect our costs will increase in 2017 primarily to fund the phase 3 trial of ICT-107, and that we will not have enough cash resources to fund the business for the next 12 months. Successful completion of our research and development activities, and our transition to attaining profitable operations, is dependent upon obtaining financing. Assuming we successfully close this offering, we expect that we will have sufficient cash to fund our operations for approximately 4 months assuming no revenue generation. Additional financing may not be available on acceptable terms or at all. If we issue additional equity securities to raise funds, the ownership percentage of existing stockholders would be reduced. New investors may demand rights, preferences or privileges senior to those of existing holders of common stock. If we cannot raise funds, we might be forced to make substantial reductions in the on-going clinical trials, thereby damaging our reputation in the biotech and medical communities which could adversely affect our ability to implement our business plan and our viability. These factors raise substantial doubt about our ability to continue as a going concern.

Risks Related to the Offering

Management will have broad discretion as to the use of the net proceeds from this offering, and we may not use these proceeds effectively.

We currently intend to use the net proceeds from this offering to continue enrollment in our phase 3 clinical trial of ICT-107, to complete phase 1 development of ICT-121, to continue our Stem-to-T-cell research program and for working capital and general corporate purposes as we work to evaluate strategic alternatives for our immuno-oncology research and development pipeline and technology platform, which may include a potential merger, consolidation, reorganization or other business combination, as well as the sale of the company or the company’s assets. We may also use a portion of the net proceeds of this offering to acquire additional technologies. Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our Common Stock. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. Our failure to apply these funds effectively could have a material adverse effect on our business, delay the development of our product candidates and cause the price of our Common Stock to decline.

Investors in this offering will experience immediate and substantial dilution.

Since the public offering price per share of the Units offered pursuant to this prospectus is expected to be substantially higher than the net tangible book value per share of our Common Stock, you will suffer immediate and substantial dilution in the net tangible book value of the Common Stock underlying the Preferred Stock and Series A Warrants from the price per Unit that you pay in this offering. Our net tangible book value as of December 31, 2016 was approximately $6.0 million, or $1.75

per share. After giving effect to the assumed sale by us of 10,000 Units in this offering at a public offering price of $1,000 per Unit (and an assumed Conversion Price of $2.31 per share, which is equal to 87.5% of the lowest volume weighted average trading price of the Common Stock during the five trading days ending March 29, 2017), and after deducting underwriting discounts, commissions and other estimated offering expenses payable by us, and allocating approximately $6.5 million of the proceeds to the Series A Warrants and deducting approximately $1.6 million from our pro-forma net equity to account for the increase in the liability associated with the revaluation of our existing warrant derivatives, you will suffer immediate dilution of $1.44 per share in the net tangible book value of the Common Stock you acquire. In the event that you exercise Series A Warrants you will experience additional dilution to the extent that the exercise price of the Series A Warrants is higher than the tangible book value per share of our common stock. See the section titled “Dilution” below for a more detailed discussion of the dilution you would incur if you purchase Units in this offering.

In addition, we have a significant number of stock options and warrants outstanding. To the extent that outstanding stock options or warrants, including the Series A Warrants offered in this prospectus, have been or may be exercised or other shares issued, you may experience further dilution.

The offering price determined for this offering is not an indication of our value.

The per-Unit offering price and the initial conversion price of the Preferred Stock and the initial exercise price of the Series B Warrants may not necessarily bear any relationship to the book value of our assets, past operations, cash flows, losses, financial condition or any other established criteria for value. You should not consider the offering price for the Units as an indication of the value of the Common Stock underlying the Preferred Stock and the Series H Warrants. After the date of this prospectus, the Common Stock may trade at prices above or below the price per share of Common Stock imputed by the offering price.

Future sales of substantial amounts of our Common Stock could adversely affect the market price of our Common Stock.

We may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. If additional capital is raised through the sale of equity or convertible debt securities, or perceptions that those sales could occur, the issuance of these securities could result in further dilution to investors purchasing our Common Stock in this offering or result in downward pressure on the price of our Common Stock, and our ability to raise capital in the future.

The exercise of outstanding options and warrants to acquire shares of our Common Stock would cause additional dilution, which could cause the price of our Common Stock to decline.

In the past, we have issued options and warrants to acquire shares of our Common Stock. At December 31, 2016, there were 162,665 shares of Common Stock issuable upon exercise of outstanding options at a weighted average exercise price of $43.11 per share and 1,708,557 shares of Common Stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $18.02 per share, and we may issue additional options, warrants and other types of equity in the future as part of stock-based compensation, capital raising transactions, technology licenses, financings, strategic licenses or other strategic transactions. In addition, after giving effect to the assumed sale by us of 10,000 Units in this offering with an assumed Conversion Price of $2.31 and Series A Warrant exercise price of $3.08 per share, the last reported sale price of our common stock on March 29, 2017, the weighted average exercise price would be adjusted to $12.71 per share as a result of exercise price protection provisions in certain warrants. To the extent these options and warrants are ultimately exercised, existing holders of our Common Stock would experience additional dilution which may cause the price of our Common Stock to decline.

Securities analysts may not continue to cover our Common Stock, and this may have a negative impact on our Common Stock’s market price.

The trading market for our Common Stock depends, in part, on the research and reports that securities analysts publish about us and our business. We do not have any control over these analysts. If our stock is downgraded by a securities analyst, our stock price would likely decline. If the analyst ceases to cover us or fails to publish regular reports on us, we could lose visibility in the financial markets, which could cause our stock price or trading volume to decline.

Anti-takeover provisions in our charter documents and under Delaware law may make an acquisition of us, which may be beneficial to our stockholders, more difficult.

Provisions of our amended and restated certificate of incorporation and amended and restated bylaws, as well as provisions of Delaware law, could make it more difficult for a third party to acquire us, even if doing so would benefit our stockholders. These provisions:

|

|

|

|

•

|

establish that members of our board of directors may be removed upon an affirmative vote of stockholders owning a majority of our capital stock

|

|

|

|

|

•

|

authorize the issuance of “blank check” preferred stock that could be issued by our board of directors to increase the number of outstanding shares and thwart a takeover attempt;

|

|

|

|

|

•

|

limit who may call a special meeting of stockholders;

|

|

|

|

|

•

|

establish advance notice requirements for nominations for election to our board of directors; and

|

|

|

|

|

•

|

provide that the authorized number of directors may be changed by a resolution of our board of directors, provided that the number is within the limits established by the bylaws.

|

In addition, Section 203 of the Delaware General Corporation Law, which imposes certain restrictions relating to transactions with major stockholders, may discourage, delay or prevent a third party from acquiring us.

Risks Related to the Units, the Preferred Stock and the Series A Warrants.

There is no public market for the Units, the Preferred Stock and the Series A Warrants.

There is no established public trading market for the Units, the Preferred Stock and the Series A Warrants offered by this prospectus and we do not expect a market to develop. In addition, we do not intend to apply to list the Units, the Preferred Stock or the Series A Warrants on any national securities exchange or other nationally recognized trading system, including the NYSE MKT. Without an active market, the liquidity of the Units, the Preferred Stock and the Series A Warrants will be limited.

As a holder of the Preferred Stock or Series A Warrants you have no voting rights.

You will have no voting rights as a holder of the Preferred Stock or Series A Warrants. Our Common Stock is currently the only class of our securities that carries full voting rights.

Until you acquire shares of our common stock upon the conversion of your preferred stock or exercise of your warrants, you will have no rights with respect to shares of our common stock issuable upon conversion of your preferred stock or exercise of your warrants. Upon conversion of your preferred stock or exercise of your warrants, you will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

We may lose our current NYSE MKT listing of our common stock and may not be eligible to list our common stock on other exchanges. If we are unable to maintain compliance with NYSE MKT continued listing standards and policies, the NYSE MKT may commence proceedings to delist our common stock, and in some cases, determine to suspend trading in our common stock immediately without an opportunity to propose a plan that could enable us to regain compliance, which would likely cause the liquidity and market price of our common stock to decline and you could lose your investment.

Our common stock currently trades on the NYSE MKT under the symbol IMUC. If we fail to adhere to the NYSE MKT’s strict listing criteria, our stock may be delisted. For example, the NYSE MKT will consider suspending dealings in, or delisting, securities of an issuer that has stockholders’ equity of less than $6 million if that issuer has sustained losses from continuing operations and/or net losses in its five most recent fiscal years. We have had a loss from operations and net loss in each of our five most recent fiscal years and we expect to incur a loss from operations and net loss for 2017. At December 31, 2016, our stockholders’ equity was $6.1 million, and in March 2017, we received an early warning letter from the NYSE MKT indicating that if our stockholders’ equity falls below $6 million, the NYSE MKT may take formal action and determine that we are no longer suitable for listing and may commence delisting proceedings pursuant Section 1003(a)(iii) of the NYSE MKT Company Guide. This could potentially impair the liquidity of our securities not only in the number of shares that could be bought and sold at a given price, which might be depressed by the relative illiquidity, but also through delays in the timing of transactions and the potential reduction in media coverage. As a result, an investor might find it more difficult to dispose of our common stock. We believe that current and prospective investors would view an investment in our common stock more favorably if it continues to be listed on the NYSE MKT.

If our Common Stock is delisted, your ability to transfer or sell the Preferred Stock or Series A Warrants may be limited and the market value of the Preferred Stock or Series A Warrants will likely be materially adversely affected.

We expect that the value of the Preferred Stock and Series A Warrants to some extent is tied to the perceived value of their conversion and exercise features. If our Common Stock is delisted from the NYSE MKT, your ability to transfer or sell the Preferred Stock and Series A Warrants may be limited and the market value of the Preferred Stock and Series A Warrants will likely be materially adversely affected.

We expect that the market value of the Preferred Stock and Series A Warrants will be significantly affected by changes in the market price of our Common Stock, which could change substantially at any time.

We expect that the market value of the Preferred Stock and Series A Warrants will depend on a variety of factors, including, without limitation, the market price of our Common Stock. Each of these factors may be volatile, and may or may

not be within our control. For example, we expect the market value of the Preferred Stock and Series A Warrants will increase with increases in the market price of our Common Stock. The market price of the Common Stock has been volatile in the past and could fluctuate widely in response to various factors.

We may issue additional shares of our Common Stock or instruments convertible or exercisable into our Common Stock, including in connection with exercise of the Preferred Stock and Series A Warrants, and thereby materially and adversely affect the market price of our Common Stock, and, in turn, the market value of the Preferred Stock and Series A Warrants.

Subject to certain contractual limitations, under the Certificate of Designation and Underwriting Agreement, we are under, we may offer and sell additional shares of our Common Stock or other securities convertible into or exercisable for our Common Stock during the life of the Preferred Stock and Series A Warrants. We cannot predict the size of future issuances or the effect, if any, that they may have on the market price for our Common Stock. If we issue additional shares of our Common Stock or instruments convertible or exercisable into our Common Stock, it may materially and adversely affect the price of our Common Stock and, in turn, the market value of the Preferred Stock and Series A Warrants. Furthermore, the conversion or exercise of some or all of our outstanding derivative securities, including the Preferred Stock and Series A Warrants, will dilute the ownership interests of existing stockholders, and any sales in the public market of shares of our Common Stock issuable upon any such conversion or exercise could adversely affect prevailing market prices of our Common Stock or the market value of the Preferred Stock and Series A Warrants.

Holders of the Preferred Stock and Series A Warrants will be entitled to only limited rights with respect to our Common Stock, and will be subject to all changes made with respect to our Common Stock to the extent holders receive shares of Common Stock pursuant to the terms of the Preferred Stock and Series A Warrants.

Holders of the Preferred Stock and Series A Warrants will be entitled to only limited rights with respect to our Common Stock until the time at which they become holders of our Common Stock pursuant to the terms of the Preferred Stock and Series A Warrants, but will be subject to all changes affecting our Common Stock before that time. For example, if an amendment is proposed to our articles of incorporation requiring stockholder approval and the record date for determining the stockholders of record entitled to vote on the amendment occurs before the date you are deemed to be a record holder of our Common Stock, you generally will not be entitled to vote on the amendment, although you will nevertheless be subject to any changes affecting our Common Stock.

Provisions of the warrants offered by this prospectus could discourage an acquisition of us by a third party.

In addition to the discussion of the provisions of our Amended and Restated Certificate of Incorporation, as amended, certain provisions of the Series A Warrants offered by this prospectus could make it more difficult or expensive for a third party to acquire us. The Series A Warrants prohibit us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving entity assumes our obligations under the warrants. Further, the Series A Warrants provide that, in the event of certain transactions constituting “fundamental transactions,” with some exception, holders of such warrants will have the right, at their option, to require us to repurchase such warrants at a price described in such warrants. These and other provisions of the Series A Warrants offered by this prospectus could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to you.

A large number of shares issued in this offering may be sold in the market following this offering, which may depress the market price of our common stock.

A large number of shares that are issuable upon conversion of the Series B Preferred Stock or exercise of the Series A Warrants may be sold in the market following this offering, which may depress the market price of our common stock. Sales of a substantial number of shares of our common stock in the public market following this offering could cause the market price of our common stock to decline. If there are more shares of our common stock offered for sale than buyers are willing to purchase, then the market price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of our common stock and sellers remain willing to sell the shares. All of the securities issued in the offering will be freely tradable without restriction or further registration under the Securities Act of 1933, as amended (Securities Act).

The Series A Warrants may not have any value.

Each Series A Warrant sold in this offering will have an exercise price of $ per share, which is equal to the last reported sale price of our common stock as of the close of the trading day immediately preceding the pricing of this offering, and will expire on the fifth anniversary of the date they first become exercisable. In the event our common stock price does not exceed the exercise price of the base warrants during the period when the base warrants are exercisable, the base warrants may not have any value.

The exercise price of the Series A Warrants will not be adjusted for certain dilutive events.

The exercise price of the Series A Warrants is subject to adjustment for certain events, including, but not limited to, certain issuances of capital stock, options, convertible securities and other securities. However, the exercise prices will not be adjusted

for dilutive issuances of securities considered “excluded securities” and there may be transactions or occurrences that may adversely affect the market price of our Common Stock or the market value of such warrants without resulting in an adjustment of the exercise prices of such warrants.

To the extent we issue shares of our Common Stock to satisfy all or a portion of our conversion or exercise obligations, conversion of the Preferred Stock and exercise of the Series A Warrants will dilute the ownership interest of our existing stockholders, including holders who had previously converted or exercised their Preferred Stock or Series A Warrants.

Issuance of shares of Common Stock upon conversion of the Preferred Stock and exercise of the Series A Warrants will dilute the ownership interest of our existing stockholders. Further, any sales in the public market of our Common Stock issuable upon such exercise could adversely affect prevailing market prices of our Common Stock. In addition, the existence of the Preferred Stock and Series A Warrants may encourage short selling by market participants because the conversion of the Preferred Stock and exercise of the Series A Warrants could depress the price of our Common Stock.

You may receive less valuable consideration than expected because the value of our Common Stock may decline after you convert the Preferred Stock or exercise the Series A Warrants issued in this offering, but before we settle our obligation thereunder.

A converting or exercising holder will be exposed to fluctuations in the value of our Common Stock during the period from the date such holder converts the Preferred Stock or surrenders Series A Warrants for exercise until the date we settle our exercise obligation. Upon conversion of the Preferred Stock and exercise of the Series A Warrants, we will be required to deliver the shares of our Common Stock, on the third business day following the relevant conversion or exercise date. Accordingly, if the price of our Common Stock decreases during this period, the value of the shares that you receive will be adversely affected and would be less than the value on the exercise date.

If we explore or engage in future business combinations or other transactions, we may be subject to various uncertainties and risks.

From time-to-time, unrelated third-parties approach the Company about potential transactions, including business combinations. Recently, we have had preliminary discussions with one such third party to explore, among other things, a potential business combination. We have not, however, completed a review of matters that would be required prior to entering into any such transaction such as due diligence, negotiating and agreeing upon terms and obtaining approval from our board of directions. As such, to date, we have not entered into any agreements related to any business combination. While we may explore such opportunities when they arise, we could not pursue any proposed business combination or other transaction unless our board of directors first has determined that doing so would be in our and our stockholders’ interest. There can be no assurance that we will negotiate acceptable terms, enter into binding agreements or successfully consummate any business combination or other transaction with this private company or any other third parties.

We cannot currently predict the effects a future, potential business combination or other transaction would have on holders of the Preferred Stock, Series A Warrants or any of our other securities. There are various uncertainties and risks relating to our evaluation and negotiation of possible business combination or other transactions, our ability to consummate such transactions and the consummation of such transactions, including:

|

|

|

|

•

|

evaluation and negotiation of a proposed transaction may distract management from focusing our time and resources on execution of our operating plan, which could have a material adverse effect on our operating results and business;

|

|

|

|

|

•

|

the process of evaluating proposed transactions may be time consuming and expensive and may result in the loss of business opportunities;

|

|

|

|

|

•

|

perceived uncertainties as to our future direction may result in increased difficulties in retaining key employees and recruiting new employees, particularly senior management;

|

|

|

|

|

•

|

even if our board of directors negotiates a definitive agreement, successful integration or execution of a business combination or other transaction will be subject to additional risks;

|

|

|

|

|

•

|

the current market price of our Common Stock may reflect a market assumption that a transaction will occur, and during the period in which we are considering a transaction, the market price of our Common Stock could be highly volatile;

|

|

|

|

|

•

|

a failure to complete a transaction could result in a negative perception by our investors generally and could cause a decline in the market price of our Common Stock, as well as lead to greater volatility in the market price of our

|

Common Stock, all of which could adversely affect our ability to access the equity and financial markets, as well as our ability to explore and enter into different strategic alternatives;

|

|

|

|

•

|

expected benefits may not be successfully achieved;

|

|

|

|

|

•

|

such transactions may increase our operating expenses and cash requirements, cause us to assume or incur indebtedness or contingent liabilities, make it difficult to retain management and key personnel; and

|

|

|

|

|

•

|

dilution of our existing stockholders if such transaction involves our issuing dilutive securities.

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, which reflect the views of our management with respect to future events and financial performance. These forward-looking statements are subject to a number of uncertainties and other factors that could cause actual results to differ materially from such statements. Forward-looking statements are identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “targets” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on the information available to management at this time and which speak only as of this date. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. For a discussion of some of the factors that may cause actual results to differ materially from those suggested by the forward-looking statements, please read carefully the information under “Risk Factors.” Examples of our forward-looking statements include:

|

|

|

|

•

|

our current views with respect to our business strategy, business plan and research and development activities;

|

|

|

|

|

•

|

the progress of our product development programs, including clinical testing and the timing of commencement and results thereof;

|

|

|

|

|

•

|

our projected research and development expenses;

|

|

|

|

|

•

|

our ability to fund, enroll and successfully complete the phase 3 study of ICT-107 and any of our other product candidates;

|

|

|

|

|

•

|

the potential for and timing of development and commercial success of ICT-107;

|

|

|

|

|

•

|

our ability to continue development plans for ICT-140 and ICT-121;

|

|

|

|

|

•

|

our ability to pursue strategic alternatives, including for our immuno-oncology research and development pipeline and technology platform;

|

|

|

|

|

•

|

our ability to enter into a strategic collaboration with Memgen;

|

|

|

|

|

•

|

our anticipated use of proceeds from this offering; and

|

|

|

|

|

•

|

our ability to further develop our technologies into product candidates.

|

The identification in this document of factors that may affect future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. You may rely only on the information contained in this prospectus.