Current Report Filing (8-k)

April 03 2017 - 6:58AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 31, 2017

CLEAN ENERGY FUELS CORP.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-33480

|

|

33-0968580

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

4675 MacArthur Court, Suite 800

Newport Beach, CA

|

|

92660

|

|

(Address of Principal Executive Offices)

|

|

Zip Code

|

(949) 437-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

On March 31, 2017, Clean

Energy Renewable Fuels, LLC (“Renewables”), an indirect subsidiary of Clean Energy Fuels Corp. (the “Registrant”), completed its sale to BP Products North America, Inc. (“BP”) of certain assets related to the

Registrant’s renewable natural gas (“RNG”) business, including two RNG production facilities, a 50% ownership interest in joint ventures formed to develop two new RNG production facilities, and third-party RNG supply contracts

(collectively, the “Assets”) (such transaction, the “Asset Sale”).

Upon completion of the Asset Sale, BP

paid Renewables $30.0 million in cash and delivered to Renewables a promissory note for $123.5 million that matures on April 3, 2017, and Renewables retained $7.1 million of cash relating to the Assets. BP has also agreed to pay up to an

additional $25.0 million in cash over a five-year period, which amount could be paid in whole, in part or not at all, depending on the satisfaction of certain performance conditions related to the Assets. The Registrant expects the net proceeds

from the Asset Sale, after deducting costs and other payments associated with the transaction paid or payable by the Registrant or Renewables, to be approximately $150.1 million, and the Registrant intends to use these net proceeds for general

working capital, including the payment of its outstanding indebtedness.

Following completion of the Asset Sale, Renewables and the

Registrant will continue to obtain RNG from BP under a long-term supply contract and from other RNG suppliers, and will resell such RNG through its natural gas fueling infrastructure as Redeem™, the Registrant’s RNG vehicle fuel. The

Registrant will collect royalties from BP on gas purchased from BP and sold as Redeem at its stations, which royalty is in addition to any payment obligation of BP under the APA (as defined below).

The Asset Sale was completed pursuant to the terms of an asset purchase agreement (the “APA”) between Renewables and BP, which

was entered into on February 27, 2017 and filed as Exhibit 2.11 to the Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on March 1, 2017. The foregoing description of the terms of the APA

does not purport to be complete and is qualified in its entirety by the full text of the APA, which is incorporated herein by reference. The APA contains customary representations and warranties by the parties thereto, which were made solely for the

purpose of the APA and as of specific dates as set forth therein, may have been qualified by certain private disclosures made between the parties and are subject to a contractual standard of materiality different from that generally applicable to

stockholders, among other limitations. As a result, these representations and warranties should not be relied upon as a disclosure of factual information.

In accordance with applicable rules of the Securities and Exchange Commission, the Registrant has prepared pro forma financial information

about the continuing impact of the Asset Sale by showing how it might have affected the Registrant’s historical consolidated financial statements if the transaction had been consummated at the end of the Registrant’s last completed fiscal

year for purposes of the pro forma consolidated balance sheet and at the beginning of the Registrant’s last completed fiscal year for purposes of the pro forma consolidated statement of operations. Such pro forma financial information is

attached as Exhibit 99.1 to this Current Report on Form 8-K.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

|

(e)

|

Surrender of Renewables Option Awards.

|

In September 2013, Renewables established

the 2013 Unit Option Plan (the “Renewables Plan”) and granted unit option awards thereunder (the “Renewables Option Awards”) to certain of its service providers. In connection with the closing of the Asset Sale, all

holders of outstanding Renewables Option Awards entered into a surrender agreement with the Registrant and Renewables, pursuant to which (i) all Renewables Option Awards held by holders who were not members of Renewables’ Board of Managers

were surrendered and cancelled in full in exchange for, upon the closing of the Asset Sale and Renewables’ receipt of any future cash payment pursuant to the terms of the APA, a cash payment in an amount determined based on such holder’s

percentage ownership of Renewables following a cashless “net exercise” of such holder’s Renewables Option Awards, and (ii) all Renewables Option Awards held by members of Renewables’ Board of Managers were surrendered and

cancelled in full in exchange for, upon the closing of the Asset Sale and Renewables’ receipt of any future cash payment pursuant to the terms of the APA, awards of shares of the Registrant’s common stock (the “Registrant Stock

Awards”). The number of shares of the Registrant’s common stock subject to each Registrant Stock Award is to be calculated by dividing the cash payment to which the applicable holder would have been entitled as described in (i) above

by the closing price of the Registrant’s common stock on March 31, 2017, the date of the closing of the Asset Sale. All Registrant Stock Awards are to be granted under the Registrant’s 2016 Performance Incentive Plan and

2

fully vested upon grant, and the shares subject to such awards will be freely tradable upon issuance, subject to applicable securities laws relating to shares held by the Registrant’s

affiliates. The foregoing description is intended to be a summary of the terms of the surrender agreement and is qualified in its entirety by reference to the full text of such agreement, which will be filed as an exhibit to the Registrant’s

Quarterly Report on Form 10-Q for the quarter ended March 31, 2017.

Among the members of Renewables’ Board of Managers who held

Renewables Option Awards prior to the closing of the Asset Sale were Andrew J. Littlefair, the Registrant’s President and Chief Executive Officer, Mitchell W. Pratt, the Registrant’s Chief Operating Officer, and Barclay F. Corbus, the

Registrant’s Senior Vice President, Strategic Development. As a result, upon the closing of the Asset Sale, each such holder’s Renewables Option Awards were surrendered and cancelled in full in exchange for grants of Registrant Stock

Awards and rights to receive additional Registrant Stock Awards upon any future cash payment to Renewables pursuant to the terms of the APA. The following table presents, for each of Mr. Littlefair, Mr. Pratt and Mr. Corbus,

(a) the number of Renewables’ units subject to the Renewables Option Awards held by such person immediately prior to the closing of the Asset Sale, (b) the number of shares of the Registrant’s common stock subject to the

Registrant Stock Awards granted to such person at the closing of the Asset Sale, and (c) the maximum approximate dollar value of shares of the Registrant’s common stock to be subject to Registrant Stock Awards that could be granted to such

person over the next five years if Renewables receives the maximum amount of future cash payments under the APA during such period:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Renewables

Option Awards

(No. of Units)

(a)

|

|

|

Registrant

Stock Awards

(No. of Shares)

(b)

|

|

|

Maximum Dollar

Value of Future

Registrant Stock

Awards ($)

(c)

|

|

|

Andrew J. Littlefair

|

|

|

12,000

|

|

|

|

460,536

|

|

|

|

313,000

|

|

|

Mitchell W. Pratt

|

|

|

9,000

|

|

|

|

345,402

|

|

|

|

235,000

|

|

|

Barclay F. Corbus

|

|

|

7,000

|

|

|

|

268,646

|

|

|

|

183,000

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(b) Pro Forma Financial Information.

The unaudited pro forma financial information of the Registrant as of and for the fiscal year ended December 31, 2016, and the notes

related thereto, as if the Asset Sale had been consummated at the end of such fiscal year for purposes of the pro forma consolidated balance sheet and at the beginning such fiscal year for purposes of the pro forma consolidated statement of

operations, is attached hereto as Exhibit 99.1 and incorporated herein by reference.

(d) Exhibits.

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

99.1

|

|

Unaudited Pro Forma Financial Information of Clean Energy Fuels Corp. and Subsidiaries.

|

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: April 3, 2017

|

|

|

|

CLEAN ENERGY FUELS CORP.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Andrew J. Littlefair

|

|

|

|

|

|

|

|

Name: Andrew J. Littlefair

|

|

|

|

|

|

|

|

Title: President and Chief Executive Officer

|

4

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Unaudited Pro Forma Financial Information of Clean Energy Fuels Corp. and Subsidiaries.

|

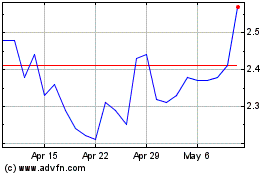

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

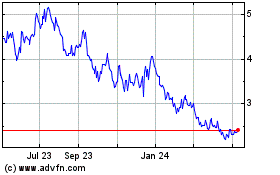

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Apr 2023 to Apr 2024