YY Inc. Announces Completion of the Repurchase Right Offer for 2.25% Convertible Senior Notes due 2019

April 03 2017 - 6:00AM

YY Inc. (NASDAQ:YY) (“

YY” or the

“

Company”), a live streaming platform, today

announced that it has completed its previously announced repurchase

right offer relating to its 2.25% Convertible Senior Notes due 2019

(the “

Notes”). The repurchase right offer expired

at 5:00 p.m., New York City time, on March 30, 2017. Based on

information from Deutsche Bank Trust Company Americas as the paying

agent for the Notes, US$399,000,000 aggregate principal amount of

the Notes were validly surrendered and not withdrawn prior to the

expiration of the repurchase right offer. The aggregate purchase

price of such Notes was US$399,000,000. The Company has accepted

all of the surrendered Notes for repurchase and has forwarded cash

in payment of the same to the paying agent for distribution to the

applicable holders.

Materials filed with the SEC will be available

electronically without charge at the SEC's website, www.sec.gov.

Documents filed with the SEC may also be obtained without charge at

the Company's website, http://investors.yy.com.

About YY Inc.

YY Inc. (“YY” or the “Company”) is a live streaming platform

that enables users to interact in live online group activities

through voice, text and video. Launched in July 2008, YY Client,

the Company’s core product, empowers users to create and organize

groups of varying sizes to discover and participate in a wide range

of activities, including online music and entertainment, online

games, online dating, live game broadcasting and education. YY Inc.

was listed on NASDAQ in November 2012 and generated revenues of

US$910 million in the fiscal year 2015.

CONTACT: For further information, please contact:

YY Inc.

Yuffie Fu

Tel: +86 (20) 8212-0000

Email: IR@YY.com

ICR, Inc.

Jessie Fan

Tel: +1 (646) 915-1611

Email: IR@YY.com

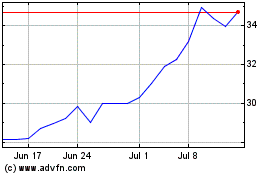

JOYY (NASDAQ:YY)

Historical Stock Chart

From Mar 2024 to Apr 2024

JOYY (NASDAQ:YY)

Historical Stock Chart

From Apr 2023 to Apr 2024