As filed with the Securities and Exchange Commission on March

31, 2017

Registration No. 333--217000

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

Amendment No. 1

to

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________

|

FLUSHING FINANCIAL CORPORATION

|

|

(Exact name of each registrant as specified in its certificate of incorporation)

|

________________________

|

DELAWARE

|

|

(State or other jurisdiction

of

incorporation or organization

of each registrant)

|

|

11-3209278

|

(I.R.S. Employer

Identification No.)

|

|

|

|

220 RXR PLAZA

UNIONDALE, NEW YORK 11556

(718) 961-5400

|

|

(Address, including zip

code, and telephone number,

including area code, of

each registrant’s principal executive offices)

|

________________________

JOHN R. BURAN

CHIEF EXECUTIVE OFFICER

FLUSHING FINANCIAL CORPORATION

220 RXR PLAZA

UNIONDALE, NEW YORK 11556

(718) 961-5400

(Name, address, including zip code,

and telephone number, including area code, of agent for service of each registrant)

________________________

Copy to:

GARY J. SIMON

HUGHES HUBBARD & REED LLP

ONE BATTERY PARK PLAZA

NEW YORK, NEW YORK 10004

(212) 837-6770

________________________

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only

in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this Form is post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective

registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e)

under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant

to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

x

|

|

Non-accelerated filer

|

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

o

|

________________________

The registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that

this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or

until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in this Prospectus is not complete and may be changed. We

may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective.

This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state

where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 31, 2017

PROSPECTUS

FLUSHING FINANCIAL CORPORATION

$200,000,000

Debt Securities

Preferred Stock

Depositary Shares

Common Stock

Warrants

________________________

These securities may be offered and sold from time to time by us

and also may be offered and sold by one or more selling security holders to be identified in the future, in one or more offerings,

up to a total dollar amount of $200,000,000 (or the equivalent in foreign currency or currency units). We will provide the specific

terms of these securities in supplements to this prospectus. You should read this prospectus and the applicable prospectus supplement

carefully before you invest in these securities. This prospectus may not be used to sell securities unless accompanied by the applicable

prospectus supplement and a pricing supplement, if any.

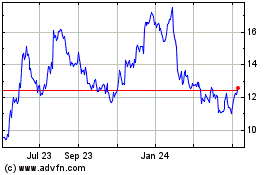

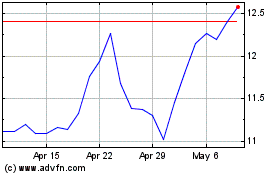

Flushing Financial Corporation’s common stock is traded on

the NASDAQ Global Select Market under the symbol “FFIC.”

________________________

Investing in the securities involves

certain risks. See “

Risk Factors

” beginning on page 5 of this prospectus and on page 44 of our annual report on

Form 10-K for the year ended December 31, 2016, which is incorporated herein by reference, as well as any risk factors included

in, or incorporated by reference into, the applicable prospectus supplement, to read about factors you should consider before

buying any of our securities.

These securities have not been approved or disapproved by the

Securities and Exchange Commission or any state securities commission nor have these organizations determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

We may offer and sell the securities directly, through agents, dealers

or underwriters as designated from time to time, or through a combination of these methods.

These securities are not savings accounts, deposits or other obligations

of any bank. These securities are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

The date of this prospectus is ______, 2017.

TABLE OF CONTENTS

In this prospectus, unless the context indicates otherwise, references

to the “Holding Company” “we,” “our” and “us” refer to the activities and the assets

and liabilities of Flushing Financial Corporation, including its subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

This prospectus and other publicly available documents, including

the documents incorporated herein by reference, may include and our representatives may from time to time make projections and

statements which may constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements are based on current expectations, estimates and projections about our business

and management’s beliefs and assumptions. Forward-looking statements are typically identified by words such as “believe,”

“expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,”

“positions,” “prospects” or “potential,” by future conditional verbs such as “will,”

“would,” “should,” “could,” or “may,” or by variations of such words or by similar

expressions. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions

(“Future Factors”) which are difficult to predict. Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements. Forward-looking statements speak only as of the date they are

made and we assume no duty to update forward-looking statements.

Future Factors include that: changes in interest rates may significantly

impact our financial condition and results of operations; our lending activities involve risks that may be exacerbated depending

on the mix of loan types; failure to effectively manage our liquidity could significantly impact our financial condition and results

of operations; our ability to obtain brokered deposits as an additional funding source could be limited; the markets in which we

operate are highly competitive; our results of operations may be adversely affected by changes in national and/or local economic

conditions; changes in laws and regulations could adversely affect our business; current conditions in, and regulation of, the

banking industry may have a material adverse effect on our results of operations; the FDIC’s adopted restoration plan and

the related increased assessment rate schedule may have a material effect on our results of operations; a failure in or breach

of our operational or security systems or infrastructure, or those of our third party vendors and other service providers, including

as a result of cyberattacks, could disrupt our business, result in the disclosure or misuse of confidential or proprietary information,

damage our reputation, increase our costs and cause losses; we may experience increased delays in foreclosure proceedings; we may

need to recognize other-than-temporary impairment charges in the future; our inability to hire or retain key personnel could adversely

affect our business; we are not required to pay dividends on our common stock; goodwill recorded as a result of acquisitions could

become impaired, negatively impacting our earnings and capital; and we may not fully realize the expected benefit of our deferred

tax assets.

These are representative of the Future Factors that could affect

the outcome of the forward-looking statements. In addition, such statements could be affected by general industry and market conditions

and growth rates, general economic and political conditions, either nationally or in the states in which Flushing and its subsidiaries

do business, including interest rate and currency exchange rate fluctuations, changes and trends in the securities markets, and

other Future Factors.

ABOUT THIS DOCUMENT

This prospectus is part of a registration statement that we filed

with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. The prospectus does

not contain all information included in the registration statement. You may review a copy of the registration statement at the

SEC’s Public Reference Room as well as through the SEC’s internet site, as described below. Under this shelf registration

process, we may offer and sell the securities identified in this prospectus. Each time we offer and sell securities, we will provide

a prospectus supplement that will contain information about the terms of the offering and the securities being offered and, if

necessary, a pricing supplement that will contain the specific terms of your securities. The prospectus supplement and, if necessary,

the pricing supplement may also add, update or change information contained in this prospectus. Any information contained in this

prospectus will be deemed to be modified or superseded by any inconsistent information contained in a prospectus supplement or

a pricing supplement. You should read carefully this prospectus and any prospectus supplement and pricing supplement, together

with the additional information described below under “Where You Can Find More Information.”

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and

other information with the SEC. You may read and copy any document we file at the SEC’s Public Reference Room at 100 F Street,

N.E., Washington, D.C. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. In addition,

our SEC filings are available to the public at the SEC’s web site at

http://www.sec.gov

. Flushing also maintains a

Web site (

http://www.flushingbank.com

) where information about Flushing and its subsidiaries can be obtained. The information

contained in the Flushing Web site is not part of this prospectus. You may also inspect copies of these filings and other information

at the offices of the Nasdaq Stock Market, Inc., One Liberty Plaza, 165 Broadway, New York, NY 10006.

In this prospectus, as permitted by law, we “incorporate by

reference” information from other documents that we file with the SEC. This means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus

and should be read with the same care. When we update the information contained in documents that have been incorporated by reference

by making future filings with the SEC, the information incorporated by reference in this prospectus is considered to be automatically

updated and superseded. In other words, in case of a conflict or inconsistency between information contained in this prospectus

and information incorporated by reference into this prospectus, you should rely on the information contained in the document that

was filed later.

We incorporate by reference the documents listed below and any documents

we file with the SEC in the future under Section 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934 (other

than those portions that may be “furnished” and not filed with the SEC) until our offering is completed:

|

|

·

|

Annual Report on Form 10-K for the year ended December 31, 2016;

|

|

|

·

|

Those portions of our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 7, 2016 that are incorporated

by reference into our Annual Report on Form 10-K for the year ended December 31, 2015.

|

|

|

·

|

The description of our common stock contained in the registration statement on Form 8-A, filed on September 25, 1995 with the

SEC pursuant to Section 12 of the Exchange Act, including any amendment or report filed for purposes of updating such description

|

You may request a copy of any of these filings, other than an exhibit

to a filing unless that exhibit is specifically incorporated by reference into that filing, at no cost, by writing to or telephoning

us at the following address:

Flushing Financial Corporation

220 RXR Plaza

Uniondale, New York 11556

(718) 961-5400

ABOUT FLUSHING FINANCIAL CORPORATION

Flushing Financial Corporation is a Delaware corporation and is registered

as a financial holding company under the Bank Holding Company Act of 1956, as amended. The primary business of Flushing Financial

Corporation is the operation of the Flushing Bank (the “Bank”). The principal executive offices of Flushing Financial

Corporation are located at 220 RXR Plaza, Uniondale, New York 11556. The telephone number for Flushing Financial Corporation is

(718) 961-5400.

RISK FACTORS

Investing in our securities involves certain risks. Before you invest

in any of our securities, in addition to the other information included in, or incorporated by reference into, this prospectus,

you should carefully consider the risk factors contained in Item 1 under the caption “Risk Factors” and elsewhere

in our annual report on Form 10-K for the fiscal year ended December 31, 2016, which is incorporated into this prospectus

by reference, as updated by our annual or quarterly reports for subsequent fiscal years or fiscal quarters that we file with the

SEC and that are so incorporated. See “Where You Can Find More Information” for information about how to obtain a copy

of these documents. You should also carefully consider the risks and other information that may be contained in, or incorporated

by reference into, any prospectus supplement relating to specific offerings of securities.

USE OF PROCEEDS

We intend to use the net proceeds from the sale of any securities

offered under this prospectus as set forth in the applicable prospectus supplement.

CONSOLIDATED EARNINGS RATIOS

The following table sets forth our consolidated ratio of earnings

to fixed charges (from continuing operations) for each of the periods shown:

|

|

|

Year Ended December 31,

|

|

|

|

2016

|

|

2015

|

|

2014

|

|

2013

|

|

2012

|

|

|

|

(Dollars

in thousands)

|

|

Earnings:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income before income taxes, net of building sales

|

|

$

|

58,001

|

(1)

|

|

$

|

66,839

|

(2)

|

|

$

|

72,812

|

|

|

$

|

60,708

|

|

|

$

|

56,178

|

|

|

Fixed charges (from below)

|

|

|

53,911

|

|

|

|

49,726

|

|

|

|

49,554

|

|

|

|

52,284

|

|

|

|

63,275

|

|

|

Total earnings for purposes of ratios

|

|

$

|

111,912

|

|

|

$

|

116,565

|

|

|

$

|

112,366

|

|

|

$

|

112,992

|

|

|

$

|

119,453

|

|

|

Fixed Charges:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total deposit interest expense

|

|

$

|

33,350

|

|

|

$

|

30,336

|

|

|

$

|

30,044

|

|

|

$

|

32,037

|

|

|

$

|

40,382

|

|

|

Other borrowing interest expense

|

|

|

20,561

|

|

|

|

19,390

|

|

|

|

19,510

|

|

|

|

20,247

|

|

|

|

22,893

|

|

|

Total fixed charges for purposes of ratios

|

|

$

|

53,911

|

|

|

$

|

49,726

|

|

|

$

|

49,554

|

|

|

$

|

52,284

|

|

|

$

|

63,275

|

|

|

Ratio of Earnings to Fixed Charges:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excluding interest on deposits

|

|

|

3.82

|

x

|

|

|

4.45

|

x

|

|

|

4.73

|

x

|

|

|

4.00

|

x

|

|

|

3.45

|

x

|

|

Including interest on deposits

|

|

|

2.08

|

x

|

|

|

2.34

|

x

|

|

|

2.47

|

x

|

|

|

2.16

|

x

|

|

|

1.89

|

x

|

|

(1)

|

Excludes $48,018 attributable to the gain on sale of buildings during the period. Including the gain on sale of buildings, earnings to fixed charges, excluding interest on deposits, is 6.16x and earnings to fixed charges including interest on deposits is 2.97x.

|

|

(2)

|

Excludes $6,537 attributable to the gain on sale of buildings during the period. Including the gain on sale of buildings, earnings to fixed charges, excluding interest on deposits, is 4.78x and earnings to fixed charges, including interest on deposits, is 2.48x.

|

The ratios of earnings to fixed charges are computed by dividing

(1) income (loss) before income taxes and fixed charges by (2) total fixed charges. For purposes of computing the foregoing ratios,

earnings represent continuing operations income (loss) before applicable income taxes and fixed charges. Fixed charges, including

interest on deposits, include all interest expense. Fixed charges, excluding interest on deposits, includes interest expense (other

than on deposits).

DESCRIPTION OF CAPITAL STOCK

The following summary discusses the material terms of our capital

stock. This description is a summary only and not meant to be complete, but is qualified in its entirety by reference to the relevant

provisions of the General Corporation Law of the State of Delaware, which we refer to in this prospectus as the DGCL, charter and

amended and restated bylaws. For more detailed information, you should refer to our charter and amended and restated bylaws, which

we have filed with the SEC and are incorporating by reference herein, and the DGCL.

Our charter provides that we may issue up to 105,000,000 shares of

capital stock, consisting of 100,000,000 shares of common stock, par value $0.01 per share, and 5,000,000 shares of preferred stock,

par value $0.01 per share. There were 31,530,595 shares of our common stock outstanding as of February 28, 2017. There currently

are no other classes or series of preferred stock authorized or outstanding.

We are a Delaware corporation governed by the DGCL. Under Delaware

law, stockholders generally are not responsible for a corporation’s debts or obligations.

Common Stock

Our charter authorizes the issuance of up to 100,000,000 shares of

common stock, par value $0.01 per share, of which 31,530,595 shares were outstanding as of February 28, 2017. Each stockholder

is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. There is no cumulative

voting for election of directors. In uncontested elections, director nominees must be elected by the majority of votes cast at

the annual meeting of stockholders. Incumbent directors who fail to receive a majority of votes - and who would otherwise remain

in office until a successor is elected under Delaware law - are required to offer a letter of resignation for consideration by

the Board of Directors. Plurality voting applies if the number of nominees exceeds the number of open director positions.

Holders of our common stock vote together as a single class, except

as otherwise provided by law. Holders of shares of our common stock have no preemptive rights, conversion rights or other subscription

rights. There are no redemption or sinking fund provisions applicable to the common stock. All shares of common stock will, when

issued, be fully paid and non-assessable.

Dividends

Subject to the DGCL and the rights of holders of any outstanding

preferred stock, holders of our common stock will be entitled to share dividends equally, share for share.

Certain Effects of Authorized but Unissued Stock

We have shares of common stock and preferred stock available for

future issuance without stockholder approval. We may utilize these additional shares for a variety of corporate purposes, including

future public offerings to raise additional capital, facilitating corporate acquisitions or paying a dividend on the capital stock.

The existence of unissued and unreserved common stock and preferred

stock may enable the Board of Directors to issue shares to persons friendly to current management or to issue preferred stock with

terms that could render more difficult or discourage a third party attempt to obtain control of our company by means of a merger,

tender offer, proxy contest or otherwise, thereby protecting the continuity of our management. In addition, if we issue preferred

stock, the issuance could adversely affect the voting power of holders of common stock and the likelihood that such holders will

receive dividend payments and payments upon liquidation.

Certain Provisions Affecting Change in Control

Certain provisions of our certificate of incorporation and bylaws,

the Bank’s federal stock charter and bylaws, certain federal regulations and provisions of Delaware corporation law, and

certain provisions of remuneration plans and agreements applicable to employees and officers of the Bank may have anti-takeover

effects by discouraging potential proxy contests and other takeover attempts, particularly those which have not been negotiated

with the Board of Directors. Applicable regulatory restrictions may also prevent or inhibit the acquisition of a controlling position

in our common stock and may prevent or inhibit takeover attempts that certain stockholders may deem to be in their or other stockholders’

interest or in our interest, or in which stockholders may receive a substantial premium for their shares over then current market

prices. These provisions may also increase the cost of, and thus discourage, any such future acquisition or attempted acquisition,

and would render the removal of our current Board of Directors or management more difficult.

Transfer Agent and Registrar

Computershare Trust Company, N.A., P.O. Box 30170, College Station,

TX 77842-3170, is the transfer agent and registrar of our common stock.

Preferred Stock

The following summary contains a description of the general terms

of the preferred stock that we may issue. The specific terms of any series of preferred stock will be described in the prospectus

supplement relating to that series of preferred stock. The terms of any series of preferred stock may differ from the terms described

below. Certain provisions of the preferred stock described below and in any prospectus supplement are not complete. You should

refer to the amendment to our Certificate of Incorporation or the Certificate of Designation, with respect to the establishment

of a series of preferred stock which would be filed with the SEC in connection with the offering of such series of preferred stock.

Our Certificate of Incorporation permits our board of directors to

authorize the issuance of up to 5,000,000 shares of preferred stock, par value $0.01, in one or more series, without stockholder

action. The board of directors can fix the voting powers (if any) and designations, preferences and relative, participating, optional

or of the special rights of each series. Therefore, without stockholder approval, our board of directors can authorize the issuance

of preferred stock with voting, dividend, liquidation and conversion and other rights that could dilute the voting power of the

common stock and may assist management in impeding any unfriendly takeover or attempted change in control. No preferred stock is

currently outstanding.

The preferred stock has the terms described below unless otherwise

provided in the prospectus supplement relating to a particular series of the preferred stock. You should read the prospectus supplement

relating to the particular series of the preferred stock being offered for specific terms, including:

|

|

·

|

the designation and stated value per share of the preferred stock and the number of shares offered;

|

|

|

·

|

the amount of the liquidation preference per share;

|

|

|

·

|

the price at which the preferred stock will be issued;

|

|

|

·

|

the dividend rate or method of calculation, the dates on which dividends will be payable, whether dividends will be cumulative

or noncumulative and, if cumulative, the dates from which dividends will commence to accumulate;

|

|

|

·

|

any redemption or sinking fund provisions;

|

|

|

·

|

any conversion provisions;

|

|

|

·

|

the voting rights (if any) of holders of shares of the preferred stock;

|

|

|

·

|

whether we have elected to offer depositary shares as described under “Description of Depositary Shares”; and

|

|

|

·

|

any other rights, preferences, privileges, limitations and restrictions on the preferred stock.

|

The preferred stock will, when issued, be fully paid and non-assessable.

Unless otherwise specified in the prospectus supplement, each series of the preferred stock will rank equally as to dividends and

liquidation rights in all respects with each other series of preferred stock. The rights of holders of shares of each series of

preferred stock will be subordinate to those of our general creditors.

As described under “Description of Depositary Shares,”

we may, at our option, with respect to any series of the preferred stock, elect to offer fractional interests in shares of preferred

stock, and provide for the issuance of depositary receipts representing depositary shares, each of which will represent a fractional

interest in a share of the series of the preferred stock. The fractional interest will be specified in the prospectus supplement

relating to a particular series of the preferred stock.

Rank

Any series of the preferred stock will, with respect to the priority

of the payment of dividends and the priority of payments upon liquidation, winding up, and dissolution, rank:

|

|

·

|

senior to all classes of common stock and all equity securities issued by us, the terms of which specifically provide that

the equity securities will rank junior to the preferred stock (the “junior securities”);

|

|

|

·

|

equally with all equity securities issued by us, the terms of which specifically provide that the equity securities will rank

equally with the preferred stock (the “parity securities”); and

|

|

|

·

|

junior to all equity securities issued by us, the terms of which specifically provide that the equity securities will rank

senior to the preferred stock.

|

Dividends

Holders of the preferred stock of each series will be entitled to

receive, when, as, and if declared by our board of directors, cash dividends at such rates and on such dates described, if any,

in the prospectus supplement. Different series of preferred stock may be entitled to dividends at different rates or based on different

methods of calculation. The dividend rate may be fixed or variable or both. Dividends will be payable to the holders of record

as they appear on our stock books on record dates fixed by our board of directors, as specified in the applicable prospectus supplement.

Dividends on any series of the preferred stock may be cumulative

or noncumulative, as described in the applicable prospectus supplement. If our board of directors does not declare a dividend payable

on a dividend payment date on any series of noncumulative preferred stock, then the holders of that noncumulative preferred stock

will have no right to receive a dividend for that dividend payment date, and we will have no obligation to pay the dividend accrued

for that period, whether or not dividends on that series are declared payable on any future dividend payment dates. Dividends on

any series of cumulative preferred stock will accrue from the date we initially issue shares of such series or such other date

specified in the applicable prospectus supplement.

Our ability to pay dividends on our preferred stock is subject to

policies established by the Federal Reserve Board.

Rights Upon Liquidation

If we dissolve, liquidate, or wind up our affairs, either voluntarily

or involuntarily, the holders of each series of preferred stock will be entitled to receive, before any payment or distribution

of assets is made to holders of junior securities, liquidating distributions in the amount described in the prospectus supplement

relating to that series of the preferred stock. If the amounts payable with respect to the preferred stock of any series and any

other parity securities are not paid in full, the holders of the preferred stock of that series and of the parity securities will

share proportionately in the distribution of our assets in proportion to the full liquidation preferences to which they are entitled.

After the holders of preferred stock and the parity securities are paid in full, they will have no right or claim to any of our

remaining assets.

Because we are a bank holding company, our rights, the rights of

our creditors and of our stockholders, including the holders of the preferred stock offered by this prospectus, to participate

in the assets of any subsidiary upon the subsidiary’s liquidation or recapitalization may be subject to the prior claims

of the subsidiary’s creditors except to the extent that we may ourselves be a creditor with recognized claims against the

subsidiary.

Redemption

We may provide that a series of the preferred stock may be redeemable,

in whole or in part, at our option, with prior Federal Reserve Board approval, if required. In addition, a series of preferred

stock may be subject to mandatory redemption pursuant to a sinking fund or otherwise. The redemption provisions that may apply

to a series of preferred stock, including the redemption dates and the redemption prices for that series, will be described in

the prospectus supplement.

In the event of partial redemptions of preferred stock, whether by

mandatory or optional redemption, our board of directors will determine the method for selecting the shares to be redeemed, which

may be by lot or pro rata or by any other method determined to be equitable.

On or after a redemption date, unless we default on the payment of

the redemption price, dividends will cease to accrue on shares of preferred stock called for redemption. In addition, all rights

of holders of the shares will terminate except for the right to receive the redemption price.

Unless otherwise specified in the applicable prospectus supplement

for any series of preferred stock, if any dividends on any other series of preferred stock ranking equally as to payment of dividends

and liquidation rights with such series of preferred stock are in arrears, no shares of any such series of preferred stock may

be redeemed, whether by mandatory or optional redemption, unless all shares of preferred stock are redeemed, and we will not purchase

any shares of such series of preferred stock. This requirement, however, will not prevent us from acquiring such shares pursuant

to a purchase or exchange offer made on the same terms to holders of all such shares outstanding.

Under current regulations, bank holding companies, except in certain

narrowly defined circumstances, may not exercise any option to redeem shares of preferred stock included as Tier 1 capital without

the prior approval of the Federal Reserve Board. Ordinarily, the Federal Reserve Board would not permit such a redemption unless

(1) the shares are redeemed with the proceeds of a sale by the bank holding company of common stock or perpetual preferred

stock, or (2) the Federal Reserve Board determines that the bank holding company’s condition and circumstances warrant

the reduction of a source of permanent capital.

Voting Rights

Unless otherwise described in the applicable prospectus supplement,

holders of the preferred stock will have no voting rights except as otherwise required by law or in our Amended and Restated Certificate

of Incorporation.

Under regulations adopted by the Federal Reserve Board, if the holders

of any series of the preferred stock are or become entitled to vote for the election of directors, such series may then be deemed

a “class of voting securities” and a holder of 25% or more of such series, or a holder of 5% or more if it otherwise

exercises a “controlling influence” over us, may then be subject to regulation as a bank holding company in accordance

with the Bank Holding Company Act. In addition, at such time as such series is deemed a class of voting securities, (a) any

other bank holding company may be required to obtain the approval of the Federal Reserve Board to acquire or retain 5% or more

of that series; and (b) any person other than a bank holding company may be required to obtain the approval of the Federal

Reserve Board to acquire or retain 10% or more of that series.

Exchangeability

We may provide that the holders of shares of preferred stock of any

series may be required at any time or at maturity to exchange those shares for our debt securities. The applicable prospectus supplement

will specify the terms of any such exchange.

DESCRIPTION OF DEBT SECURITIES

We may offer unsecured debt securities which may be senior, subordinated

or junior subordinated, and which may be convertible. Unless otherwise specified in the applicable prospectus supplement, our debt

securities will be issued in one or more series under an indenture to be entered into between us and a trustee to be selected.

The forms of both the senior and subordinated indentures are exhibits to the registration statement of which this prospectus forms

a part.

The following description briefly sets forth certain general terms

and provisions of the debt securities and does not purport to be complete. The particular terms of the debt securities offered

by any prospectus supplement and the extent, if any, to which these general provisions may apply to the debt securities, will be

described in the related prospectus supplement. Accordingly, for a description of the terms of a particular issue of debt securities,

you must refer to both the related prospectus supplement and to the following description. If any particular terms of such debt

securities described in a prospectus supplement differ from any of the terms of the debt securities generally described in this

prospectus, then the terms described in the applicable prospectus supplement will supersede the terms described in this prospectus.

Debt Securities

The debt securities may be issued in one or more series as may be

authorized from time to time. Reference is made to the applicable prospectus supplement for the following terms of the debt securities

(if applicable):

|

|

·

|

title and aggregate principal amount,

|

|

|

·

|

whether the securities will be senior, subordinated or junior subordinated,

|

|

|

·

|

applicable subordination provisions, if any,

|

|

|

·

|

conversion or exchange into other securities,

|

|

|

·

|

percentage or percentages of principal amount at which such securities will be issued,

|

|

|

·

|

interest rate(s) or the method for determining the interest rate(s) and the method of computation of interest rate(s),

|

|

|

·

|

dates on which interest will accrue or the method for determining dates on which interest will accrue and dates on which interest

will be payable,

|

|

|

·

|

redemption or early repayment provisions,

|

|

|

·

|

authorized denominations,

|

|

|

·

|

form of a debt security,

|

|

|

·

|

amount of discount or premium, if any, with which such securities will be issued,

|

|

|

·

|

whether such securities will be issued in whole or in part in the form of one or more global securities,

|

|

|

·

|

identity of the depositary for global securities,

|

|

|

·

|

whether a temporary security is to be issued with respect to such series and whether any interest payable prior to the issuance

of definitive securities of the series will be credited to the account of the persons entitled thereto,

|

|

|

·

|

the terms upon which beneficial interests in a temporary global security may be exchanged in whole or in part for beneficial

interests in a definitive global security or for individual definitive securities,

|

|

|

·

|

any covenants applicable to the particular debt securities being issued,

|

|

|

·

|

any defaults and events of default applicable to the particular debt securities being issued,

|

|

|

·

|

currency, currencies or currency units in which the purchase price for, the principal of and any premium and any interest on,

such securities will be payable,

|

|

|

·

|

time period within which, the manner in which and the terms and conditions upon which the purchaser of the securities can select

the payment currency,

|

|

|

·

|

securities exchange(s) on which the securities will be listed, if any,

|

|

|

·

|

whether any underwriter(s) will act as market maker(s) for the securities,

|

|

|

·

|

extent to which a secondary market for the securities is expected to develop,

|

|

|

·

|

our obligation or right to redeem, purchase or repay securities under a sinking fund, amortization or analogous provision,

|

|

|

·

|

provisions relating to covenant defeasance and legal defeasance,

|

|

|

·

|

provisions relating to satisfaction and discharge of the indenture,

|

|

|

·

|

provisions relating to the modification of the indenture both with and without the consent of holders of debt securities issued

under the indenture, and

|

|

|

·

|

additional terms not inconsistent with the provisions of the indenture.

|

General

One or more series of debt securities may be sold at a substantial

discount below their stated principal amount, bearing no interest or interest at a rate which at the time of issuance is below

market rates. One or more series of debt securities may be variable rate debt securities that may be exchanged for fixed rate debt

securities.

We will describe the U.S. federal income tax consequences and special

considerations, if any, applicable to any such series in the applicable prospectus supplement.

Debt securities may be issued where the amount of principal and/or

interest payable is determined by reference to one or more currency exchange rates, commodity prices, equity indices or other factors.

Holders of such securities may receive a principal amount or a payment of interest that is greater than or less than the amount

of principal or interest otherwise payable on such dates, depending upon the value of the applicable currencies, commodities, equity

indices or other factors. Information as to the methods for determining the amount of principal or interest, if any, payable on

any date, the currencies, commodities, equity indices or other factors to which the amount payable on such date is linked and certain

additional U.S. federal income tax considerations will be set forth in the applicable prospectus supplement.

The term “debt securities” includes debt securities denominated

in U.S. dollars or, if specified in the applicable prospectus supplement, in any other freely transferable currency or units based

on or relating to foreign currencies.

Subject to the limitations provided in the indenture and in the prospectus

supplement, you may transfer or exchange debt securities that we issue in registered form at our corporate office or the principal

corporate trust office of the trustee, without the payment of any service charge, other than any tax or other governmental charge

payable in connection therewith.

Global Securities

We may issue the debt securities of a series in whole or in part

in the form of one or more global securities that we will deposit with, or on behalf of, a depositary identified in the applicable

prospectus supplement relating thereto. We will issue global securities in registered form and in either temporary or definitive

form. Unless and until it is exchanged in whole or in part for the individual debt securities, a global security may not be transferred

except as a whole by the depositary for such global security to a nominee of such depositary or by a nominee of such depositary

to such depositary or another nominee of such depositary or by such depositary, or any such nominee to a successor of such depositary

or a nominee of such successor. We will describe the specific terms of the depositary arrangement with respect to any debt securities

of a series and the rights of and limitations upon owners of beneficial interests in a global security in the applicable prospectus

supplement.

DESCRIPTION OF DEPOSITARY SHARES

General

We may, at our option, elect to offer fractional shares of preferred

stock, which we call depositary shares, rather than full shares of preferred stock. If we do, we will issue public receipts, called

depositary receipts, for depositary shares, each of which will represent a fraction, to be described in the prospectus supplement,

of a share of a particular series of preferred stock.

The shares of any series of preferred stock represented by depositary

shares will be deposited with a depositary named in the prospectus supplement. Unless otherwise provided in the prospectus supplement,

each owner of a depositary share will be entitled, in proportion to the applicable fractional interest in a share of preferred

stock represented by the depositary share, to all the rights and preferences of the preferred stock represented by the depositary

share. Those rights include dividend, voting, redemption, conversion and liquidation rights.

Dividends and Other Distributions

The depositary will distribute all cash dividends or other cash distributions

received in respect of the preferred stock to the record holders of depositary shares in proportion to the numbers of depositary

shares owned by those holders.

If there is a distribution other than in cash, the depositary will

distribute property received by it to the record holders of depositary shares, unless the depositary determines that it is not

feasible to make the distribution. If this occurs, the depositary may, with our approval, sell the property and distribute the

net proceeds from the sale to the holders.

Withdrawal of Stock

Unless the related depositary shares have been previously called

for redemption, upon surrender of the depositary receipts at the office of the depositary, the holder of the depositary shares

will be entitled to delivery, at the office of the depositary, or upon his or her order, of the number of whole shares of the preferred

stock and any money or other property represented by the depositary shares. If the depositary receipts delivered by the holder

evidence a number of depositary shares in excess of the number of depositary shares representing the number of whole shares of

preferred stock to be withdrawn, the depositary will deliver to the holder at the same time a new depositary receipt evidencing

the excess number of depositary shares. In no event will the depositary deliver fractional shares of preferred stock upon surrender

of depositary receipts.

Redemption of Depositary Shares

Whenever we redeem shares of preferred stock held by the depositary,

the depositary will redeem as of the same redemption date the number of depositary shares representing shares of the preferred

stock so redeemed, so long as we have paid in full to the depositary the redemption price of the preferred stock to be redeemed,

plus an amount equal to any accumulated and unpaid dividends on the preferred stock to the date fixed for redemption. The redemption

price per depositary share will be equal to the redemption price and any other amounts per share payable on the preferred stock

multiplied by the fraction of a share of preferred stock represented by one depositary share. If fewer than all the depositary

shares are to be redeemed, the depositary shares to be redeemed will be selected by lot or pro rata or by any other equitable method

as may be determined by the depositary.

After the date fixed for redemption, depositary shares called for

redemption will no longer be deemed to be outstanding and all rights of the holders of depositary shares will cease, except the

right to receive the moneys payable upon redemption and any money or other property to which the holders of the depositary shares

were entitled upon redemption upon surrender to the depositary of the depositary receipts evidencing the depositary shares.

Voting the Preferred Stock

Upon receipt of notice of any meeting at which the holders of the

preferred stock are entitled to vote, the depositary will mail the information contained in the notice of meeting to the record

holders of the depositary receipts relating to that preferred stock. The record date for the depositary receipts relating to the

preferred stock will be the same date as the record date for the preferred stock. Each record holder of the depositary shares on

the record date will be entitled to instruct the depositary as to the exercise of the voting rights pertaining to the number of

shares of preferred stock represented by that holder’s depositary shares. The depositary will endeavor, insofar as practicable,

to vote the number of shares of preferred stock represented by the depositary shares in accordance with those instructions, and

we will agree to take all action which may be deemed necessary by the depositary in order to enable the depositary to do so. The

depositary will not vote any shares of preferred stock except to the extent that it receives specific instructions from the holders

of depositary shares representing that number of shares of preferred stock.

Charges of Depositary

We will pay all transfer and other taxes and governmental charges

arising solely from the existence of the depositary arrangements. We will pay charges of the depositary in connection with the

initial deposit of the preferred stock and any redemption of the preferred stock. Holders of depositary receipts will pay other

transfer and other taxes and governmental charges and such other charges as are expressly provided in the deposit agreement to

be for their accounts.

Resignation and Removal of Depositary

The depositary may resign at any time by delivering to us notice

of its election to do so, and we may remove the depositary at any time. Any resignation or removal of the depositary will take

effect upon our appointment of a successor depositary and its acceptance of such appointment. The successor depositary must be

appointed within 60 days after delivery of the notice of resignation or removal and must be a bank or trust company having its

principal office in the United States and having a combined capital and surplus of at least $50,000,000.

Notices

The depositary will forward to holders of depositary receipts all

notices, reports and other communications, including proxy solicitation materials received from us, that are delivered to the depositary

and that we are required to furnish to the holders of the preferred stock.

Limitation of Liability

Neither we nor the depositary will be liable if either of us is prevented

or delayed by law or any circumstance beyond our control in performing our obligations. Our obligations and those of the depositary

will be limited to performance in good faith of our and their duties thereunder. We and the depositary will not be obligated to

prosecute or defend any legal proceeding in respect of any depositary shares or preferred stock unless satisfactory indemnity is

furnished. We and the depositary may rely, upon written advice of counsel or accountants, on information provided by persons presenting

preferred stock for deposit, holders of depositary receipts or other persons believed to be competent and on documents believed

to be genuine.

Inspection of Books

Any record holder of depositary shares who has been a holder for

at least six months or who holds at least five percent of our outstanding shares of capital stock will be entitled to inspect the

transfer books relating to the depositary shares and the list of record holders of depositary shares upon certification to the

depositary that the holder is acting in good faith and that the inspection is for a proper purpose.

DESCRIPTION OF WARRANTS

We may issue warrants to purchase debt securities, preferred stock,

depositary shares or common stock. We may offer warrants separately or together with one or more additional warrants, debt securities,

preferred stock, depositary shares or common stock, or any combination of those securities in the form of units, as described in

the appropriate prospectus supplement. If we issue warrants as part of a unit, the accompanying prospectus supplement will specify

whether those warrants may be separated from the other securities in the unit prior to the warrants’ expiration date. Below

is a description of certain general terms and provisions of the warrants that we may offer. Further terms of the warrants will

be described in the prospectus supplement.

The applicable prospectus supplement will contain, where applicable,

the following terms of and other information relating to the warrants:

|

|

·

|

the specific designation and aggregate number of, and the price at which we will issue, the warrants;

|

|

|

·

|

the currency or currency units in which the offering price, if any, and the exercise price are payable;

|

|

|

·

|

the date on which the right to exercise the warrants will begin and the date on which that right will expire or, if you may

not continuously exercise the warrants throughout that period, the specific date or dates on which you may exercise the warrants;

|

|

|

·

|

any applicable anti-dilution provisions;

|

|

|

·

|

any applicable redemption or call provisions;

|

|

|

·

|

the circumstances under which the warrant exercise price may be adjusted;

|

|

|

·

|

whether the warrants will be issued in fully registered form or bearer form, in definitive or global form or in any combination

of these forms, although, in any case, the form of a warrant included in a unit will correspond to the form of the unit and of

any security included in that unit;

|

|

|

·

|

any applicable material United States federal income tax consequences;

|

|

|

·

|

the identity of the warrant agent for the warrants and of any other depositaries, execution or paying agents, transfer agents,

registrars or other agents;

|

|

|

·

|

the proposed listing, if any, of the warrants or any securities purchasable upon exercise of the warrants on any securities

exchange;

|

|

|

·

|

the designation and terms of the preferred stock or common stock purchasable upon exercise of the warrants;

|

|

|

·

|

the designation, aggregate principal amount, currency and terms of the debt securities that may be purchased upon exercise

of the warrants;

|

|

|

·

|

if applicable, the designation and terms of the debt securities, preferred stock, depositary shares or common stock with which

the warrants are issued and the number of warrants issued with each security;

|

|

|

·

|

if applicable, the date from and after which the warrants and the related debt securities, preferred stock, depositary shares

or common stock will be separately transferable;

|

|

|

·

|

the number of shares of preferred stock, the number of depositary shares or the number of shares of common stock purchasable

upon exercise of a warrant and the price at which those shares may be purchased;

|

|

|

·

|

if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time;

|

|

|

·

|

information with respect to book-entry procedures, if any;

|

|

|

·

|

the anti-dilution provisions of the warrants, if any;

|

|

|

·

|

any redemption or call provisions;

|

|

|

·

|

whether the warrants are to be sold separately or with other securities as parts of units; and

|

|

|

·

|

any additional terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of

the warrants.

|

PLAN OF DISTRIBUTION

We may offer and sell these securities in any one or more of the

following ways:

|

|

·

|

to the public through a group of underwriters managed or co-managed by one or more underwriters, or through dealers;

|

|

|

·

|

through one or more agents;

|

|

|

·

|

directly to purchasers; or

|

|

|

·

|

through a combination of such methods of sale.

|

The distribution of the securities may be effected from time to time

in one or more transactions:

|

|

·

|

at a fixed price, or prices which may be changed from time to time;

|

|

|

·

|

at market prices prevailing at the time of sale;

|

|

|

·

|

at prices related to those prevailing market prices; or

|

Each time we sell securities, a prospectus supplement will describe

the method of distribution of the securities and any applicable restrictions.

The prospectus supplement with respect to the securities of a particular

series will describe the terms of the offering of the securities, including the following:

|

|

·

|

the name or names of any agents, dealers or underwriters included in the offer and sale of the securities;

|

|

|

·

|

the public offering or purchase price and the proceeds we will receive from the sale of the securities;

|

|

|

·

|

any discounts and commissions to be allowed or paid to the agents or underwriters;

|

|

|

·

|

all other items constituting underwriting compensation;

|

|

|

·

|

any discounts and commissions to be allowed or paid to dealers; and

|

|

|

·

|

any exchanges on which the securities will be listed.

|

We may agree to enter into an agreement to indemnify the agents and

the several underwriters against certain civil liabilities, including liabilities under the Securities Act or to contribute to

payments the agents or the underwriters may be required to make.

If so indicated in the applicable prospectus supplement, we will

authorize underwriters or other persons acting as our agents to solicit offers by certain institutions to purchase debt securities

from us pursuant to delayed delivery contracts providing for payment and delivery on the date stated in the prospectus supplement.

Each contract will be for an amount not less than, and the aggregate amount of securities sold pursuant to those contracts will

be equal to, the respective amounts stated in the prospectus supplement. Institutions with which the contracts, when authorized,

may be made include commercial and savings banks, insurance companies, pension funds, investment companies, educational and charitable

institutions and other institutions, but will in all cases be subject to our approval. Delayed delivery contracts will not be subject

to any conditions, except that:

|

|

·

|

the purchase by an institution of the debt securities covered under that contract will not at the time of delivery be prohibited

under the laws of the jurisdiction to which that institution is subject; and

|

|

|

·

|

if the debt securities are also being sold to underwriters acting as principals for their own account, the underwriters will

have purchased those debt securities not sold for delayed delivery. The underwriters and other persons acting as our agents will

not have any responsibility in respect of the validity or performance of delayed delivery contracts.

|

If underwriters or dealers are used in the sale, the securities will

be acquired by the underwriters or dealers for their own account and may be resold from time to time in one or more transactions,

at a fixed price or prices, which may be changed, or at market prices prevailing at the time of sale, or at prices related to such

prevailing market prices, or at negotiated prices. The securities may be offered to the public either through underwriting syndicates

represented by one or more managing underwriters or directly by one or more of such firms. Unless otherwise set forth in the prospectus

supplement, the obligations of underwriters or dealers to purchase the securities offered will be subject to certain conditions

precedent, and the underwriters or dealers will be obligated to purchase all the offered securities if any are purchased. Any public

offering price and any discounts or concessions allowed or re-allowed or paid by underwriters or dealers to other dealers may be

changed from time to time.

The securities may be sold directly by us or through agents designated

by us from time to time. Any agent involved in the offer or sale of the securities in respect of which this prospectus is delivered

will be named, and any commission payable by us to such agent will be set forth, in the prospectus supplement. Unless otherwise

indicated in the prospectus supplement, any such agent will be acting on a best efforts basis for the period of its appointment.

To the extent that we make sales to or through one or more underwriters

or agents in at-the-market offerings, we will do so pursuant to the terms of a distribution agreement between us and the underwriters

or agents. If we engage in at-the-market sales pursuant to a distribution agreement, we will issue and sell shares of our common

stock to or through one or more underwriters or agents, which may act on an agency basis or on a principal basis. During the term

of any such agreement, we may sell shares on a daily basis in exchange transactions or otherwise as we agree with the underwriters

or agents. The distribution agreement will provide that any shares of our common stock sold will be sold at prices related to the

then prevailing market prices for our common stock. Therefore, exact figures regarding proceeds that will be raised or commissions

to be paid cannot be determined at this time and will be described in a prospectus supplement. Pursuant to the terms of the distribution

agreement, we also may agree to sell, and the relevant underwriters or agents may agree to solicit offers to purchase, blocks of

our common stock or other securities. The terms of each such distribution agreement will be set forth in more detail in a prospectus

supplement to this prospectus. In the event that any underwriter or agent acts as principal, or broker-dealer acts as underwriter,

it may engage in certain transactions that stabilize, maintain or otherwise affect the price of our securities. We will describe

any such activities in the prospectus supplement relating to the transaction.

Offers to purchase the securities offered by this prospectus may

be solicited, and sales of the securities may be made, by us of those securities directly to institutional investors or others,

who may be deemed to be underwriters within the meaning of the Securities Act with respect to any resales of the securities. The

terms of any offer made in this manner will be included in the prospectus supplement relating to the offer.

If indicated in the applicable prospectus supplement, we will authorize

underwriters, dealers or agents to solicit offers by certain institutional investors to purchase securities from us pursuant to

contracts providing for payment and delivery at a future date. Institutional investors with which these contracts may be made include,

among others:

|

|

·

|

commercial and savings banks;

|

|

|

·

|

investment companies; and

|

|

|

·

|

educational and charitable institutions.

|

In all cases, these purchasers must be approved by us. Unless otherwise

set forth in the applicable prospectus supplement, the obligations of any purchaser under any of these contracts will not be subject

to any conditions except that (a) the purchase of the securities must not at the time of delivery be prohibited under the

laws of any jurisdiction to which that purchaser is subject, and (b) if the securities are also being sold to underwriters,

we must have sold to these underwriters the securities not subject to delayed delivery. Underwriters and other agents will not

have any responsibility in respect of the validity or performance of these contracts.

Subject to any restrictions relating to debt securities in bearer

form, any securities initially sold outside the United States may be resold in the United States through underwriters, dealers

or otherwise.

Each series of securities other than common stock will be a new issue

of securities with no established trading market. Any underwriters to whom offered securities are sold by us for public offering

and sale may make a market in such securities, but such underwriters will not be obligated to do so and may discontinue any market

making at any time.

The anticipated date of delivery of the securities offered by this

prospectus will be described in the applicable prospectus supplement relating to the offering. The securities offered by this prospectus

may or may not be listed on a national securities exchange or a foreign securities exchange. No assurance can be given as to the

liquidity or activity of any trading in the offered securities.

If more than 10% of the net proceeds of any offering of securities

made under this prospectus will be received by Financial Industry Regulatory Authority (“FINRA”) members participating

in the offering or affiliates or associated persons of such FINRA members, the offering will be conducted in accordance with FINRA

Conduct Rule 2710.

We may enter into derivative or other hedging transactions with financial

institutions. These financial institutions may in turn engage in sales of our common stock to hedge their positions, deliver this

prospectus in connection with some or all of those sales, and use the shares covered by this prospectus to close out any short

position created in connection with those sales. We may also sell shares of our common stock short using this prospectus and deliver

our common stock covered by this prospectus to close out such short positions, or loan or pledge our common stock to financial

institutions that in turn may sell the shares of our common stock using this prospectus. We may pledge or grant a security interest

in some or all of our common stock covered by this prospectus to support a derivative or hedging position or other obligations

and, if we default in the performance of our obligations, the pledges or secured parties may offer and sell our common stock from

time to time pursuant to this prospectus.

We also may enter into derivative transactions with third parties,

or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus

supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and

the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by

us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities

received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such

sale transactions will be an underwriter and, if not identified in this prospectus, will be identified in the applicable prospectus

supplement (or a post-effective amendment). In addition, we may otherwise loan or pledge securities to a financial institution

or other third party that in turn may sell the securities short using this prospectus. Such financial institution or other third

party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other

securities.

Certain of the underwriters and their associates and affiliates may

in the ordinary course of business be customers of, have borrowing relationships with, engage in other transactions with, and/or

perform services, including investment banking services, for, us or one or more of our affiliates.

VALIDITY OF SECURITIES

The validity of the securities may be passed upon for us by Hughes

Hubbard & Reed LLP, or by counsel named in the applicable prospectus supplement, and for any underwriters or agents by counsel

selected by such underwriters or agents.

EXPERTS

The financial statements of Flushing Financial Corporation as of

December 31, 2016 and 2015 and for each of the two years in the period ended December 31, 2016 and management’s

assessment of the effectiveness of internal control over financial reporting as of December 31, 2016 incorporated by reference

in this prospectus have been so incorporated in reliance on the reports of BDO USA, LLP, an independent registered public accounting

firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

Grant Thornton, LLP, an independent registered public accounting

firm, has audited our consolidated financial statements for the year ended December 31, 2014 included in our Annual Report

on Form 10-K for the year ended December 31, 2014 as set forth in its report, which is incorporated by reference in this prospectus

and elsewhere in the registration statement. The financial statements for the year ended December 31, 2014 have been so incorporated

by reference in reliance on the report of Grant Thornton, LLP upon the authority of said firm as experts in accounting and auditing

in giving said report.

FLUSHING FINANCIAL CORPORATION

$200,000,000

DEBT SECURITIES

PREFERRED STOCK

DEPOSITARY SHARES

COMMON STOCK

GUARANTEES

WARRANTS

________________________

PROSPECTUS

________________________

______, 2017

PART II.

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 14.

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

.

The following is an itemized statement of the estimated fees and

expenses in connection with the offering of the securities registered hereunder.

|

Registration Statement filing fees

|

|

$

|

23,180

|

(1)

|

|

Blue Sky fees and expenses

|

|

|

0

|

|

|

Printing and engraving expenses

|

|

|

0

|

|

|

Legal fees and expenses

|

|

|

20,000

|

|

|

Accounting fees and expenses

|

|

|

25,000

|

|

|

Miscellaneous

|

|

|

0

|

|

|

Total

|

|

$

|

68,180

|

|

|

|

(1)

|

Unutilized filing fees of $5,552.50 were previously paid with respect to securities registered by the registrant pursuant to

a Form S-3 (File No. 333-195182) initially filed with the Securities and Exchange Commission on April 10, 2014. The balance

of the filing fee hereunder in the amount of $17,627.50 is paid herewith corresponding to the registration of the securities covered

hereby in accordance with Rule 415(a)(6).

|

ITEM 15.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Section 145 of the Delaware General Corporation Law (the “DGCL”)

empowers a Delaware corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action

by or in the right of the corporation) by reason of the fact that such person is or was a director, officer, employee or agent

of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another

corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments,

fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding

if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests

of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct

was unlawful. Similar indemnification is authorized for such person against expenses (including attorneys’ fees)

actually and reasonably incurred in connection with the defense or settlement of any threatened, pending or completed action or

suit by or in the right of the corporation if such person acted in good faith and in a manner he or she reasonably believed to

be in or not opposed to the best interests of the corporation, and provided further that (unless a court of competent jurisdiction

otherwise provides) he shall not have been adjudged liable to the corporation. Any such indemnification (unless ordered

by a court) may be made by the corporation only as authorized in each specific case by the corporation upon a determination that

indemnification of the present or former director, officer, employee or agent is proper because such person has met the applicable

standard of conduct, which indemnification shall be made in the case of a director or officer at the time of the determination