Current Report Filing (8-k)

March 31 2017 - 4:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 29, 2017

GENPACT LIMITED

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

Bermuda

|

|

001-33626

|

|

98-0533350

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

Canon’s Court, 22 Victoria Street

Hamilton HM 12, Bermuda

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (441) 295-2244

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01 Other Events.

On March 29, 2017, Genpact Limited (“Genpact”) entered into an accelerated share repurchase agreement with Morgan

Stanley & Co. LLC (the “Dealer”) to repurchase an aggregate of $200 million of Genpact’s common shares. The accelerated share repurchase agreement was entered into pursuant to Genpact’s existing share repurchase program.

Genpact expects to fund the accelerated share repurchase transaction through a combination of surplus cash on its balance sheet, operating cash flows and net proceeds from the recently completed private offering by Genpact’s wholly-owned

subsidiary, Genpact Luxembourg S.à r.l., of its 3.700% senior notes due 2022.

Under the terms of the accelerated share repurchase

agreement, Genpact made a $200 million payment to the Dealer on March 30, 2017 and received from the Dealer on the same day an initial delivery of 6,578,947 Genpact common shares based on the closing price of Genpact common shares on

March 29, 2017. The final number of Genpact common shares to be repurchased from the Dealer will be based on the volume-weighted average share price of Genpact’s common shares during the term of the applicable transaction, less a discount

and subject to adjustments pursuant to the terms of the accelerated share repurchase agreement. At settlement, under certain circumstances, the Dealer may be required to deliver additional Genpact common shares to Genpact, or under certain

circumstances, Genpact may be required either to deliver its common shares or to make a cash payment to the Dealer. The final settlement of the transaction under the accelerated share repurchase agreement is expected to be completed by the end of

the fourth quarter 2017.

A copy of the press release announcing the execution of the accelerated share repurchase agreement is attached

hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

|

|

|

|

|

|

|

Exhibit 99.1

|

|

Press release dated March 30, 2017

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

GENPACT LIMITED

|

|

|

|

|

|

|

Date: March 31, 2017

|

|

|

|

By:

|

|

/s/ Heather D. White

|

|

|

|

|

|

Name:

|

|

Heather D. White

|

|

|

|

|

|

Title:

|

|

Senior Vice President

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

99.1

|

|

Press release dated March 30, 2017

|

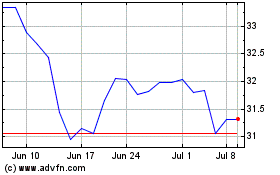

Genpact (NYSE:G)

Historical Stock Chart

From Mar 2024 to Apr 2024

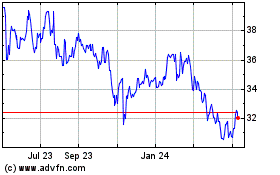

Genpact (NYSE:G)

Historical Stock Chart

From Apr 2023 to Apr 2024