UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

December 31, 2016

or

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission file number:

333-198567

|

ABV Consulting, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

46-3997344

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

Unit A, 21

st

Floor, 128 Wellington Street

Central, Hong Kong

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(852) 3106-2226

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class:

|

|

Name of each exchange on which registered:

|

|

None

|

|

None

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

¨

No

x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

¨

No

x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

x

No

¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

¨

No

x

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2015 was approximately $26,650,000 based on the closing price on June 30, 2016.

As of March 28, 2017, the number of shares of common stock of the registrant outstanding is 1,985,533,000, par value $0.0001 per share.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “pursue,” “expect,” “anticipate,” “predict,” “project,” “goals,” “strategy,” “future,” “likely,” “forecast,” “potential,” “continue,” negatives thereof or similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding:

|

|

·

|

Potential acquisition or merger targets;

|

|

|

·

|

Business strategies;

|

|

|

·

|

Future cash flows;

|

|

|

·

|

Financing plans;

|

|

|

·

|

Plans and objectives of management;

|

|

|

·

|

Any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results; and

|

|

|

·

|

Any other statements that are not historical facts.

|

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual future results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

|

|

·

|

Volatility or decline of our stock price;

|

|

|

·

|

Potential fluctuation of quarterly results;

|

|

|

·

|

Failure of the Company to earn revenues or profits;

|

|

|

·

|

Inadequate capital to continue or expand our business, and inability to raise additional capital or financing to implement its business plans;

|

|

|

·

|

Decline in demand for our products and services;

|

|

|

·

|

Rapid adverse changes in markets;

|

|

|

·

|

Litigation with or legal claims and allegations by outside parties against the Company;

|

|

|

·

|

Insufficient revenues to cover operating costs;

|

|

|

·

|

Inability to source attractive investment dealflow on terms favorable to the Company; and

|

|

|

·

|

Such other factors as discussed throughout Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2016.

|

There is no assurance that we will be profitable, we may not be able to attract or retain qualified executives and personnel, we may not be able to obtain customers for future products or services, additional dilution in outstanding stock ownership may be incurred due to the issuance of more shares, warrants and stock options, or the exercise of outstanding warrants and stock options, and other risks inherent in our businesses.

Because the statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. We caution you not to place undue reliance on the statements, which speak only as of the date of this Annual Report on Form 10-K. The cautionary statements contained or referred to in this section should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. We do not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this Annual Report, or to reflect the occurrence of unanticipated events.

PART I

Item 1. Business.

Overview of Corporate History

ABV Consulting, Inc. (“we,” “us,” “our,” “ABVN” or the “Company”) was incorporated in the state of Nevada on October 15, 2013. At formation, the Company authorized 100,000,000 shares of common stock, par value $0.0001 per share, and 10,000,000 shares of preferred stock, par value $0.0001 per share. In connection with our formation, the Company’s founder, Andrew Gavrin, received 5,000,000 shares of common stock as founder shares, and Mr. Gavrin served as the Company’s chief executive officer, chief financial officer and sole director from the time of incorporation until August 22, 2016.

In June 2014, we completed a Regulation D Rule 506 offering in which we sold 533,000 shares of common stock to 34 investors, at a price per share of $0.10 per share for an aggregate offering price of $53,300. On December 23, 2014, our Registration Statement on Form S-1 became effective, under which the investors referenced in the preceding sentence were able to sell their shares of common stock.

On August 22, 2016, in connection with the sale of a controlling interest in the Company, Mr. Gavrin sold to Ms. Ping Zhang the entire amount of his 5,000,000 shares of common stock for an aggregate price of $228,400 (the “Change of Control Transaction”). In connection with the Change of Control Transaction, Mr. Gavrin agreed pay $25,186.25 of debts of the Company in addition to the cancellation of $35,000 worth of debt owed to him by the Company. Concurrent with the Change of Control Transaction, Mr. Gavrin resigned from all corporate officer and director roles, and was replaced in all roles by Mr. Wai Lim Wong.

On December 19, 2016, the Company amended its articles of incorporation to increase the authorized number of shares of the Company’s common stock from 100,000,000 to 3,000,000,000 shares, par value $0.0001. We effected this amendment for the purposes of providing sufficient capital stock to use as consideration for our business strategy explained below in this Item 1, and for other reasons.

Because the business of the Company changed materially following the Change of Control Transaction, this Item 1 will include a brief summary of the Company’s business prior to the Change of Control Transaction and will focus primarily on the business of the Company following the Change of Control Transaction.

Summary of Business Prior to the Change of Control Transaction

The Company was originally formed to engage in merchandising and consulting services to craft beer brewers and distributors, as well as providing additional branding and marketing support within the craft beer industry to retailers and other organizations. The Company’s customer base consisted of alcohol beverage manufacturers, distributors, retailers, beer festival operators and other organizations involved in the sale and marketing of craft beer.

We focused our early efforts on pro bono engagements and secured one paid engagement for $2,000 by the close of our second quarter in 2016.

Overview of Current Business

Following the Change of Control Transaction, our new management decided to pursue a strategic acquisition strategy focused on acquisition target companies with operations located primarily in Southeast Asia, the Pacific Islands, the People’s Republic of China (including Hong Kong and Macau) (the “PRC”), Taiwan and other jurisdictions within Asia. In connection with this new strategy, we moved our corporate headquarters from Pennsylvania to Hong Kong. We believe that the PRC’s “One Belt, One Road” (“OBOR”) regional cooperation initiative will be a significant driver for strategic investment opportunities throughout Asia.

“One Belt, One Road”

Between September and October 2013, the PRC government disclosed its plan to pursue a regional trade, investment, infrastructure and cultural exchange program incorporating approximately sixty countries located along the historic silk road trading route connecting Africa, the Middle East, Europe and Central and East Asia—called the “Silk Road Economic Belt”—and also nations located in the South China Sea, the South Pacific Ocean and the Indian Ocean—called the “Maritime Silk Road.” The initiative has since been labeled “One Belt, One Road” or “OBOR” for short, and in 2014 the Chinese foreign minister identified OBOR as the single most important feature of Chinese President Xi Jinping’s foreign policy.

The PRC government intends to invest at least $4 trillion over an indefinite time period on projects located within OBOR constituent countries, and hundreds of projects worth approximately $1 trillion have been approved to date.

OBOR-Related Investment Opportunities

We anticipate that entities based in Hong Kong will continue their historic gatekeeping function as financial and advisory intermediaries between the PRC and the world at large, and Asia in particular. We intend to avail ourselves of this strategic advantage to pursue strategic co-investments with entities deploying OBOR-related funds and to invest into companies and assets that are well positioned to benefit from OBOR-related investments.

Objectives and Strategies

We explored a number of strategic investment opportunities following the Change of Control Transaction, but we did not enter into any definitive agreements by the end of FY2016. See our Current Report on Form 8-K, dated March 2, 2017, for a description of our recent acquisition of Allied Plus (Samoa) Limited (“APSL”), which closed on February 28, 2017. APSL is now a wholly-owned subsidiary of the Company.

In pursuing our acquisition strategy, we are guided by our core objective of maximizing stockholder value by sourcing and acquiring assets with stable cash flow and/or significant growth potential connected to OBOR-related investment and trade and our ability to assist the investment target with securing economic and financial resources.

Allied Plus (Samoa) Limited

APSL primarily engages in the business of providing services to agents and financial advisers in Southeast Asia. The management of APSL possesses certain knowledge of investment criteria of OBOR-related investment entities, and provides consulting services to regional consultants and brokers with regard to their efforts to source and promote attractive investment opportunities.

Marketing and Sales Efforts, Pricing

We engage in no marketing or sales efforts. APSL secures clients primarily on a word-of-mouth basis, due to its management’s reputation for having a broad network and industry-specific knowledge base which appeals to regional consultants and brokers.

APSL charges regional consultants and brokers a flat fee over a contract period of 90 days, after which the contract expires. We have not identified any specific customers of APSL on which we rely to a material degree for the continued business of APSL.

As of the date hereof, we intend to continue with APSL’s current line of business, and we will consider providing other kinds of services and generating revenues from other activities.

Governmental Approvals and Environmental Laws

As a service company, APSL does not produce or sell any products, and apart from regular business licenses in the jurisdiction in which we operate, the Company is not currently subject to material governmental approvals or environmental regulations.

Competition

We face substantial competition from individuals and entities that seek to invest into Asia. Although we feel that the personal relationships developed by our management and business partners provide us with a competitive advantage in sourcing, analyzing, and approving optimal deals, we compete with corporate strategic investors, financial investors like private equity funds, wealth management offices, high net worth individuals and ultra high net worth individuals, sovereign wealth funds, and any entities which engage in investment activities in Asia. Our management and the management of APSL compete primarily on the basis of reputation for honest and thoughtful business practices, as well as quality of network and strategic relationships.

Intellectual Property and Other Contracts

We currently do not have any patents, trademarks, licenses, franchises, concessions, royalty agreements, or labor contracts.

Employees

We have two paid full-time employees who provide services on an at-will basis.

Item 1A. Risk Factors

Not applicable.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

The Company's principal executive office is Room 601C, Empire Centre, 68 Mody Road, Kowloon, Hong Kong, and mailing address is Unit A, 21st Floor, 128 Wellington Street, Central, Hong Kong, PRC. Our telephone number is (852) 3106-2226. Our principal executive office is approximately 1,292 square feet, and we occupy this office under a two year lease which expires on May 16, 2018, with payments due on a monthly basis.

Item 3.

Legal Proceedings

Neither the Company, APSL or any of our properties are presently a party to any material litigation or regulatory proceeding, and we are not aware of any pending or threatened litigation or regulatory proceeding against the Company, APSL or any of our properties which could have a material adverse effect on our business, operating results, financial condition or cash flows.

Item 4. Mine Safety Disclosures

Not Applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

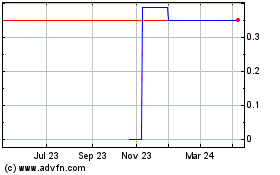

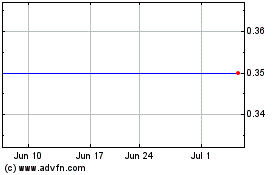

Our common stock is currently quoted on the OTC Markets (“OTCQB”) under the symbol “ABVN.”

The table below sets forth the high and low closing prices of the Company’s Common Stock during the periods indicated as reported by the NASDAQ Markets. The Company’s Common Stock was initially quoted on the OTCQB on February 13, 2015.

|

|

|

Bid Price

|

|

|

|

|

HIGH

|

|

|

LOW

|

|

|

Period ended March 30, 2017

|

|

|

|

|

|

|

|

FISCAL YEAR 2016:

|

|

|

|

|

|

|

|

Fourth Quarter ended December 31, 2016

|

|

$

|

2.74

|

|

|

$

|

1.00

|

|

|

Third Quarter ended September 30, 2016

|

|

$

|

50.005

|

|

|

$

|

0.20

|

|

|

Second Quarter ended June 30, 2016

|

|

$

|

50.005

|

|

|

$

|

50.005

|

|

|

First Quarter ended March 31, 2016

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

|

FISCAL YEAR 2015:

|

|

|

|

|

|

|

|

|

|

Fourth Quarter ended December 31, 2015

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

|

Third Quarter ended September 30, 2015

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

|

Second Quarter ended June 30, 2015

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

|

First Quarter ended March 31, 2015

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

Holders

As of March 30, 2017, we had approximately 46 holders of our common stock.

Dividends

To date, we have not declared or paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock. Our Board of Directors has the authority to declare and pay dividends at its discretion in the future. Payment of dividends in the future will depend upon our earnings, capital requirements, and any other factors that our Board of Directors deems relevant.

Equity Compensation Plans

We have not established, and do not plan to establish, any equity compensation plans.

Recent Sales of Unregistered Securities

In June 2014, the Company completed a Regulation D Rule 506 offering in which we sold 533,000 shares of common stock to 34 investors, at a price per share of $0.10 per share for an aggregate offering price of $53,300. Funds from the offering were used for working capital.

On February 28, 2017, the Company closed its acquisition of APSL by means of a share exchange, in which the Company issued 1,980,000,000 shares of common stock to the 22 shareholders of APSL on a pro rata basis. As consideration for the Company’s shares, the APSL shareholders transferred to the Company 100% of the issued and outstanding equity interests in APSL. In issuing our common stock to the APSL shareholders, we relied on the exemption provided by Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder because, among other things, the transactions did not involve a public offering, each of the recipients acquired the securities for investment and not resale, and the Company took appropriate measures to restrict the transfer of the securities in each instance.

Item 6. Selected Financial Data

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and related notes and other financial information appearing elsewhere in this Annual Report on Form 10-K. Some of the information contained in this discussion and analysis or set forth elsewhere in this Annual Report on Form 10-K, including information with respect to our plans and strategy for our business and related financing, includes forward-looking statements that involve risks and uncertainties. As a result of many factors, our actual results could differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Overview

ABV Consulting, Inc. (“we,” “us,” “our,” “ABVN” or the “Company”) was incorporated in the state of Nevada on October 15, 2013. At formation, the Company authorized 100,000,000 shares of common stock, par value $0.0001 per share, and 10,000,000 shares of preferred stock, par value $0.0001 per share. In connection with our formation, our founder, Andrew Gavrin, received 5,000,000 shares of common stock as founder shares, and Mr. Gavrin served as the Company’s chief executive officer, chief financial officer and sole director from the time of incorporation until August 22, 2016.

In June 2014, we completed a Regulation D Rule 506 offering in which we sold 533,000 shares of common stock to 34 investors, at a price per share of $0.10 per share for an aggregate offering price of $53,300. On December 23, 2014, our Registration Statement on Form S-1 became effective, under which the investors referenced in the preceding sentence became able to sell their shares of common stock.

On August 22, 2016, in connection with the sale of a controlling interest in the Company, Mr. Gavrin sold to Ms. Ping Zhang the entire amount of his 5,000,000 shares of common stock for an aggregate price of $228,400 (the “Change of Control Transaction”). In connection with the Change of Control Transaction, Mr. Gavrin agreed pay $25,186.25 of debts of the Company in addition to the cancellation of $35,000 worth of debt owed to him by the Company. Concurrent with the Change of Control Transaction, Mr. Gavrin resigned from all corporate officer and director roles, and was replaced in all roles by Mr. Wai Lim Wong.

On December 19, 2016, the Company amended its articles of incorporation to increase the authorized number of shares of the Company’s common stock from 100,000,000 to 3,000,000,000 shares, par value $0.0001. We effected this amendment for the purposes of providing sufficient capital stock to use as consideration for our business strategy explained below in this Item 1, and for other reasons.

The Company was originally formed to engage in merchandising and consulting services to craft beer brewers and distributors, as well as providing additional branding and marketing support within the craft beer industry to retailers and other organizations. The Company’s customer base consisted of alcohol beverage manufacturers, distributors, retailers, beer festival operators and other organizations involved in the sale and marketing of craft beer.

Following the Change of Control Transaction, our new management decided to pursue a strategic acquisition strategy focused on acquisition target companies with operations located primarily in Southeast Asia, the Pacific Islands, the People’s Republic of China (including Hong Kong and Macau) (the “PRC”), Taiwan and other jurisdictions within Asia. In connection with this new strategy, we moved our corporate headquarters from Pennsylvania to Hong Kong. We believe that the PRC’s “One Belt, One Road” (“OBOR”) regional cooperation initiative will be a significant driver for strategic investment opportunities throughout Asia.

We explored a number of strategic investment opportunities following the Change of Control Transaction, but we did not enter into any definitive agreements by the end of FY2016. See our Current Report on Form 8-K, dated March 2, 2017, for a description of our recent acquisition of Allied Plus (Samoa) Limited (“APSL”), which closed on February 28, 2017. APSL is now a wholly-owned subsidiary of the Company.

APSL primarily engages in the business of providing services to agents and financial advisers in Southeast Asia. The management of APSL possesses certain knowledge of investment criteria of OBOR-related investment entities, and provides consulting services to regional consultants and brokers with regard to their efforts to source and promote attractive investment opportunities.

Results of Operations

Fiscal year Ended December 31, 2016 Compared to Fiscal year Ended December 31, 2015

The Company recognized $2,000 in sales revenues for the fiscal year ended December 31, 2016, as compared to $0 for the fiscal year ended December 31, 2015. The change in the amount of sales revenue is a result of a small consulting contract that the Company secured prior to the Change in Control Transaction.

The Company did not recognize cost of revenue for the fiscal years ended December 31, 2016 and 2015.

Net loss from operations was $69,523 for the fiscal year ended December 31, 2016 as compared to net loss of $46,383 for the same period in 2015. This is primarily attributable to a 62.7% increase in professional fees and a 38% increase in general and administrative expenses over that time period.

For the fiscal year ended December 31, 2016, the Company recorded operating expenses totaling $71,523 which was comprised of general and administrative expenses and professional fees. For the fiscal year ended December 31, 2015, our operating expenses were $46,383, which was comprised of general and administrative expenses and professional fees. The increase in operating expenses was mainly attributed to increase in professional fee for complying with SEC reporting requirement. Since the Change in Control Transaction, we have devoted more resources to exploring strategic acquisitions and hiring service providers to analyze investment opportunities.

Liquidity and Capital Resources

The Company’s cash and cash equivalents, our only current assets, were $1,636 at December 31, 2016, as compared to $8,513 at December 31, 2015. The decrease in cash was primarily due to increased operating expenses.

Net cash used in operating activities amounted to $67,332 for the fiscal year ended December 31, 2016, as compared to $57,111 for the fiscal year ended December 31, 2015. The change in cash used in operating activities was primarily due to increased operating expenses, which was partially offset by a significant reduction in cash outflows associated with accounts payable from $17,228 for the fiscal year ended December 31, 2015, to $1,059 for the fiscal year ended December 31, 2016.

Based on our current plans for the next 12 months, we anticipate that revenues from consulting contracts of our subsidiary APSL will be the primary organic source of funds for future operating activities in 2017. However, to fund operations and to acquire additional entities, as we may deem appropriate, we may raise capital through public or private offerings. There is no assurance that we will be able to obtain such funding on acceptable terms, if at all.

Critical Accounting Policies and Estimates

Use of Estimates in Financial Statements

The presentation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates during the periods covered by these financial statements include the valuation of deferred tax asset and imputed compensation costs.

Emerging Growth Company

We are not currently required to comply with the SEC rules that implement Sections 302 and 404 of the Sarbanes-Oxley Act, and are therefore not required to make a formal assessment of the effectiveness of our internal controls over financial reporting for that purpose. Upon becoming a public company, we will be required to comply with certain of these rules, which will require management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of our internal control over financial reporting. Though we will be required to disclose changes made in our internal control procedures on a quarterly basis, we will not be required to make our first annual assessment of our internal control over financial reporting pursuant to Section 404 until the year following our first annual report required to be filed with the SEC.

We will remain an “emerging growth company” for up to five years following the date of our initial public offering, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time, we would cease to be an “emerging growth company” as of the following December 31, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an “emerging growth company” immediately.

Our independent registered public accounting firm is not required to formally attest to the effectiveness of our internal control over financial reporting until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an “emerging growth company.” At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating.

Fair value measurements and Fair value of Financial Instruments

The Company's financial instruments consist primarily of cash, accounts receivable, and accounts payable. The carrying amounts of such financial instruments approximate their respective estimated fair value due to their short-term maturities.

Foreign Currency Translation

The Company's reporting currency is the U.S. dollars (“USD”). The functional currency of the Company is the Hong Kong dollar (“HKD”). All transactions initiated in HKD are translated into USD in accordance with ASC 830-30, "

Translation of Financial Statements

," as follows:

|

|

i)

|

Assets and liabilities at the rate of exchange in effect at the balance sheet date.

|

|

|

ii)

|

Equities at historical rate

|

|

|

iii)

|

Revenue and expense items at the average rate of exchange prevailing during the period.

|

Adjustments arising from such translations are included in accumulated other comprehensive income in shareholders’ equity. No significant realized exchange gains or losses were recorded during the year ended December 31, 2016 and 2015.

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Spot HKD:USD exchange rate

|

|

$

|

0.128

|

|

|

$

|

0.128

|

|

|

Average HKD:USD exchange rate

|

|

$

|

0.128

|

|

|

$

|

0.128

|

|

Revenue Recognition

The Company recognizes revenue on arrangements in accordance with FASB ASC No. 605, “

Revenue Recognition

”. In all cases, revenue is recognized only when the price is fixed and determinable, persuasive evidence of an arrangement exists, the service is performed and collectability of the resulting receivable is reasonably assured.

Earnings (Loss) Per Share

The basic loss per share is calculated by dividing the Company's net loss available to common shareholders by the weighted average number of common shares during the period. The diluted loss per share is calculated by dividing the Company's net loss available to common shareholders by the diluted weighted average number of shares outstanding during the period. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. As of December 31, 2016, and 2015, the company has no dilutive securities.

Income Taxes

The Company accounts for income taxes under ASC 740, “

Income Taxes

”. Under ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under ASC 740, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

The Company’s income tax expense differs from the “expected” tax expense for federal income tax purpose by applying the Federal rate of 35% as follows:

|

|

|

Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Expected income tax (benefit) expense at the statutory rate of 35%

|

|

$

|

(24,455

|

)

|

|

$

|

(17,020

|

)

|

|

Tax effect of expenses that are not deductible for income tax purposes (net of other amounts deductible for tax purposes)

|

|

|

1,138

|

|

|

|

2,446

|

|

|

Change in valuation allowance

|

|

|

23,318

|

|

|

|

14,574

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

The components of deferred income taxes are as follows:

|

|

|

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Deferred income tax asset:

|

|

|

|

|

|

|

|

Net operating loss carryforwards

|

|

$

|

61,778,

|

|

|

$

|

38,460

|

|

|

Valuation allowance

|

|

|

(61,778

|

)

|

|

|

(38,460

|

)

|

|

Deferred income taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

As of December 31, 2016, the Company has a net operating loss carry forward of approximately $139,900 available to offset future taxable income, which will begin to expire in 2033. The utilization of these NOLs may become subject to limitations based on past and future changes in ownership of the Company pursuant to Internal Revenue Code Section 382.

Tax returns for the years ended December 31, 2016, 2015 and 2014 are subject to examination by the United States tax authority.

Reclassification

Certain amounts from prior periods have been reclassified to conform to the current period presentation.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Not applicable.

Item 8. Financial Statements and Supplementary Data

The financial statements required by this item are set forth beginning in Item 15 of this Annual Report on Form 10-K, beginning on page F-1, and are incorporated herein by reference.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

On February 23, 2015, we dismissed our independent registered public accounting firm, M&K CPAs, PLLC (“M&K”), and replaced them with Liggett & Webb, P.A. (“LW”). On January 17, 2017, we dismissed LW and replaced them with Anthony Kam & Associates Ltd. (“AKAM”). In connection with our retention of the services of M&K and LW, we did not encounter any disagreements or reportable events that require disclosure in this Annual Report on Form 10-K.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our principal executive officer and principal financial officer, evaluated the effectiveness of our disclosure controls and procedures as of December 31, 2016. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act, means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost- benefit relationship of possible controls and procedures. Based on the evaluation of our disclosure controls and procedures as of December 31, 2016, our principal executive officer and principal financial officer concluded that, as of such date, our disclosure controls and procedures were effective at the reasonable assurance level.

Management’s Annual Report on Internal Control Over Financial Reporting

Internal control over financial reporting is defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934, as amended, as a process designed by, or under the supervision of, the company’s principal executive and principal financial officers and effected by the company’s board of directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The company’s internal control over financial reporting includes those policies and procedures that:

|

|

·

|

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company;

|

|

|

·

|

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and

|

|

|

·

|

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements.

|

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The company’s management assessed the effectiveness of the company’s internal control over financial reporting as of December 31, 2016. In making this assessment, management used the criteria set forth in the Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

Based on our assessment, management believes that, as of December 31, 2016, the company’s internal control over financial reporting is effective based on those criteria.

Changes in Internal Controls over Financial Reporting

No change in our internal control over financial reporting occurred during the fourth fiscal quarter of the year ended December 31, 2016 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information

None.

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Directors and Executive Officers

The following sets forth information about our directors and executive officers as of the date of this report:

|

Name

|

|

Age

|

|

Position

|

|

Wai Lim Wong

|

|

45

|

|

President, Chief Executive Officer, Chief Financial Officer and Director

|

Set forth below is a brief description of the background and business experience of our executive officer and director for the past five years.

Wai Lim Wong, President, Chief Executive Officer, Chief Financial Officer and Director

Since August 22, 2016, Mr. Wong has served as our President, Chief Executive Officer, Chief Financial Officer and Director. He has over 25 years in customer service, sales and marketing experience, and is fluent in English, Cantonese and Mandarin. Prior to joining the Company, from 2014 to 2016 Mr. Wong was a sales and marketing manager for Keymax International Development Co., Ltd, an organization primarily focused on customer referrals to local finance companies for money lending businesses. There his key responsibilities included customer and supplier solicitation, operations, contract management and customer relations. Previously, from 2009 to 2014, Mr. Wong was an investor in and provided ad-hoc sales and marketing services for Wing Fung Marine Products, Ltd. (China), a renowned marine seafood cultivation company in China. Previously from 2007 to 2009, Mr. Wong was a project manager at Tomi Fuji Corporation Limited, where he was responsible for market promotion on energy savings products offered by the company.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Family Relationships

There are no family relationships between any of our directors or executive officers.

Certain Legal Proceedings

To our knowledge, no director, nominee for director, or executive officer of the Company has been a party in any legal proceeding material to an evaluation of his ability or integrity during the past ten years.

Code of Ethics

The Company has not adopted a Code of Ethics applicable to its Principal Executive Officer and Principal Financial Officer.

Item 11. Executive Compensation

Our sole director and executive officer has not received any compensation for services rendered to us, and are not accruing any compensation pursuant to any agreement with us.

We do not expect to pay any compensation to Mr. Wong until sufficient and sustainable revenues and profits are realized.

No retirement, pension, profit sharing, insurance programs, long-term incentive plans or other similar programs have been adopted by us for the benefit of our employees. We had no outstanding equity awards as of December 31, 2016.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth certain information as of the date hereof with respect to the beneficial ownership of our shares of common stock, the sole outstanding class of our voting securities, by (i) each executive officer and director, and (ii) all executive officers and directors as a group. There are no shares of preferred stock of the Company which are issued and outstanding. There exists no stockholder known to be the beneficial owner of 5% or more of the outstanding common stock of the Company. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Common stock subject to options, warrants or convertible securities exercisable or convertible within 60 days as of the date hereof are deemed outstanding for computing the percentage of the person or entity holding such options, warrants or convertible securities but are not deemed outstanding for computing the percentage of any other person and is based on 1,985,533,000 shares issued and outstanding as of March 22, 2017. Unless otherwise indicated, we believe that all persons named in the table have sole voting and investment power with respect to all ordinary shares beneficially owned by them. The Company does not maintain any equity compensation plans.

|

Name

|

|

Number of

Shares

Beneficially

Owned

|

|

|

Percent of Class (1)

|

|

|

Wai Lim Wong

|

|

|

0

|

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

All Executive Officers and Directors as a group (1 person)

|

|

|

0

|

|

|

|

0

|

%

|

_____________

(1) Indicates shares of common stock, par value $0.0001 per share.

Item 13. Certain Relationships and Related Transactions, and Director Independence

Related Transactions

The following sets forth a summary of transactions since January 1, 2015, and any currently proposed transactions, in which the Company was to be a participant and the amount involved exceeds the lesser of $120,000 or one percent of the average of our total assets at year end for the last two completed fiscal years, and in which any related person had or will have a direct or indirect material interest (other than compensation described under “Executive Compensation”). We believe the terms obtained or consideration that we paid or received, as applicable, in connection with the transactions described below were comparable to terms available or the amounts that would be paid or received, as applicable, in arm’s-length transactions.

On April 21, 2015, the Company entered into an unsecured promissory note in the amount of $20,000 with its former chief executive officer, Andrew Gavrin. The note was due on April 21, 2017 and bore interest at a rate of 2% per annum. Accrued interest at August 22, 2016 amounted to approximately $478.

On October 8, 2015, the Company entered into an unsecured promissory note in the amount of $15,000 with its former chief executive officer, Andrew Gavrin. The note was due on October 8, 2017 and bore interest at a rate of 2% per annum. Accrued interest at August 22, 2016 amounted to approximately $218.

On August 22, 2016, in connection with the Change of Control Transaction, Mr. Gavrin cancelled each of the aforementioned promissory notes and acknowledged that the Company does not owe Mr. Gavrin or any other related party any amounts. Mr. Gavrin also entered into a consulting agreement with the Company whereby he agreed to provide sales and customer service and collection of accounts receivable in exchange for the right to retain up to $4,000 of accounts receivable due the Company. The agreement in on an “at-will” basis and may be terminated by the Company after 30 days notice. As of December 31, 2016, no amounts were paid to Mr. Gavrin and the consulting agreement had not been cancelled.

Director Independence

We adhere to the NASDAQ listing standards in determining whether a director is independent. Our board of directors consults with its counsel to ensure that the board’s determinations are consistent with those rules and all relevant securities and other laws and regulations regarding the independence of directors. The NASDAQ listing standards define an “independent director” as a person, other than an executive officer of a company or any other individual having a relationship which, in the opinion of the issuer’s board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Consistent with these considerations, and considering his position as an executive officer of the Company, we have determined that Mr. Wong does not qualify as an independent director. Additionally, and for the same reasons, we have determined that Mr. Gavrin also did not qualify as an independent director during his service on the board of directors. We do not maintain a compensation, nominating or audit committee.

Item 14.

Principal Accountant Fees and Services

Fees Charged by Principal Accountant

Audit Fees

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the Company’s annual financial statements and review of financial statements included in the Company’s Form 10-K or 10-Q or services that are normally provided by the accountant in connection with statutory and regulatory filings was $11,500 and $11,500 for the fiscal year ended December 31, 2016 and 2015, respectively.

Audit-Related Fees

The aggregate fees billed for each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of audit or review of the Company’s financial statements was $0 and $0 for the fiscal year ended December 31, 2016 and 2015, respectively.

Tax Fees

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning was $0 and $0 for the fiscal year ended December 31, 2016 and 2015, respectively.

All Other Fees

The aggregate fees billed for each of the last two fiscal years for products or services provided by the principal accountant, other than the Audit Fees, Audit-Related Fees and Tax Fees discussed in this Item 14, was $0 and $0f or the fiscal year ended December 31, 2016 and 2015, respectively.

Approval of Fees

In order to ensure independence of the principal accountant, the engagement must be approved by the Company in accordance with Section 10A(i) of the Securities Exchange Act of 1934, as amended. The engagement must be either: (i) approved by our audit committee prior to the engagement; or (ii) entered into pursuant to pre-approval policies and procedures established by our audit committee, provided the policies and procedures are detailed as to the particular service, the audit committee is informed of each service, and such policies and procedures do not include delegation of the audit committee's responsibilities to management.

We do not have an audit committee. Our entire board of directors pre-approves all services provided by our independent auditors. All of the above services and fees were reviewed and approved by the entire board of directors before the respective services were rendered.

PART IV

Item 15. Exhibits, Financial Statement Schedules

a) The following documents are filed as part of this Annual Report on Form 10-K:

1. Financial Statements

Index to Audited Financial Statements

|

|

|

Page

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

F-2

|

|

|

Balance Sheets

|

|

F-3

|

|

|

Statements of Operations

|

|

F-4

|

|

|

Statements of Stockholders’ Deficit

|

|

F-5

|

|

|

Statements of Cash Flows

|

|

F-6

|

|

|

Notes to the Financial Statements

|

|

F-7

|

|

2. Financial Statement Schedules

All other schedules are omitted because they are not required or the required information is included in the financial statements or notes thereto.

3. The following exhibits are filed as part of this Annual Report on Form 10-K

|

Exhibit No.

|

|

Title

|

|

|

|

|

|

2.1

|

|

Stock Purchase Agreement, dated as of August 22, 2016, by and between Ping Zhang and Andrew Gavrin(1)

|

|

3.1

|

|

Articles of Incorporation(2)

|

|

3.2

|

|

Certificate of Correction(2)

|

|

3.3

|

|

Certificate of Amendment(3)

|

|

3.4

|

|

Bylaws(2)

|

|

10.1

|

|

Acknowledgement of Debt Cancellation, dated August 22, 2016, by and between the Company and Andrew Gavrin(1)

|

|

10.2

|

|

Services Agreement, dated August 22, 2016, by and between the Company and Andrew Gavrin(1)

|

|

10.3

|

|

Share Exchange Agreement, dated February 24, 2017, by and among the Company, Allied Plus (Samoa) Limited, and the shareholders of Allied Plus (Samoa) Limited(3)

|

|

16.1

|

|

Letter from Liggett & Webb P.A., Certified Public Accountants, dated January 17, 2017(4)

|

|

21.1

|

|

Subsidiaries of the Registrant

|

|

31.1

|

|

Certification of Principal Executive Officer and Principal Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

32.1+

|

|

Certification of Principal Executive Officer and Principal Financial Officer Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

101.INS

|

|

XBRL Instance Document

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

______________

|

(1)

|

Incorporated by reference to the Registrant’s Current Report on Form 8-K filed on August 26, 2016.

|

|

(2)

|

Incorporated by reference to the Registrant’s Registration Statement on Form S-1, filed on September 3, 2014.

|

|

(3)

|

Incorporated by reference to the Registrant’s Current Report on Form 8-K filed on February 24, 2017.

|

|

(4)

|

Incorporated by reference to the Registrant’s Current Report on Form 8-K filed on January 24, 2017.

|

|

+

|

In accordance with the SEC Release 33-8238, deemed being furnished and not filed.

|

Item 16. Form 10-K Summary

None.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

ABV CONSULTING, INC.

|

|

|

|

|

|

|

|

March 31, 2017

|

By:

|

/s/ Wai Lim Wong

|

|

|

|

|

Wai Lim Wong

|

|

|

|

|

President, Chief Executive Officer (Principal Executive Officer), Chief Financial Officer (Principal Financial and Accounting Officer) and Director

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Name

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Wai Lim Wong

|

|

President, Chief Executive Officer (Principal Executive Officer),

|

|

March 31, 2017

|

|

Wai Lim Wong

|

|

Chief Financial Officer (Principal Financial and Accounting Officer), Director

|

|

|

Supplemental Information to be Furnished With Reports Filed Pursuant to Section 15(d) of the Act by Registrants Which Have Not Registered Securities Pursuant to Section 12 of the Act

The Company has not sent an annual report, proxy statement, form of proxy or other proxy soliciting material to our security holders.

INDEX TO FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of ABV Consulting, Inc.

(Incorporated in the State of Nevada, United States of America)

We have audited the accompanying balance sheets of ABV Consulting, Inc. (the “Company”) as of December 31, 2016 and December 31, 2015, and the statements of operations, the statements of stockholders’ equity, and the statements of cash flows for the years ended December 31, 2016 and December 31, 2015. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor have we been engaged to perform, an audit from its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statements presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, these financial statements referred to above present fairly, in all material respects, the financial position of ABV Consulting, Inc. as of December 31, 2016 and December 31, 2015, and the results of its operations and its cash flows for each of the years ended December 31, 2016 and December 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has an accumulated deficit of $181,943 as of December 31, 2016, and a net loss of $69,872 and used cash in operations of $67,332 for the year ended December 31, 2016. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans concerning these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Anthony Kam & Associates Limited

Anthony Kam & Associates Limited

Certified Public Accountants

March 30, 2017

Hong Kong, China

ABV CONSULTING, INC.

Balance Sheets

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

ASSETS

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

1,636

|

|

|

$

|

8,513

|

|

|

Total Current Assets

|

|

|

1,636

|

|

|

|

8,513

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

1,636

|

|

|

$

|

8,513

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

3,589

|

|

|

$

|

4,648

|

|

|

Due to related parties

|

|

|

20,000

|

|

|

|

-

|

|

|

Total Current Liabilities

|

|

|

23,589

|

|

|

|

4,648

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued interest - Related party

|

|

|

-

|

|

|

|

347

|

|

|

Note payable - Related party

|

|

|

-

|

|

|

|

35,000

|

|

|

TOTAL LIABILITIES

|

|

|

23,589

|

|

|

|

39,995

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Deficit

|

|

|

|

|

|

|

|

|

|

Preferred stock: 10,000,000 authorized; $0.0001 par value

|

|

|

|

|

|

|

|

|

|

No shares issued and outstanding

|

|

|

|

|

|

|

|

|

|

Common stock: 3,000,000,000 shares authorized; $0.0001 par value

|

|

|

|

|

|

|

|

|

|

5,533,000 shares issued and outstanding at December 31, 2016 and 2015, respectively

|

|

|

553

|

|

|

|

553

|

|

|

Additional paid in capital

|

|

|

159,437

|

|

|

|

80,036

|

|

|

Accumulated deficit

|

|

|

(181,943

|

)

|

|

|

(112,071

|

)

|

|

Total Stockholders' Deficit

|

|

|

(21,953

|

)

|

|

|

(31,482

|

)

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

$

|

1,636

|

|

|

$

|

8,513

|

|

The accompanying notes are an integral part of these financial statements.

ABV CONSULTING, INC.

Statements of Operations

|

|

|

Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

2,000

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

22,053

|

|

|

|

15,984

|

|

|

Professional fees

|

|

|

49,470

|

|

|

|

30,399

|

|

|

Total Operating Expenses

|

|

|

71,523

|

|

|

|

46,383

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from operations

|

|

|

(69,523

|

)

|

|

|

(46,383

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense)

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(349

|

)

|

|

|

(347

|

)

|

|

Total other income (expense)

|

|

|

(349

|

)

|

|

|

(347

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(69,872

|

)

|

|

$

|

(46,730

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and dilutive loss per common share

|

|

$

|

(0.01

|

)

|

|

$

|

(0.01

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding

|

|

|

5,533,000

|

|

|

|

5,533,000

|

|

The accompanying notes are an integral part of these financial statements.

ABV CONSULTING, INC.

Statement of Stockholders’ Deficit

For the Years Ended December 31, 2016 and 2015

|

|

|

Preferred Stock

|

|

|

Common Stock

|

|

|

Additional

|

|

|

|

|

|

Total

|

|

|

|

|

Number

of Shares

|

|

|

Amount

|

|

|

Number

of Shares

|

|

|

Par

Value

|

|

|

Paid in

Cap

ital

|

|

|

Accumulated

Deficit

|

|

|

Stockholders'

Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance December 31, 2014

|

|

|

-

|

|

|

$

|

-

|

|

|

|

5,533,000

|

|

|

$

|

553

|

|

|

$

|

73,536

|

|

|

$

|

(65,341

|

)

|

|

$

|

8,748

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Imputed Compensation

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

6,500

|

|

|

|

-

|

|

|

|

6,500

|

|

|

Net loss for the year ended December 31, 2015

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(46,730

|

)

|

|

|

(46,730

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance December 31, 2015

|

|

|

-

|

|

|

|

-

|

|

|

|

5,533,000

|

|

|

|

553

|

|

|

|

80,036

|

|

|

|

(112,071

|

)

|

|

|

(31,482

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contribution of capital

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

76,151

|

|

|

|

-

|

|

|

|

76,151

|

|

|

Imputed Compensation

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

3,250

|

|

|

|

-

|

|

|

|

3,250

|

|

|

Net loss for the year ended December 31, 2016

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(69,872

|

)

|

|

|

(69,872

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance December 31, 2016

|

|

|

-

|

|

|

$

|

-

|

|

|

|

5,533,000

|

|

|

$

|

553

|

|

|

$

|

159,437

|

|

|

$

|

(181,943

|

)

|

|

$

|

(21,953

|

)

|

The accompanying notes are an integral part of these financial statements.

ABV CONSULTING, INC.

Statements of Cash Flows

|

|

|

Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(69,872

|

)

|

|

$

|

(46,730

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Imputed compensation

|

|

|

3,250

|

|

|

|

6,500

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

-

|

|

|

|

|

|

|

Accounts payable

|

|

|

(1,059

|

)

|

|

|

(17,228

|

)

|

|

Accrued interest

|

|

|

349

|

|

|

|

347

|

|

|

Net Cash Used in Operating Activities

|

|

|

(67,332

|

)

|

|

|

(57,111

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from notes payable - related party

|

|

|

20,000

|

|

|

|

35,000

|

|

|

Capital contribution

|

|

|

40,455

|

|

|

|

-

|

|

|

Repayment of note payable

|

|

|

(12,500

|

)

|

|

|

-

|

|

|

Proceeds from notes payable

|

|

|

12,500

|

|

|

|

-

|

|

|

Net cash provided by Financing Activities

|

|

|

60,455

|

|

|

|

35,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash decrease for year

|

|

|

(6,877

|

)

|

|

|

(22,111

|

)

|

|

Cash at beginning of year

|

|

|

8,513

|

|

|

|

30,624

|

|

|

Cash at end of year

|

|

$

|

1,636

|

|

|

$

|

8,513

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

|

|

|

|

|

|

|

|

|

Cash paid for income taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Cash paid for interest

|

|

$

|

-

|