Today's Top Supply Chain and Logistics News From WSJ

March 31 2017 - 6:50AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

Big measures that could hit online sales across the U.S. are

starting to form at state revenue-collection agencies. After

spending years fighting Amazon.com Inc. over sales taxes, states

are turning their attention to the individuals and small companies

that account for a growing share of the online marketplace's sales,

the WSJ's Laura Stevens writes. Amazon itself has turned away from

its long-held resistance to state sales taxes. But third-party

sellers have remained elusive, giving them a price advantage over

local brick-and-mortar retailers and even Amazon's own sales.

Traditional retailers say the tax gap amounts to a subsidy for

online sellers, and states say they're missing billions of dollars

in revenue. Some states already are cracking down, and others are

considering forcing marketplaces to collect sales taxes on behalf

of those selling merchandise on their sites or to force sellers to

report sales. The change may surprise customers and could upend the

financial calculations over sales and shipping in some markets.

H&M will try to find the solution to its sales problem in

its supply chain. The company, formally Hennes & Mauritz AB, is

digging into its operations after a 3% decline in first-quarter

profit and slowing sales growth signaled it's stumbling behind

rival Zara in apparel retailing's fast-fashion competition. Like

other retailers, H&M is shuffling its store lineup, closing

sites that aren't delivering profits, the WSJ's Dominic Chopping

reports. The deeper dive will come with a sharper focus on its

supply chain, including the addition of automation and software

aimed at pushing inventories more quickly where they're needed.

H&M is trying to build up its version of an omni-channel

strategy, with physical stores and online sales working in concert.

That's proving tough to pull off for many retailers, and the pace

of H&M's fast-fashion competition will make it especially

challenging.

Global commodity markets are shifting attention from Chinese

demand for raw materials to the country's stockpiles. Expectations

of falling production of goods from aluminum to coal are moving

prices and getting more attention from investors, the WSJ's

Rhiannon Hoyle reports, drawing greater focus to rooting out

China's murky supply information. China's internal shifts on energy

production have already sent coal markets into sharp swings, and

experts say the country's outsize role in commodities from aluminum

to zinc leaves other markets open to sharp swings. That's created a

market for what's essentially detective work, as consultants use

satellite imagery and measure truck movements to check official

figures. The results may have a crucial impact on commodity

shipping operations that are finally flexing some financial muscle.

The Baltic Dry Index measure of dry bulk shipping rates reached a

28-month high this week, suggesting demand is on the upturn and

could stay there unless commodity markets become oversupplied.

ECONOMY & TRADE

The promised complete overhaul of North American trade terms may

have hit a wall. The Trump administration is signaling to Congress

it would seek mostly modest changes to the North American Free

Trade Agreement in negotiations with Mexico and Canada, the WSJ's

William Mauldin reports, scaling back some ambitions to redraw a

deal that President Donald Trump has called a "disaster." Still, a

draft proposal circulating in Congress shows strong attention to

"Buy American" and tariff provisions. The administration would

allow a Nafta nation to reinstate tariffs in case of a flood of

imports that cause "serious injury or threat of serious injury" to

domestic industries. And rules of origin -- the share of a product

that must be produced in Nafta countries -- would be set to support

"production and jobs in the United States." A seeming compromise

between trade hawks and moderates, the document could change, and

it doesn't take into account proposals Canada and Mexico might

seek. So far, however, the approach may amount to an update rather

than a full rewrite.

QUOTABLE

IN OTHER NEWS

U.S. corporate after-tax profits rose 3.7% from the third

quarter to the fourth quarter, and 22.3% year-over-year. (WSJ)

An official gauge of Chinese factory activity rose to a near

five-year high in March. (WSJ)

The White House appears poised to cement China's unfavorable

status in trade cases, making Chinese goods eligible for higher

U.S. tariffs. (WSJ)

General Electric Co. CEO Jeffrey Immelt says the industrial

giant will continue efforts to reduce its emissions and fight

climate change. (WSJ)

British airlines running profitable regional services across

Europe may face major upheaval as the country exit the European

Union. (WSJ)

Ford Motor Co. is hiring 400 engineers from BlackBerry Ltd.'s

mobility-software unit to work on developing internet-connected

vehicles. (WSJ)

India's Mahindra Group is considering entering the U.S. and

China with high-end electric vehicles made by its Italian affiliate

Pininfarina SpA. (WSJ)

More than 200 companies have expressed interest in designing and

building a wall along the U.S. border with Mexico. (WSJ)

McDonald's Corp. will switch from frozen to fresh beef in its

Quarter Pounder burgers at most of its U.S. restaurants by

mid-2018. (WSJ)

Amazon is asking several big consumer-goods brands to redesign

their packaging to make it easier to ship directly to online

consumers. (Bloomberg)

Consumer goods giant Unilever PLC and Singapore-based Lazada

Group will work together on marketing and supply chain management

for e-commerce in Southeast Asia. (Business Times)

Chinese shipping line COSCO Shipping Holdings Co. Ltd. recorded

a $1.44 billion loss last year but expects improved results this

year. (Reuters)

Freight forwarder DB Schenker said global revenue fell 2.1% last

year but earnings before interest and taxes expanded 3.8% on

contract logistics growth. (Lloyd's Loading List)

China-based shipping container maker Singamas says demand and

pricing for containers is rising this year. (Lloyd's List)

Wal-Mart Stores Inc. will get $15.3 million in tax breaks under

its plan to put one of its biggest U.S. distribution centers in

Mobile, Ala. (Birmingham News)

India's Tata Global Beverages Ltd. will use an agreement with

Alibaba Group Holding Ltd. to sell Tetley tea in China. (Live

Mint)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

March 31, 2017 06:35 ET (10:35 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

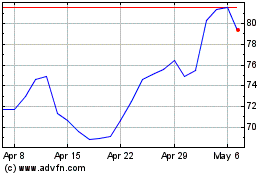

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

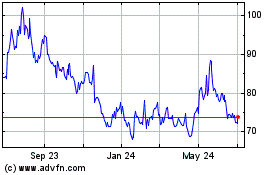

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024