Heidelberg, Germany, March 30, 2017 - Affimed

N.V. (Nasdaq: AFMD), a clinical stage biopharmaceutical company

focused on discovering and developing highly targeted cancer

immunotherapies, today reported financial results for the quarter

and year ended December 31, 2016.

"Throughout 2016, we expanded our leadership

position in NK-cell engagement and made considerable progress both

with our clinical and preclinical programs," said Dr. Adi Hoess,

CEO of Affimed. "We have successfully executed on our strategy to

broaden our efforts in combination therapies, advancing our

clinical trial for AFM13 with Merck's Keytruda as well as

initiating our collaboration with MD Anderson to combine our

NK-cell engagers with MD Anderson's adoptive NK-cell transfer."

Corporate Updates

- In January 2017, Affimed and The University of Texas MD

Anderson Cancer Center (MDACC) announced an exclusive strategic

clinical development and commercialization collaboration to

evaluate Affimed's tetravalent bispecific immune cell engager

technology in combination with MDACC's natural killer (NK-) cell

product. The collaboration comprises research, development, and

eventually commercialization of novel oncology therapeutics

resulting from this combination of products. MDACC will be

responsible for conducting preclinical research activities and

these are intended to be followed by a Phase 1 clinical trial.

Affimed will fund research and development expenses for this

collaboration and the agreement includes a provision for the

potential expansion of the partnership. Affimed holds an option to

exclusive worldwide rights to develop and commercialize any product

developed under the collaboration. Leveraging MDACC's expertise in

NK-cells and translational medicine, and Affimed's capabilities to

develop tumor-targeting bispecific tetravalent immune cell

engagers, the combination is initially planned to investigate

Affimed's AFM13, a CD30/CD16A-targeting tetravalent bispecific

antibody, with MDACC's proprietary NK-cell product in HL.

Harnessing the advantages of both antibody-based and cell therapy

approaches, this combination has the potential to better exploit

the therapeutic activity of NK-cells in HL and beyond, for example

in other medically underserved indications such as multiple myeloma

or acute myeloid leukemia.

- In January and February 2017, Affimed completed an underwritten

public offering on the Nasdaq Global Market, raising a total of

approximately US $17.7 million (€16.5 million) in net proceeds.

Proceeds from this transaction are expected to fund operations,

including clinical development and early development activities, at

least until the end of 2018.

- The Company entered into a loan agreement with Silicon Valley

Bank in November 2016 for up to €10.0 million. The loan is

available in two tranches, the first of which (€5.0 million) was

drawn in December 2016. The Company may draw up to an additional

€5.0 million on or before May 31, 2017, contingent on the Company's

satisfaction of certain conditions. The then-existing loan

outstanding to Perceptive was repaid.

- The Company has recently entered into a termination agreement

with its COO, Dr. Jörg Windisch, who will be leaving the Company at

the end of June 2017. Dr. Windisch has accepted a position on the

executive committee of a non-competing company focusing on the

large-scale manufacturing of biologics and the development of

biosimilars. He will continue to support Affimed as a consulting

expert following his departure.

- Affimed's subsidiary AbCheck announced achievement of the first

clinical milestone in its antibody discovery collaboration with Eli

Lilly and Company in January 2017. The milestone, the commencement

of patient enrollment for a Phase 1 study of an antibody discovered

under the collaboration agreement, triggered an undisclosed payment

to AbCheck from Eli Lilly and represents an important validation of

AbCheck's technology suite and its capability to reliably deliver

high-quality antibodies suitable for clinical development.

- Moving beyond its tetravalent, bispecific tandem diabodies

(TandAbs), Affimed is broadening its immune cell engager

capabilities. Building on the Company's team's unique antibody

engineering expertise, Affimed is developing a suite of

multivalent, multi-specific antibody formats for NK- and T-cell

engagement. These novel antibody formats have the potential to

tailor immune-engaging therapy to different indications and target

populations.

Pipeline Updates

NK-cell engager programs

- In May 2016, Affimed initiated a Phase 1b combination study of

AFM13 with Keytruda (pembrolizumab) in Hodgkin lymphoma (HL), No

dose-limiting toxicities for the combination were observed in the

first and second dose cohorts of the study. The overall safety

profile determined for the combination was unchanged from that

described for each drug alone in these cohorts. Data read-out is

ongoing and the study has recently completed recruitment into the

third dose cohort. The Company intends to provide an update on the

study in the second half of 2017.

- For the Company's investigator-sponsored Phase 2a monotherapy

of AFM13 in HL, the study's sponsor, the German Hodgkin Study Group

(GHSG), and Affimed have revised the overall study design in order

to adapt to the changing treatment landscape, namely the

availability of anti PD-1 antibodies. The study will now include HL

patients relapsed or refractory to treatment with both brentuximab

vedotin and anti-PD-1, and different dosing protocols of AFM13 are

being explored to allow for improved exposure in this more heavily

pretreated patient population. Affimed continues to anticipate

providing an update on the study in the second half of 2017, with

the study expected to begin recruiting under the new design in the

first half of 2017. In addition, Affimed also expects to report

data collected from specific patient subsets enrolled under the

original study protocol.

- Affimed has demonstrated in recent preclinical studies that

AFM13 induced upregulation of specific interleukin receptors on

NK-cells in a target-dependent manner and sensitized NK-cells to

IL-2- or IL-15-mediated expansion. This provides a rationale for

clinical combination of NK-cell engagers with cytokines aiming for

deeper clinical responses. Affimed plans to provide an update on

preclinical data supporting this approach at the upcoming AACR

Annual Meeting in early April 2017.

- Affimed continues to develop first-in-class NK-cell engagers to

address the critical unmet need to effectively treat epidermal

growth factor receptor (EGFR)-expressing solid tumors such as lung,

head & neck and colon cancers. AFM24, an EGFR/CD16A-targeting

tetravalent bispecific antibody, is designed to improve both

efficacy and safety of current therapeutic monoclonal antibodies.

AFM24 lead candidates are being developed to offer different PK/PD

profiles relevant to certain diseases. Affimed plans to provide an

update on its EGFR-targeting antibodies at the upcoming AACR Annual

Meeting in early April 2017.

- Affimed is developing AFM26 to treat multiple myeloma (MM), the

second most common hematological cancer. AFM26 is a first-in-class

tetravalent bispecific antibody targeting BCMA/CD16A. MM is

characterized by high serum levels of monoclonal immunoglobulin

(M-protein) and most patients eventually relapse with and/or become

refractory to the currently available treatments. Importantly,

AFM26's NK-cell binding appears to be virtually unaffected by the

presence high levels of IgG. Preclinical investigations are ongoing

and Affimed plans to provide an update on AFM26 at the upcoming

AACR Annual Meeting in early April 2017.

T-cell engager programs

- In September 2016, the Company initiated a Phase 1

dose-escalation trial of its tetravalent bispecific

CD19/CD3-targeting antibody AFM11 in patients with relapsed and

refractory acute lymphocytic leukemia (ALL). The trial is ongoing

and trial sites in the Czech Republic, Poland, Russia and Israel

have been initiated. Affimed intends to provide a progress update

on the study in the first half of 2017.

- In Affimed's Phase 1 study in non-Hodgkin lymphoma (NHL) for

AFM11, several additional trial sites were opened throughout 2016

and the trial is ongoing and recruiting. The Company continues to

expect providing a progress update in the first half of 2017.

- In July 2016, an IND for the tetravalent bispecific

CD33/CD3-targeting antibody AMV564, a molecule developed from

Affimed's TandAb platform, became effective. AMV564 is being

developed by Amphivena Therapeutics, Inc. and Amphivena has

announced its intent to initiate a Phase 1 dose escalation clinical

trial for AMV564 in patients with acute myeloid leukemia (AML).

Together with the existing investor consortium, Affimed is

financially supporting the clinical development of AMV564.

- Affimed has successfully generated and preclinically

investigated T-cell engagers specifically binding MHC-peptide

complexes. In preclinical studies, lead candidates showed selective

potent in vitro killing of tumor cells endogenously expressing the

targeted MHC-peptide complex. Affimed plans to provide an update on

this program at the upcoming AACR Annual Meeting in early April

2017.

Financial Highlights(Figures for the

fourth quarter of 2016 and 2015 represent unaudited figures)

Cash and cash equivalents and financial assets

totaled €44.9 million as of December 31, 2016 compared to €76.7

million as of December 31, 2015. The decrease was primarily

attributable to Affimed's operational expenses.

Net cash used in operating activities for the

fourth quarter of 2016 was €6.6 million compared to €4.0 million

for the fourth quarter of 2015. Net cash used in operating

activities was €32.1 million for the twelve months ended December

31, 2016 compared to €18.5 million for the twelve months ended

December 31, 2015. The year-over-year increase was primarily

related to higher cash expenditure for research and development

(R&D) in connection with our development and collaboration

programs.

Revenue for the fourth quarter of 2016 was €1.4

million compared to €1.7 million for the fourth quarter of 2015.

Revenue for the full year 2016 was €6.3 million compared to €7.6

million for the full year 2015. Revenue in both periods was

primarily derived from Affimed's collaborations with Amphivena and

the LLS as well as from third party services rendered by

AbCheck.

R&D expenses for the fourth quarter of 2016

were €5.7 million compared to €7.0 million for the fourth quarter

of 2015. For the full year 2016, R&D expenses were €30.2

million compared to €22.0 million for the full year 2015. The

increase was primarily related to higher expenses for AFM13, AFM11,

preclinical programs and infrastructure.

G&A expenses for the fourth quarter of 2016

were €2.1 million compared to €2.0 million for the fourth quarter

of 2015. For the full year 2016, G&A expenses were €8.3 million

compared to €7.5 million for the full year 2015. The increase was

primarily related to higher share-based payment expenses.

Net loss for the fourth quarter of 2016 was €5.4

million, or €0.16 per common share, compared to a net loss of €6.3

million, or €0.19 per common share, for the fourth quarter of 2015.

Net loss for the full year 2016 was €32.2 million, or €0.97 per

common share, compared to a loss of €20.2 million, or €0.71 per

common share, for the full year 2015. The increase in net loss for

the full year 2016 was primarily related to increased spending on

R&D for AFM13, AFM11, preclinical programs and infrastructure.

In addition, the result was affected by lower revenue and lower

finance income. Additional information regarding these results is

included in the notes to the consolidated financial statements as

of December 31, 2016 and "Item 5. Operating and Financial Review

and Prospects," which will be included in Affimed's Annual Report

on Form 20-F as filed with the SEC.

Including the proceeds from the offering in

January and February 2017, the Company's operations, including

clinical development and early development activities, are expected

to be funded at least until the end of 2018.

Note on IFRS Reporting Standards

Affimed prepares and reports the consolidated

financial statements and financial information in accordance with

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board (IASB). None of the

financial statements were prepared in accordance with Generally

Accepted Accounting Principles (GAAP) in the United States. Affimed

maintains its books and records in Euro.

Conference call and webcast

information

Affimed's management will host a conference call

to discuss the company's financial results and recent corporate

developments today at 8:30 a.m. ET. A webcast of the conference

call can be accessed in the "Events" section on the "Investors

& Media" page of the Affimed website at

http://www.affimed.com/events.php. A replay of the webcast will be

available on Affimed's website shortly after the conclusion of the

call and will be archived on the Affimed website for 30 days

following the call.

About Affimed N.V.

Affimed (Nasdaq: AFMD) engineers targeted

immunotherapies, seeking to cure patients by harnessing the power

of innate and adaptive immunity (NK- and T-cells). We are

developing single and combination therapies to treat cancers and

other life-threatening diseases. For more information, please visit

www.affimed.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as "anticipate," "believe," "could," "estimate," "expect,"

"goal," "intend," "look forward to", "may," "plan," "potential,"

"predict," "project," "should," "will," "would" and similar

expressions. Forward-looking statements appear in a number of

places throughout this release and include statements regarding our

intentions, beliefs, projections, outlook, analyses and current

expectations concerning, among other things, our ongoing and

planned preclinical development and clinical trials, our

collaborations and development of our products in combination with

other therapies, the timing of and our ability to make regulatory

filings and obtain and maintain regulatory approvals for our

product candidates our intellectual property position, our

collaboration activities, our ability to develop commercial

functions, expectations regarding clinical trial data, our results

of operations, cash needs, financial condition, liquidity,

prospects, future transactions, growth and strategies, the industry

in which we operate, the trends that may affect the industry or us

and the risks uncertainties and other factors described under the

heading "Risk Factors" in Affimed's filings with the Securities and

Exchange Commission. Given these risks, uncertainties and other

factors, you should not place undue reliance on these

forward-looking statements, and we assume no obligation to update

these forward-looking statements, even if new information becomes

available in the future.

IR Contact:Caroline Stewart, Head IRPhone: +1 347394

6793E-Mail: IR@affimed.com or c.stewart@affimed.com

Media Contact:Anca Alexandru, Head of Communications, EU

IRPhone: +49 6221 64793341E-Mail: a.alexandru@affimed.com

AFFIMED N.V.CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

Affimed N.V.Consolidated statement of

comprehensive loss (in € thousand)

| |

|

|

|

|

|

| |

2014 |

|

2015 |

|

2016 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Revenue |

3,382 |

|

7,562 |

|

6,314 |

| |

|

|

|

|

|

| Other income - net |

381 |

|

651 |

|

145 |

| Research and

development expenses |

(9,595) |

|

(22,008) |

|

(30,180) |

| General and

administrative expenses |

(2,346) |

|

(7,548) |

|

(8,323) |

| |

|

|

|

|

|

| Operating

loss |

(8,178) |

|

(21,343) |

|

(32,044) |

| |

|

|

|

|

|

| Finance income /

(costs) - net |

7,753 |

|

1,104 |

|

(230) |

| |

|

|

|

|

|

| Loss before

tax |

(425) |

|

(20,239) |

|

(32,274) |

| |

|

|

|

|

|

| Income taxes |

166 |

|

0 |

|

58 |

| |

|

|

|

|

|

| Loss for the

period |

(259) |

|

(20,239) |

|

(32,216) |

| |

|

|

|

|

|

| Total comprehensive

loss |

(259) |

|

(20,239) |

|

(32,216) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Loss per share in €

per share |

(0.01) |

|

(0.71) |

|

(0.97) |

| (undiluted =

diluted) |

|

|

|

|

|

Affimed N.V.Consolidated statement of

financial position (in € thousand)

| |

December 31, 2015 |

|

December 31, 2016 |

| |

|

|

|

| ASSETS |

|

|

|

| Non-current

assets |

|

|

|

| |

|

|

|

| Intangible assets |

72 |

|

55 |

| Leasehold improvements

and equipment |

915 |

|

822 |

| |

987 |

|

877 |

| |

|

|

|

| Current

assets |

|

|

|

| |

|

|

|

| Inventories |

228 |

|

197 |

| Trade and other

receivables |

915 |

|

2,255 |

| Other assets |

452 |

|

516 |

| Financial assets |

0 |

|

9,487 |

| Cash and cash

equivalents |

76,740 |

|

35,407 |

| |

78,335 |

|

47,862 |

| |

|

|

|

| TOTAL

ASSETS |

79,322 |

|

48,739 |

| |

|

|

|

| EQUITY AND

LIABILITIES |

|

|

|

| Equity |

|

|

|

| |

|

|

|

| Issued capital |

333 |

|

333 |

| Capital reserves |

187,169 |

|

190,862 |

| Accumulated

deficit |

(120,228) |

|

(152,444) |

| Total

equity |

67,274 |

|

38,751 |

| |

|

|

|

| Non current

liabilities |

|

|

|

| |

|

|

|

| Borrowings |

3,104 |

|

3,617 |

| Total

non-current liabilities |

3,104 |

|

3,617 |

| |

|

|

|

| Current

liabilities |

|

|

|

| |

|

|

|

| Trade and other

payables |

4,444 |

|

5,323 |

| Borrowings |

1,472 |

|

973 |

| Deferred revenue |

3,028 |

|

75 |

| Total current

liabilities |

8,944 |

|

6,371 |

| |

|

|

|

| TOTAL

EQUITY AND LIABILITIES |

79,322 |

|

48,739 |

Affimed N.V.Consolidated statement of

cash flows (in € thousand)

| |

|

2014 |

|

2015 |

|

2016 |

| Cash flow from

operating activities |

|

|

|

|

|

|

| Loss for the

period |

|

(259) |

|

(20,239) |

|

(32,216) |

| Adjustments for the

period: |

|

|

|

|

|

|

| - Income taxes |

|

(166) |

|

0 |

|

(58) |

| - Depreciation and

amortisation |

|

441 |

|

336 |

|

369 |

| - Loss from disposal of

leasehold improvements and equipment |

|

3 |

|

0 |

|

0 |

| - Share based

payments |

|

(4,891) |

|

2,220 |

|

3,545 |

| - Finance income /

costs - net |

|

(7,753) |

|

(1,104) |

|

230 |

| |

|

(12,625) |

|

(18,787) |

|

(28,130) |

| Change in trade and

other receivables |

|

62 |

|

24 |

|

(1,311) |

| Change in

inventories |

|

(59) |

|

(29) |

|

31 |

| Change in other

assets |

|

0 |

|

(452) |

|

(64) |

| Change in trade, other

payables and deferred revenue |

|

2,275 |

|

1,253 |

|

(2,177) |

| |

|

|

|

|

|

|

| Cash used in operating

activities |

|

(10,347) |

|

(17,991) |

|

(31,651) |

| Interest received |

|

2 |

|

10 |

|

102 |

| Paid interest |

|

(202) |

|

(554) |

|

(578) |

| |

|

|

|

|

|

|

| Net cash used in

operating activities |

|

(10,547) |

|

(18,535) |

|

(32,127) |

| |

|

|

|

|

|

|

| Cash flow from

investing activities |

|

|

|

|

|

|

| Purchase of intangible

assets |

|

(45) |

|

(28) |

|

(21) |

| Purchase of leasehold

improvements and equipment |

|

(260) |

|

(249) |

|

(238) |

| Cash paid for

investments in financial assets |

|

0 |

|

0 |

|

(27,037) |

| Cash received from

maturity of financial assets |

|

0 |

|

0 |

|

18,147 |

| Proceeds from sale of

equipment |

|

7 |

|

0 |

|

0 |

| |

|

|

|

|

|

|

| Net cash used for

investing activities |

|

(298) |

|

(277) |

|

(9,149) |

| Cash flow from

financing activities |

|

|

|

|

|

|

| Proceeds from issue of

common shares |

|

43,213 |

|

56,615 |

|

6 |

| Transactions costs

related to issue of common shares |

|

(5,343) |

|

(3,117) |

|

0 |

| Proceeds from issue of

preferred shares |

|

2,999 |

|

0 |

|

0 |

| Proceeds from

borrowings |

|

4,020 |

|

0 |

|

5,000 |

| Transaction costs

related to borrowings |

|

0 |

|

0 |

|

(105) |

| Repayment of

borrowings |

|

0 |

|

0 |

|

(5,137) |

| Cash flow from

financing activities |

|

44,889 |

|

53,498 |

|

(236) |

| Net changes to cash

and cash equivalents |

|

34,044 |

|

34,686 |

|

(41,512) |

| Cash and cash

equivalents at the beginning of the period |

|

4,151 |

|

39,725 |

|

76,740 |

| Exchange-rate

related changes of cash and cash equivalents |

|

1,530 |

|

2,329 |

|

179 |

| Cash and cash

equivalents at the end of the period |

|

39,725 |

|

76,740 |

|

35,407 |

Affimed N.V.Consolidated statement of

changes in equity (in € thousand)

| |

|

Issued

capital |

|

Capital

reserves |

|

Own

shares |

|

Accumulated deficit |

|

Total equity |

| |

|

|

|

|

|

|

|

|

|

|

| Balance as of

January 1, 2014 |

|

63 |

|

469 |

|

(25) |

|

(99,730) |

|

(99,223) |

| |

|

|

|

|

|

|

|

|

|

|

| Exchange of preferred

shares |

|

97 |

|

84,907 |

|

25 |

|

|

|

85,029 |

| Issue of common

shares |

|

80 |

|

37,791 |

|

|

|

|

|

37,871 |

| Modification of

cash-settled share based payment awards |

|

|

|

7,648 |

|

|

|

|

|

7,648 |

| Equity-settled share

based payment awards |

|

|

|

299 |

|

|

|

|

|

299 |

| Issue of warrant note

(Perceptive loan) |

|

|

|

430 |

|

|

|

|

|

430 |

| Loss for the

period |

|

|

|

|

|

|

|

(259) |

|

(259) |

| |

|

|

|

|

|

|

|

|

|

|

| Balance as of

December 31, 2014 |

|

240 |

|

131,544 |

|

0 |

|

(99,989) |

|

31,795 |

| |

|

|

|

|

|

|

|

|

|

|

| Balance as of

January 1, 2015 |

|

240 |

|

131,544 |

|

0 |

|

(99,989) |

|

31,795 |

| |

|

|

|

|

|

|

|

|

|

|

| Issue of common

shares |

|

91 |

|

52,463 |

|

|

|

|

|

52,554 |

| Exercise of share based

payment awards |

|

2 |

|

942 |

|

|

|

|

|

944 |

| Equity-settled share

based payment awards |

|

|

|

2,220 |

|

|

|

|

|

2,220 |

| Loss for the

period |

|

|

|

|

|

|

|

(20,239) |

|

(20,239) |

| |

|

|

|

|

|

|

|

|

|

|

| Balance as of

December 31, 2015 |

|

333 |

|

187,169 |

|

0 |

|

(120,228) |

|

67,274 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Balance as of

January 1, 2016 |

|

333 |

|

187,169 |

|

0 |

|

(120,228) |

|

67,274 |

| |

|

|

|

|

|

|

|

|

|

|

| Issue of common

shares1 |

|

0 |

|

6 |

|

|

|

|

|

6 |

| Equity-settled share

based payment awards |

|

|

|

3,545 |

|

|

|

|

|

3,545 |

| Issue of warrant note

(loan Silicon Valley Bank) |

|

|

|

142 |

|

|

|

|

|

142 |

| Loss for the

period |

|

|

|

|

|

|

|

(32,216) |

|

(32,216) |

| Balance as of

December 31, 2016 |

|

333 |

|

190,862 |

|

0 |

|

(152,444) |

|

38,751 |

1 Issue of 3,341 shares

Affimed N.V.Consolidated statement of

comprehensive loss (in € thousand)

| |

|

Q4 2015(unaudited) |

|

Q4

2016(unaudited) |

|

|

|

|

|

|

| |

|

|

|

|

| Revenue |

|

1,659 |

|

1,371 |

| |

|

|

|

|

| Other income - net |

|

20 |

|

2 |

| Research and

development expenses |

|

(7,034) |

|

(5,724) |

| General and

administrative expenses |

|

(1,956) |

|

(2,084) |

| |

|

|

|

|

| Operating

(loss) |

|

(7,311) |

|

(6,435) |

| |

|

|

|

|

| Finance income /

(costs) - net |

|

996 |

|

953 |

| |

|

|

|

|

| Loss before

tax |

|

(6,315) |

|

(5,482) |

| |

|

|

|

|

| Income taxes |

|

36 |

|

60 |

| |

|

|

|

|

| Loss for the

period |

|

(6,279) |

|

(5,422) |

| |

|

|

|

|

| Total comprehensive

loss |

|

(6,279) |

|

(5,422) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| Loss per share in €

per share |

|

(0.19) |

|

(0.16) |

| (undiluted =

diluted) |

|

|

|

|

Affimed N.V.Consolidated statement of

cash flows (in € thousand)

| |

|

Q4

2015(unaudited) |

|

Q4

2016(unaudited) |

| Cash flow from

operating activities |

|

|

|

|

| Loss for the

period |

|

(6,279) |

|

(5,422) |

| Adjustments for the

period: |

|

|

|

|

| - Income taxes |

|

(36) |

|

(60) |

| - Depreciation and

amortisation |

|

96 |

|

76 |

| - Share based

payments |

|

767 |

|

826 |

| - Finance income /

costs - net |

|

(996) |

|

(953) |

| |

|

|

|

|

| |

|

(6,448) |

|

(5,533) |

| Change in trade and

other receivables |

|

532 |

|

87 |

| Change in

inventories |

|

11 |

|

56 |

| Change in other

assets |

|

(452) |

|

87 |

| Change in trade, other

payables and deferred revenue |

|

2,471 |

|

(1,097) |

| |

|

|

|

|

| Cash used in operating

activities |

|

(3,886) |

|

(6,400) |

| Interest received |

|

5 |

|

42 |

| Paid interest |

|

(128) |

|

(223) |

| Net cash used in

operating activities |

|

(4,009) |

|

(6,581) |

| |

|

|

|

|

| Cash flow from

investing activities |

|

|

|

|

| Purchase of intangible

assets |

|

(18) |

|

0 |

| Purchase of leasehold

improvements and equipment |

|

(45) |

|

(44) |

| Cash paid for

investments in financial assets |

|

0 |

|

51 |

| Cash received from

maturity of financial assets |

|

0 |

|

4,611 |

| Net cash used for

investing activities |

|

(63) |

|

4,618 |

| |

|

|

|

|

| Cash flow from

financing activities |

|

|

|

|

| Proceeds from issue of

common shares |

|

19,091 |

|

6 |

| Transactions costs

related to issue of common shares |

|

(27) |

|

0 |

| Proceeds from

borrowings |

|

0 |

|

5,000 |

| Transaction costs

related to borrowings |

|

0 |

|

(105) |

| Repayment of

borrowings |

|

0 |

|

(4,058) |

| Cash flow from

financing activities |

|

19,064 |

|

843 |

| |

|

|

|

|

| Net changes to cash

and cash equivalents |

|

14,992 |

|

(1,120) |

| Cash and cash

equivalents at the beginning of the period |

|

60,425 |

|

35,693 |

| Exchange-rate

related changes of cash and cash equivalents |

|

1,323 |

|

834 |

| Cash and cash

equivalents at the end of the period |

|

76,740 |

|

35,407 |

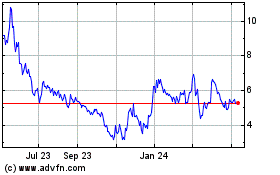

Affimed NV (NASDAQ:AFMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

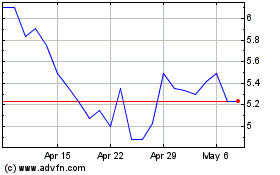

Affimed NV (NASDAQ:AFMD)

Historical Stock Chart

From Apr 2023 to Apr 2024