Expected FCC ruling on audience caps could spark slew of media

deal making

By John D. McKinnon and Joe Flint

WASHINGTON -- Federal regulators plan to reverse an Obama-era

rule that prevented major television-station owners from buying

stations or readily selling themselves, a move that could touch off

a wave of deals among media companies.

The proposal, which would effectively loosen a national cap on

audience share for station owners that the rule had tightened, is

scheduled to be put before the Federal Communications Commission in

late April, an agency official said. Chairman Ajit Pai is expected

to announce the plan on Thursday afternoon.

The longstanding ownership cap limits TV groups to a 39%

national audience share. But for years, the government said station

owners didn't have to fully count UHF stations in calculating their

share because UHF was typically a less powerful signal. The

Obama-era FCC eliminated the so-called UHF discount last September,

contending that the distinction between UHF stations and VHF

stations had effectively disappeared.

The FCC under Mr. Pai is expected to revert to the previous rule

in one of a series of actions he is taking as he plans to reverse

several policies adopted under his predecessor, Tom Wheeler, who

was FCC chairman for much of President Barack Obama's second

term.

TV station owners have contended that fully counting the UHF

channels unfairly penalized them at a time when other types of

media have been growing rapidly.

One CBS Corp. executive, Anne Lucey, complained in recent

meetings with FCC officials that "our industry has been frozen in

time" by the Obama-era rule, according to regulatory filings.

Meanwhile, "our video competitors have marched on unfettered by

ownership limits," she said. CBS and some other media companies

asked the commission to reinstate the UHF discount, without waiting

to launch a broader proceeding on media-ownership issues.

21st Century Fox, which shares ownership with The Wall Street

Journal, challenged the Obama-era change in the U.S. Circuit Court

of Appeals for the D.C. Circuit, although the case has been on hold

while the FCC weighs what to do.

Despite that challenge, CEO James Murdoch recently indicated

that the company doesn't have a "big appetite" to add more stations

should the ownership regulations change.

Independent TV company Sinclair Broadcast Group Inc. has urged

the commission to get rid of the national cap entirely.

"Television stations face increased national competition from a

host of new services," including satellite and cable networks as

well as internet providers, Sinclair said in a recent filing. "The

national cap is simply no longer justified in today's media

environment."

A coalition of consumer groups including Free Press has opposed

the rollback. "Reversing the rule will allow these large group

owners to grow larger" and make acquisitions harder for new

entrants and smaller companies, said Andrew Schwartzman, a

Georgetown University law professor who represents the

coalition.

For independent station owners like Sinclair, growing through

acquisitions gives them more clout to negotiate lucrative carriage

deals with cable providers. It also ensures they can hold their own

in their affiliate relationships with national networks that supply

their key programming, such as ABC, CBS, NBC and Fox. The parent

companies of several of the big broadcasters also own some of their

own stations, and buying more is a way to reduce the leverage of

the independent groups.

The reinstatement of the UHF discount would give many

broadcasters room to grow. Sinclair would see its current 38% share

drop to 24% with the discount applied. Nexstar Media Group Inc.'s

39% attribution would decline to 26%, and Tegna Inc. would fall

from 32% to 27%.

Speaking on an earnings call last month, Tegna Media President

Dave Lougee said changes to the ownership rules would be "a very

good and overdue development for Tegna and the industry overall."

Nexstar Chief Executive Perry Sook told investors and analysts last

month that the company is "already in discussions should the rules

change about opportunities that might be available to us."

CBS, which owns stations with an audience share of 38%, would

also be able to become a buyer with the discount reducing its reach

to around 25%. CBS CEO Leslie Moonves told analysts earlier this

month that the company would welcome deregulation.

"I can tell you in the right circumstance if the cap is lifted

we would strategically want to buy some more stations because we

think it is important," Mr. Moonves said.

A deal that many analysts and industry executives are

anticipating is Sinclair acquiring Tribune Media Co., whose

national reach of 44% would fall to 26%. Wells Fargo Securities

analyst Marci Ryvicker in a recent report that such a purchase is

"complicated but possible."

Sinclair-Tribune combination would create a broadcasting

behemoth of more than 200 local stations. Sinclair operates 173 TV

stations, while Tribune owns or operates 42. Sinclair has a market

cap of $4.1 billion, and Tribune's market cap is $3.2 billion.

Even with the reduced ownership reach that a UHF discount would

bring, the combination would still likely require some stations to

be sold off to keep in line with the 39% cap. Tribune exceeds the

current 39% cap because its reach grew when the UHF discount was

eliminated and the company was granted a waiver.

Sinclair and Tribune have declined to comment.

Besides Tribune, few potential sellers have emerged. "We see

more buyers vs. sellers," Ms. Ryvicker said.

While the return of the UHF discount will likely lead to some

deals, television executives are also pining for a relaxation of

the rules that limit the number of television stations one

broadcaster can own in a market.

Currently, one company can own two TV stations in a market only

if eight independent TV stations remain afterward. That limits such

possibilities to big and midsize markets and leaves out smaller

markets where many TV stations are economically challenged,

broadcasters say.

Nexstar's Mr. Sook has told investors the company wants to

"pursue opportunities to grow our scale within local markets" and

would be "appropriately aggressive on that front."

Such changes would have to wait until later in the year, when

the FCC appears likely to take up other changes to its

media-ownership rules.

Another rule change that would significantly lead to more deals

and consolidation would be removing or relaxing the 39% cap itself,

although that may not be in the agency's purview.

Republican FCC Commissioner Michael O'Rielly wrote in a 2016

rule-making procedure that Congress, not the commission, has the

authority to alter the cap. Mr. O'Rielly said the cap is one of a

handful of media-ownership rules exempted from the FCC's

Quadrennial Review process in which the agency decides which

regulations are still necessary and which should be changed or

eliminated.

Write to John D. McKinnon at john.mckinnon@wsj.com and Joe Flint

at joe.flint@wsj.com

(END) Dow Jones Newswires

March 30, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

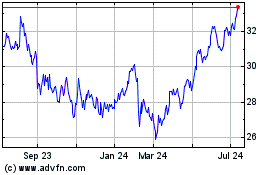

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

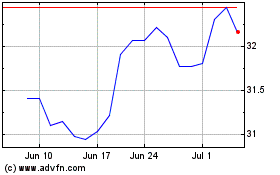

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024