ConocoPhillips to Sell Chunk of Canadian Oil-Sands Assets For $13.3 Billion

March 29 2017 - 6:33PM

Dow Jones News

By Maria Armental

ConocoPhillips is selling a large chunk of its Canadian

oil-sands assets to Cenovus Energy Inc. to pay down debt and

significantly increase stock buybacks, marking the latest exit from

the oil sands by non-Canadian player.

The $13.3 billion cash-and-stock deal would turn over to

Alberta-based Cenovus the majority of ConocoPhillips's western

Canada Deep Basin gas assets along with its joint stake in the

Foster Creek Christina Lake oil sands, in which Cenovus and

ConocoPhillips each own 50% and which Cenovus operates.

"This means we will not only accelerate, but exceed, the

three-year plan we laid out in November 2016, ConocoPhillips Chief

Executive Ryan Lance said Wednesday in a prepared statement.

The deal, which would double Cenovus's Canadian production and

reserves, is expected to close in the second quarter and is subject

to regulatory approval.

If approved, ConocoPhillips, one of the largest U.S. shale

producers, would still own a 50% stake in Canada's Surmont oil

sands, which it runs, and full ownership in the Blueberry-Montney

unconventional acreage position.

ConocoPhillips' daily net production from the oil sands totaled

183,000 barrels of crude oil equivalent, of which Foster Creek

accounted for 70,000 barrels a day, according to the company. The

remainder came from its stake in another Cenvous-run project called

Christina Lake, which made up 78,000 barrels a day of oil

equivalent, and its 35,000 barrel a day oil equivalent share of

Surmont. ConocoPhillips is the operator at Surmont, in which

France's Total SA owns a 50% stake

The Houston-based company plans to use the cash proceeds to cut

its debt burden to about $20 billion, from $27.28 billion as of

Dec. 31. It also plans to triple the amount allotted for stock

buybacks this year to $3 billion and double the overall amount set

aside to buy back stock through 2019 to $6 billion.

Cenovus also agreed to make extra payments to Conoco if the

price of oil rises above a certain threshold.

Canada's oil sands have been losing out to cheaper U.S. shale

oil as the energy industry's supplier of choice for higher cost

barrels of oil. Royal Dutch Shell is selling nearly all of its

Canadian oil-sands developments, while Norway's Statoil ASA exited

its Canadian oil-sands operations last year.

ConocoPhillips shares, up 16% over the past 12 months, rose 6%

to $48.90 in after-hours trading while Cenovus's stock fell 7.49%

to $12.10.

--Chester Dawson contributed to this article.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

March 29, 2017 18:18 ET (22:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

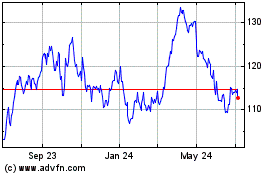

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

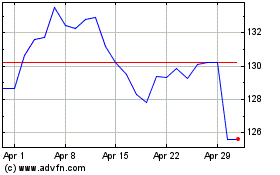

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024