Current Report Filing (8-k)

March 29 2017 - 4:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 27, 2017

SILVERSUN TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-50302

|

|

16-1633636

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

5 Regent Street, Suite 520

Livingston, New Jersey 07039

|

|

|

|

(Address of Principal Executive Offices)

|

|

(973) 396-1720

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On March 27, 2017 (the “

Effective Date

”), SilverSun Technologies, Inc. (the “

Company

”) and John Schachtel entered into a director agreement (the “

Director Agreement

”) in

connection with Mr. Schachtel’s appointment to the Board of Directors of the Company (the “

Board

”), as more fully described in Item 5.02 below

.

The term of the Director Agreement commences on the Effective Date, and continues through the Company’s next annual stockholders’ meeting (the “

Term

”)

.

The Director Agreement automatically renews on such date that Mr. Schachtel is re-elected to the Board.

Pursuant to the Director Agreement, the Company will provide Mr. Schachtel compensation of $1,000 for each month of the Term. In addition, the Company will issue Mr. Schachtel a warrant to purchase up to 5,000 shares of the Company’s common stock (the “

Warrant

”). The Warrant vests immediately and is exercisable for 5 years with an exercise price of $4.01.

The above description of the Director Agreement and the Warrant do not purport to be complete and are qualified in their entirety by reference to the Director Agreement and the Warrant, which are attached as Exhibits 10.1 and 4.1, respectively, to this Current Report on Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of John Schachtel

On March 27, 2017, Mr. Schachtel was appointed to the Board.

Below is a description of Mr. Schachtel’s professional work experience.

Before joining the Board, Mr. Schachtel was the Chief Operating Officer of OneMain Finanacial Holdings, Inc. As Chief Operating Officer of OneMain Finanacial Holdings, Inc., Mr. Schachtel’s responsibilities included

oversight of sales and field operations, marketing, and centralized collections. Prior to assuming the Chief Operating Officer role, Mr. Schachtel served 11 years as the Executive Vice President, Northeast & Midwest Division for

OneMain Finanacial Holdings, Inc.

He holds a Bachelor of Science degree from Northwestern University and an MBA in Finance from New York University.

Family Relationships

Mr. Schachtel does not have a family relationship with any of the current officers or directors of the Company.

Related Party Transactions

There are no applicable related party transactions.

Compensatory Arrangements

As described in Item 1.01 above, which is incorporated by reference to this Item 5.02, in connection with Mr. Schachtel’s appointment to the Board, the Company will issue Mr. Schachtel a Warrant,

vesting immediately, exercisable for 5 years with an exercise price of $4.01. Additionally, Mr.

Schachtel will receive

$1,000 for each month of service during the Term.

Item 8.01 Other Items.

Board Committees

On March 27, 2017, the Board formed a compensation committee (the “

Compensation Committee

”) and a nominating and corporate governance committee (the “

N&CG Committee

”) of the Board. Prior to creating the committees, the Company had in place an audit committee (the “

Audit Committee

” and each a “

Committee

”), of which Joseph Macaluso served as the chairman and sole member of.

In connection with forming the Compensation Committee and the N&CG Committee, the Board appointed each of Mr. Schachtel, Mr. Macaluso, and Stanley Wunderlich to serve on both committees. The Board also appointed Mr. Schachtel as the chairman of the Compensation Committee and Mr. Wunderlich as chairman of the N&CG Committee. Additionally, the Board appointed Mr. Schachtel and Mr. Wunderlich to the Audit Committee.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

SILVERSUN TECHNOLOGIES, INC.

|

|

|

Date: March 29, 2017

|

By:

|

/s/Mark Meller

|

|

|

|

|

Mark Meller

|

|

|

|

|

Chief Executive Officer

|

|

|

|

|

|

|

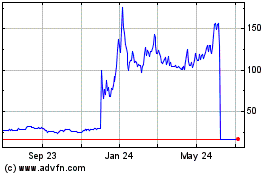

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

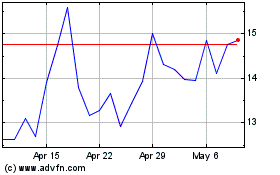

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Apr 2023 to Apr 2024