Collapsed Skyscraper Deal Another Setback for Anbang

March 29 2017 - 1:16PM

Dow Jones News

By Esther Fung and Kane Wu

China's Anbang Insurance Group Co. has had a tough time pulling

off splashy U.S. real-estate deals since it scooped up the iconic

Waldorf Astoria Hotel in 2015.

On Wednesday, New York real-estate developer Kushner Cos. said

it had ceased talks with Anbang for a planned $7.5 billion

redevelopment of a mixed-use skyscraper in Manhattan.

That came almost exactly a year after the Chinese insurer made a

high-profile retreat from a bidding war to buy Starwood Hotels

& Resorts Worldwide Inc. The hotel chain went to Marriott

International Inc. for $13 billion.

The Beijing-based insurer, one of China's best-known overseas

investors, had shot to fame in the international deal-making

circuit with its $1.95 billion purchase of Manhattan's Waldorf

Astoria, at the time the steepest price ever paid for a U.S.

hotel.

Last year, Anbang made an abortive attempt to steal Starwood

from Marriott, sealing its reputation for flashy deal making. It

had partnered with New York financier Chris Flowers on the Starwood

bid. But Anbang pulled the bid after questions about its ownership

and political connections in China -- concerns that kept some Wall

Street banks from taking the insurer as a client -- and scrutiny

increased over the company at home.

A few weeks before the Starwood pullout, Anbang had inked an

agreement to buy Strategic Hotels & Resorts from Blackstone

Group LP in a deal valued at $6.5 billion.

Anbang's shareholders include a collection of 39 Chinese

companies, some of which at one point shared the same contact

address or legal representative and in turn are owned by other

companies, according to online corporate registry filings reviewed

by The Wall Street Journal. Anbang's chairman and founder, Wu

Xiaohui, is married to the granddaughter of former Chinese leader

Deng Xiaoping.

Since the aborted Starwood deal, Anbang has made lower-profile

property deals in Canada and Japan, according to data from

Dealogic.

For more than a year, Chinese regulators have intensified

controls over capital outflows and spend more time scrutinizing

potential deals that Chinese companies are making abroad.

But Chinese investors are still doing deals overseas. "When you

think about investing in China, there isn't so much to buy.

Properties aren't cheap," said Theo Cheng, Anbang's head of

overseas real-estate investment, at an industry conference in

France earlier this month. "There's a whole bunch of capital that

for different reasons needs to come out to diversify and seek

better returns."

Mr. Wu, who has hobnobbed with former U.S. Secretary of State

Henry Kissinger and Stephen Schwarzman, the billionaire chief

executive of Blackstone Group, said in a dinner gala earlier this

year that friendships built at a personal level between business

partners help improve ties between China and the U.S.

This time, Anbang had been in talks to provide as much as half

of the $2.5 billion in equity for the planned redevelopment of 666

Fifth Avenue, according to people close to the negotiations. A

Kushner Cos. spokesman added that the firm remains in active

negotiations with other potential investors for the project.

The disclosure about ending talks with Anbang came after

lawmakers and ethics experts last week expressed concerns about the

potential for a conflict of interest. Jared Kushner, son of the

real-estate company's founder, Charles, is the son-in-law of

President Donald Trump and occupies a key advisory position in the

administration.

The younger Mr. Kushner has taken steps to protect against

potential conflicts. For example, he has sold his personal stake in

666 Fifth Ave. and dozens of other properties to a trust controlled

by other family members. But some ethics experts have said the

measures have fallen short, and members of Congress expressed

concerns over the Anbang talks.

--Phred Dvorak and Peter Grant contributed to this article.

Write to Esther Fung at esther.fung@wsj.com and Kane Wu at

Kane.Wu@wsj.com

(END) Dow Jones Newswires

March 29, 2017 13:01 ET (17:01 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

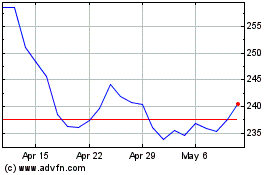

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

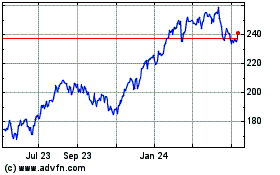

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Apr 2023 to Apr 2024