By Newley Purnell

As the U.S.'s top tech brands ramp up operations in India, they

are running into unexpected resistance: their Chinese equivalents

stepping in to bolster their Indian competitors with billions of

dollars in investments and expertise.

In recent years, Amazon.com Inc., Facebook Inc., Uber

Technologies Inc. and others have announced ambitious plans and

rapid rollouts in India, calling it one of the last great untapped

internet economies.

The U.S firms plan to use their massive war chests to dominate

India's market of more than 1.2 billion people, most of whom are

just now connecting to the internet. The companies have been able

to use their capital to capture significant market share, but local

startups have put up a good fight, going toe to toe with the U.S.

giants thanks to help from China.

More U.S. tech firms are pouring money into their Indian

subsidiaries, expanding their cutting-edge offerings directly into

the market as it begins to mature, and largely without the

regulatory challenges found in China. Amazon is investing $5

billion in its operations in India, while Uber is putting more than

$1 billion into the country. India is Facebook's second-biggest

market in terms of users after the U.S., and more people use its

WhatsApp messaging platform in the country than anywhere else.

But joining the battle for India's internet newcomers are

China's tech titans -- including Alibaba Group Holding Ltd.

(e-commerce), Tencent Holdings Ltd. (social networking) and Didi

Chuxing Technology Co. (ride-hailing) -- all of which are providing

muscle to their Indian counterparts.

Alibaba this month led a $200 million round of fundraising into

a new e-commerce arm of Indian mobile-payments and online-shopping

startup Paytm. That followed its 2015 investment, with its

financial-services affiliate Zhejiang Ant Small & Micro

Financial Services Group, of more than $500 million for a 40% stake

in One97 Communications, Paytm's parent company.

"India is an important emerging market with great potential,"

said an Alibaba spokesman.

Chinese interest in Indian startups has shot up just as U.S.

investment has waned. In 2015 and 2016, Chinese tech firms invested

a total of $3.2 billion in Indian startups, more than twice the

$1.4 billion invested in Indian startups by U.S. companies during

those years, according to AVCJ Research in Hong Kong.

Indian startups -- sometimes clones of the American trailblazers

-- thrived for years as Western companies showed little interest in

emerging markets. When U.S. companies turned their attention and

money to the Asian subcontinent, they made rapid gains and may have

expected to easily outspend and outlast their tiny local rivals,

said Neha Dharia, a Bangalore, India, analyst with London

technology research firm Ovum.

But Indian startups have fought back with strong local brands

and Chinese backing. U.S. firms likely "didn't expect the local

guys to give them such a run for their business," she said.

An Amazon spokeswoman declined to comment on how Chinese

investments have changed the playing field in India, but said the

company has made rapid strides in the country and is "committed to

long-term investment" in e-commerce infrastructure and technology

in India.

Uber and WhatsApp declined to comment. Facebook didn't respond

to requests for comment.

Chinese firms may have an edge in India because its budding

internet economy is familiar territory. With tens of millions of

new users connecting to the internet for the first time via

low-cost smartphones and affordable data plans, India's startup

environment today compares with China's a decade ago, some analysts

say -- when rapid adoption of the web and strict government

controls on foreign firms allowed Chinese web companies to

flourish.

Many Chinese firms have launched their own brands directly in

India but most have failed to take off. The English-speaking

populace that dominates India's internet is more familiar with

American and local names. As a plan B, the Chinese leaders are now

buying into Indian startups eager for money as they try to survive

the competition from U.S. giants.

Chinese ride-hailing app Didi, which proved it could beat a

global leader last year when it forced Uber to give up on China,

has had a stake in ANI Technologies Pvt. Ltd. -- the company behind

India's largest Uber competitor, Ola -- since 2015.

Last year, Tencent, which is behind China's wildly popular

WeChat social-networking app, led a $175 million fundraising round

in New Delhi-based messaging app Hike Ltd., which competes with

WhatsApp.

The Chinese companies are offering more than cash. They are

giving Indian companies expertise in how to tailor services to a

vast, diverse and less affluent populace.

Alibaba frequently hosts Paytm employees at its offices and

sends staff to India to encourage the exchange of ideas, said

Madhur Deora, Paytm's chief financial officer.

"It's really the scale and the scope" of operating in a

billion-person economy that Alibaba is able to help with, he

said.

Alibaba's senior managers have provided input as Paytm has

grown, offering insight on the right way to engineer Paytm's app,

for instance, based on ways mobile usage exploded in China.

China's Uber rival, Didi, is helping Ola untangle the problems

that come from the scale of serving a billion-person economy while

juggling hundreds of thousands of drivers. The "enormous and

complex" ride-sharing demands require "creative solutions," said a

Didi spokeswoman.

Messaging app Hike, which has about 100 million users in India,

has been getting advice from Tencent on how to better serve the

Indian market. One feature tailored to India allows users to share

music and video files between their phones without using the web or

data.

Tencent executives are helping roll out many new services so it

can become, like WeChat, a one-stop platform for not just sending

messages, but also for consuming news and more, said Kavin Bharti

Mittal, Hike's founder.

"These guys have built what we're trying to build," he said.

"India's economy and population has many more similarities to China

than the U.S."

(END) Dow Jones Newswires

March 29, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

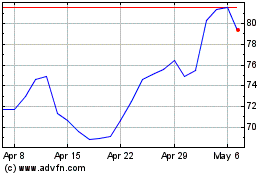

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

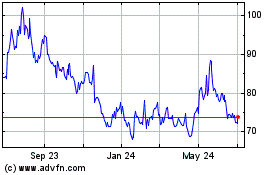

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024