Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

March 28 2017 - 6:06AM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(5)

Registration No. 333- 215126

Prospectus Supplement

(To Prospectus Supplement Dated February 3, 2017 and Prospectus

Dated December 16, 2016)

Rights Offering for Common Shares

Advanced Semiconductor

Engineering, Inc.

(Incorporated as a company limited by shares in the Republic of China)

_______________

We distributed to holders of our existing

common shares rights to subscribe for an aggregate of 240,000,000 of our common shares, par value 10 NT dollars per share (the

“New Shares”). Each common share held of record as of 5:00 p.m. (the close of trading on the Taiwan Stock Exchange)

on February 15, 2017 (Taiwan time) entitled its holder to one right to subscribe for 31.23335914 New Shares at the subscription

price of NT$34.30 per New Share (the “Subscription Price”). A holder of rights that exercised all of its rights was

also able to apply during the Preemptive Subscription Period (as defined below) to subscribe at the Subscription Price for additional

New Shares that were not subscribed for pursuant to the exercise of rights (the “Additional Shares”). We accepted subscription

for whole common shares only. The subscription period for the rights commenced on February 21, 2017 and expired at the close of

business in Taiwan on March 21, 2017 (the “Preemptive Subscription Period”) and after the Preemptive Subscription Period,

New Shares, including fractional New Shares, that were not subscribed for were offered at the Subscription Price to Chairman of

ASE’s Board of Directors and his designated persons (the “Designated Persons”) during a period starting on March

23, 2017 (Taiwan time) following the expiration of the Preemptive Subscription Period (as defined below) and ending at the close

of business in Taiwan on March 27, 2017 (the “Additional Shares Allocation Period”).

Holders of American Depositary Shares,

or ADSs, each representing five common shares, did not receive rights to subscribe for new ADSs. The rights with respect to ordinary

shares represented by ADSs were issued to Citibank, N.A., as depositary (the “Depositary”). At the instruction of holders,

a total of 15,321,903 ADSs were cancelled during the period from February 16, 2017 until March 7, 2017, and the shares and the

rights underlying such ADSs were delivered upon the instruction of the cancelling holders. The Depositary determined, in consultation

with us, that it was not reasonably practicable to sell the rights it receives with respect to the common shares represented by

ADSs (as the rights are not listed or eligible to trade on any securities exchange), and therefore such rights were not sold by

the Depositary and the holders of ADSs will not receive any cash proceeds from the sale of rights.

We made this offering directly to shareholders

without the use of any underwriters, agents or dealers.

The results of the offering are set forth

below:

|

|

·

|

194,863,030 New Shares were subscribed for by the holders of rights during the Preemptive Subscription Period; and

|

|

|

·

|

45,136,970 Additional Shares were subscribed for by the Designated Persons during the Additional Shares Allocation Period.

|

Investing in our ordinary shares involves

risks. See “Risk Factors” beginning on page S-16 of the prospectus supplement dated February 3, 2017 and page 2 of

the prospectus dated December 16, 2016, as well as in the documents incorporated by reference

in the prospectus supplement dated February 3, 2017 and the prospectus dated December 16, 2016.

The following amounts relate to the shares and ADSs issued in

the rights offering only and do not relate to the shares to be sold in the subsequent offering:

|

|

|

|

|

|

|

|

|

Subscription Price

|

|

Proceeds to Company (1)

|

|

|

|

|

|

Per New Share

|

|

NT$34.30

|

|

NT$34.30

|

|

|

|

|

|

Total offering (2)

|

|

US$269,724,770.64

|

|

US$269,724,770.64

|

|

(1)

|

Before deducting transaction expenses and commissions payable by the Company.

|

|

(2)

|

Based on an exchange rate of NT$30.52 per US$1.00.

|

Neither the U.S. Securities and Exchange

Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy

of this prospectus supplement, the prospectus supplement dated February 3, 2017 or the prospectus dated December 16, 2016. Any

representation to the contrary is a criminal offense.

This prospectus supplement, the prospectus

supplement dated February 3, 2017 and the prospectus dated December 16, 2016 may be used in connection with the offering.

The date of this prospectus supplement

is March 28, 2017.

Ordinary Share Price

In March 2017 (through March 24), the highest

closing price per common share as reported on the Taiwan Stock Exchange was NT$39.65 and the lowest closing price per common share

was NT$37.45.

Listing

We expect that the New Shares will be listed

on Taiwan Stock Exchange. The first trading day is expected to be March 31, 2017.

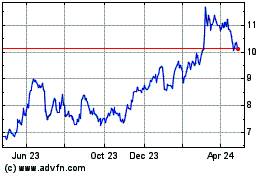

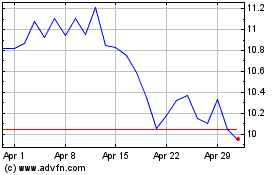

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024