Report of Foreign Issuer (6-k)

March 28 2017 - 6:05AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2017

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

STATEMENT OF MATERIAL FACT

COMPANHIA SIDERÚRGICA NACIONAL

Publicly-Held Company

Corporate Taxpayer's ID (CNPJ/MF): 33.042.730/0001-04

Companhia Siderúrgica Nacional (BOVESPA: CSNA3; NYSE: SID) ("CSN" or "Company"), pursuant to Article 157, paragraph 4, of Law 6.404/76, as amended, and according to the Instruction of the Securities and Exchange Commission ("CVM") number 358/02, as amended, hereby informs its shareholders and the market that:

1- Exceptionally, the Company will not file the Financial Statements for the year ended on December 31, 2016 ("DFs 2016") with CVM within the period established by the CVM Instruction 480/09, due to the review of the accounting treatment determined upon for the transactions carried out by the Company on November 30, 2015, which resulted in the business combination of mining and related logistics activities, without changing its business structure.

2 - This review will impact the financial statements for the fiscal year ended on December 31, 2015, and will consequently impact the opening balances for the DFs 2016.

3 - Due to the technical complexity of the matter and the fact that revision work is still ongoing, with the accompanying of the external auditors, it will not be possible to close the DFs 2016 within the period established by the applicable legislation, leading to a delay in the disclosure of the DFs 2016.

4- As a result, the Ordinary and Extraordinary Shareholders' Meeting to be held on April 28, 2017 will deliberate the following matters: (i) to establish the number of members of the Board of Directors and to elect its members; (ii) to establish the management overall annual compensation for the 2017 fiscal year; and (iii) to discuss the amendment and consolidation of the Company's bylaws. Accordingly, other matters attributed to the Ordinary Shareholders' Meeting, such as taking the management's accounts, examining, discussing and voting on the financial statements and deciding on the allocation of financial earnings for the fiscal year, will be subject to deliberation at an Extraordinary Shareholders' Meeting to be duly convened.

5- The Company is committed to disclosing the DFs 2016 reviewed by the external auditors as soon as possible. However, considering the duty to inform and act with diligence and transparency, the Company has decided to disclose to the market the main operating indicators for the year ended on December 31, 2016, not yet revised by the independent auditors, which will not be impacted by the potential adjustments that may occur as a result of the reviews that are in progress, as follows:

|

Highlights

|

3Q16

|

4Q16

|

2015

|

2016

|

Change

|

|

4Q16

|

x

|

3Q16

|

2016

|

x

|

2015

|

|

Steel Sales (Thousand t)

|

1,172

|

1,187

|

4,990

|

4,857

|

1%

|

(3%)

|

|

- Domestic Market

|

62%

|

62%

|

59%

|

57%

|

-

|

(2%)

|

|

- Overseas Subsidiaries

|

34%

|

34%

|

37%

|

37%

|

-

|

-

|

|

- Exports

|

4%

|

4%

|

4%

|

6%

|

-

|

2%

|

|

|

|

|

|

|

|

|

|

|

|

Average Net Revenue per tonne (R$/t)

|

2,446

|

2,495

|

2,245

|

2,370

|

2%

|

6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Iron Ore Sales (thousand t)¹

|

10,230

|

9,191

|

25,669

|

36,983

|

(10%)

|

44%

|

|

- Domestic Market

|

11%

|

14%

|

2%

|

11%

|

3%

|

9%

|

|

- Exports

|

89%

|

86%

|

98%

|

89%

|

(3%)

|

(9%)

|

|

Average Net Revenue per tonne (USD/t)

|

39

|

45

|

38

|

36

|

15%

|

(5%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Results (R$ million)

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenue

|

4,469

|

4,519

|

15,262

|

17,149

|

1%

|

12%

|

|

Adjusted EBITDA²

|

1,239

|

1,249

|

3,251

|

4,075

|

1%

|

25%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steel

|

552

|

545

|

1,791

|

1,887

|

(1%)

|

5%

|

|

Mining

|

599

|

511

|

1,171

|

1,759

|

(15%)

|

50%

|

|

Logistics

|

161

|

163

|

532

|

604

|

1%

|

14%

|

|

Railways

|

152

|

137

|

469

|

550

|

(10%)

|

17%

|

|

Port

|

9

|

26

|

63

|

54

|

189%

|

(14%)

|

|

Cement

|

4

|

2

|

75

|

22

|

(50%)

|

(71%)

|

|

Energy

|

17

|

17

|

43

|

65

|

-

|

51%

|

|

Eliminations

|

(95)

|

12

|

(361)

|

(262)

|

(113%)

|

(27%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Result (R$ million)

|

|

|

|

|

|

|

|

|

|

|

|

Proporcional Financial Result

4

|

(780)

|

(711)

|

(2,265)

|

(2,684)

|

(9%)

|

18%

|

|

Result with Exchange Rate Variation

|

(74)

|

14

|

416

|

89

|

(119%)

|

(79%)

|

|

CAPEX

|

383

|

452

|

2,182

|

1,632

|

18%

|

(25%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Debt³

|

25,842

|

25,831

|

26,499

|

25,831

|

-

|

(2%)

|

|

Adjusted Cash Position³

|

5,

663

|

5,762

|

8,862

|

5,762

|

2%

|

(35%)

|

|

Net Debt / Adjusted EBITDA²

|

7.4X

|

6.3X

|

8.2X

|

6.3X

|

(1.1X)

|

(1.9X)

|

1

Iron ore sales volumes include 100% of the stake in NAMISA until November 2015 and 100% of the stake in CSN Mineração (former “Congonhas Minérios”) as of December 2015. As of December 2015, iron ore volumes include sales to UPV.

2

Adjusted EBITDA is calculated based on net income/loss, plus depreciation and amortization, income tax, net financial result, results from investees, other operating income (expenses) and includes the proportional share of EBITDA of the jointly-owned investees MRS Logística and CBSI. Adjusted EBITDA includes the 60% stake in Namisa, 33.27% in MRS and 50% in CBSI until November 2015 and the 100% stake in CSN Mineração, 37.27% in MRS and 50% in CBSI as of December 2015.

³Adjusted net debt and adjusted cash include the 33.27% stake in MRS, 60% in Namisa and 50% in CBSI until November 2015. As of December 2015 these lines include the 100% stake in CSN Mineração, 37.27% in MRS and 50% in CBSI, and exclude Forfaiting and Debtor Risk operations.

4

The managerial financial result includes the 60% stake in Namisa, 33.27% in MRS and 50% in CBSI until November 2015 and the 100% stake in CSN Mineração, 37.27% in MRS and 50% in CBSI as of December 2015.

As soon as we have a definition of the date of completion of the abovementioned work, with the review report from the external auditors, the Company will make a further announcement to the market.

São Paulo, March 27, 2017.

David Moise Salama

Investor Relations Executive Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 27, 2017

|

COMPANHIA SIDERÚRGICA NACIONAL

|

|

|

|

By:

|

/

S

/ Benjamin Steinbruch

|

|

|

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By:

|

/

S

/ David Moise Salama

|

|

|

David Moise Salama

Executive Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

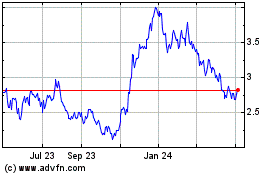

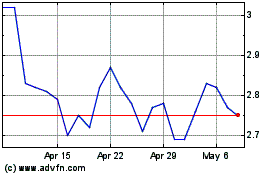

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Apr 2023 to Apr 2024