- Announces sale of New Diversey to Bain

Capital Private Equity for approximately $3.2 billion

- Increases share repurchase program by

an additional $1.5 billion

Sealed Air Corporation (NYSE:SEE) today announced it has entered

into a definitive agreement to sell its Diversey Care division and

the food hygiene and cleaning business within its Food Care

division (together “New Diversey”) to Bain Capital Private Equity,

a leading global private investment firm, for approximately $3.2

billion.

New Diversey will be a leading hygiene and cleaning solutions

company that integrates chemicals, floor care machines, tools and

equipment, with a wide range of technology based value-added

services, food safety services and water and energy management. New

Diversey will continue to employ approximately 8,600 people

globally. Diversey Care and the related food hygiene businesses

combined generated net sales of approximately $2.6 billion in

2016.

“We are pleased that New Diversey has a strong partner to

support future growth initiatives and drive further expansion.

Diversey Care and its related hygiene business has built an

impressive innovation pipeline that includes the Internet of

Clean™, robotics and AHP disinfection technologies, revamped its

go-to-market strategy and significantly improved profitability,”

said Jerome A. Peribere, President and Chief Executive Officer.

“New Sealed Air, a leading provider of food, product and medical

packaging solutions, will continue to focus on accelerating

profitable growth and generating strong cash flow through end

market opportunities and the global adoption of new products and

solutions. Sealed Air’s advanced product portfolio is designed to

reduce waste, conserve resources and provide product security, and

deliver unique and measurable value to customers and the

planet.”

“Diversey has a long track record of leadership in the hygiene

and cleaning solutions market on a global basis,” said Ken Hanau, a

Managing Director at Bain Capital Private Equity. “We are excited

to partner with the talented team at Diversey to grow across key

market verticals and geographies while investing in innovative

hygiene solutions. Bain Capital’s integrated global platform and

strong growth orientation are well aligned with the strategic

vision for Diversey.”

Upon closing of the transaction, Sealed Air expects to use the

proceeds to repay debt and maintain its net leverage ratio in the

range of 3.5 to 4.0 times, repurchase shares to minimize earnings

dilution, and fund core growth initiatives, including potential

complementary acquisitions to its Food Care and Product Care

divisions.

Sealed Air's Board of Directors has authorized an increase of

the share repurchase program by an additional $1.5 billion of

Sealed Air common stock. With this increase, the total

authorization for future repurchases under the program is

approximately $2.2 billion. The Board has also determined that

Sealed Air will maintain its quarterly cash dividend of $0.16 per

common share while the Company reduces earnings dilution. Following

past practices, the Board will continue to evaluate the quarterly

cash dividend annually.

The sale of New Diversey is expected to close in the second half

of 2017, and is subject to certain regulatory approvals and

customary closing conditions. The Acquisition includes a formal

offer to acquire certain of Diversey's business in France and the

Netherlands, which may be accepted following Works Council

consultation. The results of operations of New Diversey will be

reported as discontinued operations beginning in the first quarter

of 2017. Sealed Air is tentatively scheduled to report its first

quarter 2017 results on May 9, 2017.

Citi is acting as financial advisor, and Skadden, Arps, Slate,

Meagher & Flom LLP as legal advisor to Sealed Air. Barclays and

RBC Capital Markets LLC are serving as financial advisors and

Kirkland & Ellis LLP is serving as legal counsel to Bain

Capital Private Equity. Credit Suisse and Goldman Sachs together

with Barclays, BofA Merrill Lynch, HSBC, RBC Capital Markets, and

SunTrust Robinson Humphrey are providing committed financing for

the transaction.

Peribere and Carol P. Lowe, Senior Vice President and CFO, will

host an investor conference call to discuss highlights of the

transaction on March 27, 2017 at 11:00 a.m. (ET). The conference

call will be webcast live on the Investor Relations home page at

www.sealedair.com/investors. A replay of the webcast will also be

available thereafter. Investors who cannot access the webcast may

listen to the conference call live via telephone by dialing (855)

472-5411 (domestic) or (330) 863-3389 (international) and use the

participant code 95564160.

About Sealed Air

Sealed Air Corporation creates a world that feels, tastes and

works better. In 2016, the Company generated revenue of

approximately $6.8 billion by helping our customers achieve their

sustainability goals in the face of today’s biggest social and

environmental challenges. Our portfolio of widely recognized

brands, including Cryovac® brand food packaging solutions, Bubble

Wrap® brand cushioning and Diversey® cleaning and hygiene

solutions, enables a safer and less wasteful food supply chain,

protects valuable goods shipped around the world, and improves

health through clean environments. Sealed Air has approximately

23,000 employees who serve customers in 171 countries. To learn

more, visit www.sealedair.com.

About Bain Capital

Bain Capital Private Equity (www.baincapitalprivateequity.com)

has partnered closely with management teams to provide the

strategic resources that build great companies and help them thrive

since our founding in 1984. Our team of more than 220 investment

professionals creates value for our portfolio companies through our

global platform and depth of expertise in key vertical industries,

including industrials, consumer/retail, financial and business

services, healthcare, and technology, media and telecommunications.

In addition to private equity, Bain Capital invests across asset

classes including credit, public equity and venture capital, and

leverages the firm’s shared platform to capture opportunities in

strategic areas of focus.

Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 concerning our business, consolidated

financial condition and results of operations. Forward-looking

statements are subject to risks and uncertainties, many of which

are outside our control, which could cause actual results to differ

materially from these statements. Therefore, you should not rely on

any of these forward-looking statements. Forward-looking statements

can be identified by such words as “anticipates,” “believes,”

“plan,” “assumes,” “could,” “should,” “estimates,” “expects,”

“intends,” “potential,” “seek,” “predict,” “may,” “will” and

similar references to future periods. All statements other than

statements of historical facts included in this press release

regarding our strategies, prospects, financial condition,

operations, costs, plans and objectives are forward-looking

statements. Examples of forward-looking statements include, among

others, statements we make regarding expected future operating

results, expectations regarding the results of restructuring and

other programs, anticipated levels of capital expenditures and

expectations of the effect on our financial condition of claims,

litigation, environmental costs, contingent liabilities and

governmental and regulatory investigations and proceedings. The

following are important factors that we believe could cause actual

results to differ materially from those in our forward-looking

statements: the tax benefits associated with the Settlement

agreement (as defined in our 2016 Annual Report on Form 10-K),

global economic and political conditions, changes in our credit

ratings, changes in raw material pricing and availability, changes

in energy costs, competitive conditions, the success of the

separation of the Diversey Care and related hygiene business, the

success of our restructuring activities, currency translation and

devaluation effects, the success of our financial growth,

profitability, cash generation and manufacturing strategies and our

cost reduction and productivity efforts, the success of new product

offerings, the effects of animal and food-related health issues,

pandemics, consumer preferences, environmental matters, regulatory

actions and legal matters, and the other information referenced in

the “Risk Factors” section appearing in our most recent Annual

Report on Form 10-K, as filed with the Securities and Exchange

Commission, and as revised and updated by our Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K. Any forward-looking

statement made by us is based only on information currently

available to us and speaks only as of the date on which it is made.

We undertake no obligation to publicly update any forward-looking

statement, whether written or oral, that may be made from time to

time, whether as a result of new information, future developments

or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170327005307/en/

Sealed Air CorporationInvestor:Lori Chaitman,

201-712-7310orMedia:Ken Aurichio, 917-693-5417

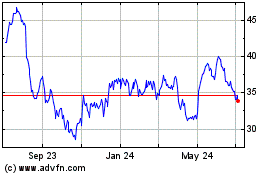

Sealed Air (NYSE:SEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

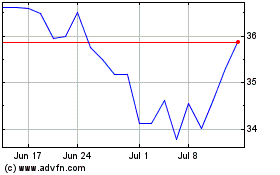

Sealed Air (NYSE:SEE)

Historical Stock Chart

From Apr 2023 to Apr 2024