UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment

No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

SPX Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

| 13320-A Ballantyne Corporate Place

Charlotte, NC 28277

Telephone: (980) 474-3700

Facsimile: (980) 474-3729

March 27, 2017 |

|

|

Fellow Stockholders:

On behalf of the Board of

Directors, we invite you to attend the SPX Corporation 2017 Annual Meeting of Stockholders on May 8, 2017, at 8:00 a.m. (Eastern Time), at the SPX Building, 13320 Ballantyne Corporate Place, Charlotte, North Carolina 28277.

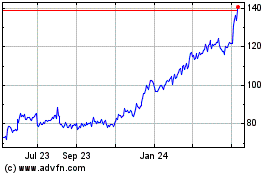

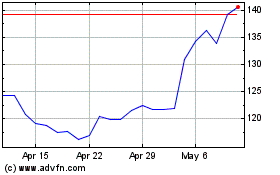

Significant Accomplishments in 2016

We hope you

will join us in celebrating the tremendous success that SPX Corporation has enjoyed over the past year. 2016 marked the first full year of operations as the “new” SPX and was a transformative year for our company. We have accomplished many

of the goals we outlined in the value creation roadmap we presented to investors immediately prior to the spin-off of SPX FLOW, Inc., in September 2015. SPX is now a stronger and more profitable company, which is reflected in the significant

stockholder return we have delivered over the past year.

In our two growth platforms, HVAC and Detection & Measurement, we have seen the introduction of new

products and expansion into new channels. We have also experienced margin expansion in the HVAC segment and in our Transformer business. Furthermore, we have significantly reduced our exposure to the power generation end market through the sales of

the Global Dry Cooling and European Power Generation businesses. In addition to eliminating the ongoing earnings and liquidity implications, these disposals have allowed us to significantly change the business model and risk profile of SPX.

Introducing the Engineered Solutions Segment

In

recognition of this shift in our end market exposure as well as our focus on engineered solutions for grid and process cooling applications, we have changed the name of our Power segment to “Engineered Solutions.”

Enhancing our Focus on Growth and Operational Excellence

We are now positioned to pivot our focus towards growth opportunities. As we presented at our March 6, 2017 Investor Day, we believe that we will deliver significant

organic and inorganic growth over the next few years. We expect to do this by leveraging our foundation of established brands and channels; strong technology and innovation; leading positions in growth markets; and large installed base, as well as

through the implementation of the SPX Business System and a disciplined approach to identifying, executing, and integrating high-quality acquisitions in our HVAC and Detection & Measurement segments. Our Investor Day Presentation is available on

our website (www.spx.com), under the heading “Investor Relations”—“Webcasts and Presentations.”

As you can see, the changes that we have made over the past year have positioned SPX to pursue the growth opportunities ahead of us. We are proud of our team and the

company that we are building together.

Meeting Attendance and Voting

All SPX stockholders of record at the close of business on March 13, 2017, are welcome to attend the Annual Meeting. Whether or not you plan to attend, it is

important that your shares are represented at the Annual Meeting. To ensure that you will be represented, we ask you to vote by telephone, mail, or over the internet as soon as possible.

For stockholders planning to attend this year’s meeting, we and the other members of your Board of Directors look forward to personally greeting you. On behalf of

the Board of Directors and our leadership team, we would like to express our appreciation for your continued interest in the business of SPX.

Sincerely,

|

|

|

| Patrick O’Leary Chairman of the Board of

Directors |

|

Gene Lowe President and Chief Executive

Officer |

SPX CORPORATION

13320-A Ballantyne Corporate Place

Charlotte, North

Carolina 28277

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Monday, May 8, 2017

8:00 a.m. (Eastern Time)

SPX Building, 13320 Ballantyne Corporate Place, Charlotte, North Carolina 28277

Agenda

The principal business of the Annual

Meeting will be to:

| 1. |

Elect the two nominees named in our Proxy Statement to serve as directors until our 2020 Annual Meeting; |

| 2. |

Approve our named executive officers’ compensation, on a non-binding advisory basis; |

| 3. |

Recommend the frequency of future advisory votes on our named executive officers’ compensation, on a non-binding advisory basis; |

| 4. |

Ratify our Audit Committee’s appointment of our independent registered public accounting firm for 2017; and |

| 5. |

Transact any other business properly brought before the meeting or any adjournment thereof. |

Record Date

March 13, 2017

You may vote at the Annual Meeting in person or by proxy if you were a stockholder of record at the close of business on March 13, 2017. You may revoke your proxy

at any time prior to its exercise at the Annual Meeting.

Proxy Materials

This year, we are again electronically disseminating Annual Meeting materials to some of our stockholders, as permitted under the “Notice and Access” rules

approved by the Securities and Exchange Commission. Stockholders for whom Notice and Access applies will receive a Notice of Internet Availability of Proxy Materials containing instructions on how to access Annual Meeting materials via the internet.

The Notice also provides instructions on how to obtain paper copies if preferred.

By Order of the Board of Directors,

John W. Nurkin

Vice President, Secretary and General Counsel

Approximate Date of Mailing of Proxy Materials or

Notice of Internet

Availability:

March 27, 2017

SPX CORPORATION

Proxy Statement

Annual Meeting of Stockholders

The Annual Meeting of our stockholders will be held

at 8:00 a.m. (Eastern Time), on Monday, May 8, 2017, at the SPX Building, 13320 Ballantyne Corporate Place, Charlotte, North Carolina 28277.

We are furnishing

this Proxy Statement to our stockholders in connection with the solicitation of proxies by our Board of Directors for the 2017 Annual Meeting of Stockholders on that date, and any adjournment or postponement of the meeting.

Our 2016 Annual Report on Form 10-K, without exhibits, accompanies this Proxy Statement. You may obtain a copy of the exhibits described in the Form 10-K for a fee

upon request. Please contact Paul Clegg, Vice President, Finance and Investor Relations, SPX Corporation, 13320-A Ballantyne Corporate Place, Charlotte, North Carolina 28277.

Important Notice Regarding the Availability of Proxy Materials

for the 2017 Annual Meeting of Stockholders:

The Notice of Annual Meeting, Proxy Statement, and our 2016 Annual Report

to Stockholders are available electronically at

www.envisionreports.com/SPXC (for stockholders of record) or

www.edocumentview.com/SPXC (for all other stockholders).

TABLE OF CONTENTS

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

MEETING AND VOTING HIGHLIGHTS

This summary highlights information about SPX Corporation (“Company,” “SPX,” “we,” “our,” or “us”), vote

recommendations of our Board of Directors (“Board”), and certain information contained elsewhere in this proxy statement (“Proxy Statement”) for the Company’s 2017 Annual Meeting of Stockholders (the “Annual

Meeting” or the “meeting”). This summary does not contain all of the information that you should consider in voting your shares. You should read the entire Proxy Statement and our 2016 Annual Report on Form 10-K carefully before

voting.

As you read this Proxy Statement, keep in mind that 2016 was a transformative year for SPX. In 2015, we completed the spin-off of the Flow business (the

“Spin-Off”) into a newly-formed, independent, publicly-owned company called SPX FLOW, Inc. (“FLOW”). The Spin-Off became effective on September 26, 2015, at which time our executive officers and directors assumed their new

roles. As a result, 2016 was our first full year as the “new” SPX.

Annual Meeting

|

|

|

| Time and Date: |

|

8:00 a.m. (Eastern Time), Monday, May 8, 2017 |

|

|

| Place: |

|

SPX Building |

|

|

13320 Ballantyne Corporate Place |

|

|

Charlotte, North Carolina 28277 |

|

|

| Record Date: |

|

March 13, 2017 |

Purpose of Meeting and Board Recommendations

|

|

|

|

|

|

|

|

|

| Proposals |

|

Board Vote

Recommendation |

|

Votes Required for

Approval |

|

Page

Reference |

| Proposal 1: |

|

Election of Directors |

|

FOR

each nominee |

|

Majority of votes cast |

|

10 |

| Proposal 2: |

|

Approval of Named Executive Officers’ Compensation, on a Non-binding Advisory Basis (“Say-on-Pay”) |

|

FOR |

|

Majority of votes cast |

|

42 |

| Proposal 3: |

|

Recommendation on Frequency of Future Advisory Votes on Named Executive Officers’ Compensation, on a Non-binding Advisory Basis (“Say-on-Frequency”) |

|

FOR

EVERY “1 YEAR” |

|

Greatest number of votes cast |

|

43 |

| Proposal 4: |

|

Ratification of Appointment of Independent Registered Public Accounting Firm |

|

FOR |

|

Majority of shares present or represented by proxy and entitled to vote |

|

46 |

The Board strongly encourages you to exercise your right to vote on these matters. Your vote is important.

Who May Vote

Holders of SPX common stock whose shares are recorded directly

in their names in our stock register (“stockholders of record”) at the close of business on March 13, 2017, may vote their shares on the matters to be acted upon at the meeting. Stockholders who hold shares of our common stock in

“street name,” that is, through an account with a broker, bank, trustee, or other holder of record, as of such date may direct the holder of record how to vote their shares at the meeting by following the instructions that they receive

from the holder of record.

A list of stockholders entitled to vote at the meeting will be available for examination at our principal executive offices located at

13320-A Ballantyne Corporate Place, Charlotte, North Carolina 28277, for a period of at least ten days prior to the Annual Meeting and during the meeting. The stock register will not be closed between the record date and the date of the

meeting.

|

|

|

|

|

| i |

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

|

How to Vote

|

|

|

|

|

|

|

| How to Vote |

|

Stockholders of

Record* |

|

Street

Name

Holders† |

| |

|

|

|

|

MOBILE DEVICE |

|

Scan the QR Code to vote using your mobile device: |

|

|

|

Refer to voting

instruction form. |

| |

|

|

|

|

INTERNET |

|

Visit the applicable voting website: |

|

www.envisionreports.com/

SPXC |

|

www.proxyvote.com |

| |

|

|

|

|

TELEPHONE |

|

Within the United States, U.S. Territories, and Canada, on touch-tone telephone, call toll free: |

|

1-800-652-VOTE (8683) |

|

Refer to voting

instruction form. |

| |

|

|

MAIL |

|

Complete, sign, and mail your proxy card or voting instruction form in the self-addressed envelope

provided. |

| |

|

|

MEETING |

|

For instructions on attending the Annual Meeting in person, please see below and

page 47. |

| * |

You hold shares registered in your name with SPX’s transfer agent, Computershare, or you are an Employee Benefit Plan Participant. |

| † |

You hold shares held through a broker, bank, trustee, or other holder of record. |

To allow sufficient time for

voting, your voting instructions must be received by 11:59 p.m. (Eastern Time) on May 7, 2017, if you are not voting in person at the meeting.

Admission to Meeting

If you are a stockholder of record, you will need to bring with

you to the meeting either the Notice of Internet Availability of Proxy Materials or any proxy card that is sent to you. Otherwise, you will be admitted only upon other verification of record ownership at the admission counter.

If you own shares held in street name, bring with you to the meeting either (i) the Notice of Internet Availability of Proxy Materials or any voting instruction

form that is sent to you, or (ii) your most recent brokerage statement or a letter from your bank, broker, or other holder of record indicating that you beneficially owned shares of our common stock on March 13, 2017. We can use that to

verify your beneficial ownership of common stock and admit you to the meeting. If you intend to vote at the meeting, you also will need to bring to the meeting a legal proxy from your bank, broker, or other holder of record that authorizes you to

vote the shares that the holder of record holds for you in its name.

Additionally, all persons will need to bring a valid government-issued photo ID to gain

admission to the meeting.

Additional Information

More detailed information about the Annual Meeting and voting

can be found in “Questions and Answers” beginning on page 47.

|

|

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

ii |

CORPORATE GOVERNANCE

CODE OF BUSINESS CONDUCT

We have adopted a Code of Business Conduct that

applies to all our directors, officers, and employees, including our CEO and senior financial and accounting officers. Our Code of Business Conduct requires each director, officer, and employee to avoid conflicts of interest, comply with all laws

and other legal requirements, conduct business in an honest and ethical manner, and otherwise act with integrity and in the best interest of our Company and our stockholders. In addition, our Code of Business Conduct acknowledges special ethical

obligations for financial reporting. The Code of Business Conduct also meets the requirements of a code of business conduct and ethics under the listing standards of the New York Stock Exchange (the “NYSE”) and the requirement of a

“Code of Ethics” as defined in the rules of the Securities and Exchange Commission (the “SEC”). We maintain a current copy of our Code of Business Conduct, and we will promptly post any amendments to or waivers of our Code of

Business Conduct regarding our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, on our website

(www.spx.com) under the heading “Investor Relations—Corporate Governance—Commitment to Compliance.”

CORPORATE GOVERNANCE GUIDELINES

As part of its ongoing commitment to good

corporate governance, the Board has codified its corporate governance practices into a set of Corporate Governance Guidelines. These guidelines assist the Board in the exercise of its responsibilities and may be amended by the Board from time to

time. Our Corporate Governance Guidelines comply with the applicable requirements of the listing standards of the NYSE and are available on our website (www.spx.com) under the heading “Investor Relations—Corporate Governance.”

DIRECTOR INDEPENDENCE

Our Corporate Governance Guidelines require that a substantial majority of the Board meets the independence requirements of the listing standards of the NYSE. At least

annually, our Board reviews whether each of our directors is independent. The Board has adopted categorical Independence Standards to help guide it in this process. Our Independence Standards are available on our website (www.spx.com) under the heading “Investor Relations—Corporate Governance.” Members of the Audit Committee, Compensation Committee, and Nominating and

Governance Committee must meet all applicable independence tests of the NYSE and SEC. Based on its most recent annual review, the Board has concluded that Mr. O’Leary, Mr. Puckett, Mr. Roberts, Dr. Shaw, and Ms. Utley

are independent, as defined in our Independence Standards and the listing standards of the NYSE. The Board has concluded that Mr. Lowe is not independent as defined in our Independence Standards and the listing standards of the NYSE.

The non-employee members of the Board meet regularly in executive session without management. In addition, the non-employee members of the Board meet in

executive session on a regular basis with the CEO and such other management as the Board deems appropriate.

CHARITABLE CONTRIBUTIONS

It is the policy of the Board that no officer or director shall solicit contributions for charities from other officers or directors or directly from SPX if the director

or officer soliciting the contributions personally controls the charity. In addition, no officer or director shall solicit contributions from other officers or directors for charities controlled by SPX.

From time to time, SPX may make contributions to charitable organizations for which a member of our Board or one of our executive officers serves as a director or

officer. In the past three fiscal years, however, the amount of any of these contributions in any single fiscal year has not exceeded the greater of (a) $1 million or (b) 2% of the charitable organization’s consolidated gross

revenues.

RISK OVERSIGHT

The Board exercises risk oversight at SPX.

Committees of the Board take the lead in discrete areas of risk oversight when appropriate. For example, the Audit Committee is primarily responsible for risk oversight relating to financial statements, the Compensation Committee is primarily

responsible for risk oversight relating to executive compensation, and the Nominating and Governance Committee is primarily responsible for risk oversight relating to corporate governance. Committees report to the Board on risk management matters.

Management presents to the Audit Committee its view of the top risks facing SPX in a dedicated “enterprise risk management” presentation at least once a

year. Matters such as risk tolerance and management of risk are also

|

|

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

1 |

CORPORATE GOVERNANCE

discussed at this meeting. Further, management periodically reviews with the Audit Committee the Company’s major risk exposures, identified through the enterprise

risk management process, as well as the steps management has taken to monitor and control such exposures.

In addition, risk is explicitly addressed in a wide range

of Board discussions, including those relating to segment or business unit activities; specific corporate functions (such as treasury, intellectual property, tax, capital allocation, legal, etc.); cybersecurity; and consideration of extraordinary

transactions. As part of these discussions, our directors ask questions, offer insights, and challenge management to continually improve its risk assessment and management. The Board has full access to management, as well as the ability to engage

advisors in order to assist in its risk oversight role.

We conduct an annual in-depth review of the risks associated with our incentive-based agreements and

practices. In 2016, we again determined that the risks were appropriate.

See “Risk Analysis,” on page 30, for further discussion.

COMMUNICATIONS WITH DIRECTORS

Interested parties may communicate with any of

our non-employee directors by writing to the director in care of our Corporate Secretary at our address shown on the cover of this Proxy Statement. In accordance with the policy adopted by our non-employee directors, our Corporate Secretary will

promptly relay to the addressee all communications that he determines require prompt attention by a non-employee director and will regularly provide the non-employee directors with a summary of all substantive communications.

BOARD QUALIFICATIONS AND DIVERSITY

The Nominating and Governance Committee

selects individuals as director nominees based on their business and professional accomplishments; integrity; demonstrated ability to make independent analytical inquiries; ability to understand our business; absence of conflicts of interest; and

willingness to devote the necessary time to Board duties. Neither the Board nor the Nominating and Governance Committee has set minimum requirements with respect to age, education, or years of business experience or has set specific required skill

sets for directors, but each does require each director to have a proven record of success and leadership. The Nominating and Governance Committee seeks to structure the Board such that it consists of a diverse group of individuals, each with a

unique combination of skills, experience, and background. The Nominating and Governance Committee has no set diversity policy or targets, but places what it believes to be appropriate emphasis on certain skills, experience, and background that it

determines adds or would add value to our Board. Knowledge of our industry and strategic perspective, as well as financial expertise and experience on other boards, are examples of attributes that our Board and the Nominating and Governance

Committee consider to be key. The Nominating and Governance Committee also considers effective interaction among Board members and between the Board and management to be crucial factors in considering individuals for nomination.

We believe that each director should bring a wealth of experience and talent, and a diverse perspective that, individually and in the aggregate, adds value to our

Company. As our Corporate Governance Guidelines state, our Nominating and Governance Committee, and ultimately our Board, selects individuals as director nominees based on the totality of their business and professional accomplishments; integrity;

demonstrated ability to make independent analytical inquiries; ability to understand our business; absence of conflicts of interest; and willingness to devote the necessary time to Board duties. For a better understanding of the qualifications of

each of our directors, we encourage you to read their biographies, beginning on page 10, as well as other publicly available documents discussing their careers and experiences.

DIRECTOR NOMINEES

The Nominating and Governance Committee is responsible for

proposing director nominees and will consider director nominee recommendations offered by stockholders in accordance with our by-laws.

At such times as the Board

and the Nominating and Governance Committee determine there is a need to add or replace a director, the Nominating and Governance Committee identifies director candidates through references from its members, other directors, management, or outside

search firms, if appropriate.

In considering individuals for nomination, the Nominating and Governance Committee consults with our Chairman and our President and

CEO. A director’s qualifications in meeting the criteria discussed above under “Board Qualifications and Diversity” are considered at least each time the director is re-nominated for Board membership. The Nominating and

|

|

|

|

|

| 2 |

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

|

CORPORATE GOVERNANCE

Governance Committee applies the same process and standards to the evaluation of each potential director nominee, regardless of whether he or she is recommended by one

or more stockholders or is identified by some other method.

Once the Nominating and Governance Committee identifies a director candidate, directors and members of

management interview the candidate. Following that process, the Nominating and Governance Committee and the Board determine whether to nominate the candidate for election at an annual meeting of stockholders or, if applicable, to appoint the

candidate as a director. Any such nomination or appointment is subject to acceptance by the candidate. Our by-laws require that any director appointed to the Board other than at an annual meeting of stockholders be submitted for election by our

stockholders at the next annual meeting.

If you wish to recommend a nominee for director for the 2018 Annual Meeting, our Corporate Secretary must receive your

written nomination on or before January 8, 2018. You should submit your proposal to our Corporate Secretary at our address on the cover of this Proxy Statement. As detailed in our by-laws, for a nomination to be properly brought before an

annual meeting, your notice of nomination must include the following: (1) your name and address, as well as the name and address of any beneficial owner of SPX stock owned beneficially and of record by you and any beneficial owner as of the

date of the notice, and the name and address of the nominee; (2) the class and number of the shares (which information must be supplemented as of the record date); (3) a description of certain agreements, arrangements, or understandings

entered into by you or any beneficial owner with respect to the shares (which information must be supplemented as of the record date); (4) a statement that you are a record holder of SPX shares entitled to vote at the meeting and that you plan

to appear in person or by proxy at the meeting to make the nomination; (5) a description of all arrangements or understandings between you and any other persons pursuant to which you are making the nomination; (6) any other information

regarding you, any beneficial owner, or the nominee that the rules of the SEC require to be included in a proxy statement; (7) the nominee’s agreement to serve as a director if elected; and (8) a statement as to whether each nominee,

if elected, intends to tender, promptly following his or her election or re-election, an irrevocable resignation effective upon his or her failure to receive the required vote for re-election at the next meeting at which he or she would face

re-election and the acceptance of such resignation by the Board, in accordance with our Corporate Governance Guidelines. In addition, any director nominee must provide information we may reasonably request in order for us to determine the

eligibility of such nominee to serve as an independent director.

DIRECTOR ELECTION

In uncontested elections, we elect directors by majority vote. Under this majority vote standard, each director must be elected by a majority of the votes cast with

respect to that director, meaning that the number of shares voted “for” a director must exceed the number of shares voted “against” that director. In a contested election, directors are elected by a plurality of the votes

represented in person or by proxy at the meeting. An election is contested if the number of nominees exceeds the number of directors to be elected. Whether or not an election is contested is determined ten days in advance of the date we file our

definitive proxy statement with the SEC. This year’s election is uncontested. Accordingly, the majority vote standard will apply.

If a nominee already serving

as a director is not elected at an annual meeting, the law of the State of Delaware (SPX’s state of organization) provides that the director will continue to serve on the Board as a “holdover director” until his or her successor is

elected. Our Nominating and Governance Committee, however, has established procedures requiring directors to tender to the Board advance resignations. As set forth in our Corporate Governance Guidelines, the Board will nominate for election or

re-election as a director only those candidates who agree to tender, promptly following each annual meeting of stockholders at which they are elected or re-elected as a director, irrevocable resignations that will be effective only if (1) the

director fails to receive a sufficient number of votes for re-election at the next annual meeting of stockholders at which he or she faces re-election, and (2) the Board accepts the resignation. In addition, the Board will only fill director

vacancies and new directorships with candidates who agree to tender, promptly following their appointment to the Board, the same form of resignation tendered by other directors in accordance with this provision.

In the event a resignation is triggered as a result of a director not receiving a majority vote, the Nominating and Governance Committee will consider the resignation

and make a recommendation to the Board on whether to accept or reject it, or whether other action should be taken. The Board will consider the Nominating and Governance Committee’s recommendation and publicly disclose its decision and the

rationale behind it in a Current Report on Form 8-K filed with the SEC within 90 days from the date of certification of the election results. At the 2016 Annual Meeting, each director standing for election received a majority of the votes cast for

his or her election or re-election.

|

|

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

3 |

CORPORATE GOVERNANCE

ATTENDANCE AT ANNUAL MEETING

It is our policy to invite all members of our

Board to attend our Annual Meeting. While their attendance is not required, each of our directors serving at the time of our last Annual Meeting attended that meeting. We anticipate all our directors will attend the 2017 Annual Meeting.

INDEPENDENT COMPENSATION CONSULTANT

The Compensation Committee has retained

Pearl Meyer as its sole independent compensation consultant. Pearl Meyer does not provide any services to our Company other than advice to and services for the Compensation Committee relating to compensation of all executives and the Nominating and

Governance Committee relating to compensation of our non-employee directors. The independent compensation consultant may provide other consulting services to SPX, with approval from the Compensation Committee or the Nominating and Governance

Committee. The Compensation Committee reviews services provided by its independent compensation consultant on at least an annual basis.

The independent compensation

consultant:

| • |

|

Assesses data relating to executive pay levels and structure; |

| • |

|

Works with management on recommendations on compensation amounts and structure for all executive officers and directors other than the President and CEO; |

| • |

|

Presents to the Compensation Committee recommendations on compensation amounts and structure for the President and CEO; |

| • |

|

Presents to the Nominating and Governance Committee recommendations on compensation amounts and structure for the non-employee directors; |

| • |

|

Reviews and comments on management’s recommendations relating to executive officer compensation; |

| • |

|

Recommends the list of peer companies against which we benchmark our executive officer and director compensation for approval by the Compensation Committee; |

| • |

|

Reviews compensation-related proxy statement disclosures; and |

| • |

|

Advises the relevant committee on regulatory, best practice, and other developments in the area of executive and director compensation. |

The Compensation Committee has directed the independent compensation consultant to collaborate with management, including our human resources function, to obtain data,

clarify information, and review preliminary recommendations prior to the time they are shared with the relevant committee.

The Compensation Committee has considered

the independence of Pearl Meyer in light of SEC rules, NYSE listing standards, and the requirements of the Compensation Committee charter. The Compensation Committee requested and received a letter from Pearl Meyer addressing the independence of

Pearl Meyer and the Pearl Meyer senior advisor involved in the engagement, including the following factors: (1) other services provided to us; (2) fees paid by us as a percentage of Pearl Meyer’s total revenue; (3) policies or

procedures maintained by Pearl Meyer that are designed to prevent a conflict of interest; (4) any business or personal relationships between the Pearl Meyer senior advisor and any member of the Compensation Committee; (5) any SPX stock

owned by the Pearl Meyer senior advisor; and (6) any business or personal relationships between our executive officers and the Pearl Meyer senior advisor. The Compensation Committee discussed these considerations and concluded that the work

performed by Pearl Meyer and Pearl Meyer’s senior advisor involved in the engagement did not raise any conflict of interest and that Pearl Meyer provides objective and competent advice. The following protocols are designed to help ensure

objectivity:

| • |

|

The consultant reports directly to the Compensation Committee or, in the case of matters relating to non-employee director compensation, to the Nominating and Governance Committee; |

| • |

|

Only the Compensation Committee and the Nominating and Governance Committee have the authority to retain or terminate the consultant with respect to services provided to the relevant committee; and |

| • |

|

The consultant meets as needed with committee members, without the presence of management. |

|

|

|

|

|

| 4 |

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

|

CORPORATE GOVERNANCE

RELATED-PARTY TRANSACTIONS

Pursuant to its charter and a written

related-party policy, the Audit Committee is charged with reviewing and approving any related-party transactions. A related-party transaction is a transaction involving SPX and any of the following persons: a director, director nominee, or executive

officer of SPX; a holder of more than 5% of SPX common stock; or an immediate family member or person sharing the household of any of these persons. When considering a transaction, the Audit Committee is required to review all relevant factors,

including whether the transaction is in the best interest of our Company; our Company’s rationale for entering into the transaction; alternatives to the transaction; whether the transaction is on terms at least as fair to our Company as would

be the case were the transaction entered into with a third party; potential for an actual or apparent conflict of interest; and the extent of the related party’s interest in the transaction. Our legal staff is primarily responsible for the

development and implementation of procedures and controls to obtain information from our directors and officers relating to related-party transactions and then for determining, based on the facts and circumstances, whether we or a related party has

a direct or indirect material interest in the transaction.

In the course of the Board’s determination regarding the independence of each of the non-employee

directors, the Nominating and Governance Committee and Audit Committee considered any relevant transactions, relationships, or arrangements. No member of our Board or management was aware of any transactions that would require disclosure.

BOARD LEADERSHIP STRUCTURE

Our governance documents provide the Board with

flexibility to select the leadership structure that is most appropriate for the Company and its stockholders in consideration of then-current circumstances. The Board regularly evaluates the Company’s leadership structure and has concluded that

the Company and its stockholders are best served by not having a formal policy regarding whether the same individual should serve as both Chairman of the Board and CEO. This approach allows the Board to elect the most qualified director as Chairman

of the Board while also maintaining the ability to separate the Chairman of the Board and CEO roles when necessary or appropriate. For example, as of September 26, 2015, we separated the positions of Chairman of the Board and CEO in light of

the fact that our then-elected CEO was both new to the role and had not previously served on a public company board of directors.

Currently, Eugene J. Lowe,

III, serves as our President and CEO, a position he has held since September 26, 2015. In this role, Mr. Lowe is responsible for managing the day-to-day operations of the Company and for planning, formulating, and coordinating the

development and execution of our corporate strategy, policies, goals, and objectives. Mr. Lowe is accountable for Company performance and reports directly to the Board.

Effective September 26, 2015, Patrick J. O’Leary was appointed to serve as our non-employee Chairman of the Board. In this role,

Mr. O’Leary’s responsibilities include the following:

| • |

|

Serving as a resource to the President and CEO in connection with strategic planning and other matters of strategic importance to the Company; |

| • |

|

Receiving reports from the President and CEO, organizing and facilitating the President and CEO evaluation process, and providing ongoing, constructive feedback to the President and CEO; |

| • |

|

Consulting with the President and CEO regarding the Company’s relations and communications with stockholders of the Company, analysts, and the investor community; |

| • |

|

Chairing meetings of the Board; |

| • |

|

Setting the schedule and agenda for Board meetings in consultation with the President and CEO; |

| • |

|

Determining the information that is sent to the Board in consultation with the President and CEO; |

| • |

|

Presiding over the executive sessions and other meetings of the non-employee directors; and |

| • |

|

Communicating the results of meetings of the non-employee directors to the President and CEO and other members of management, as appropriate. |

In the event the Board determines that the same individual should again serve as both Chairman of the Board and CEO, the Board will establish an independent Lead

Director position. In such case, the Lead Director would be elected by and from the independent directors and would have clearly delineated duties. These duties, as set forth in our Corporate Governance Guidelines,

|

|

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

5 |

CORPORATE GOVERNANCE

would include acting as principal liaison between the independent directors and the Chairman and CEO, chairing meetings of independent directors, developing the

Board’s agendas in collaboration with the Chairman and CEO, and reviewing and advising on the quality of the information provided to the Board.

The small size

of our Board and the relationship between management and non-employee directors put each director in a position to influence agendas, the flow of information, and other matters. Our non-employee directors meet regularly in private session, without

management, as part of our Board meetings and can also call additional meetings of the non-employee directors at their discretion.

The Board believes that its

current leadership structure provides an appropriate balance among strategy development, operational execution, and independent oversight, and this structure is therefore in the best interests of the Company and its stockholders.

BOARD COMMITTEES

The Board met six times in 2016. The Board currently has a

standing Audit Committee, Compensation Committee, and Nominating and Governance Committee. Each director attended at least 75% of the meetings of the Board and of the committees on which he or she served in 2016. Each committee has adopted a charter

that specifies the composition and responsibilities of the committee. Each committee charter is posted on our website (www.spx.com) under the heading

“Investor Relations—Corporate Governance—Board Committees.”

The table below provides membership and 2016 meeting information for each of

the Board committees.

|

|

|

|

|

|

|

| Directors |

|

Audit

Committee |

|

Compensation

Committee |

|

Nominating and

Governance Committee |

| Ricky D.

Puckett |

|

Chair |

|

X |

|

X |

| David A.

Roberts |

|

X |

|

Chair |

|

X |

| Ruth G.

Shaw |

|

X |

|

X |

|

Chair |

| Tana L.

Utley |

|

X |

|

|

|

|

| Number of

Meetings |

|

7 |

|

6 |

|

4 |

AUDIT COMMITTEE

Membership

The Board has determined that each

member of the Audit Committee is independent in accordance with our Audit Committee charter, Corporate Governance Guidelines, and Independence Standards, as well as with the rules of the SEC and the listing standards of the NYSE. In addition, the

Board has determined that each member of the Audit Committee has a working familiarity with basic finance and accounting practices, including the ability to read and understand financial statements. Finally, the Board has determined that

Mr. Puckett is an “audit committee financial expert” under the rules of the SEC and has accounting and/or related financial management expertise, as required by the listing standards of the NYSE.

Function

The Audit Committee is responsible for

ensuring the integrity of the financial information reported by our Company. The Audit Committee appoints the independent registered public accounting firm, approves the scope of audits performed by it and by the internal audit staff, and reviews

the results of those audits. The Audit Committee also meets with management, the Company’s independent registered public accounting firm, and the internal audit staff to review audit and non-audit results, as well as financial, cybersecurity,

accounting, compliance, and internal control matters.

Additional information on the Audit Committee and its activities is set forth in the “Audit Committee

Report” on page 44.

|

|

|

|

|

| 6 |

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

|

CORPORATE GOVERNANCE

COMPENSATION COMMITTEE

Membership

The Board has determined that each member of the Compensation Committee is independent in accordance with our Compensation Committee Charter, Corporate Governance

Guidelines, and Independence Standards, as well as with the rules of the SEC and the listing standards of the NYSE. In addition, the Board has determined that each member of the Compensation Committee meets the “outside director” and

“non-employee director” requirements as defined, respectively, under Section 162(m) of the Internal Revenue Code and Section 16 under the Securities Exchange Act of 1934, as amended.

Function

The Compensation Committee sets the

compensation for our executive officers, including agreements with our executive officers, equity grants, and other awards, and makes recommendations to the Board on these same matters for our CEO. The Compensation Committee receives input regarding

compensation for our executive officers, including proposed compensation, from its independent compensation consultant, as well as from our CEO for his direct reports. The Compensation Committee has delegated to our CEO the authority to issue

one-time grants of up to $50,000 per individual and $250,000 in the aggregate annually to non-officer employees.

The Compensation Committee has the authority under

its charter to retain, terminate, and set fees and retention terms for such independent compensation consultant or other outside advisors as it deems necessary or appropriate in its sole discretion. The Compensation Committee reviews outside

advisors and consultants on at least an annual basis to determine objectivity and review performance, including a review of the total fees paid to such advisors or consultants. The Compensation Committee has retained Pearl Meyer as its independent

compensation consultant.

Additional information on the Compensation Committee, its activities, and its relationship with its independent compensation consultant,

and on management’s role in setting compensation, is set forth in “Compensation Discussion and Analysis,” beginning on page 18, and “Corporate Governance—Independent Compensation Consultant,” beginning on

page 4.

NOMINATING AND GOVERNANCE COMMITTEE

Membership

The Board has determined that each

member of the Nominating and Governance Committee is independent in accordance with our Nominating and Governance Committee Charter, Corporate Governance Guidelines, and Independence Standards, as well as with the rules of the SEC and the listing

standards of the NYSE.

Function

The

Nominating and Governance Committee assists the Board in identifying qualified individuals to become Board members and recommending director nominees to the Board; develops and recommends to the Board our Corporate Governance Guidelines; leads the

Board in its annual review of the Board’s performance; and makes recommendations to the Board regarding the compensation of non-employee directors and the assignment of individual directors to various committees. The Nominating and Governance

Committee also approves equity awards for non-employee directors, subject to Board approval.

|

|

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

7 |

DIRECTOR COMPENSATION

Annual Compensation

Our director compensation program includes the following

compensation opportunities for our non-employee directors:

|

|

|

|

|

|

Annual Retainer of Cash |

|

$ |

75,000 |

|

| Annual Equity Grant

of Time-Vested Restricted Stock |

|

$ |

130,000 |

|

| Additional

Fees: |

|

|

|

|

| Chairman of the Board |

|

$ |

125,000 |

|

| Audit Committee Chair |

|

$ |

20,000 |

|

| Compensation Committee

Chair |

|

$ |

15,000 |

|

| Nominating and Governance Committee

Chair |

|

$ |

10,000 |

|

We pay the annual retainer and any applicable additional fees to our non-employee directors in equal quarterly installments, paid in

arrears. The cash portion of compensation for a director who has a partial quarter of service (due to joining or leaving the Board, or beginning or ending service as Chairman or a Committee Chair, during the quarter) is pro-rated. We do not pay

meeting fees or additional compensation to directors for special meetings.

The annual equity grant is provided by grants of restricted stock under the SPX

Corporation 2006 Non-Employee Directors’ Stock Incentive Plan (the “2006 Directors’ Plan”) and the SPX Corporation 2002 Stock Compensation Plan (the “2002 Stock Plan”). We award restricted shares to our non-employee

directors based on the grant date value of the award (calculated by dividing the $130,000 annual equity retainer by the closing price of the Company’s stock on the date of grant). The restricted stock award is granted on the date of our Annual

Meeting, which restricted shares vest the day before the following annual meeting. Vesting is subject to the director’s continued service on our Board through such vesting date. The annual equity grant for a director who has a partial year of

service (due to joining the Board during the year) is pro-rated.

We do not currently pay dividends.

Directors who are SPX employees receive no compensation for their service as directors.

The Nominating and Governance Committee reviews non-employee director compensation from time to time and makes recommendations to the Board. The Nominating and

Governance Committee compares our non-employee director compensation to our peer companies and consults with our independent compensation consultant when reviewing compensation type and structure.

2016 COMPENSATION

As of the Spin-Off, our non-employee directors each

received payments for the annual retainer and any applicable additional fees, with annualized values as listed above, pro-rated for his or her period of service beginning as of the Spin-Off, which was the date they each became a non-employee

director of the Company, through the 2016 Annual Meeting. After the 2016 portions of the pro-rated annual retainer from the Spin-Off to the 2016 Annual Meeting and any applicable additional fees (described above) were paid to our non-employee

directors, the third and fourth quarters of the 2016 payments were made in equal installments as described above. In addition, each received restricted stock of the Company in the amount of $130,000 (as described above) granted as of the

2016 Annual Meeting, which vests the day before the 2017 Annual Meeting, subject to the director’s continued service on our Board through such vesting date.

Mr. Lowe, our President and Chief Executive Officer, received no compensation for his service as a director.

CHANGES FOR 2017

Effective for 2017, the annual equity grant will be

provided by grants of restricted stock units, which shall be subject to the same vesting schedule described above. Additionally, our non-employee directors will be given the option to defer settlement of such restricted stock unit grants that vest

until six months after separating from service on our Board.

|

|

|

|

|

| 8 |

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

|

DIRECTOR COMPENSATION

OTHER BENEFITS

Matching Gifts Program

The SPX Foundation will make matching donations for qualified charitable contributions for any director up to a total of $10,000 per year.

Travel Reimbursements

We reimburse non-employee

directors for the reasonable expenses of attending Board and committee meetings and for expenses associated with director training and development. From time to time, a director’s spouse may accompany the director to certain business

functions, and tax laws may require the incremental costs associated with the spouse’s attendance to be imputed as income to the director. On occasion, a director’s spouse may accompany a director when he or she travels on our corporate

aircraft for Board-related business; in such instances, the value of the spouse’s travel is imputed as income to the director (determined under the U.S. Department of Transportation’s standard industry fare level (“SIFL”)).

STOCK OWNERSHIP GUIDELINES

Our Stock Ownership Guidelines are designed to

help ensure that our directors are engaged and have interests closely aligned with those of our long-term stockholders. We request that all non-employee directors achieve holdings in Company stock of three times the annual cash retainer within five

years of his or her date of appointment as a director. All of our directors were in compliance with these requirements as of March 13, 2017. For additional information on our Stock Ownership Guidelines, see “Stock Ownership

Guidelines,” beginning on page 15.

Director Compensation Table

The following table summarizes the compensation of our directors who served during 2016. Mr. Lowe, our President and CEO, receives no compensation in connection

with his service as a director and, accordingly, he is omitted from this table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Directors |

|

Fees Earned or

Paid in Cash

($)(1) |

|

|

Stock

Awards

($)(2) |

|

|

All Other

Compensation ($)(3) |

|

|

Total

($) |

|

| Christopher J.

Kearney |

|

$ |

61,562 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

61,562 |

|

| Patrick J.

O’Leary |

|

$ |

164,166 |

(a) |

|

$ |

130,000 |

|

|

$ |

— |

|

|

$ |

294,166 |

|

| Ricky D.

Puckett |

|

$ |

77,979 |

(b) |

|

$ |

130,000 |

|

|

$ |

7,500 |

|

|

$ |

215,479 |

|

| David A.

Roberts |

|

$ |

73,875 |

(c) |

|

$ |

130,000 |

|

|

$ |

— |

|

|

$ |

203,875 |

|

| Ruth G. Shaw |

|

$ |

69,770 |

(d) |

|

$ |

130,000 |

|

|

$ |

— |

|

|

$ |

199,770 |

|

| Tana L.

Utley |

|

$ |

61,562 |

|

|

$ |

130,000 |

|

|

$ |

— |

|

|

$ |

191,562 |

|

| (1) |

Represents annual retainer of $75,000, a portion of which is the 2016 portion of the pro-rated fee for service beginning as of the Spin-Off in 2015 and running until the 2016 Annual Meeting. In addition:

|

| |

a. |

Mr. O’Leary’s fees include $102,604, representing the 2016 portion of the pro-rated additional fee for serving as Chairman of the Board after the Spin-Off.

|

| |

b. |

Mr. Puckett’s fees include $16,417, representing the 2016 portion of the pro-rated additional fee for serving as Audit Committee Chair after the Spin-Off.

|

| |

c. |

Mr. Roberts’s fees include $12,312, representing the 2016 portion of the pro-rated additional fee for serving as Compensation Committee Chair after the Spin-Off. |

| |

d. |

Dr. Shaw’s fees include $8,208, representing the 2016 portion of the pro-rated additional fee for serving as Nominating and Governance Committee Chair after the Spin-Off. |

| (2) |

Stock awards are time-vested awards that vest the day before the next annual meeting following the grant date. The amounts in the table represent the grant date fair value, based on the closing price of our stock on the

grant date. Mr. Kearney resigned from service on our Board effective December 31, 2016; therefore, Mr. Kearney’s award was forfeited as he resigned prior to the vesting date. |

| (3) |

Represents matching donations for qualified charitable contributions for Mr. Puckett. |

|

|

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

9 |

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board currently consists of six directors and one vacancy. The directors are divided into three classes. There are currently three directors in the first class, two

directors in the second class, and one director and one vacancy in the third class.

At this Annual Meeting, you will be asked to elect two directors to the second

class, Mr. Puckett and Ms. Utley. Mr. Lowe, Mr. O’Leary, and Mr. Roberts were elected to the first class and Dr. Shaw was elected to the third class by our stockholders at our 2016 Annual Meeting of Stockholders,

and they will continue to serve on the Board as described below.

Each of the director nominees is a current SPX director and, if elected, will serve for the terms

as described below until a qualified successor director has been elected or until he or she resigns, retires, or is removed by the stockholders for cause.

Each

director nominee has agreed to tender, promptly following his or her election, an irrevocable resignation effective upon his or her failure to receive the required vote for re-election at the next meeting at which he or she would face re-election

and the acceptance of such resignation by the Board, in accordance with our Corporate Governance Guidelines.

Your shares will be voted as you specify on the proxy

card that accompanies this Proxy Statement. If you do not specify how you want your shares voted, then we will vote them FOR the election of each of Mr. Puckett and Ms. Utley. If unforeseen circumstances (such as death or disability) make

it necessary for the Board to substitute another person for any of the nominees, then your shares will be voted FOR that other person. The Board does not anticipate that any of the nominees will be unable to serve.

Nominees for Election to Serve Until 2020 Annual Meeting

|

|

|

Rick Puckett

Retired Executive

Vice President, CFO,

Treasurer, and

Chief

Administrative Officer of

Snyder’s-Lance, Inc. Age: 63

Director since: 2015

Committees:

• Audit (Chair) • Compensation • Nom. &

Gov. |

|

PROFESSIONAL HIGHLIGHTS

Ricky D. Puckett, 63, retired in December 2016 from Snyder’s-Lance, Inc., a snack

foods manufacturer, where he had served as Executive Vice President, Chief Financial Officer and Treasurer since December 2010, adding the role of Chief Administrative Officer, with responsibility for Human Resources and Legal, in 2014.

Mr. Puckett served as Executive Vice President, Chief Financial Officer and Treasurer of Lance, Inc., from 2006 until its merger with Snyder’s-Lance, Inc. in 2010. Prior to joining Lance, Inc., Mr. Puckett served as Executive Vice

President, Chief Financial Officer, Secretary and Treasurer of United Natural Foods, Inc., a wholesale distributor of natural and organic products, from 2005 to 2006; and as Senior Vice President, Chief Financial Officer and Treasurer of United

Natural Foods, Inc., from 2003 to 2005. Mr. Puckett is a director of, and serves as audit committee chair for, Whitehorse Finance, Inc. He has served on the board of the North Carolina Blumenthal Performing Arts Center and the Wake Forest

Graduate School in Charlotte. He is a certified public accountant and received his bachelor’s degree in Accounting and his MBA from the University of Kentucky.

SKILLS AND QUALIFICATIONS

Mr. Puckett brings extensive accounting and financial experience, including financial strategy and governance to our Board. In addition, he offers a deep

understanding of mergers and acquisitions; strategic planning and analysis; commodity risk management; strategic information technology; organizational development; human relations management; and investor relations. |

|

|

|

|

|

| 10 |

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

|

PROPOSAL NO. 1: ELECTION OF DIRECTORS

|

|

|

Tana Utley

Vice President of Large

Power Systems Division at

Caterpillar Inc.

Age: 53 Director

since: 2015 Committees: • Audit |

|

PROFESSIONAL HIGHLIGHTS

Tana L. Utley, 53, has served as Vice President of the Large Power Systems Division at

Caterpillar Inc., a manufacturer of construction and mining equipment, engines, turbines, and locomotives, since 2013. She joined the company in 1986 and has held a number of roles, including a variety of engineering and general management

positions. Ms. Utley has served in key engineering and leadership roles in the development of near-zero-emissions engines, and she has held general management positions in Caterpillar’s components and engines businesses. She earned her

bachelor’s degree in Mechanical Engineering from Bradley University and her M.S. in Management from the Massachusetts Institute of Technology.

SKILLS AND QUALIFICATIONS

Ms. Utley brings a wealth of knowledge in engineering, operations, and implementation of new programs to our Board. Ms. Utley also brings a depth of

understanding of how to minimize the environmental impact of manufacturing companies. |

|

|

|

|

|

YOUR BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS

A VOTE “FOR” EACH OF THE

DIRECTOR NOMINEES. |

Director Continuing to Serve Until 2018 Annual Meeting

|

|

|

Ruth Shaw

Retired Group Executive

for Public Policy and

President

of

Duke Nuclear Age: 69 Director since: 2015 Committees:

• Nom. & Gov. (Chair)

• Audit • Compensation |

|

PROFESSIONAL HIGHLIGHTS

Ruth G. Shaw, 69, retired in 2007 from Duke Energy Corporation, an electricity and

natural gas provider, but remained an Executive Advisor to the company until 2009. At Duke, she served as Group Executive for Public Policy and President, Duke Nuclear, from 2006 to 2007; President and Chief Executive Officer, Duke Power Company,

from 2003 to 2006; Executive Vice President and Chief Administrative Officer from 1997 to 2003; and in various other roles from 1992 to 1997. She was also President of The Duke Energy Foundation from 1994 to 2003. Dr. Shaw is currently a

director of The Dow Chemical Company and DTE Energy, and she serves on the board of trustees of the UNC Charlotte Foundation. She is also the founding board chair and a board member of The Carolinas Thread Trail and a former member of the executive

committees of the Nuclear Energy Institute and the Institute of Nuclear Power Operations. She earned her bachelor’s degree and M.A. from East Carolina University and her Ph.D. from the University of Texas at Austin.

SKILLS AND QUALIFICATIONS

Dr. Shaw contributes a deep understanding of corporate governance; human resources management;

executive compensation; information technology; communications and public relations; environment, health and safety management; procurement; and diversity to our Board. |

|

|

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

11 |

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Directors Continuing to Serve Until 2019 Annual Meeting

|

|

|

Gene Lowe

President and CEO of

SPX Corporation

Age: 49 Director

since: 2015 Committees: • None |

|

PROFESSIONAL HIGHLIGHTS

Eugene J. Lowe, III, 49, has served as President and Chief Executive Officer of

SPX Corporation since September 2015. He was appointed an officer of SPX in 2014 and previously served as Segment President, Thermal Equipment and Services, from 2013 to 2015; President, Global Evaporative Cooling, from 2010 to 2013; and Vice

President of Global Business Development and Marketing, Thermal Equipment and Services, from 2008 to 2010. Prior to joining SPX, Mr. Lowe held positions with Milliken & Company, Lazard Technology Partners, Bain & Company, and Andersen

Consulting. He earned his bachelor’s degree in Management Science from Virginia Polytechnic Institute and State University and his MBA from Dartmouth’s Tuck School of Business.

SKILLS AND QUALIFICATIONS

Mr. Lowe brings valuable operations, strategic planning, and business development experience to our Board. As the only member of SPX management to serve on the

Board, Mr. Lowe also contributes a level of understanding of our Company not easily attained by an outside director. |

|

|

|

Patrick O’Leary

Retired

Executive

Vice President, Finance,

Treasurer, and CFO of

SPX Corporation Age: 59

Director since: 2015

Committees:

• None |

|

PROFESSIONAL HIGHLIGHTS

Patrick J. O’Leary, 59, retired in August 2012 from SPX Corporation, having served

as Vice President, Finance, Treasurer and Chief Financial Officer from 1996, and later adding the title of Executive Vice President in 2004. During his more than 15 years with SPX, he was a principal architect of the Company’s transformation

until his retirement. Prior to joining SPX, Mr. O’Leary served as Chief Financial Officer and a director of Carlisle Plastics, Inc., from 1994 to 1996. He began his career with Deloitte & Touche, where he held various roles of

increasing responsibility from 1978 to 1994, including Partner in the firm’s Boston office from 1988 to 1994. Mr. O’Leary currently serves as a director of PulteGroup, Inc., and Halyard Health Inc. He earned his bachelor’s degree

in Accountancy and Law from the University of Southampton, England. SKILLS AND

QUALIFICATIONS Mr. O’Leary contributes a deep understanding of SPX history and

businesses to our Board. In addition, he brings broad financial strategy and governance experience, including strong financial acumen. Mr. O’Leary also contributes leadership skills developed through his experience serving on various

public company boards. |

|

|

|

|

|

| 12 |

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

|

PROPOSAL NO. 1: ELECTION OF DIRECTORS

|

|

|

Dave Roberts

Chairman of the Board

and Retired Executive

Chairman,

President, and

CEO of Carlisle Companies, Inc.

Age: 69 Director

since: 2015 Committees: • Compensation (Chair)

• Audit • Nom. & Gov. |

|

PROFESSIONAL HIGHLIGHTS

David A. Roberts, 69, has served as Chairman of the Board of Carlisle Companies, Inc., a

diversified manufacturing company, since 2017. He previously served as Carlisle’s Executive Chairman of the Board, in 2016; its Chairman and Chief Executive Officer, from 2014 to 2015; and its Chairman, President and Chief Executive Officer,

from 2007 to 2014. Prior to joining Carlisle, Mr. Roberts served as Chairman, President and Chief Executive Officer of Graco, Inc., a fluid handling system provider, from 2001 to 2007. Prior to that, Mr. Roberts served as a Group Vice

President of The Marmon Group, LLC, a diversified industrial holding company, from 1995 to 2001. He began his career serving in a variety of manufacturing, engineering, and general management positions with The Budd Company, Pitney Bowes, and FMC

Corporation. Mr. Roberts is currently Lead Director of Franklin Electric Co., Inc. He earned his bachelor’s degree from Purdue University and his MBA from Indiana University.

SKILLS AND QUALIFICATIONS

Mr. Roberts brings extensive experience in senior management of multinational companies,

including expertise in the industrial and manufacturing sectors, to our Board. Mr. Roberts also contributes strong financial acumen and experience from his service on various public company boards. |

|

|

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

13 |

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Director and Nominee Skills and Experience

Under the leadership of our Nominating and Governance Committee,

in 2016 our Board developed a director skills matrix that identifies expertise and experience that the Board believes contribute to an effective and well-functioning board and that the Board as a whole should possess.

The Nominating and Governance Committee and the Board use this matrix to identify areas for director training and as a tool to maintain a balanced and well-rounded

board. In addition, the Nominating and Governance Committee considers these and other criteria when evaluating potential candidates for the Board. Together, this variety of skill sets, experiences, and personal backgrounds allows our directors to

provide the diversity of thought that is critical to the Board’s decision-making and oversight process. For a better understanding of our Board qualifications and diversity, we encourage you to read “Board Qualifications and

Diversity” on page 2.

|

|

|

|

|

| 14 |

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

|

OWNERSHIP OF COMMON STOCK

Stock Ownership Guidelines

We maintain Stock Ownership Guidelines to emphasize the

importance of substantive, long-term share ownership by our directors and officers to align their financial interests with those of our stockholders.

The guidelines

are:

|

|

|

| Position |

|

Target Value |

| Non-employee Directors |

|

3x annual retainer |

| Chief Executive Officer |

|

5x annual salary |

| Chief Operating Officer* |

|

4x annual salary |

| Other Executive Officers |

|

3x annual salary |

| Other Designated Executives |

|

1x annual salary |

|

| * SPX does not currently have the COO position. |

Shares held in family trusts and shares held in retirement plan accounts are deemed to be owned shares for purposes of these guidelines.

Unexercised stock options and unvested performance-based equity awards are excluded. We ask non-employee directors and executives to attain the desired level of stock ownership within five years of appointment to a director or officer position.

Once a non-employee director or executive attains the desired level of share ownership, he or she will continue to be in compliance with these guidelines even if he or

she later falls below the guideline, as long as he or she retains at least 50% of the net shares acquired upon exercise of stock options and at least 50% of the net shares acquired pursuant to vested restricted equity awards and vested restricted

stock unit grants until he or she again meets or exceeds the guidelines. “Net shares” means the shares remaining after disposition of shares necessary to pay the related tax liability and, if applicable, the stock option exercise price.

Each non-employee director and named executive officer was in compliance with these requirements as of March 13, 2017.

|

|

|

|

|

|

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

15 |

OWNERSHIP OF COMMON STOCK

Ownership of Common Stock

DIRECTORS AND EXECUTIVE OFFICERS

The following table includes information about how much of our common stock (our only outstanding class of equity securities) is beneficially owned by:

| • |

|

Each director and nominee for director; |

| • |

|

Each executive officer in the Summary Compensation Table on page 32; and |

| • |

|

All directors and officers as a group. |

Unless otherwise noted, amounts and percentages are as of March 13, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Number of

Shares of Common Stock

Beneficially Owned(1) |

|

|

Right to

Acquire Beneficial Ownership

Under Options Exercisable/ Stock Units

Distributable Within

60 Days |

|

|

Percent

of Class |

|

| DIRECTORS AND DIRECTOR

NOMINEES WHO ARE NOT NAMED EXECUTIVE OFFICERS |

|

| Patrick J.

O’Leary |

|

|

15,382 |

|

|

|

— |

|

|

|

* |

|

| Ricky D.

Puckett |

|

|

15,382 |

|

|

|

— |

|

|

|

* |

|

| David A.

Roberts |

|

|

15,382 |

|

|

|

— |

|

|

|

* |

|

| Ruth G.

Shaw |

|

|

15,382 |

|

|

|

— |

|

|

|

* |

|

| Tana L.

Utley |

|

|

15,382 |

|

|

|

— |

|

|

|

* |

|

| NAMED EXECUTIVE OFFICERS |

|

|

|

|

|

|

|

|

|

|

|

|

| Eugene J. Lowe,

III |

|

|

49,830 |

|

|

|

92,820 |

|

|

|

* |

|

| Scott W.

Sproule |

|

|

37,157 |

|

|

|

15,576 |

|

|

|

* |

|

| J Randall

Data |

|

|

8,400 |

|

|

|

12,461 |

|

|

|

* |

|

| John W.

Nurkin |

|

|

25,161 |

|

|

|

10,342 |

|

|

|

* |

|

| John W. Swann,

III |

|

|

21,840 |

|

|

|

10,592 |

|

|

|

* |

|

| All directors and executive officers as a group (12 persons) |

|

|

237,728 |

|

|

|

157,366 |

|

|

|

* |

|

| (1) |

Beneficial ownership is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. In general, beneficial ownership includes any shares a director or officer can vote or transfer and

stock options that are exercisable. The number of our shares beneficially owned by each of the named executive officers and by all directors and officers as a group includes shares represented as held under the individual’s account under SPX

Corporation Retirement Savings and Stock Ownership Plan. The stockholders named in this table have sole voting and investment power for all shares shown as beneficially owned by them. |

|

|

|

|

|

| 16 |

|

2017 PROXY STATEMENT

2017 PROXY STATEMENT |

|

|

OWNERSHIP OF COMMON STOCK

PRINCIPAL STOCKHOLDERS

The following table

includes certain information about each person or entity known to us to be the beneficial owner of more than five percent of the issued and outstanding shares of our common stock.

|

|

|

|

|

|

|

|

|

| Name and Address |

|

Shares of

Common Stock Beneficially Owned |

|

|

Percent

of

Class(1) |

|

| BlackRock, Inc.

55 East 52nd Street

New York, NY 10055 |

|

|

5,170,944 |

(2) |

|

|

12.09 |

% |

| The Vanguard

Group 100 Vanguard Boulevard

Malvern, PA 19355 |

|

|

3,348,529 |

(3) |

|

|

7.83 |

% |

| Alpine Investment

Management, LLC 8000 Maryland Avenue, Suite 700

St. Louis, MO 63105 |

|

|

2,585,658 |

(4) |

|

|

6.04 |

% |

| (1) |

Ownership percentages set forth in this column are based on the assumption that each of the principal shareowners continued to own, as of March 13, 2017, the number of shares reflected in the table.

|

| (2) |