By Asa Fitch and Benoit Faucon

After years shunning Iran, Western businesses are bursting

through the country's doors.

France's Peugeot and Renault SA are building cars. The U.K.'s

Vodafone Group PLC is teaming up with an Iranian firm to build up

network infrastructure. Major oil companies including Royal Dutch

Shell PLC have signed provisional agreements to develop energy

resources. And infrastructure giants, including Germany's Siemens

AG, have entered into agreements for large projects.

After Iran's nuclear accord with world powers lifted a range of

sanctions, many foreign investors began to push into the promising

market of 80 million people, setting off skirmishes among European

and Asian companies eager to gain a step on more cautious American

rivals.

Peugeot Middle East chief Jean-Christophe Quemard says his

company's early entry has left American competitors in the dust.

"This is our opportunity to accelerate," he said in February.

U.S. companies are at risk of losing lucrative deals to early

movers into the Iranian market, analysts say. But as latecomers,

the companies likely won't face a learning curve in dealing with

the political risks and the bureaucratic difficulties in Iran.

Apple Inc. explored entering Iran after the Obama administration

allowed the export of personal communications devices in 2013,

according to people familiar with the matter. But the company

decided against it because of banking and legal problems, these

people said. Apple declined to comment.

U.S. companies usually need special permission from the Treasury

Department to do business with the country. So though the

Chicago-based Boeing Co. got the go-ahead to sell 80 craft worth

$16.6 billion to Iran last year, the list of American firms with

significant Iranian deals is a short one.

Further complicating matters for U.S. firms: President Donald

Trump threatened to rip up Iran's nuclear deal during his campaign

and he hit the country with new sanctions shortly after taking

office. On Sunday, Iran imposed its own sanctions on 15 American

companies, mainly defense firms.

The nuclear deal removed a range of U.S., European Union and

United Nations sanctions in 2016 that had held back Iranian energy

exports and put the brakes on foreign investment. In exchange,

Tehran agreed to curbs on its nuclear program. But while food,

medicine and agricultural products are exempted from U.S.

restrictions, American products are available in Iran often only

through foreign subsidiaries or third-party importers.

Two of the world's biggest auto makers, Ford Motor Co. and

General Motors Co., have steered clear of Iran since the nuclear

deal. A spokeswoman for Ford said the company was complying with

U.S. law and didn't have any business with Iran. GM is focusing "on

other markets, and other opportunities," said spokesman Tony

Cervone.

Meanwhile, Peugeot, officially known as Groupe PSA SA, is aiming

to hit annual production of 200,000 cars in Iran by next year in

conjunction with its partner Iran Khodro, after the two signed a

400 million-euro (about $430 million) joint-venture agreement in

June. Already, the pace of both Peugeot's and Renault's car sales

in Iran has more than doubled. In February, Renualt sold 15,230

vehicles in Iran, up 175% from a year earlier.

On a recent visit in Tehran's biggest hotels, lobbies were full

of foreigners huddling with prospective Iranian partners. A packed

automotive conference in February drew top executives from Peugeot,

Renault and Citroën. The same day, the Swedish prime minister was

visiting a Scania truck factory west of the capital following its

deal to supply Iran with 1,350 buses.

Iran has caught the attention of a broad spectrum of investors

beyond autos, with foreign companies selling everything from

gas-powered turbines to mining technologies in the country.

Government-approved foreign direct investment shot up to more

than $11 billion last year, official figures show, from $1.26

billion in 2015. Pedram Soltani, the vice president of Iran's

Chamber of Commerce, said more than 200 foreign business

delegations have visited Iran since the nuclear deal took

effect.

"We see what's happening in the U.S. and Mr. Trump's comments,"

says Ghadir Ghiafe, an Iranian steel-industry executive who is

exploring partnerships with South American and European companies.

"Our businessmen don't pay much attention to it."

Foreign firms still face daunting obstacles to do business in

Iran. Iran placed 131st out of 176 countries for corruption in a

ranking by Transparency International last year. It also has major

economic problems, including high unemployment and a banking system

saddled with bad loans. Large international banks remain reluctant

to re-establish links with Iran despite the nuclear deal. That

reluctance has made transfers of money into and out of Iran a

challenge.

Some large multinationals -- including major oil companies and

infrastructure giants -- are keeping a close eye on the U.S. and

its new president, in case sanctions snap back into place. Shell,

Total SA of France and OMV of Austria have signed memorandums of

understanding for deals in Iran but have yet to finalize terms.

Last month, Total Chief Executive Patrick Pouyanne said the

company would wait for clarity from the Trump administration before

completing a $4.8 billion investment in the country's huge South

Pars offshore gas field.

But many foreign firms are finding the country's growth hard to

ignore.

The International Monetary Fund recently estimated the economy

grew by 7.4% in the first half of the Iranian fiscal year that

ended this month, rebounding from a decline in the previous year .

Meanwhile, a surge in demand has pushed consumer spending in Tehran

to $5,240 per capita in 2017, up by around 11% compared with 2016,

according to the London-based Planet Retail.

The upshot is even if there is demand to buy American, much of

Iran's market is left to European and Asian firms.

"The market is now more diverse with Chinese cars and we realize

how important it is to have satisfied customers," says Mohsen

Karimi, a sales manager at Iran Khodro, a domestic auto

manufacturer that has a partnership with Peugeot. Khodro had sold

out its stock of cars this past year, and was now behind delivery

targets for advance sales, added Mr. Karimi.

Like many Tehran residents, Alireza Aniseh wanted his first car

to stand out in a streetscape filled with boxy Iranian models. The

24-year-old says he is leaning toward buying a Toyota Corolla or

Camry, but his dream is owning a Ford Focus.

"Who doesn't love American cars?" he says.

--Aresu Eqbali contributed to this article.

(END) Dow Jones Newswires

March 27, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

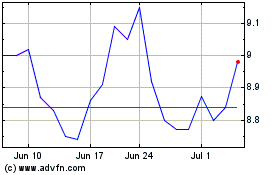

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

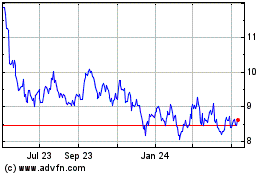

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024