CEO Paid $46.4 Million for Month -- WSJ

March 27 2017 - 3:02AM

Dow Jones News

Johnson Controls withholds what chief earned rest of year

because of loophole

By Theo Francis

Johnson Controls won't say how much it paid its chief executive

for 11 of the months he ran the publicly traded company last fiscal

year, taking advantage of a loophole in pay-disclosure

regulations.

Alex Molinaroli, who has been CEO of Johnson Controls since 2013

and an employee since 1983, received $46.4 million in compensation

from Sept. 2 to Sept. 30, according to documents recently filed

with the Securities and Exchange Commission. The documents omit

what he made for the rest of the company's fiscal year.

Johnson Controls Inc. merged with Tyco International PLC on

Sept. 2, creating a conglomerate renamed Johnson Controls

International PLC that sells everything from smoke alarms to car

batteries.

The SEC doesn't require a company to disclose what its top

executives were paid by a firm before it disappears or becomes a

subsidiary in a merger.

"SEC rules do not call for the company to file additional

information about Mr. Molinaroli's compensation before the merger

with Tyco, which we did not," spokesman Fraser Engerman wrote in an

email. "All SEC guidelines were followed in the formation of our

proxy."

In the merger, the old Johnson Controls became a subsidiary of

Tyco, which then took the Johnson Controls name and stock symbol.

However, for accounting purposes, securities filings note, the old

Johnson Controls was considered the acquirer.

"In the interest of transparency, it seems like you'd want to

disclose, even though you don't have to," said David Larcker,

director of Stanford University's Corporate Governance Research

Initiative.

The value of premerger pay also wasn't disclosed for three other

executives making the transition from the old Johnson Controls to

the new one, company filings show.

Attorneys who handle compensation and pay disclosure for large

companies say such omissions are uncommon but not unheard of. SEC

staff have endorsed the approach in guidance provided to companies

for a decade. The SEC declined to comment.

"Essentially, the rules provide that if you are an executive at

an acquired company and your company goes away in the transaction,

the compensation that was paid to you by your original company, it

just evaporates," said Mark Borges, a pay consultant with Compensia

Inc. and a former special counsel in the SEC division that polices

corporate disclosure.

In recent years, other companies going through big mergers also

have left pre-transaction compensation undisclosed. That list

includes United Continental Holdings Inc. in 2010 and Office Depot

Inc., which bought OfficeMax in 2013. A United spokeswoman said the

company followed SEC reporting requirements. Office Depot declined

to comment.

Compensation consultants and former SEC officials say the

approach is rooted in the idea that the proxy is intended to

reflect decisions by the continuing company's board -- an acquired

company's directors are no longer the ones under scrutiny. None of

the members of the compensation committee at the old Johnson

Controls, for example, now sit on the combined company's pay

committee.

But some say that doesn't justify giving incomplete pay figures,

and leaving investors unsure how much has been omitted. "The

immediate question is, what are you trying to hide, and why are you

trying to hide it?" said Nell Minow, a longtime

corporate-governance advocate.

The pay Johnson Controls disclosed for Mr. Molinaroli includes

$27 million in stock awards, $5.4 million in cash incentive

payments, and a $13.1 million payout of his balance from a

deferred-compensation plan. Much of it was tied to the merger and

paid out after it closed.

Mr. Engerman said investors could look up Mr. Molinaroli's 2015

salary in an earlier securities filing to calculate that portion of

his premerger 2016 pay, and could identify equity awards made

during fiscal 2016 using vesting and expiration dates listed in

tables in the current proxy. Johnson Controls doesn't provide

values for those awards.

Corrections & Amplifications Johnson Controls's merger with

Tyco created a conglomerate that sells everything from smoke alarms

to car batteries. An earlier version of this article incorrectly

stated the conglomerate sells car doors.

Write to Theo Francis at theo.francis@wsj.com

(END) Dow Jones Newswires

March 27, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

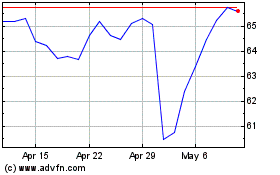

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024