UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

|

|

☒

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to

§240.14a-12

|

OptimumBank Holdings, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(4)

and

0-11.

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount previously paid:

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

4)

|

|

Date Filed:

|

PROXY STATEMENT

2017

ANNUAL MEETING OF SHAREHOLDERS

PROXY VOTING OPTIONS

YOUR

VOTE IS IMPORTANT!

Whether or not you expect to attend in person, we urge you to vote your shares by phone, via the Internet, or by

signing, dating, and returning the enclosed proxy card at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares will save us the expense and extra work of additional solicitation. Submitting

your proxy now will not prevent you from voting your stock at the meeting if you want to do so, as your vote by proxy is revocable at your option.

Voting by the

Internet

or

Telephone

is fast, convenient, and your vote is immediately confirmed and tabulated. Most important,

by using the Internet or telephone, you help us reduce postage and proxy tabulation costs.

Or, if you prefer, you can return the enclosed

Proxy Card in the envelope provided.

PLEASE DO NOT RETURN THE ENCLOSED PROXY CARD IF YOU ARE VOTING OVER THE INTERNET OR BY TELEPHONE.

|

|

|

|

|

|

|

VOTE BY INTERNET

:

|

|

|

|

VOTE BY TELEPHONE

:

|

|

|

|

|

|

http://www.cstproxyvote.com

|

|

|

|

1-866-894-0537

via touchtone phone

|

|

|

|

|

|

24 hours a day / 7 days a week

|

|

|

|

toll-free 24 hours a day / 7 days a week

|

|

|

|

|

|

INSTRUCTIONS:

|

|

|

|

INSTRUCTIONS:

|

|

|

|

|

|

Read the accompanying Proxy Statement.

|

|

|

|

Read the accompanying Proxy Statement.

|

|

|

|

|

|

Go to the following website:

|

|

|

|

Call

1-866-894-0537

|

|

|

|

|

|

http://www.optimumbank.com/stockholder-information/

|

|

|

|

Have your Proxy Card in hand and follow the instructions.

|

|

|

|

|

|

Have your Proxy Card in hand and follow the instructions.

|

|

|

|

|

March 24, 2017

Dear Shareholder:

You are cordially

invited to attend the annual meeting of shareholders of OptimumBank Holdings, Inc., which will be held at the executive offices of OptimumBank, 2477 East Commercial Boulevard, Fort Lauderdale, Florida 33308, on Tuesday, April 25, 2017, at 10:00

a.m.

Details of the business to be conducted at the annual meeting are given in the attached Notice of Annual Meeting and Proxy

Statement.

Also enclosed is a copy of our Annual Report on Form

10-K

for 2016, which contains

important information about our company.

Whether or not you attend the annual meeting, it is important that your shares be represented

and voted at the meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or by signing, dating, and returning the enclosed proxy card in the enclosed envelope. If you decide to attend the annual meeting, you

will be able to vote in person, even if you have previously submitted your proxy.

If you need directions to the annual meeting, please

call our offices at (954)

900-2805.

On behalf of the Board of Directors, I would like to express

our appreciation for your continued support for our company.

Sincerely,

Moishe Gubin

Director

OPTIMUMBANK HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on April 25, 2017

To

the Shareholders:

The annual meeting of the shareholders of OptimumBank Holdings, Inc. will be held at the executive offices of

OptimumBank, 2477 East Commercial Boulevard, Fort Lauderdale, Florida 33308, on Tuesday, April 25, 2017, at 10:00 a.m. for the following purposes:

1. To elect four (4) directors;

2. To ratify the selection of Hacker, Johnson & Smith PA as the Company’s independent auditor for fiscal

year 2017;

3. To consider an advisory vote on executive compensation; and

4. To transact such other business as may properly come before the Annual Meeting.

Only shareholders of record at the close of business on March 17, 2017 are entitled to notice of, and to vote at, this meeting.

|

|

|

By order of the Board of Directors

|

|

|

|

Moishe Gubin

|

|

|

|

Director

|

|

|

|

Fort Lauderdale, Florida

|

|

|

|

March 24, 2017

|

IMPORTANT

Whether or not you expect to attend in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a

quorum at the meeting. Promptly voting your shares by telephone, via the Internet, or by signing, dating, and returning the enclosed proxy card will save our company the expenses and extra work of additional solicitation. An addressed envelope for

which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your

option.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on

April

25, 2017.

Our Proxy Statement and Annual Report on Form

10-K

for 2016 are available at

http://www.optimumbank.com/stockholder-information/

OPTIMUMBANK HOLDINGS, INC.

2477 EAST COMMERCIAL BOULEVARD

FORT LAUDERDALE, FLORIDA 33308

PROXY STATEMENT

2017

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 25, 2017

This Proxy Statement will be first mailed to shareholders on or about March 24, 2017. It is furnished in connection with the solicitation

of proxies by the Board of Directors of OptimumBank Holdings, Inc. (the “Company”) to be voted at the annual meeting of the shareholders of the Company, which will be held at 10:00 a.m. on Tuesday, April 25, 2017, at the executive

offices of OptimumBank (the “Bank”), 2477 East Commercial Boulevard, Fort Lauderdale, Florida 33308, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. Shareholders who execute proxies retain the right

to revoke them at any time before the shares are voted by proxy at the meeting. A shareholder may revoke a proxy by delivering a signed statement to the Secretary of the Company at or prior to the annual meeting or by executing and delivering

another proxy dated as of a later date. The Company will pay the cost of solicitation of proxies.

Shareholders of record at the close of

business on March 17, 2017, will be entitled to vote at the meeting on the basis of one vote for each share held. On the record date, there were 1,103,447 outstanding shares of common stock held of record by approximately 751 shareholders.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

When and where will the annual meeting take place?

The annual meeting will be held on April 25, 2017 at 10:00 a.m. (local time), at the executive offices of the Bank, 2477 East Commercial

Boulevard, Fort Lauderdale, Florida 33308.

Why did I receive this proxy statement?

You received this proxy statement because you held shares of the Company’s common stock on March 17, 2017 (the “Record

Date”) and are entitled to vote at the annual meeting. The Board of Directors is soliciting your proxy to vote at the meeting.

What am I voting

on?

You are being asked to vote on three items:

1. The election of four (4) Directors (see page 6);

2. The ratification of the appointment of Hacker, Johnson & Smith, PA as the Company’s independent

registered public accounting firm for the 2017 fiscal year (see page 10); and

1

3. An advisory vote on executive compensation (see page 13).

How do I vote?

Shareholders of

Record

If you are a shareholder of record, there are four ways to vote:

|

|

•

|

|

By toll free telephone at

1-866-894-0537.

|

|

|

•

|

|

By internet at

http://www.cstproxyvote.com

|

|

|

•

|

|

If you request printed copies of the proxy materials, you may vote by proxy by completing and returning your proxy card in the postage-paid envelope provided by the Company; or

|

|

|

•

|

|

By voting in person at the meeting.

|

Street Name Holders

Shares which are held in a brokerage account in the name of the broker are said to be held in “street name.”

If your shares are held in street name, you should follow the voting instructions provided by your broker. If you requested printed copies of

the proxy materials, you may complete and return a voting instruction card to your broker, or, in many cases, your broker may also allow you to vote via the telephone or Internet. Check your notice from your broker for more information. If you hold

your shares in street name and wish to vote at the meeting, you must obtain a legal proxy from your broker and bring that proxy to the meeting.

Regardless of how your shares are registered, if you request printed copies of the proxy materials, complete and properly sign the

accompanying proxy card and return it to the address indicated, it will be voted as you direct.

What is the deadline for voting via Internet or

telephone?

Internet and telephone voting is available through 11:59 p.m. (Eastern Daylight Time) on Monday, April 24, 2017 (the

day before the annual meeting).

What are the voting recommendations of the Board of Directors?

The Board of Directors recommends that you vote in the following manner:

1. FOR each of the persons nominated by the Board of Directors to serve as Directors;

2. FOR the ratification of the appointment of Hacker, Johnson & Smith, PA as independent registered public

accounting firm for the 2017 fiscal year; and

3. FOR the approval of the compensation of the Company’s named

executive officers as disclosed in the Executive Compensation section and accompanying compensation tables contain in this Proxy Statement.

2

Unless you give contrary instructions in your proxy, the persons named as proxies will vote your

shares in accordance with the recommendations of the Board of Directors.

Will any other matters be voted on?

We do not know of any other matters that will be brought before the shareholders for a vote at the annual meeting. If any other matter is

properly brought before the meeting, your proxy would authorize Moishe Gubin, Joel Klein, Martin Schmidt, and John Clifford of the Company to vote on such matters in their discretion.

Who is entitled to vote at the meeting?

Only shareholders of record at the close of business on the Record Date are entitled to receive notice of and to vote at the annual meeting. If

you were a shareholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the annual meeting, or any postponement or adjournment of the meeting.

How many votes do I have?

You will have

one vote for each share of the Company’s common stock that you owned on the Record Date.

How many votes can be cast by all shareholders?

The Company had 1,103,447 outstanding shares of common stock on the Record Date. Each of these shares is entitled to one vote. There is no

cumulative voting.

How many votes must be present to hold the meeting?

The holders of a majority of the Company’s common stock outstanding on the Record Date must be present at the meeting in person or by

proxy in order to fulfill the quorum requirement necessary to hold the meeting. This means at least 551,723 shares must be present in person or by proxy.

If you vote, your shares will be part of the quorum. Abstentions and broker

non-votes

will also be

counted in determining the quorum. A broker

non-vote

occurs when a bank or broker holding shares in street name submits a proxy that states that the broker does not vote for some or all of the proposals

because the broker has not received instructions from the beneficial owners on how to vote on the proposals and does not have discretionary authority to vote in the absence of instructions.

We urge you to vote by proxy even if you plan to attend the meeting so that we will know as soon as possible that a quorum has been achieved.

What vote is required to approve each proposal?

For the election of Directors (Proposal No. 1), the affirmative vote of a plurality of the votes present in person or by proxy and

entitled to vote at the meeting is required. A proxy that has properly withheld authority with respect to the election of one or more Directors will not be voted with respect to the Director or Directors indicated, although it will be counted for

the purposes of determining whether there is a quorum.

3

For the ratification of the appointment of Hacker, Johnson & Smith, PA (Proposal

No. 2), the affirmative vote of a majority of the shares represented in person or by proxy and entitled to vote at the meeting will be required for approval. An abstention with respect to this proposal will be counted for the purposes of

determining the number of shares entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of a negative vote.

For the advisory vote on executive compensation (Proposal No. 3), the resolution will be approved if a majority of the shares represented

in person or by proxy and entitled to vote at the meeting are cast in favor of the compensation. Because your vote is advisory, it will not be binding on the Board or the Company. However, the Board will review the voting results and take them into

consideration when making future decisions regarding executive compensation.

Can I change my vote?

Yes. If you are a shareholder of record, you may change your vote at any time before your proxy is voted at the annual meeting. You can do this

in one of three ways. First, you can send a written notice stating that you would like to revoke your proxy. Second, you can submit new proxy instructions either on a new proxy card, by telephone or via the Internet. Third, you can attend the

meeting, and vote in person. Your attendance alone will not revoke your proxy. If you have instructed a broker to vote your shares, you must follow directions received from your broker to change those instructions.

Who can attend the annual meeting?

Any

person who was a shareholder of the Company on March 17, 2017 may attend the meeting. If you own shares in street name, you should ask your broker or bank for a legal proxy to bring with you to the meeting. If you do not receive the legal proxy

in time, bring your most recent brokerage statement so that we can verify your ownership of the Company’s stock and admit you to the meeting. However, you will not be able to vote your shares at the meeting without a legal proxy.

What happens if I sign and return the proxy card but do not indicate how to vote on an issue?

If you return a proxy card without indicating your vote, your shares will be voted as follows:

|

|

•

|

|

FOR each of the nominees for Director named in this proxy statement;

|

|

|

•

|

|

FOR ratification of the appointment of Hacker, Johnson & Smith, PA as the independent registered public accounting firm for the Company for the 2017 fiscal year; and

|

|

|

•

|

|

FOR the approval of the compensation of the Company’s named executive officers as disclosed in the Executive Compensation section and accompanying compensation tables contained in this Proxy Statement.

|

4

Who can help answer my questions?

If you are a shareholder, and would like additional copies, without charge, of this proxy statement or if you have questions about the annual

meeting, including the procedures for voting your shares, you should contact:

Mary Franco, Operations Assistant

(954)

900-2805

5

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of four members, each of whom are to be elected at the annual meeting. Directors hold office until

the next annual meeting of shareholders and until their successors are elected and qualified. All of the nominees are current Directors. The Board of Directors has nominated each of the current Directors for election at the 2017 annual meeting.

The Company is currently seeking additional candidates to serve as Directors.

The accompanying proxy will be voted in favor of the following persons to serve as directors unless the shareholder indicates to the contrary

on the proxy. The election of the Company’s Directors requires a plurality of the votes cast in person or by proxy at the meeting. Management expects that each of the nominees will be available for election, but if any of them is unable to

serve at the time the election occurs, the proxy will be voted for the election of another nominee to be designated by the Board of Directors.

Moishe Gubin

, age 40, has served as Director of the Company and OptimumBank since March 2010. Mr. Gubin is Chief Executive Officer

of Strawberry Fields REIT, a real estate holding company, which owns properties in multiple states, and owns many other businesses. Mr. Gubin graduated from Touro Liberal Arts and Science College, in New York, New York, with a BS in Accounting

and Information Systems and a Minor in Jewish Studies. Mr. Gubin is the founder of the Midwest Torah Center Inc., a

non-profit

spiritual outreach center (

www.midwesttorah.org

). He also attended

Yeshiva Bais Israel where he received a BA in Talmudic Literature. Mr. Gubin has been a licensed Certified Public Accountant in the State of New York since 2010.

Joel Klein,

age 70, became a Director of the Company and OptimumBank in February 2012. Mr. Klein has been retired since 2011. From

2006 until 2010, he served as Chief Financial Officer for Chicago-based Taxi Affiliation Services, LLC, a company that provides support services to transportation companies in five states and over twenty separate municipalities. Between 1994 and

2005, he was a vice president at The Stamford Group, Inc., a Connecticut based provider of investment and merchant banking services. Prior to his service with The Stamford Group, Mr. Klein served in various financial management capacities,

including Chief Financial Officer, Controller, and Senior Accountant with various firms, including Equilease Corporation, Choice Drug Systems, Inc., The Leasing Equipment Group, Ltd., I.C. Herman & Co., Goldstein, Golub, Kessler &

Co. CPA’s, and Brout, Isaacs & Co. CPA’s. Mr. Klein received a Bachelor of Science degree in Accounting from Brooklyn College in 1969. He has been licensed as a CPA in the State of New York since 1972.

Martin Z. Schmidt

, age 69, became a Director of the Company and OptimumBank in August 2015. Mr. Schmidt has been in the financial

and estate planning, securities and insurance industries since 1975. Since 2013, he has been an independent financial consultant with National Holdings Corp/Gilman Ciocia. In 2007, he served in a marketing capacity and liaison to the national senior

accounting firms for Twenty-First Securities, Inc., introducing market based solutions for tax and corporate based problems within their institutional client base. From 1993 to 2000, he served as a Vice President and Branch Manager for multiple

branches of Advest, Inc., a major regional securities and investment management firm. Mr. Schmidt served with the 423d Military Police, U.S. Army Reserve, for five years, completed 3 years of coursework towards an MBA in Management Science and

Statistics at the Lubin Graduate School of Business Administration in 1973, and graduated Brooklyn College with a B.A. in Economics in 1969.

6

John Clifford

, age 60, became a Director of the Company and OptimumBank on

October 26, 2016. Mr. Clifford is a resident of Hobe Sound, Florida and a retired banker who provides additional banking experience to the Company and the Bank. From 2012 to 2015, Mr. Clifford was President and CEO of Coastal Federal

Credit Union in Jacksonville, Florida. During his career, he was associated with several other financial institutions in the northeast, including The Community Bank, Brockton, Massachusetts and Bank of Fall River, Fall River, Massachusetts.

Mr. Clifford received his MBA from Suffolk University in 1987 and graduated Northeastern University in 1981 with a BSBA degree.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR ALL DIRECTOR NOMINEES.

CORPORATE GOVERNANCE

Director

Independence

The Board of Directors analyzed the independence of each director and determined that Moishe Gubin, Martin Schmidt, and

John Clifford, each meet the standards of independence under the listing standards of NASDAQ Stock Market (“NASDAQ”).

The Board of

Directors Meetings and Committees

OptimumBank Holdings’ Board of Directors met 14 times during 2016. The independent directors

did not meet in executive session without management during 2016. Each of the current members of the Board of Directors attended at least 75% of the meetings of the Board and committees on which he served. The Company’s Board of Directors has

established several standing committees, including the following:

Compensation Committee

The Compensation Committee currently consists of Moishe Gubin (Chairman) and Martin Schmidt. Mr. Gubin and Mr. Schmidt are

independent under the NASDAQ listing standards. The Compensation Committee reviews and recommends to the Board of Directors the compensation arrangements for executive management and

non-employee

directors.

The Compensation Committee met once during 2016 and operates under a written charter. A copy of the current Compensation Committee Charter can be viewed on the Company’s website at

www.optimumbank.com/information-center/corporate-governance/

.

In 2016, no executive officer had a role in determining or

recommending the amount or form of outside director compensation. The Compensation Committee does not delegate its authority to any other persons. The Compensation Committee does not use consultants to determine or recommend the amount or form of

compensation arrangements.

7

Nominating Committee

The Nominating Committee currently consists of Mr. Gubin, Mr. Klein, and Mr. Clifford. The committee evaluates new candidates

and current directors, and recommends candidates to the Board to fill vacancies occurring between annual shareholder meetings. A copy of the charter for the Nominating Committee can be viewed on the Company’s website at

www.optimumbank.com/

information-center/corporate-governance

.

All of the director nominees of the Company set forth in the Proposal entitled

“Election of Directors” were recommended by a majority of the independent directors of the Company. The independent directors, acting in their capacity as the nominating committee, held one meeting during 2017.

The Nominating Committee will initially consider nominating the Company’s existing directors for

re-election

to the Board as appropriate or to other director nominees proposed, as appropriate, by the directors, and in doing so considers each director’s independence, if required, share ownership,

skills, performance and attendance at a minimum of 75% of the Board and respective committee meetings. In evaluating any candidates for potential director nomination, the Nominating Committee will consider candidates that are independent, if

required, who possess personal and professional integrity, have good business judgment, relevant experience and skills, including banking, financial, real estate and/or legal expertise, who would be effective as a director in conjunction with the

full Board, who would commit to attend Board and committee meetings, and whose interests are aligned with the long-term interests of the Company’s shareholders.

The Nominating Committee will consider director candidates recommended by shareholders, provided the recommendation is in writing and

delivered to the Corporate Secretary of the Company at the principal executive offices of the Company not later than the close of business on the 120th day prior to the first anniversary of the date on which the Company first mailed its proxy

materials to shareholders for the preceding year’s annual meeting of shareholders. For the 2018 annual meeting, recommendations must be received by December 3, 2017. The nomination and notification must contain the nominee’s name,

address, principal occupation, total number of shares owned, consent to serve as a director, and all information relating to the nominee and the nominating shareholder as would be required to be disclosed in solicitation of proxies for the election

of such nominee as a director pursuant to the SEC’s proxy rules.

Audit Committee

The Audit Committee of the Board of Directors is responsible for the oversight of the Company’s financial and accounting reporting

processes and the audits of the Company’s financial statements. The Audit Committee is currently composed of three

non-employee

directors consisting of Joel Klein, Moishe Gubin, and Martin Schmidt. The

Audit Committee operates under a written charter adopted and approved by the Board of Directors. A copy of the current Audit Committee Charter can be viewed on the Company’s website at

www.optimumbank.com/information-center/corporate-governance

.

Prior to 2015, the Board determined that all of the members of the

Audit Committee were financially literate and independent in accordance with the NASDAQ listing standards applicable to audit committee members. During the fall of 2015, Mr. Klein agreed to assume, on an interim basis, the duties of the

Company’s principal executive officer and principal accounting officer. As a result, Mr. Klein is not currently deemed to be independent. The Board also has determined that both Moishe Gubin and Joel Klein are “audit committee

financial experts” as defined by SEC rules. The Audit Committee met 13 times during 2016. A Report from the Audit Committee is included on page 19.

8

Attendance by Directors at Annual Shareholders’ Meetings

The Company expects its directors to attend the annual meeting. All of the current directors attended the 2016 annual meeting (held in May

2016), with the exception of John Clifford, who did not join the Board until October 26, 2016.

Shareholder Communications with the Board of

Directors

The Board of Directors has adopted a formal process by which shareholders may communicate with the Board. Shareholders who

wish to communicate with the Board may do so by sending written communications addressed to: Board of Directors, OptimumBank Holdings, Inc., at 2477 East Commercial Boulevard, Fort Lauderdale, Florida 33308, Attention: Mary Franco. All

communications will be compiled by the Corporate Secretary and submitted to the members of the Board. Concerns about accounting or auditing matters or possible violations of the Company’s Code of Ethics should be reported under the procedures

outlined in the Company’s Whistleblower Policy. Our Whistleblower Policy is available on the Company’s website at

www.optimumbank.com/information-center/corporate-governance

.

Board Leadership Structure and Role in Risk Oversight

The Company’s policy is to separate the roles of chairman and chief executive officer of the Company. At the present time, the Company

does not have any person serving as the Chairman of the Board or Chief Executive Officer.

The Board believes that risk management is an

important component of the Company’s corporate strategy. While we assess specific risks at the Company’s committee levels, the Board, as a whole, oversees the Company’s risk management process, and discusses and reviews with

management major policies with respect to risk assessment and risk management. The Board is regularly informed through committee reports about the Company’s risks. The Audit Committee reviews and assesses the Company’s processes to manage

financial reporting risk. It also reviews the Company’s policies for risk assessment and assesses steps management has taken to control significant risks. The Compensation Committee oversees risks relating to compensation practices and

policies.

9

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT AUDITOR

The Audit Committee has selected Hacker, Johnson & Smith PA (“

Hacker Johnson

”) as the Company’s independent

auditor for fiscal year 2017, and the Board asks shareholders to ratify that selection. Although current law, rules, and regulations, as well as the charter of the Audit Committee, require the Audit Committee to engage, retain, and oversee the

Company’s independent auditor, the Board considers the selection of the independent auditor to be an important matter of shareholder concern and is submitting the selection of Hacker Johnson for ratification by shareholders as a matter of good

corporate governance

Assuming the presence of a quorum, this Proposal will require the affirmative vote of a majority of the shares

represented in person or by proxy and entitled to vote at the meeting.

THE BOARD OF DIRECTS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” PROPOSAL NO. 2.

10

AUDIT COMMITTEE REPORT

The Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31,

2016 with Company’s management and has discussed with the independent auditors, Hacker, Johnson & Smith PA, communications pursuant to applicable auditing standards. In addition, Hacker, Johnson & Smith PA has provided the

Audit Committee with the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent auditor’s communications with the audit committee concerning independence, and the Audit Committee has

discussed with Hacker, Johnson & Smith PA, the independent auditor’s independence.

Based on these reviews and discussions,

the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form

10-K

for the fiscal year ended December 31, 2016 and

selected Hacker, Johnson & Smith PA as the Company’s independent auditor for 2017.

AUDIT COMMITTEE

Joel Klein

Moishe Gubin

Martin Schmidt

11

INDEPENDENT ACCOUNTANTS

Hacker Johnson, the Company’s independent registered public accounting firm, audited the Company’s consolidated financial statements

for the fiscal year ended December 31, 2016.

Audit and Tax Fees

The following table is a summary of the fees billed to the Company by Hacker, Johnson & Smith PA and Crowe Horwath PA for professional

services rendered for the year ended December 31, 2016 and Hacker, Johnson & Smith for the year ended 2015:

|

|

|

|

|

|

|

|

|

|

|

Fee Category

|

|

2016 Fees

|

|

|

2015 Fees

|

|

|

Audit Fees

|

|

$

|

66,000

|

|

|

$

|

65,000

|

|

|

Tax Fees

|

|

$

|

12,900

|

|

|

$

|

11,200

|

|

|

Total Fees

|

|

$

|

78,900

|

|

|

$

|

76,200

|

|

Audit Fees

.

Consists of fees billed for professional services rendered for the audit of the

Company’s financial statements and review of the interim financial statements included in quarterly reports and services that are normally provided by Hacker, Johnson & Smith, PA in connection with statutory and regulatory filings or

engagements.

Tax Fees

. Consists of fees billed for professional services for tax compliance, tax advice and tax planning. These

services include assistance regarding federal and state tax compliance.

Pre-approved

Services.

Consistent with SEC rules regarding auditor independence, the Company’s Audit Committee Charter requires the Audit Committee to

pre-approve

all audit services and

non-audit

services permitted by law and Audit Committee policy (including the fees and terms of such services) to be performed for the Company by the independent auditors, subject to the “de minimis”

exceptions for

non-audit

services described in SEC rules that are approved by the Audit Committee prior to the completion of the audit. The Audit Committee may delegate

pre-approval

authority to a member of the committee. The decisions of any committee member to whom

pre-approval

is delegated must be presented to the Audit Committee at

its next scheduled meeting.

A representative from Hacker, Johnson & Smith PA, independent public auditors for the Company for

2016 and the current year, is expected to be present at the annual meeting, will have an opportunity to make a statement, and will be available to respond to appropriate questions.

12

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act enacted in July 2010 (the “Dodd-Frank Act”), the shareholders of

the Company are entitled to vote at the annual meeting on the compensation of the Company’s named executive officers, as disclosed in the Executive Compensation section and accompanying compensation tables contained in this Proxy Statement.

Pursuant to the Dodd-Frank Act, the shareholder vote on executive compensation is an advisory vote only, and it is not binding on Company or the Board of Directors.

Although the vote is

non-binding,

the Board of Directors values the opinions of the shareholders and

will consider the outcome of the vote when making future compensation decisions.

The Company’s current executive compensation

program is designed to provide a competitive level of annual cash compensation that will allow the Company to attract, motivate and retain individuals with the skills required to achieve the Company’s performance goals. At the present time, the

Company is not utilizing any equity based compensation or other long term compensation for the Company’s executive officers. The Company plans to consider the use of equity based compensation or other long term compensation after the

Company’s financial condition is stabilized.

The advisory vote regarding the compensation of the named executive officers shall be

approved if the votes cast in favor of the proposal exceed the votes cast against the proposal. Abstentions will not be counted as either votes cast for or against the proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS

AS DISCLOSED IN THE EXECUTIVE COMPENSATION SECTION AND ACCOMPANYING COMPENSATION TABLES CONTAINED IN THIS PROXY STATEMENT.

13

EXECUTIVE OFFICERS

Executive Officers of the Company

The

Board of Directors is seeking to appoint Moishe Gubin as the Company’s Chief Executive Officer. Mr. Gubin has submitted requests for the required regulatory approvals to serve as Chief Executive Officer of the Company. These requests are

currently pending.

From October 2015 to March 2016, Joel Klein, a director of the Company, performed the functions of the Company’s

principal executive officer and principal financial officer on an interim basis. Since June 2016, Timothy Terry, President and Chief Executive Officer of the Bank has been acting as the Principal Executive Officer for the Company, and since March

2016, James Odza, Chief Financial Officer of the Bank has been acting as the Principal Financial Officer for the Company.

Executive Officers of

the Bank

The executive officers of the Bank are Timothy Terry, President and Chief Executive Officer of the Bank, James R. Odza,

Executive Vice President and Chief Financial Officer of the Bank, Ari L. Bodner, Senior Executive Vice President and Chief Operating Office, and Jeff Cannon, Executive Vice President, Chief Lending Officer, and Chief Credit Officer

1

. The background of each of these executive officers is set forth below.

Timothy

Terry

, age 61, was appointed President and Chief Executive Officer of the Bank in February 2013. Mr. Terry has been in banking for 34 years and most recently served as President/CEO of Putnam State Bank in Palatka, Florida. Prior to joining

OptimumBank, he served as President, CEO and Senior Loan Officer for Enterprise Bank of Florida in North Palm Beach, Florida, and held senior lending, branch administration & sales management positions at Palm Beach National Bank &

Trust, Flagler National Bank of the Palm Beaches and Comerica Bank. Mr. Terry received his BBA degree in finance from Western Michigan University located in Kalamazoo, Michigan. He is also a graduate of the American Bankers Association Stonier

Graduate School of Banking at the University of Delaware.

James R. Odza

, age 54, is an Executive Vice President, and is the Chief

Financial Officer of the Bank. He joined the Bank in September 2015. Mr. Odza has been in banking for 30 years and most recently served as Executive Vice President and CFO of Grand Bancshares, Inc. and its wholly-owned subsidiary Grand

Bank & Trust of Florida in West Palm Beach, Florida from 1998 to 2015. Also, he served as Assistant Vice President for SunTrust Banks, Inc. in Loan Review and Real Estate Finance and Assistant Vice President for NCNB National Bank of

Florida in Real Estate Finance. Mr. Odza received his MBA in Finance from the A.B. Freeman School of Business, Tulane University, New Orleans, Louisiana. Mr. Odza earned a BA degree in Economics from Tulane University, New Orleans,

Louisiana. He is a graduate of the American Bankers Association Stonier Graduate School of Banking, Georgetown University, Washington, D.C.

Ari L.

Bodner

, age 51, is a Senior Vice President and is the Chief Operations Officer of OptimumBank. He joined OptimumBank in

September 2015. Mr. Bodner has been in banking for 33 years and most recently served as Senior Vice President/Director of Operations, Branch Administration and Security Officer of Grand Bank & Trust of Florida in West Palm Beach,

14

Florida from 2007 to 2015. Prior to his service with Grand Bank, Mr. Bodner was Senior Vice President and Operations Manager at Fidelity Federal Bank & Trust in West Palm Beach from

2004 to 2007. Mr. Bodner has a diverse background in operations and information systems. From 2000 to 2004, Mr. Bodner worked at UnitedTrust Bank in Bridgewater NJ as First Vice President/Loan and Retail Operations Manager. His banking

career started at Roosevelt Savings Bank in Garden City NY in 1983. Mr. Bodner earned a BA degree in Economics from Queens College in Flushing NY.

EXECUTIVE COMPENSATION

The following table shows the compensation paid by the Company and the Bank for 2016 and 2015 to its executive officers whose total

compensation exceeded $100,000, other than persons serving as the principal executive officer. The Company did not have any persons who were appointed as executive officers in 2015, although Joel Klein, a director of the Company, was acting

principal executive officer and principal financial officer from October 15, 2015 to March 2016. Since June 2016, Timothy Terry, President and Chief Executive Officer of the Bank has been acting as the Principal Executive Officer for the

Company, and since March 2016, James Odza, Chief Financial Officer of the Bank has been acting as the Principal Financial Officer for the Company.

Summary Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

|

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

All Other

Compensation ($)

|

|

|

Total

Compensation

($)

|

|

|

Timothy Terry

President and Chief Executive Officer of Bank

|

|

|

2016

|

|

|

|

225,000

|

|

|

|

0

|

|

|

|

8,400

|

|

|

|

233,400

|

|

|

|

|

2015

|

|

|

|

225,000

|

|

|

|

0

|

|

|

|

8,400

|

|

|

|

233,400

|

|

|

|

|

|

|

|

|

|

James Odza

Chief Financial Officer of Bank

|

|

|

2016

|

|

|

|

128,333

|

|

|

|

0

|

|

|

|

0

|

|

|

|

128,333

|

|

|

|

|

|

|

|

|

|

Ari Bodner

Chief Operating Officer of Bank

|

|

|

2016

|

|

|

|

130,000

|

|

|

|

0

|

|

|

|

0

|

|

|

|

130,000

|

|

|

|

|

|

|

|

|

|

Jeffrey Cannon

Executive Vice President and Chief Lending Officer of Bank

(1)

|

|

|

2016

|

|

|

|

87,955

|

|

|

|

0

|

|

|

|

0

|

|

|

|

87,955

|

|

|

|

|

2015

|

|

|

|

180,000

|

|

|

|

0

|

|

|

|

0

|

|

|

|

180,000

|

|

|

|

|

|

|

|

|

|

Joel Klein,

Director of the Company (2)

|

|

|

2016

|

|

|

|

—

|

|

|

|

—

|

|

|

|

14,505

|

|

|

|

14,505

|

|

|

|

|

2015

|

|

|

|

—

|

|

|

|

—

|

|

|

|

14,101

|

|

|

|

14,101

|

|

|

(1)

|

Mr. Cannon’s employment terminated on June 22, 2016.

|

|

(2)

|

Mr. Klein served as acting Principal Executive Officer from October 2015 to June 2016.

|

15

Stock Options

No stock options were granted to any of the executive officers in 2016. None of the Company’s executive officers holds any stock options.

Director Compensation

Each director

receives compensation for serving on the Board of Directors and committees of the Board. The Chairman receives $1,500 for each Board meeting attended, and all other directors receive $1,000 for each Board meeting attended. These amounts are payable

25% in cash, and 75% in shares of the Company’s common stock (based on the fair market value on the date of grant). For Audit Committee meetings, the Chairman receives compensation of $250 for each meeting attended, and the members receive

$200, all of which are payable in shares of the Company’s common stock (based on the fair market value on the date of grant). For Compensation Committee meetings, the Chairman receives compensation of $125 for each meeting attended and the

other members receive $100, all of which are payable in shares of the Company’s common stock (based on the fair market value on the date of grant).

Director Compensation Table For 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Cash

Compensation($)

|

|

|

Stock

Awards($)(1)

|

|

|

All Other

Compensation ($)

|

|

|

Total($)

|

|

|

Moishe Gubin

|

|

|

4,500

|

|

|

|

214,307

|

|

|

|

0

|

|

|

|

218,807

|

|

|

Joel Klein

|

|

|

3,000

|

|

|

|

11,505

|

|

|

|

0

|

|

|

|

14,505

|

|

|

Martin Schmidt

|

|

|

2,750

|

|

|

|

10,059

|

|

|

|

0

|

|

|

|

12,809

|

|

|

John Clifford

|

|

|

750

|

|

|

|

2,253

|

|

|

|

0

|

|

|

|

3,003

|

|

|

Total

|

|

|

11,000

|

|

|

|

238,124

|

|

|

|

0

|

|

|

|

249,124

|

|

|

(1)

|

The amounts in this column represent the fair value of the stock grants made to the directors in payment of a portion of their directors’ fees in 2016.

|

SECTION 16 BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, as well as persons who own

10% or more of a class of the Company’s equity securities, to file reports of their ownership of the Company’s securities, as well as statements of changes in such ownership, with the SEC. The Company believes that all such filings

required during 2016 were made on a timely basis, except for a Form 3 on behalf of Mr. Schmidt and a Form 5 on behalf of Messrs. Gubin, Klein, Schmidt, and Clifford with respect to their Director Compensation.

16

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

This following table sets forth information regarding the beneficial ownership of the common stock as of December 31, 2016, for:

|

|

•

|

|

each of the directors and executive officers of the Company and the Bank;

|

|

|

•

|

|

all of the directors and executive officers of the Company and the Bank as a group; and

|

|

|

•

|

|

each other person known by the Company to own beneficially more than 5% of the Company common stock.

|

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting and investment

power with respect to the securities. The persons named in the table have sole voting and investment power or have shared voting and investment power with a spouse with respect to all shares of common stock shown as beneficially owned by them,

unless otherwise indicated in these footnotes.

|

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owners

|

|

Number of Shares

Beneficially

Owned

|

|

|

Percent

of Class

2

|

|

|

Directors and Executive Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Moishe Gubin, Director

|

|

|

71,387

|

|

|

|

6.47

|

%

|

|

Joel Klein, Director

|

|

|

18,390

|

|

|

|

1.67

|

%

|

|

Martin Schmidt, Director

|

|

|

4,140

|

|

|

|

0.38

|

%

|

|

John Clifford. Director

|

|

|

596

|

|

|

|

0.05

|

%

|

|

Timothy Terry, President and Chief Executive Officer of the Bank

|

|

|

0

|

|

|

|

0

|

|

|

James R. Odza, Executive Vice President and Chief Financial Officer of the Bank

|

|

|

0

|

|

|

|

0

|

|

|

Ari L. Bodner, Senior Vice President of Bank

|

|

|

0

|

|

|

|

0

|

|

|

All directors and executive officers as a group

|

|

|

94,513

|

|

|

|

8.57

|

%

|

|

2

|

Based on 1,103,447 shares of common stock outstanding on December 31, 2016.

|

17

|

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owners

|

|

Number of Shares

Beneficially

Owned

|

|

|

Percent

of Class

|

|

|

Principal Shareholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chan Heng Fai Ambrose

No 11 Maryland Drive

Singapore 277508

|

|

|

104,480

|

|

|

|

9.47

|

%

|

|

|

|

|

|

Midwest Kosher Deli

2722 Tucker Drive, South Bend, Indiana 46624

|

|

|

94,425

|

|

|

|

8.56

|

%

|

|

|

|

|

|

Midwest Torah Center

2516 S. Twyckenham Dr., South Bend, Indiana 46614

|

|

|

77,262

|

|

|

|

7.00

|

%

|

|

|

|

|

|

Ari Haas

6028 N. Monticello

Chicago, Illinois 60659

|

|

|

75,000

|

|

|

|

6.80

|

%

|

18

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The following are transactions since January 1, 2016, or proposed transactions in which the Company was or is a party, in which the amount

involved exceeded $120,000, and in which a director, director nominee, executive officer, holder of more than 5% of the Company’s common stock or any member of the immediate family of any of the foregoing persons had or will have a direct or

indirect material interest.

Loans to Officers, Directors and Affiliates

The Bank offers loans in the ordinary course of business to its directors and employees, including executive officers, their related interests

and immediate family members. Applicable law and Bank policy require that these loans be on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unrelated parties,

and must not involve more than the normal risk of repayment or present other unfavorable features. Loans to individual employees, directors and executive officers must also comply with the Bank’s lending policies and statutory lending limits,

and directors with a personal interest in any loan application are excluded from the consideration of such loan application.

19

SHAREHOLDER PROPOSALS FOR 2017 ANNUAL MEETING

Proposals of shareholders of the Company that are intended to be presented by such shareholders at the Company’s 2017 annual meeting of

shareholders and that shareholders desire to have included in the Company’s proxy materials relating to such meeting must be received by the Company at its corporate offices no later than December 3, 2017, which is 120 calendar days prior

to the anniversary of this year’s mailing date. Upon timely receipt of any such proposal, the Company will determine whether or not to include such proposal in the proxy statement and proxy in accordance with applicable regulations governing

the solicitation of proxies.

If a shareholder wishes to present a proposal at the Company’s 2018 annual meeting or to nominate one

or more Directors and the proposal is not intended to be included in the Company’s proxy statement relating to that meeting, the shareholder must give advance written notice to the Company by February 16, 2018, as required by SEC Rule

14a-4(c)(1).

Any shareholder filing a written notice of nomination for Director must describe various

matters regarding the nominee and the shareholder, including such information as name, address, occupation and shares held. Any shareholder filing a notice to bring other business before a shareholder meeting must include in such notice, among other

things, a brief description of the proposed business and the reasons for the business, and other specified matters. Copies of those requirements will be forwarded to any shareholder upon written request.

SOLICITATION OF PROXIES

The proxy accompanying this Proxy Statement is solicited by the Board of Directors of the Company. All of the costs of solicitation of proxies

will be paid by the Company. We may also reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable

out-of-pocket

expenses incurred by them

in sending proxy materials to the beneficial owners of the Company’s shares of common stock. In addition to solicitations by mail, the Company’s directors, officers and employees, including those of the Bank, may solicit proxies

personally, by telephone or otherwise, but will not receive any additional compensation for their services.

OTHER MATTERS

Management does not know of any matters to be presented at the meeting other than those set forth above. However, if other matters come before

the meeting, it is the intention of the persons named in the accompanying proxy to vote the shares represented by the proxy in accordance with the recommendations of management on such matters, and discretionary authority to do so is included in the

proxy.

HOW TO OBTAIN EXHIBITS TO FORM

10-K

AND OTHER INFORMATION

A copy of the Company’s annual report on Form

10-K

for the fiscal year ended December 31,

2016 is included with this proxy statement. We will mail without charge copies of any particular exhibit to the Company’s Form

10-K

upon written request. Requests should be sent to OptimumBank Holdings,

Inc., Attn: Mary Franco, 2477 East Commercial Boulevard, Fort Lauderdale, FL 33308. Our proxy statement, annual reports on form

10-K,

quarterly reports on Form

10-Q,

and

current reports on Form

8-K,

as well as any amendment to those reports, are also available free of charge through the SEC’s website,

www.sec.gov

.

20

YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY.

Vote by Internet

or Telephone – QUICK

«

«

«

EASY

IMMEDIATE – 24 Hours a Day, 7 Days a Week or by Mail

|

|

|

|

|

|

|

|

|

|

|

OPTIMUMBANK

HOLDINGS, INC.

|

|

|

|

Your phone or internet vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed and

returned your proxy card. Votes submitted electronically over the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on April 24, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTERNET/MOBILE – www.cstproxyvote.com

Use the Internet to vote your proxy. Have your proxy card available when you access the above website. Follow the prompts to vote your shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE

–

1 (866)

894-0537

Use a touch-tone telephone to vote your proxy. Have your proxy card available when you call. Follow the voting instructions to vote your

shares.

|

|

|

|

|

|

|

PLEASE DO NOT RETURN THE PROXY CARD IF YOU ARE VOTING ELECTRONICALLY OR BY PHONE.

|

|

|

|

|

|

MAIL –

Mark, sign and date your proxy card and return it in the postage-paid envelope provided.

|

p

FOLD HERE • DO NOT

SEPARATE • INSERT IN ENVELOPE PROVIDED

p

|

|

|

|

|

|

|

PROXY

|

|

Please mark your votes like this

|

|

☒

|

|

THIS PROXY WILL BE VOTED AS DIRECTED. IF NO DIRECTION IS PROVIDED,

THIS PROXY WILL BE VOTED “FOR” PROPOSALS 1, 2, 3 AND 4. THIS PROXY IS SOLICITED ON BEHALF OF OPTIMUMBANK HOLDINGS, INC.’S BOARD OF DIRECTORS.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR

|

|

WITHOUT AUTHORITY

|

|

FOR ALL

|

|

|

|

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

1. To elect four directors.

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

3. To consider an advisory vote on Executive Compensation

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

|

|

|

(Instruction: To withhold authority

to vote for any individual nominee, strike a line through that nominee’s name in the list below)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOMINEES:

|

|

|

|

|

|

|

|

|

|

|

|

4. To transact such other business as may

properly come before the Annual Meeting

|

|

01 Moishe

Gubin 02 Joel Klein 03 Martin Schmidt

|

|

|

|

|

|

|

04 John Clifford

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. To ratify the appointment of Hacker,

Johnson & Smith PA as the Company’s independent auditor for fiscal year 2017.

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

|

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY ID:

PROXY NUMBER:

ACCOUNT NUMBER:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature

|

|

|

|

Signature, if held jointly

|

|

|

|

Date

|

|

|

|

, 2017.

|

Note: Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as

attorney, executor, administrator, trustee, guardian, or corporate officer, please give title as such.

p

FOLD HERE • DO NOT SEPARATE • INSERT IN ENVELOPE PROVIDED

p

OPTIMUMBANK HOLDINGS, INC.

PROXY

FOR 2016 ANNUAL

MEETING OF SHAREHOLDERS

APRIL 25, 2017

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints MOISHE GUBIN, JOEL KLEIN, MARTIN SCHMIDT and JOHN

CLIFFORD, and each of them, with full power of

substitution, as proxies to vote the shares which the undersigned is entitled to vote at the Annual Meeting of Shareholders of the Company to be held at the executive offices of OptimumBank, 2477 East Commercial Boulevard, Fort Lauderdale, Florida

33308, on April 25, 2017, at 10:00 a.m. or any adjournment thereof. Such shares shall be voted as indicated with respect to the proposals listed on the reverse side hereof and in the discretion of the proxies on such other matters as may

properly come before the meeting or any adjournment thereof.

(CONTINUED, AND TO BE MARKED, SIGNED AND DATED ON THE REVERSE SIDE)

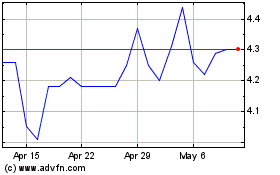

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

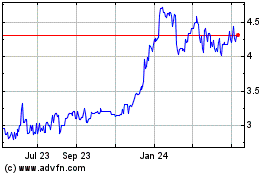

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024