Charles Schwab Investment Management, Inc., the asset management

arm of The Charles Schwab Corporation, announced that it has

received four Best-In-Class Thomson Reuters Lipper Fund Awards. The

annual Lipper Fund Awards recognize funds and fund management firms

for their consistently strong, risk-adjusted performance relative

to their peers.

Lipper honored the following funds on the basis of risk-adjusted

returns for the three-, five-, or ten-year periods ending November

30, 2016:

- Schwab Fundamental International

Small Company Index Fund (SFILX) was named best-in-class among

66 International Small/Mid-Cap Core Funds for the 3-year

period.

- Laudus Mondrian International Equity

Fund, Institutional (LIEIX) was named best-in-class among 33

International Large-Cap Value Funds for the 3-year period and among

32 International Large-Cap Value Funds for the 5-year period.

- Laudus International MarketMasters

Fund™, Select (SWMIX) was named best-in-class among 206

International Multi-Cap Growth Funds for the 10-year period.

“It’s an honor to be recognized by Lipper for our consistent

performance in each of these categories because these awards are a

reflection of our commitment to delivering strong investment

results over the long-term,” said Marie Chandoha, president and

chief executive officer of Charles Schwab Investment Management.

“We are dedicated to providing a modern approach to asset

management, quality products and a focus on service in order to

deliver value to our clients.”

The honor was announced last night at the Lipper Fund Awards

ceremony in New York.

About The Lipper Fund Awards

For more than three decades and in over 20 countries worldwide,

the Thomson Reuters Lipper Fund Awards have honored funds and fund

management firms that have excelled in providing consistently

strong, risk-adjusted performance relative to their peers.

Renowned fund data and proprietary methodology is the foundation

of the award qualification. Individual classifications of three-,

five-, and ten-year periods, as well as fund families with high

average scores for the three-year period are recognized.

The highly respected Lipper Fund Awards are part of the Thomson

Reuters Awards for Excellence. For more information, please email

markets.awards@thomsonreuters.com or visit

http://www.lipperfundawards.com.

About Charles Schwab Investment Management

Founded in 1989, Charles Schwab Investment Management, Inc., a

subsidiary of The Charles Schwab Corporation, is one of the

nation’s largest asset management companies, with more than $300B

in assets under management as of 12/31/16. It is among the

country’s largest money market fund managers based on assets under

management according to iMoneyNet as of 12/31/16. It is also the

third-largest provider of index mutual funds and the fifth largest

provider of ETFs.*

More information is available at csimfunds.com.

*Source: Strategic Insight, as of 12/31/16; based on assets

under management

About Schwab

At Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube and LinkedIn.

DISCLOSURES:

Investors should consider carefully information contained in

the prospectus, or if available, the summary prospectus, including

investment objectives, risks, charges, and expenses. You can view

and download a prospectus by visiting

csimfunds.com/prospectus. Please read the prospectus

carefully before investing.

Performance data quoted represents past performance and is no

guarantee of future results.

Investment returns and principal value will fluctuate so that

an investor’s shares, when sold or redeemed, may be worth more or

less than their original cost. Current performance may be lower or

higher than performance data quoted. To obtain performance

information current to the most recent month end, please visit

www.csimfunds.com. Performance data quoted does not

reflect the non-recurring redemption fee of 2% that may be charged

if shares are sold or exchanged within 30 days of the purchase

date. If these fees were reflected, the performance data quoted

would be lower.

Investment value will fluctuate, and shares, when redeemed,

may be worth more or less than their original cost.

Lipper Leaders fund ratings do not constitute and are not

intended to constitute investment advice or an offer to sell or the

solicitation of an offer to buy any security of any entity in any

jurisdiction. As a result, you should not make an investment

decision on the basis of this information. Rather, you should use

the Lipper ratings for informational purposes only. Certain

information provided by Lipper may relate to securities that may

not be offered, sold or delivered within the United States (or any

State thereof) or to, or for the account or benefit of, United

States persons. Lipper is not responsible for the accuracy,

reliability or completeness of the information that you obtain from

Lipper. In addition, Lipper will not be liable for any loss or

damage resulting from information obtained from Lipper or any of

its affiliates.

Distinction does not imply a guarantee of future results.

Distinction does not necessarily imply that the fund had the best

performance within its category. There are numerous Lipper Leaders

in every category.

International investments involve additional risks, which

include differences in financial accounting standards, currency

fluctuations, geopolitical risk, foreign taxes and regulations, and

the potential for illiquid markets. Investing in emerging markets

may accentuate these risks.

Small cap funds are subject to greater volatility than those in

other asset categories.

The Laudus Group® of Funds includes the Laudus U.S. Large Cap

Growth Fund and Laudus Mondrian Funds, which are part of the Laudus

Trust and distributed by ALPS Distributors, Inc. ALPS Distributors,

Inc. and Charles Schwab & Co., Inc. are unaffiliated

entities.

Charles Schwab Investment Management, Inc. (CSIM), the

investment advisor for Schwab Funds, and Charles Schwab & Co.,

Inc. (Schwab), Member SIPC, the distributor for Schwab Funds, are

separate but affiliated companies and subsidiaries of The Charles

Schwab Corporation.

Thomson Reuters Lipper is a nationally recognized organization

that ranks the performance of mutual funds within a universe of

funds that have similar investment objectives. The fund award

rankings are historical and are based on risk-adjusted total return

with capital gains and dividends reinvested.

(0317-WMHG) LAU003595 (0318)

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170324005029/en/

Charles SchwabKaitlyn Downing,

212-403-9240Kaitlyn.Downing@schwab.com

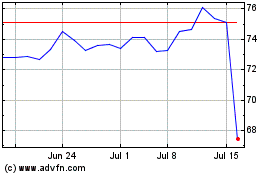

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

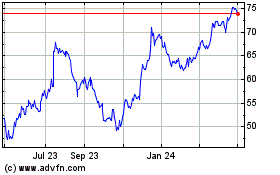

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024