Current Report Filing (8-k)

March 23 2017 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 22, 2017

InfuSystem Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35020

|

|

20-3341405

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

31700 Research Park Drive

Madison Heights, Michigan 48071

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (248)

291-1210

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On March 22, 2017, InfuSystem

Holdings, Inc. (the “Company”), and its direct and indirect subsidiaries, entered into a Second Amendment to the Credit Agreement (the “Second Amendment”) with JPMorgan Chase Bank, N.A., as lender (the “Lender”), which

amends the credit agreement among the Company, its direct and indirect subsidiaries, and the Lender, entered into on March 23, 2015 (the “Credit Agreement”). All capitalized terms used herein are defined in either the Second Amendment

or the Credit Agreement.

The Second Amendment amends the Credit Agreement to, among other things:

|

|

(i)

|

amend the definition of “Fixed Charges” in Section 1.01 of the Credit Agreement by deleting the phrase therein that reads as follows:

|

“plus prepayments and scheduled principal payments on Indebtedness actually made (excluding the prepayment on any debt paid as a

result of entering into this Agreement)”

and replacing such phrase therein with the phrase

“plus scheduled principal payments on Indebtedness actually made (excluding the prepayment on any debt paid as a result of entering

into this Agreement)”

|

|

(ii)

|

restate Section 6.12(a) of the Credit Agreement as follows:

|

(a)

Leverage Ratio

. The Borrowers will not permit the Leverage Ratio to exceed (i) 3.0 to 1.0 at any time on or

after the Effective Date but prior to December 31, 2015, (ii) 2.75 to 1.0 at any time on or after December 31, 2015 but prior to March 31, 2018, (iii) 2.50 to 1.0 at any time on or after March 31, 2018 but prior to March 31,

2019 or (iv) 2.25 to 1.00 at any time on or after March 31, 2019.

As a result of the change to the definition of “Fixed

Charges” contained within the Second Amendment, the Company will have increased ability to prepay its indebtedness under the Credit Agreement without negatively impacting its financial covenants. Additionally, the change to the leverage

covenant delays the scheduled reductions in the maximum allowed Leverage Ratio by one full year for each such scheduled reduction (for example, the reduction of the maximum allowed ratio scheduled to be effective on March 31, 2017 which reduces

the allowed ratio from 3.0x to 2.75x will be delayed until March 31, 2018, with all subsequent reductions similarly delayed by one year).

The foregoing description of the Second Amendment does not purport to be complete and is qualified in its entirety by reference to the

complete text of the Second Amendment, which is filed herewith, as well as the complete text of the Credit Agreement, which was filed with the Securities and Exchange Commission on May 12, 2015 as Exhibit 10.1 to the Company’s Quarterly

Report on Form

10-Q.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

|

The information in Item 1.01 of the Current Report on Form

8-K

is hereby incorporated by reference into

this Item 2.03.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

10.1

|

|

Second Amendment to the Credit Agreement, dated as of March 22, 2017, among InfuSystem Holdings, Inc., and its direct and indirect subsidiaries, with JPMorgan Chase Bank, N.A., as Lender.

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

INFUSYSTEM HOLDINGS, INC.

|

|

|

|

|

By:

|

|

/s/ Trent N. Smith

|

|

|

|

Trent N. Smith

|

|

|

|

EVP and Chief Accounting Officer

|

Dated: March 23, 2017

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

Second Amendment to the Credit Agreement, dated as of March 22, 2017, among InfuSystem Holdings, Inc., and its direct and indirect subsidiaries, with JPMorgan Chase Bank, N.A., as Lender.

|

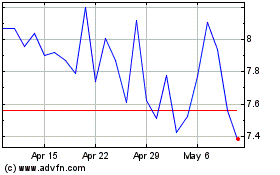

InfuSystems (AMEX:INFU)

Historical Stock Chart

From Mar 2024 to Apr 2024

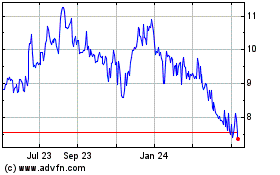

InfuSystems (AMEX:INFU)

Historical Stock Chart

From Apr 2023 to Apr 2024