Current Report Filing (8-k)

March 23 2017 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8

‑

K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 23, 2017

VERIFONE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-32465

Delaware

(State or Other Jurisdiction of Incorporation or Organization)

04-3692546

(IRS Employer Identification No.)

88 West Plumeria Drive

San Jose, CA 95134

(Address of principal executive offices, including zip code)

408-232-7800

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) At the annual meeting of stockholders (the "Annual Meeting") of VeriFone Systems, Inc. (the "Company") on March 23, 2017, the Company's stockholders approved the amendment and restatement of the VeriFone 2006 Equity Incentive Plan (the "2006 Plan") to (i) increase the number of shares of common stock that may be issued thereunder by 8,750,000 shares; (ii) provide a maximum annual limit on non-employee director compensation of $750,000; (iii) provide that no dividend or dividend equivalents shall be paid on any award granted under the 2006 Plan prior to the vesting of such award; (iv) permit the Compensation Committee of the Company's Board of Directors to designate certain awards made under the 2006 Plan as performance based awards intended to qualify as performance-based compensation under Section 162(m) of the United States Internal Revenue Code; (v) provide for minimum vesting provisions; (vi) extend the term of the 2006 Plan by an additional ten years, to March 23, 2027; and (vii) make other clarifying and administrative changes. A brief summary of the amended and restated 2006 Plan was included as part of Proposal 2 in the Company's definitive proxy statement filed with the Securities and Exchange Commission on February 9, 2017 (the "Proxy Statement"). Such summary is qualified by and subject to the full text of the amended and restated 2006 Plan, which was filed as Appendix B to the Proxy Statement and is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The Company held its Annual Meeting on March 23, 2017. The matters submitted to a vote of stockholders at the Annual Meeting and the final results for each matter submitted are as follows:

1. The Company's stockholders elected each of the following eight director nominees to serve a one-year term on the Company's Board of Directors. The vote results were as follows:

|

|

|

|

|

|

|

|

|

Director

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

Robert W. Alspaugh

|

85,350,137

|

1,270,962

|

123,934

|

9,742,463

|

|

Karen Austin

|

85,255,396

|

1,365,908

|

123,729

|

9,742,463

|

|

Paul Galant

|

85,286,814

|

1,335,403

|

122,816

|

9,742,463

|

|

Alex W. (Pete) Hart

|

85,167,279

|

1,452,745

|

125,009

|

9,742,463

|

|

Robert B. Henske

|

83,833,792

|

2,786,987

|

124,254

|

9,742,463

|

|

Eitan Raff

|

84,083,472

|

2,519,412

|

142,149

|

9,742,463

|

|

Jonathan I. Schwartz

|

83,990,003

|

2,627,914

|

127,116

|

9,742,463

|

|

Jane J. Thompson

|

83,646,523

|

2,973,565

|

124,945

|

9,742,463

|

2. The Company's stockholders approved the amendment and restatement of the 2006 Plan. The vote results were as follows:

|

|

|

|

|

|

|

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

75,142,185

|

11,471,898

|

130,950

|

9,742,463

|

3. The Company's stockholders approved, on an advisory basis, the compensation of the Company's named executive officers as set forth in its Proxy Statement. The vote results were as follows:

|

|

|

|

|

|

|

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

79,767,873

|

6,419,839

|

557,321

|

9,742,463

|

4. The Company's stockholders approved, on an advisory basis, the holding of an advisory vote on the compensation of the Company's named executive officers every year. The vote results were as follows:

|

|

|

|

|

|

|

|

|

One Year

|

Two Years

|

Three Years

|

Abstain

|

Broker Non-Votes

|

|

76,758,227

|

88,734

|

9,754,709

|

143,363

|

9,742,463

|

Based on the results of this advisory vote and consistent with the Company’s recommendation for this proposal, the Company will hold an advisory vote on compensation of its named executive officers every year.

5. The Company's stockholders ratified the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending October 31, 2017. The vote results were as follows:

|

|

|

|

|

|

|

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

95,845,008

|

505,443

|

137,045

|

--

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VERIFONE SYSTEMS, INC.

|

|

|

|

|

Date: March 23, 2017

|

By:

/s/ Albert Liu

Name: Albert Liu

Title: Executive Vice President, Corporate Development and General Counsel

|

|

|

|

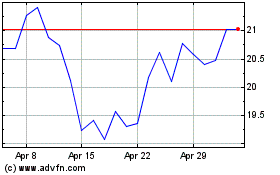

Paymentus (NYSE:PAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

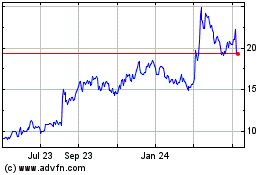

Paymentus (NYSE:PAY)

Historical Stock Chart

From Apr 2023 to Apr 2024