Current Report Filing (8-k)

March 23 2017 - 5:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

March 17, 2017

Northwest Biotherapeutics, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

(State or other jurisdiction

of incorporation or organization)

|

0-35737

(Commission

File Number)

|

94-3306718

(IRS Employer

Identification No.)

|

4800 Montgomery Lane, Suite 800

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

(240) 497-9024

(Registrant’s telephone number, including

area code)

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2 below):

|

|

☐

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

As previously reported by Northwest Biotherapeutics,

Inc. (the “Company”), on March 9, 2017, the Company and the holders (the “Holders”) of its 5.00% Convertible

Senior Notes due 2017 (the “Notes”) entered into a Note Repurchase Agreement (the “Repurchase Agreement”).

The Notes were issued pursuant to an (“Indenture”), dated August 19, 2014 (the “Indenture”). On March 17,

2017, the Company executed a first supplemental indenture to the Indenture, providing that a default on the Company’s payment,

performance or other obligations under the Repurchase Agreement in accordance with its terms also is also a default under the Indenture

and that, if such a default occurs and is continuing, the principal of all the Notes and accrued and unpaid interest shall be automatically

due and payable. A copy of the First Supplemental Indenture and the Repurchase Agreement are attached hereto as Exhibits 10.1 and

10.2, respectively, and are incorporated by reference herein.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d)

Exhibits

.

|

Exhibit No.

|

Description

|

|

10.1

|

First Supplemental Indenture, dated March 17, 2017, between Northwest Biotherapeutics, Inc. and The Bank of New York Mellon, as trustee

|

|

10.2

|

Repurchase Agreement, dated March 8, 2017, between Northwest Biotherapeutics, Inc. and the holders of 5.00% Convertible Senior Notes due 2017

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NORTHWEST BIOTHERAPEUTICS, INC.

|

|

|

|

|

|

|

|

Date: March 23, 2017

|

By:

/s/ Linda Powers

|

|

|

Name: Linda Powers

Title: Chief Executive Officer

and Chairman

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

10.1

|

First Supplemental Indenture, dated March 17, 2017, between Northwest Biotherapeutics, Inc. and The Bank of New York Mellon, as trustee

|

|

10.2

|

Repurchase Agreement, dated March 8, 2017, between Northwest Biotherapeutics, Inc. and the holders of 5.00% Convertible Senior Notes due 2017

|

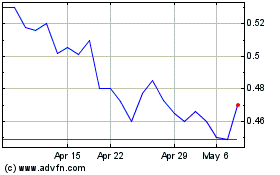

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Apr 2023 to Apr 2024