Pacific Premier Bancorp Ranked as a Top Performing Community Bank by S&P Global Market Intelligence

March 23 2017 - 6:00AM

Business Wire

Pacific Premier Bancorp, Inc. (NASDAQ: PPBI), the holding

company of Pacific Premier Bank, announced today that it was named

as a top performing community bank by S&P Global Market

Intelligence based on its financial results for the year ended

December 31, 2016. Pacific Premier Bancorp was ranked as the fifth

best performing community bank in the United States with total

assets between $1 billion and $10 billion. This is the second

consecutive year that Pacific Premier Bancorp has been ranked as

one of the 10 best performing community banks in this size

range.

S&P Global Market Intelligence’s rankings are based on six

metrics: pretax return on average tangible common equity, net

charge-offs as a percentage of average loans, efficiency ratio,

adjusted Texas ratio, net interest margin on a fully taxable

equivalent basis and loan growth. More than 540 companies were

eligible for the S&P Global Market Intelligence rankings.

“Our ranking as one of the top performing community banks in the

United States is a testament to our commitment to a strong sales,

service and credit culture, as well as a high level of efficiency

in our operations and capital utilization,” said Steven R. Gardner,

Chairman, President and Chief Executive Officer of Pacific Premier

Bancorp. “As we continue to build Pacific Premier into one of the

leading commercial banks on the West Coast, we believe we can

maintain our position as one of the highest performing banks in the

country.”

About Pacific Premier Bancorp, Inc.

Pacific Premier Bancorp, Inc. is the holding company for Pacific

Premier Bank, one of the largest banks headquartered in Southern

California with $4.0 billion in assets. Pacific Premier Bank is a

business bank primarily focused on serving small and middle market

businesses in the counties of Los Angeles, Riverside, San

Bernardino and San Diego, California. Pacific Premier Bank offers a

diverse range of lending products including commercial, commercial

real estate, construction, and SBA loans, as well as specialty

banking products for homeowners associations and franchise lending

nationwide. Pacific Premier Bank serves its customers through its

15 full-service depository branches in Southern California located

in the cities of Corona, Encinitas, Huntington Beach, Irvine, Los

Alamitos, Murrieta, Newport Beach, Palm Desert (2), Palm Springs,

Redlands, Riverside, San Bernardino (2), and San Diego.

Forward-Looking Comments

The statements contained herein that are not historical facts

are forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Such statements involve inherent

risks and uncertainties, many of which are difficult to predict and

are generally beyond the control of the Company. There can be no

assurance that future developments affecting the Company will be

the same as those anticipated by management. The Company cautions

readers that a number of important factors could cause actual

results to differ materially from those expressed in, or implied or

projected by, such forward-looking statements. These risks and

uncertainties include, but are not limited to, the following: the

strength of the United States economy in general and the strength

of the local economies in which we conduct operations; the effects

of, and changes in, trade, monetary and fiscal policies and laws,

including interest rate policies of the Board of Governors of the

Federal Reserve System; inflation, interest rate, market and

monetary fluctuations; the timely development of competitive new

products and services and the acceptance of these products and

services by new and existing customers; the willingness of users to

substitute competitors’ products and services for the Company’s

products and services; the impact of changes in financial services

policies, laws and regulations (including the Dodd-Frank Wall

Street Reform and Consumer Protection Act) and of governmental

efforts to restructure the U.S. financial regulatory system;

technological changes; the effect of acquisitions that the Company

may make, if any, including, without limitation, the failure to

achieve the expected revenue growth and/or expense savings from its

acquisitions; changes in the level of the Company’s nonperforming

assets and charge-offs; any oversupply of inventory and

deterioration in values of California real estate, both residential

and commercial; the effect of changes in accounting policies and

practices, as may be adopted from time-to-time by bank regulatory

agencies, the Securities and Exchange Commission (“SEC”), the

Public Company Accounting Oversight Board, the Financial Accounting

Standards Board or other accounting standards setters; possible

other-than-temporary impairment of securities held by us; changes

in consumer spending, borrowing and savings habits; the effects of

the Company’s lack of a diversified loan portfolio, including the

risks of geographic and industry concentrations; ability to attract

deposits and other sources of liquidity; changes in the financial

performance and/or condition of our borrowers; changes in the

competitive environment among financial and bank holding companies

and other financial service providers; unanticipated regulatory or

judicial proceedings; and the Company’s ability to manage the risks

involved in the foregoing. Additional factors that could cause

actual results to differ materially from those expressed in the

forward-looking statements are discussed in the 2016 Annual Report

on Form 10-K of Pacific Premier Bancorp, Inc. filed with the SEC

and available at the SEC’s Internet site (http://www.sec.gov).

The Company specifically disclaims any obligation to update any

factors or to publicly announce the result of revisions to any of

the forward-looking statements included herein to reflect future

events or developments.

Notice to Heritage Oaks Bancorp and

Pacific Premier Shareholders

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of

any vote or approval. In connection with the proposed acquisition

of Heritage Oaks by Pacific Premier. Pacific Premier filed a

registration statement on Form S-4 (The "Registration

Statement") with the SEC. The registration statement contains a

joint proxy statement/prospectus. The Registration Statement was

declared by the SEC to be effective on February 27, 2017, and a

definitive joint proxy statement/prospectus was distributed to the

shareholders of Heritage Oaks and the Pacific Premier in connection

with the respective special meetings of Heritage Oaks and the

Pacific Premier shareholders and their respective votes concerning

the acquisition. SHAREHOLDERS OF HERITAGE OAKS AND PACIFIC PREMIER

ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND THE

DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC, AS WELL AS SUPPLEMENTS TO THOSE

DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED ACQUISITION. The definitive joint proxy

statement/prospectus was mailed to shareholders of Pacific Premier

and Heritage Oaks. Investors and security holders are able to

obtain the documents, including the definitive joint proxy

statement/prospectus free of charge at the SEC’s

website, www.sec.gov. In addition, documents filed with the

SEC by Pacific Premier will be available free of charge by

(1) accessing Pacific Premier’s website at

www.ppbi.com under the “Investor Relations” link and then

under the heading “SEC Filings,” (2) writing to Pacific

Premier at 17901 Von Karman Avenue, Suite 1200, Irvine,

CA 92614, Attention: Investor Relations or (3) writing

Heritage Oaks at 1222 Vine Street, Paso Robles, CA 93446,

Attention: Corporate Secretary.

The Pacific Premier directors, executive officers and certain

other members of management and employees of Pacific Premier may be

deemed to be participants in the solicitation of proxies from the

Pacific Premier shareholders in respect of the proposed

acquisition. Pacific Premier has also engaged D.F. King &

Co., Inc. as its proxy solicitation firm. Information about

the Pacific Premier directors and executive officers is included in

the proxy statement for its 2016 annual meeting, which was filed

with the SEC on April 27, 2016. The Heritage Oaks directors,

executive officers and certain other members of management and

employees of Heritage Oaks may also be deemed to be participants in

the solicitation of proxies in favor of the acquisition from the

shareholders of Heritage Oaks. Heritage Oaks has also engaged Okapi

Partners LLC as its proxy solicitation firm. Additional information

regarding the interests of those participants and other persons who

may be deemed participants in the transaction may be obtained by

reading the definitive joint proxy statement/prospectus regarding

the proposed acquisition when it becomes available. Free copies of

this document may be obtained as described in the preceding

paragraph.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170323005468/en/

Pacific Premier Bancorp, Inc.Steven R. GardnerChairman,

President and CEO949-864-8000orRonald J. Nicolas, Jr.Senior

Executive Vice President & CFO949-864-8000

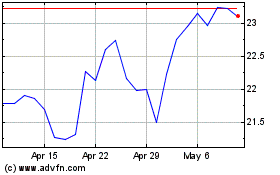

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

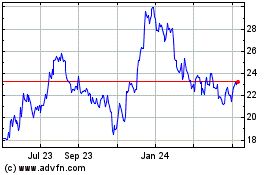

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Apr 2023 to Apr 2024