Current Report Filing (8-k)

March 22 2017 - 4:36PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): March 21, 2017

HOUSTON

AMERICAN ENERGY CORP.

(Exact

name of registrant as specified in Charter)

|

Delaware

|

|

1-32955

|

|

76-0675953

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File

No.)

|

|

(IRS

Employer

Identification

No.)

|

|

|

801

Travis St., Suite 1425

Houston,

Texas 77002

|

|

|

|

(Address

of Principal Executive Offices)(Zip Code)

|

|

|

|

713-222-6966

|

|

|

|

(Issuer

Telephone number)

|

|

|

|

|

|

|

|

(Former

name or former address, if changed since last report)

|

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item

3.01.

|

Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On

March 21, 2017, Houston American Energy Corp. (the “Company”) received notification (the “Deficiency Letter”)

from the NYSE MKT LLC that it continues to be in non-compliance with certain NYSE MKT continued listing standards relating to

stockholders’ equity. Specifically, the Company is not in compliance with Section 1003(a)(iii) of the NYSE MKT Company Guide

(requiring stockholders’ equity of $6.0 million or more if it has reported losses from continuing operations and/or net

losses in its five most recent fiscal years) and Section 1003(a)(ii) (requiring stockholders’ equity of $4.0 million or

more if it has reported losses from continuing operations and/or net losses in its four most recent fiscal years). As of December

31, 2016, the Company had stockholders’ equity of $2.86 million.

As

previously reported, the Company has submitted a plan to regain compliance with NYSE MKT listing standards. If the Company does

not regain compliance with those standards by September 18, 2017, or does not make progress consistent with the plan, the NYSE

MKT staff may commence delisting proceedings. The Company’s common stock continues to be listed on the NYSE MKT during the

plan period.

The

Company issued a press release on March 22, 2017, announcing that it had received the Deficiency Letter. A copy of the press release

is attached to this Current Report on Form 8-K as Exhibit 99.1.

|

Item

9.01.

|

Financial

Statements and Exhibits.

|

|

|

99.1

|

Press

release, dated March 22, 2017, regarding NYSE MKT notice of non-compliance

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

HOUSTON

AMERICAN ENERGY CORP.

|

|

|

|

|

|

Dated:

March 22, 2017

|

|

|

|

|

By:

|

/s/

John P. Boylan

|

|

|

|

John

P. Boylan, President

|

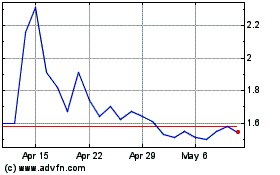

Houston American Energy (AMEX:HUSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Houston American Energy (AMEX:HUSA)

Historical Stock Chart

From Apr 2023 to Apr 2024