Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-216512

PROSPECTUS

3,135,000 SHARES

PARAMOUNT GOLD NEVADA CORP.

Common Stock

This prospectus

covers the sale, transfer or other disposition of up to 3,135,000 shares of our common stock, including 1,045,000 shares issuable upon exercise of warrants, by certain Selling Stockholders, which as used herein includes donees, pledgees, transferees

and other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership, distribution or other transfers, or the

Selling Stockholders. The Selling Stockholders may, from time to time, sell, transfer, or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market, or trading facility on

which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale,

or at negotiated prices.

Paramount Gold Nevada Corp. is not offering any shares of common stock for sale under this prospectus. We will

not receive any of the proceeds from the sale or other disposition of the shares of common stock by the Selling Stockholders, other than any proceeds from the cash exercise of the warrants to purchase shares of common stock.

All expenses of registration incurred in connection with this offering are being borne by us. All selling and other expenses incurred by the

Selling Stockholders will be borne by the Selling Stockholders.

Our common stock is quoted on the NYSE MKT LLC under the symbol

“PZG.” On March 21, 2017, the last reported sales price of our common stock, as reported on the NYSE MKT LLC, was $1.61 per share.

Investing in our common stock involves certain risks. See the “Risk Factors” section herein and in our Annual Report on Form 10-K

for the year ended June 30, 2016 as well as our subsequently filed periodic and current reports, which we file with the Securities and Exchange Commission and are incorporated by reference into this prospectus. You should read the entire

prospectus carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 22, 2017

TABLE OF CONTENTS

- i -

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the

“SEC”) using a “shelf” registration or continuous offering process.

You should read this prospectus and the

information and documents incorporated by reference carefully. Such documents contain important information you should consider when making your investment decision. See “Where You Can Find More Information” and “Incorporation of

Certain Documents by Reference” in this prospectus.

You should rely only on the information provided in this prospectus or documents

incorporated by reference into this prospectus. We have not, and each of the Selling Stockholders has not, authorized anyone to provide you with different information. This prospectus covers offers and sales of common stock only in jurisdictions in

which such offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. You should not

assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, or that the information contained in any document incorporated by reference is accurate as of any date

other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

In this prospectus, we refer to Paramount Gold Nevada Corp. as “we,” “us,” “our,” the “Company” or

“Paramount.” References to “Selling Stockholders” refers to the stockholders listed herein under “Selling Stockholders” and their donees, pledgees, transferees, or other successors-in-interest.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

Information in and incorporated by reference into this prospectus contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 and the safe harbor provided by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). Statements that are not purely historical may be forward-looking. You can identify some forward-looking statements by the use of words such as “believes,” “anticipates,” “expects,”

“intends” and similar expressions. Forward looking statements involve inherent risks and uncertainties regarding events, conditions and financial trends that may affect our future plans of operation, business strategy, results of

operations, and financial position. These statements by their nature involve substantial risks and uncertainties, credit losses, dependence on management and key personnel, variability of quarterly results, and our ability to continue growth.

Statements in this annual report regarding planned drilling activities and any other statements about Paramount’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements.

For a discussion of these and other factors that could cause actual results to differ from those contemplated in the forward-looking

statements, please see the discussion under “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended June 30, 2016 and in our subsequent filings with the SEC.

Forward-looking statements speak only as of the date made. Because actual results or outcomes could differ materially from those expressed in

any forward-looking statements made by us or on our behalf, you should not place undue reliance on any such forward-looking statements. We do not undertake any responsibility to update or revise any of these factors or to announce publicly any

revisions to forward-looking statements, whether as a result of new information, future events or otherwise.

- ii -

PROSPECTUS SUMMARY

The following is only a summary and therefore does not contain all of the information you should consider before investing in our common stock. We urge you

to read this entire prospectus, including the matters discussed under “Risk Factors” in this prospectus and the more detailed consolidated financial statements, notes to the consolidated financial statements and other information

incorporated by reference from our other filings with the SEC.

Our Company

We are an emerging growth company engaged in the business of acquiring, exploring and developing precious metal projects in the United States

of America. Paramount owns advanced stage exploration projects in the states of Nevada and Oregon. We enhance the value of our projects by implementing exploration and engineering programs that are likely to expand and upgrade known mineralized

material to reserves. Paramount believes there are several ways to realize the value of its projects: selling its projects to producers; joint venturing its projects with other companies; or building and operating small mines on its own.

The Company’s principal Nevada interest, the Sleeper Gold Project, is located in Humboldt County, Nevada, and was a producing mine until

1996.

Our project located in Oregon, known as the Grassy Mountain Project, is located in Malheur County, Oregon, and was acquired by way

of statutory plan of arrangement in the Province of British Columbia, Canada with Calico Resources Corp. in July 2016.

Inter-corporate

Relationships

We currently have three active wholly owned direct subsidiaries:

New Sleeper Gold LLC and Sleeper Mining Company, LLC, which operate our mining interests in Nevada.

Calico Resources USA Corp., which holds our interest in the Grassy Mountain Project in Oregon.

Initial Public Offering and Organizational Transactions

Paramount Gold Nevada Corp. is a Nevada corporation formed on June 15, 1992 under the name X-Cal (USA), Inc.

On April 17, 2015, we entered into the previously disclosed separation and distribution agreement with Paramount Gold and Silver Corp.

(“PGSC”), to effect the separation (the “separation”) of the Company from PGSC, and to provide for the allocation between the Company and PGSC of the Company’s and PGSC’s assets, liabilities and obligations attributable

to periods prior to, at and after the separation.

We filed a registration statement on Form S-1 in connection with the distribution (the

“distribution”) by PGSC to its stockholders of all the outstanding shares of common stock of the Company. The registration statement was declared effective by the Securities and Exchange Commission on April 9, 2015. The distribution,

which effected a spin-off of the Company from PGSC, was made on April 17, 2015. As a result of the distribution, the Company is now a publicly traded company independent from PGSC. On April 20, 2015, the Company’s shares of common

stock commenced trading on the NYSE MKT LLC under the symbol “PZG”.

On March 14, 2016, Paramount Gold Nevada Corp. and

Calico Resources Corp. (“Calico”) entered into an Arrangement Agreement providing for the acquisition of Calico by Paramount. On July 7, 2016, after having received the approval of the Supreme Court of British Columbia to the

transaction, Paramount and Calico completed the transaction contemplated by the Arrangement Agreement, pursuant to which Calico became a wholly-owned subsidiary of Paramount.

Corporate Information

Our principal

business office is located at 665 Anderson Street, Winnemucca, Nevada 89445, and our telephone number is (775) 625-3600. Our website address is www.paramountnevada.com. Information contained in our website or any other website does not

constitute part of this prospectus.

1

Private Placement

On February 6, 2017, the Company entered into definitive agreements and accepted subscriptions (the “Subscription Agreements”)

with accredited investors to issue common stock and warrants (the “Warrants”) in a non-brokered private transaction (the “Transaction”). Under the terms of the Transaction, Paramount agreed to sell an aggregate of 2,090,000 units

at $1.75 per unit for aggregate proceeds of $3,657,500. Each unit consists of one share of common stock and one warrant to purchase one-half of a share of common stock. Each warrant has a two-year term and is exercisable at the following exercise

prices: in the first year at $2.00 per share and in the second year at $2.25 per share. There were no commissions or underwriting fees paid in connection with the Transaction.

Closing of the private placement pursuant to the definitive agreements occurred on February 15, 2017.

Copies of the forms of Subscription Agreements and Warrants are incorporated by reference as exhibits to the registration statement of which

this prospectus forms a part. The foregoing summaries of each of the transaction documents, including the warrants, are qualified in their entirety by reference to such documents.

2

The Offering

|

Common stock outstanding:

|

17,779,954 shares (1)

|

|

Common stock that may be sold or otherwise disposed of by the Selling Stockholders:

|

3,135,000 shares (2)

|

|

NYSE MKT symbol for common stock:

|

PZG

|

|

Use of proceeds:

|

We will not receive any of the proceeds from the sale or other disposition of the shares covered by this prospectus. We will receive proceeds from the cash exercise of the warrants held by the Selling Stockholders, and we intend to use any such

proceeds for working capital and general corporate purposes.

|

|

Risk factors:

|

See “Risk Factors” in our Annual Report on Form 10-K for the year ended June 30, 2016 as well as our subsequently filed periodic and current reports, for a discussion of factors to consider before investing in shares of our common

stock.

|

|

(1)

|

The number of shares shown to be outstanding is based on the number of shares of our common stock outstanding as of March 1, 2017, and does not include shares issuable upon exercise of warrants (including the

shares of common stock being registered hereunder underlying the warrants held by the Selling Stockholders), or reserved for issuance upon the exercise of options granted or available under our equity compensation plans.

|

|

(2)

|

The number of shares being registered hereunder includes 2,090,000 shares of our common stock outstanding, and 1,045,000 shares issuable upon exercise of the Warrants.

|

3

RISK FACTORS

An investment in our common stock involves risks. Prior to making a decision about investing in our common stock, you should consider carefully the risks

together with all of the other information contained or incorporated by reference in this prospectus, including any risks described in the section entitled “Risk Factors” contained in any supplements to this prospectus and in our Annual

Report on Form 10-K for the fiscal year ended June 30, 2016 and in our subsequent filings with the SEC. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price

of shares of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

USE OF PROCEEDS

We will not receive any of the proceeds from any sale or other disposition of the shares of common stock covered

by this prospectus. We will receive proceeds upon the cash exercise of the warrants for which underlying shares of common stock are being registered hereunder. Assuming full cash exercise of the Warrants in the first year at the exercise price of

$2.00 per underlying share of common stock, we will receive proceeds of $2,090,000. Assuming full cash exercise of the Warrants in the second year at the exercise price of $2.25 per underlying share of common stock, we will receive additional

proceeds of $2,351,250. We currently intend to use the cash proceeds from any warrant exercise for working capital and general corporate purposes. The amount and timing of our actual use of proceeds may vary significantly depending upon numerous

factors, including the actual amount of proceeds we receive and the timing of when we receive such proceeds. Our management will retain broad discretion in the allocation of the net proceeds from the exercise of the Warrants.

4

PLAN OF DISTRIBUTION

The Selling Stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common

stock or interests in shares of common stock received after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership distribution or other transfer, may from time to time sell, transfer or otherwise dispose of any or all

of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market

prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. The Selling Stockholders may use any one or more of the following methods when selling

securities:

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

settlement of short sales;

|

|

|

•

|

|

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security;

|

|

|

•

|

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

•

|

|

a combination of any such methods of sale; or

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders may also sell

securities under Rule 144 or any other exemption from registration under the Securities, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive

commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case

of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

In connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with

broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Stockholders may also sell securities short and deliver these securities to

close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into options or other transactions with broker-dealers or other financial

institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities covered by this prospectus, which securities such broker-dealer or other financial institution may

resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any

broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The Selling Stockholders have informed us that they do not have any written or oral

agreement or understanding, directly or indirectly, with any person to distribute the securities.

We are required to pay certain fees and

expenses incurred by us incident to the registration of the securities. We agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until the earlier of

(i) the date that such securities become eligible for resale without volume or manner-of-sale restrictions and without current public information pursuant to Rule 144 and certain other conditions have been satisfied, or (ii) all of the

securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to our common stock for the applicable restricted period,

as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may

limit the timing of purchases and sales of common stock by the Selling Stockholders or any other person.

5

SELLING STOCKHOLDERS

The shares of common stock covered by this prospectus are those previously issued in the private placement described above and those issuable

upon exercise of the Warrants. For additional information regarding the issuances of those securities, see “Private Placement” above.

The shares of common stock to be offered by the Selling Stockholders are “restricted” securities under applicable federal and state

securities laws and are being registered under the Securities Act to give the Selling Stockholders the opportunity to sell these shares publicly. The registration of these shares does not require that any of the shares be offered or sold by the

Selling Stockholders. Subject to these resale restrictions, the Selling Stockholders may from time to time offer and sell all or a portion of their shares indicated below in privately negotiated transactions or on the NYSE MKT LLC or any other

market on which our common stock may subsequently be listed.

The registered shares may be sold directly or through brokers or dealers, or

in a distribution by one or more underwriters on a firm commitment or best effort basis. To the extent required, the names of any agent or broker-dealer and applicable commissions or discounts and any other required information with respect to any

particular offering will be set forth in a prospectus supplement. See the section of this prospectus entitled “Plan of Distribution”. The Selling Stockholders and any agents or broker-dealers that participate with the Selling Stockholders

in the distribution of registered shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions received by them and any profit on the resale of the registered shares may be deemed to be

underwriting commissions or discounts under the Securities Act.

No estimate can be given as to the amount or percentage of common stock

that will be held by the Selling Stockholders after any sales made pursuant to this prospectus because the Selling Stockholders are not required to sell any of the Securities being registered under this prospectus.

The table below lists the Selling Stockholders and other information regarding the beneficial ownership of the shares of our common stock by

each of the Selling Stockholders. The second column lists the number of shares of our common stock beneficially owned by each of the Selling Stockholders, based on ownership of shares of common stock and the Warrants, as of March 2, 2017, assuming

exercise of the Warrants held by the Selling Stockholders on that date, without regard to any limitations on exercises. The third column lists the shares of common stock covered by this prospectus. The fourth column assumes the sale of all of the

shares covered by this prospectus.

Unless otherwise indicated in the footnotes below, no Selling Stockholder has had any material

relationship with us or any of our affiliates within the past three years other than as a security holder.

6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

Shares of

Common

Stock

Owned

Prior to

Offering

|

|

|

Maximum

Number of

Shares of

Common

Stock to

be Sold

Pursuant

to this

Prospectus

|

|

|

Number of Shares of

Common Stock Owned

After Offering

(1)

|

|

|

Name of Selling Stockholder

|

|

|

|

Numbers

|

|

|

Percentage

|

|

|

FCMI Parent Co.

|

|

|

3,397,161

|

|

|

|

745,200

|

|

|

|

2,651,961

|

|

|

|

14.09

|

%

|

|

Seavista, LLC

|

|

|

558,383

|

|

|

|

429,000

|

|

|

|

129,383

|

|

|

|

*

|

|

|

Porter Partners, L.P.

|

|

|

300,000

|

|

|

|

300,000

|

|

|

|

0

|

|

|

|

*

|

|

|

EDJ Limited

|

|

|

75,000

|

|

|

|

75,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Gary Grauberger

|

|

|

603,500

|

|

|

|

172,500

|

|

|

|

431,000

|

|

|

|

2.29

|

%

|

|

Nordgestion SA

|

|

|

135,845

|

|

|

|

90,000

|

|

|

|

45,045

|

|

|

|

*

|

|

|

Seabridge Gold, Inc.

(2)

|

|

|

1,124,963

|

|

|

|

154,800

|

|

|

|

970,163

|

|

|

|

5.15

|

%

|

|

Ian MacKellar

|

|

|

186,150

|

|

|

|

60,150

|

|

|

|

120,000

|

|

|

|

*

|

|

|

Marshall Berol

|

|

|

12,525

|

|

|

|

10,500

|

|

|

|

2,025

|

|

|

|

*

|

|

|

1567509 Ontario Inc.

|

|

|

85,800

|

|

|

|

85,800

|

|

|

|

0

|

|

|

|

*

|

|

|

Tom Wright

|

|

|

44,615

|

|

|

|

42,900

|

|

|

|

1,715

|

|

|

|

*

|

|

|

John Pelow

|

|

|

342,900

|

|

|

|

342,900

|

|

|

|

0

|

|

|

|

*

|

|

|

Childress Family LP

|

|

|

85,800

|

|

|

|

85,800

|

|

|

|

0

|

|

|

|

*

|

|

|

Wayne Wew

|

|

|

884,445

|

|

|

|

200,000

|

|

|

|

684,445

|

|

|

|

3.64

|

%

|

|

Talkot Fund, LP

|

|

|

240,450

|

|

|

|

240,450

|

|

|

|

0

|

|

|

|

*

|

|

|

Martha Wile

|

|

|

100,000

|

|

|

|

100,000

|

|

|

|

0

|

|

|

|

*

|

|

|

(1)

|

Assumes 18,824,954 shares of our common stock are outstanding after the offering, which reflects 17,779,954 shares presently outstanding and 1,045,000 shares issuable upon exercise of the Warrants.

|

|

(2)

|

Mr. Rudi Fronk, the chairman and chief executive officer of Seabridge Gold Inc. (“Seabridge”), Mr. Christopher Reynolds, the chief financial officer of Seabridge, and Eliseo Gonzalez-Urien, a

director of Seabridge, are all members of our Board of Directors. Mr. Rudi Fronk is also the Chairman of our Board of Directors. All three are shareholders of the Company.

|

7

EXPERTS

The consolidated financial statements incorporated in this prospectus by reference from our Annual Report on Form 10-K for the year ended

June 30, 2016, and the effectiveness of our internal control over financial reporting, have been audited by MNP LLP, an independent registered public accounting firm as stated in their reports, which are incorporated herein by reference, and

have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

LEGAL MATTERS

The validity of the shares of our common stock covered hereby will be passed upon for us by Duane Morris LLP,

Newark, New Jersey.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the

information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements, or other documents, the reference may not be complete and you should refer to the exhibits that are a part of

the registration statement or the exhibits to the reports or other documents incorporated by reference in this prospectus supplement and the accompanying prospectus for a copy of such contract, agreement, or other document. Because we are subject to

the information and reporting requirements of the Exchange Act, we file annual, quarterly, and current reports, proxy statements, and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of

the Public Reference Room. Our website address is www.paramountnevada.com. Information contained in, or accessible through, our website is not a part of this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information contained in any supplement to this prospectus and information that we file

with the SEC in the future and incorporate by reference in this prospectus will automatically update and supersede the information contained in this prospectus. We incorporate by reference the documents listed below and any future filings (other

than current reports on Form 8-K furnished under Item 2.02 or Item 7.01 and exhibits filed on such form that are related to such items) we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the

initial filing date of the registration statement of which this prospectus forms a part and prior to the termination of this offering covered by this prospectus:

|

|

•

|

|

Our Annual Report on Form 10-K for the fiscal year ended June 30, 2016 filed on September 16, 2016, including certain information incorporated by reference therein from our Definitive Proxy Statement for our

2016 annual meeting of stockholders;

|

|

|

•

|

|

Our Quarterly Reports on Form 10-Q for the fiscal periods ended September 30, 2016 and December 31, 2016 filed on November 9, 2016 and February 9, 2017 respectively;

|

|

|

•

|

|

Our Current Reports on Form 8-K or Form 8-K/A filed on December 16, 2016, January 12, 2017, February 8, 2017 and February 9, 2017; and

|

|

|

•

|

|

The description of our common stock included in our registration statement on Form 8-A filed on April 6, 2015.

|

We will provide without charge upon written or oral request, to each person, including any beneficial owner, to whom a prospectus is

delivered, a copy of any or all of the documents incorporated by reference, including exhibits to these documents. You should direct any requests for documents to:

Paramount Gold Nevada Corp.

665

Anderson Street

Winnemucca, NV 89445

(775) 625-3600

8

3,135,000 SHARES

Common Stock

PROSPECTUS

March 22, 2017

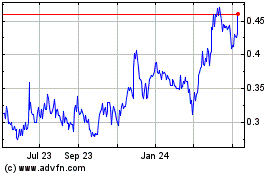

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Apr 2023 to Apr 2024