Current Report Filing (8-k)

March 22 2017 - 1:57PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

Date of Report (date of earliest event reported): March

13, 2017

Kaya Holdings, Inc.

(Exact name of registrant as specified in charter)

Delaware

(State or other jurisdiction of incorporation)

|

333177532

|

|

90-0898007

|

|

(Commission File

Number)

|

|

(IRS Employer Identification

No.

)

|

305 S. Andrews Avenue, Suite 209, Fort Lauderdale, Florida

33301

(Address of principal executive offices and zip code)

(954) 5347895

(Registrant’s telephone number including area code)

Former Name or Former Address (If Changed Since Last

Report)

Check the appropriate box below if the

Form 8K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

|

[ ]

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

|

Soliciting material pursuant to Rule 14a12(b) under the Exchange Act (17 CFR 240.14a12)

|

|

[ ]

|

|

Precommencement communications pursuant to Rule 14d2(b) under the Exchange Act (17

CFR 240.14d2(b))

|

|

[ ]

|

|

Precommencement communications pursuant to Rule 13e4(c) under the Exchange Act (17

CFR 240.13e4(c))

|

As used in this Current Report on Form

8K and unless otherwise indicated, the terms “

KAYS

,” “

the Company

,” “

we

,”

“

us

” and “

our

” refer to Kaya Holdings, Inc. and its subsidiaries.

Item 3.02 Unregistered Sales of Equity Securities

.

In

March 2017, the Company completed a $2.1 million financing with an institutional investor (the “

Investor

”)

who had previously furnished KAYS with $1.2 million in financing, pursuant to a financing agreement (the “

Financing Agreement

”)

which the Company had previously reported in a Current Report on Form 8-K filed with the Securities and Exchange Commission on

January 6, 2017 (the “

Prior Form 8-K

”). Pursuant to the Financing Agreement, the Investor purchased $2.1 million

in principal amount of convertible notes (the “

Notes

”) from the Company as follows:

|

|

·

|

$400,000

in principal amount of Notes which are convertible into shares of the Company’s

common stock (“

Shares

”), at a conversion price of $0.04;

|

|

|

·

|

$700,000

in principal amount of Notes which are convertible into Shares at a conversion price

of $0.07; and

|

|

|

·

|

$1,000,000

in principal amount of Notes which are convertible into Shares at a conversion price

of $0.10.

|

The purchase price for the Notes is equal

to the principal amount thereof. The Notes have a term of two years from issuance and bear interest at the rate of eight percent

(8%) annum, which accrues and is payable to together with interest at maturity. The Investor may convert the principal amount

of the Notes (as well as other notes it currently holds as referenced above), together with accrued but unpaid interest thereon,

into Shares at the applicable conversion price, at any time or from time to time prior to maturity. The conversion price is subject

to adjustment for stock splits, stock dividends, recapitalizations and similar transactions. The Notes also provide that at no

time may they be convertible if the number of Shares being issued upon conversion to and then held by the Investor would result

in the Investor beneficially owning in excess of 4.99% of the Company’s then outstanding Shares, after giving effect to

the proposed conversion.

The Notes were issued pursuant to the exemption from

registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended and Regulation D thereunder. No

commissions or placement fees were paid in connection with the offer and sale of the Notes. The proceeds from the offer

and sale of Notes are being used to fund the Company’s 2017 growth plan, including expansion of our chain of legal Kaya

Shack™ Marijuana Superstores in Oregon, increasing the capacity of our legal marijuana grow facility and manufacturing

operations and introducing new Kaya branded cannabis products.

Copies of the Financing Agreement and

the form of Note were filed as Exhibits to the Prior Form 8-K. The foregoing summaries do not purport to be complete and are qualified

in their entirety by reference to such documents.

Item 5.03 Amendments to Articles of

Incorporation or Bylaws; Change in Fiscal Years

.

On March 13, 2017, we filed a Certificate of Amendment to our

Certificate of Incorporation with the Delaware Secretary of State increasing the number of shares of common stock KAYA is

authorized to issue to five hundred million (500,000,000). The Company believes that the authorization of additional shares

of common stock (which was authorized by our board of directors and holders of a majority of our voting shares) was needed to

meet the Company’s obligations under outstanding convertible notes and securities, as well as to afford it with the

ability to raise additional capital as needed and accordingly, is in the best interests of the Company and its stockholders.

A copy of the Certificate of Amendment is filed as Exhibit 3.1 to this report and incorporated herein by reference.

Item 8.01 Other Information

.

On March 21, 2017, we issued a press release announcing that

KAYA had received its third Marijuana Retailer license from the Oregon Liquor Control Commission and had opened its third

retail outlet, a Kaya Shack™ Marijuana Superstore, in North Salem, Oregon. A copy of the press release is filed as

Exhibit 99.1 to this report.

Item 9.01 Financial Statements and Exhibits

.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: March 22, 2017

|

KAYA

HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

By: /s/

Craig Frank

|

|

|

|

Craig

Frank, President and Chief Executive Offi

cer

|

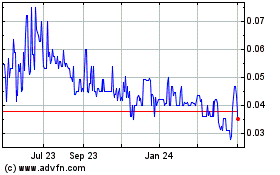

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

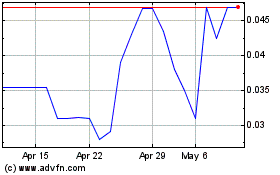

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Apr 2023 to Apr 2024