Current Report Filing (8-k)

March 20 2017 - 9:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 16, 2017

|

INDOOR HARVEST CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

Texas

|

|

333-194326

|

|

45-5577364

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

5300 East Freeway Suite A

Houston, Texas

|

|

77020

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

713-410-7903

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

An amendment has been made pursuant to a Letter of Intent dated January 3, 2017 as well as an amendment made February 15, 2017 (collectively, the “Alamo LOI”), between Alamo CBD, LLC (“Alamo”) and Indoor Harvest Corp (“Indoor Harvest”), collectively (the “Parties”). Both Parties have agreed that all pre-conditions under the Alamo LOI have been sufficiently met to proceed to a definitive agreement (the “Alamo Definitive Agreement”). Both Parties agree to act in good faith to consummate the Alamo Definitive Agreement and the combination of the Parties on, or before, March 31, 2017 (the “Combination”), which date may be extended, as the Parties mutually agree.

Effective March 15, 2017, Indoor Harvest Corp closed its Rule 506 private offering for $1M. Subject to the terms of that Alamo Definitive Agreement, both Parties have proposed changes to the original reorganization plans as generally follows:

|

·

|

The Parties will share resources and costs, as may be more specifically stated in the Alamo Definitive Agreement, to (a) undertake and file an application to produce Cannabis under the Texas Compassionate Use Act and (b) share resources associated with preparing an application to register as a Cannabis producer with the Drug Enforcement Agency

|

|

|

|

|

·

|

Indoor Harvest Corp will acquire 100% of the membership interest of Alamo CBD, LLC, the result of which will be that Alamo will become a wholly owned subsidiary of Indoor Harvest. This would be a share to share exchange, under the original Alamo LOI provisions, in order to qualify as a tax-free reorganization. It is currently expected that the total number of shares to be issued to Alamo CBD, LLC will be 25,280,027 shares of common stock and that the total capital stock of Indoor Harvest Corp after Combination will be 41,953,378 shares of common stock.

|

|

|

|

|

·

|

A new Company, to be named “The Harvest Group”, will be formed by exiting Officers and Directors of Indoor Harvest Corp.

|

|

|

|

|

·

|

After repayment of Indoor Harvest’s outstanding debt and the costs related to the corporate reorganization of Indoor Harvest and the Combination have been paid, Indoor Harvest will make an investment in The Harvest Group, in consequence of which Indoor Harvest will receive a minority interest in the The Harvest Group. The amount to be invested by Indoor Harvest in The Harvest Group will be determined after closing of the Alamo Definitive Agreement. It is currently expected that the total amount of debt to be repaid totals $522,415 in promissory notes and $21,506 in credit lines. $132,302 in funds will be allocated to the operations of Indoor Harvest Corp and $147,777 in funds will be allocated to Alamo CBD, LLC during the closing period.

|

|

|

|

|

·

|

Indoor Harvest will execute a license agreement with The Harvest Group (the “THG License Agreement”) to permit the exclusivity to the High Pressure Aeroponics technology portfolio created by Indoor Harvest for use in the Cannabis or its derivatives industry. The Harvest Group will maintain use of the technology and intellectual property of Indoor Harvest for industries not involving the Cannabis plant, which use shall be exclusive to Alamo CBD and Indoor Harvest. The THG License Agreement will include mutual exit options which will permit termination of the THG License Agreement.

|

|

|

|

|

·

|

The THG License Agreement will provide to The Harvest Group the global exclusive right for the use of the "Indoor Harvest" trademark without encumbrance.

|

|

·

|

Indoor Harvest Corp will undertake a name change to be determined by Alamo.

|

|

|

|

|

·

|

The Harvest Group will do business as “Indoor Harvest”.

|

|

|

|

|

·

|

Indoor Harvest Corp will keep all filed intellectual property, as well as all other assets, of Indoor Harvest Corp, including the Houston, Texas warehouse lease (the “Houston Facility”).

|

|

|

|

|

·

|

The Houston Facility will serve as a staging/warehousing and assembly area for equipment and construction of the planned indoor Cannabis production facility to be constructed in Wilson County, Texas (the “Wilson County Cannabis Facility”). In consideration of Indoor Harvest’s assumption of the overhead related to the Houston Facility, The Harvest Group will provide construction services to Alamo CBD and/or Indoor Harvest Corp at a discounted rate (to be determined in good faith by the parties) for the construction of the Wilson County Cannabis Facility. After construction of the Wilson County Cannabis Facility is completed and the facility fully commissioned and turned over, Indoor Harvest Corp will have the option to sub-lease Houston facility to The Harvest Group, or terminate the lease.

|

|

|

|

|

·

|

The Indoor Harvest Corp currently intends to hold a minority interest in The Harvest Group for a minimum period of one year and, subsequently, to distribute its shares of the The Harvest Group to shareholders of Indoor Harvest Corp, as a dividend in a manner consistent with relevant SEC rules.

|

|

|

|

|

·

|

The Harvest Group will operate independently of the Indoor Harvest Corp and Alamo CBD who will have no obligation for future funding beyond the amount of the initial investment, the amount of which is subject to agreement of the parties.

|

Item 3.02 Unregistered Sales of Equity Securities

From February 22, 2017 through March 15, 2017, the Company sold, in reliance upon Regulation D Rule 506, a total of 2,060,000 shares of Common Stock to 17 U.S. accredited investors at $0.40 per share for cash totaling $824,000.

Exhibits

|

99.1

|

Alamo Letter of Intent Amendment #2

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated.

|

|

INDOOR HARVEST CORP.

|

|

|

|

|

|

|

|

Date: March 20, 2017

|

By

|

/s/ Chad Sykes

|

|

|

|

|

Chad Sykes

|

|

|

|

|

Chief Innovation Officer and Director

|

|

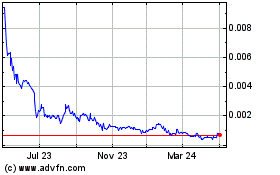

Indoor Harvest (PK) (USOTC:INQD)

Historical Stock Chart

From Mar 2024 to Apr 2024

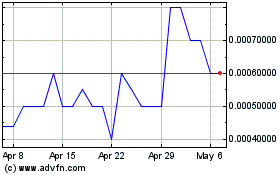

Indoor Harvest (PK) (USOTC:INQD)

Historical Stock Chart

From Apr 2023 to Apr 2024