Sony, Paramount Try to Get Off the B List -- WSJ

March 18 2017 - 3:02AM

Dow Jones News

By Ben Fritz

As Hollywood's two worst-performing movie studios seek new

leaders, Paramount Pictures and Sony Pictures Entertainment also

face more fundamental questions about how to turn around their

businesses after years of underinvestment by their parent

companies.

Paramount has consistently ranked last at the box office among

Hollywood's six majors studios since 2013 and Sony Pictures has

been No. 5 or No. 4, according to industry data.

Paramount's profits have declined for five straight years, most

recently reaching a loss of $445 million for the fiscal year ended

September. Sony Corp. doesn't report its motion-picture profit

separately from television, but recently took a write-down of

nearly $1 billion at its studio. It also reduced profit projections

for movies after a series of box-office disappointments.

Viacom Inc. abandoned plans to sell 49% of Paramount last year

and Sony has denied rumors it is looking to sell its studio. Both

companies are looking to turn around their movie businesses under

new management, but face formidable challenges, current and former

employees say.

Their struggles illustrate the importance of long-term

investments and strategic acquisitions in the film business at a

time when franchises and recognizable brands generate the biggest

profits. "The movie business has become a story of haves and

have-nots," said Michael Nathanson, senior analyst at

MoffettNathanson Research. "You need to build a good farm system

and then you need to execute."

For instance, Walt Disney Co.'s multibillion-dollar acquisitions

of Pixar Animation Studios, Marvel Entertainment and Lucasfilm LLC

have provided most of the franchises that have helped it dominate

the movie business in recent years. Universal Pictures for years

lingered at the bottom of the box-office rankings until Comcast

Corp. bought it from General Electric Co. in 2011.

The cable company upped annual production spending to about $1.2

billion from $850 million, invested in its consumer-products and

theme-parks businesses and last year bought DreamWorks Animation

SKG Inc. The investments have boosted Universal's profits, and

employees say this has helped improved morale.

Rather than increase spending, new Viacom Chief Executive Bob

Bakish wants the studio to focus on films related to shows and

talent on its cable networks such as MTV and Nickelodeon. Viacom is

currently negotiating with former Fox studio executive Jim

Gianopulos to lead Paramount, according to people familiar with the

matter. "There are significant resources and it will be up to the

studio management to take those resources and produce returns for

shareholders," Mr. Bakish said in an interview.

Sony isn't as close to finding a new CEO for its studio, a

larger job than Paramount as it also includes a television business

in which it has invested. But since Tom Rothman was named head of

Sony Pictures' motion-picture unit in 2015, he has sought to

improve results by increasing the focus on international markets

and trying to bring PlayStation games to the big screen, although

box-office results haven't improved.

"We are confident that the groundwork has been laid for

meaningful, long-term reform," said a Sony Pictures spokesman.

Sony finance chief Kenichiro Yoshida said last month that the

struggles of the Japanese company's studio stem partly from

decisions "to raise short-term cash in exchange for long-term cash

flow when the electronics units were struggling."

He cited the company's decision to sell its 25% interest in the

merchandise rights to Spider-Man to Marvel in 2011. Under the deal,

which also resolved longstanding legal disputes, Marvel made a net

payment of about $180 million, according to documents released in a

corporate hack. Sony still controls film rights to Spider-Man.

Paramount and Sony haven't bought assets to augment their movie

businesses in the past decade. Paramount previously distributed

movies from Marvel and DreamWorks Animation and considered trying

to buy both, employees said. Instead, Marvel and DreamWorks were

acquired by Disney and Comcast, respectively. Sony Pictures

executives discussed buying Metro-Goldwyn-Mayer, whose James Bond

movies Sony had distributed for years. Instead MGM reorganized

itself into an independent venture. Other potential acquisitions

targets for Sony included DreamWorks Animation and pay-cable

network Starz, according to employees. Lions Gate Entertainment

Corp. ended up buying the network.

"There was a cautious business philosophy where we did not want

to take big swings," said a former Sony Pictures executive. Many at

the studio have also expressed frustration at the lack of synergy

with Sony's biggest entertainment asset: the PlayStation. The

company could have used the videogame console's huge global

footprint to launch a Netflix-like streaming service featuring Sony

Pictures content, they note.

Paramount and Sony have at times chosen release dates not based

on what is best for a film, but in order to maximize short-term

profits, employees said. Releasing a movie late in a fiscal year

typically means accounting for tens of millions in marketing

expenses while waiting until the next fiscal year for the revenue

that follows.

Paramount and Sony spend less than $1 billion a year on movie

production, people who have worked at both said, while other

studios spend as much as $1.5 billion. Major "event" movies

typically cost between $100 million and $250 million to make.

That was the reason Paramount, whose fiscal year ends in

September, delayed the Leonardo DiCaprio thriller "Shutter Island"

to February 2010, from October 2009, and why it has released no

movies in August or September for five of the past seven years,

employees said.

"Cutting, cutting, cutting as a way to create the appearance of

wealth was the philosophy here for a long time," said one Paramount

employee.

Paramount and Sony have each made two or three such movies

annually for the past few years, while studios such as Disney and

Universal have made between four and eight such movies.

Write to Ben Fritz at ben.fritz@wsj.com

(END) Dow Jones Newswires

March 18, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

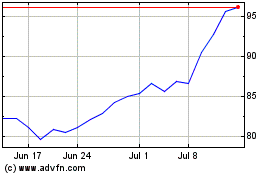

Sony (NYSE:SONY)

Historical Stock Chart

From Mar 2024 to Apr 2024

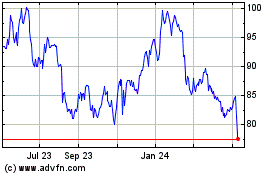

Sony (NYSE:SONY)

Historical Stock Chart

From Apr 2023 to Apr 2024