Elliott Owns Stake in Akzo Nobel, Pushes for Talks With Suitor PPG--Update

March 17 2017 - 5:03PM

Dow Jones News

By Dana Mattioli and David Benoit

Activist investor Elliott Management Corp. owns a stake in Akzo

Nobel NV and is pushing the Dutch paint maker to engage in talks

with suitor PPG Industries Inc., according to people familiar with

the matter.

Elliott has owned a stake since 2016, and had wanted Akzo to

separate its specialty-chemicals business, a move the company said

it would consider last week as it rejected a $22.1 billion takeover

offer from PPG. But now Elliott wants Akzo to consider a sale too,

though only at a higher price than the EUR83 a share ($89.17) PPG

offered, the people said.

In its rejection, Akzo said the bid from PPG "substantially

undervalues" the company. It went on to say, in notably strong

language, that the offer "is not in the interest of its

stakeholders, including its shareholders, customers and employees,"

and that it "carries significant delivery and timing risk for

shareholders, both in relation to substantial antitrust issues,

pension schemes and the achievability of proposed synergies."

Elliott has expressed concerns to Akzo management that it didn't

engage with PPG and that it didn't consult the hedge fund, which

owns less than 3% of Akzo -- the reporting threshold in the

Netherlands.

PPG has made clear it is still interested in a deal with Akzo,

saying in a statement last week that it "continues to believe there

is a strong strategic rationale for the proposed transaction

between PPG and Akzo Nobel and will carefully evaluate and consider

its position and path forward related to its proposal."

As of Friday, the company hadn't made a revised offer for Akzo,

one of the people said.

Nevertheless, the revelation that Elliott is on Akzo's

shareholder register could increase the odds of a sale of the

company. Elliott is a well-known activist that is managed to shake

up boardrooms and trigger sales and other major changes at a

succession of companies in recent years.

In a sign that investors are already hopeful there will be a

deal, Akzo's shares closed Friday in Amsterdam at EUR75.21, up more

than 15% and near their high since last week.

Elliott believes the company should engage with PPG and at the

same time explore separating the specialty-chemicals business, the

people said. It has also raised concerns to management about the

performance of Akzo stock, which before the bid was little changed

in a decade.

Elliott, a $30 billion New York hedge fund, has a history of

agitating for European mergers. Its London office has taken stakes

in several companies and either pushed them to agree to a sale or

forced a bidder to pay more.

Pittsburgh-based PPG, with paint brands including Pittsburgh

Paints, Olympic and Glidden, is seeking a tie-up a year after rival

Sherwin-Williams Co. agreed to buy Valspar Corp. for more than $9

billion.

There have been a number of tie-ups in the broader chemicals

industry too. U.S. giants Dow Chemical Co. and DuPont Co. are

seeking to complete a roughly $60 billion merger, and have offered

to sell businesses to gain approval from the European Union's

antitrust regulator.

Industrial-gas giant Praxair Inc. and Germany's Linde AG agreed

to a roughly $30 billion merger late last year.

Write to Dana Mattioli at dana.mattioli@wsj.com and David Benoit

at david.benoit@wsj.com

(END) Dow Jones Newswires

March 17, 2017 16:48 ET (20:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

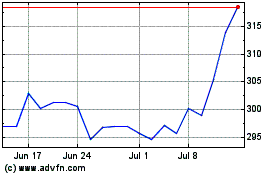

Sherwin Williams (NYSE:SHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

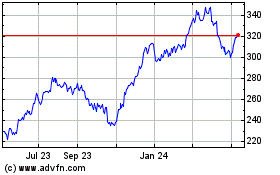

Sherwin Williams (NYSE:SHW)

Historical Stock Chart

From Apr 2023 to Apr 2024