Amended Tender Offer Statement by Issuer (sc To-i/a)

March 17 2017 - 4:39PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

TO

SCHEDULE TO

(Rule 14d-100)

Tender Offer Statement Under Section

14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

Safe Bulkers, Inc.

(Name of Subject Company (Issuer) and

Filing Person (Offeror))

8.00% Series B Cumulative Redeemable Perpetual

Preferred Shares, par value $0.01 per share,

liquidation preference $25.00 per share

|

Y7388 L111

|

|

(Title of Class of Securities)

|

(CUSIP Number of Class of Securities)

|

Dr. Loukas Barmparis

President

Apt. D11,

Les Acanthes

6, Avenue des Citronniers

MC98000 Monaco

+30 2 111 888 400

+357 25 887 200

(Name, Address and Telephone Number of

Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copy to:

Richard M. Brand

Joshua A. Apfelroth

Cadwalader, Wickersham & Taft LLP

One World Financial Center

New York, New York 10281

(212) 504-6000

Calculation of Filing Fee

|

Transaction Valuation(1)

|

Amount of

Filing Fee(2)

|

|

$35,658,432

|

$4,133

|

|

(1)

|

Estimated solely for purpose of calculating the filing fee.

This Tender Offer Statement on Schedule TO relates to an exchange offer (the “Exchange Offer”) through which Safe

Bulkers, Inc. seeks to acquire any and all of its outstanding 8.00% Series B Cumulative Redeemable Perpetual Preferred Shares

(the “Series B Preferred Shares”). The transaction valuation was calculated in accordance with Rule 0-11 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), as follows:

|

|

|

|

|

|

The product of (i) $24.00, the average of the high and low prices per

Series B Preferred Shares on the New York Stock Exchange on March 3, 2017, and (ii) 1,485,768, the maximum number of Series

B Preferred Shares that could be accepted for exchange in the Exchange Offer.

|

|

|

|

|

(2)

|

The Amount of Filing Fee calculated in accordance with Rule 0-11(b) of

the Exchange Act, equals $115.90 for each $1,000,000 of the value of the transaction.

|

|

|

|

|

x

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement

number, or the Form or Schedule and date of its filing.

|

|

|

Amount Previously Paid: $4,133

|

Filing Party: Safe Bulkers, Inc.

|

|

|

Form or Registration No.: Schedule TO-I

|

Date Filed: March 9, 2017

|

|

o

|

Check the box if the filing relates solely to preliminary communications made

before the commencement of a tender offer.

|

|

|

|

|

Check the appropriate boxes below to designate any transactions to which the

statement relates:

|

|

|

|

o

|

third-party tender offer subject to Rule 14d-1.

|

|

|

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

|

|

|

o

|

going-private transaction subject to Rule 13e-3.

|

|

|

|

|

o

|

amendment to Schedule 13D under Rule 13d-2.

|

|

|

|

|

Check the following box if the filing is a final amendment reporting the results of the tender offer:

o

|

|

|

|

|

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

|

|

|

|

|

o

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer).

|

|

|

|

|

o

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer).

|

|

|

|

INTRODUCTION

This Amendment No. 1 (this “

Amendment

No. 1

”) amends and supplements the Tender Offer Statement on Schedule TO (the “

Schedule TO

”)

originally filed by Safe Bulkers, Inc., a Republic of Marshall Islands corporation (“

Safe Bulkers

” or the “

Company

”),

with the Securities and Exchange Commission (“

SEC

”) on March 9, 2017. The Schedule TO relates to the offer by

the Company to exchange (1) newly issued shares of Common Stock, par value $0.001 per share, of Safe Bulkers (NYSE: SB) (the “Common

Stock”); and (2) cash, on the terms and conditions set forth in this Offer to Exchange, dated March 9, 2017 (the “

Offer

to Exchange

”) and in the related letter of transmittal, for any and all outstanding 8.00% Series B Cumulative Redeemable

Perpetual Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share, of Safe Bulkers (NYSE: SB.PR.B)

(the “

Series B Preferred Shares

”).

All information in the Offer to Exchange

and the related letter of transmittal, which were previously filed as Exhibits (a)(1)(A) and (a)(1)(B), respectively, to the

Schedule TO, is hereby expressly incorporated by reference in this Amendment No. 1 in response to all applicable items required

in the Schedule TO, except that such information is hereby amended and supplemented to the extent specifically provided herein.

Capitalized terms used and not otherwise defined in this Amendment No. 1 shall have the meanings assigned to such terms in

the Offer to Exchange as amended or supplemented. You should read this Amendment No. 1 together with the Schedule TO, the

Offer to Exchange and the related letter of transmittal.

Items 1 through 11

Items 1 through 11 of the Schedule TO, to

the extent they incorporated by reference information contained in the Offer to Exchange, are hereby amended as follows:

|

1.

|

The paragraph on page 5 of the Offer to Exchange under the heading “Will the Series B Preferred Shares remain listed on the NYSE following the consummation of the Exchange Offer?” in the section entitled “Questions and Answers About the Exchange Offer” is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

“If the Exchange Offer is consummated, the number of outstanding Series B Preferred Shares, and likely the trading volume and liquidity of the Series B Preferred Shares, will be significantly reduced.

The consummation of the Exchange Offer is subject to the satisfaction of a non-waivable condition that consummation of the Exchange Offer will not result in the delisting of the Series B Preferred Shares from the NYSE. Thus, the Series B Preferred Shares are expected to continue to be listed on the NYSE following consummation of the Exchange Offer. “

|

|

|

|

|

2.

|

The paragraph beginning on page 6 of the Offer to Exchange under the heading “What will happen if I do not tender my Series B Preferred Shares and the Exchange Offer is successfully consummated?” in the section entitled “Questions and Answers About the Exchange Offer” is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

“If the Exchange Offer is successfully consummated but you do not tender your Series B Preferred Shares, you will remain a holder of the Series B Preferred Shares. Upon consummation of the Exchange Offer, the number of outstanding Series B Preferred Shares, and the trading volume and liquidity of the Series B Preferred Shares, may be significantly reduced. See “Risk Factors – Risks to Holders of Series B Preferred Shares After the Exchange Offer – Series B Preferred Shares that you continue to hold after the Exchange Offer are expected to become less liquid following the Exchange Offer.””

|

|

|

|

|

3.

|

The risk factor on page 11 of the Offer to Exchange under the heading “Series B Preferred Shares that you continue to hold after the Exchange Offer are expected to become less liquid following the Exchange Offer.” in the section entitled “Risk Factors” is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

“Following consummation of the Exchange Offer, the number of Series B Preferred Shares that are publicly traded will be reduced and the trading market for the remaining outstanding Series B Preferred Shares may be less liquid. This may reduce the volume of trading and make it more difficult to buy or sell Series B Preferred Shares, or to do so without affecting the market price. Thus, your ability to buy and sell Series B Preferred Shares, and the market price of the Series B Preferred Shares, may fluctuate significantly.”

|

|

|

|

|

4.

|

The risk factor on page 13 of the Offer to

Exchange entitled “If the Exchange Offer is consummated, the number of outstanding Series B Preferred Shares may fall below

the requirements for listing of such Series B Preferred Shares on the NYSE and a delisting of the Series B Preferred Shares from

the NYSE may have adverse tax consequences to you if you continue to own Series B Preferred Shares.” in the section entitled

“Risk Factors” is hereby deleted in its entirety.

|

|

5.

|

The first paragraph on page 17 of the Offer to Exchange under the heading “Conditions of the Exchange Offer” in the section entitled “The Exchange Offer” is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

“We will not be required to accept for exchange, or to

issue Common Stock and pay cash in respect of, any Series B Preferred Shares, and we may terminate the Exchange Offer and

may (subject to Rule 14e-1 under the Exchange Act) postpone the acceptance for exchange of, and issuance of Common Stock

and payment of cash in respect of, any Series B Preferred Shares validly tendered and not properly withdrawn pursuant to

the Exchange Offer, unless each of the following conditions have been satisfied or waived (if applicable) during all

periods between the commencement of the Exchange Offer and the expiration date:”

|

|

|

|

|

6.

|

The second to last bullet on page 18 of the Offer to Exchange under the heading “Conditions of the Exchange Offer” in the section entitled “The Exchange Offer” is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

·

|

“the market price for the shares of Common Stock on the NYSE as of the close of trading on the expiration date shall not have increased by more than 25%, as measured from the close of trading on the trading day immediately prior to the date of this Offer to Exchange;”

|

|

|

|

|

|

7.

|

The last bullet on page 18 of the Offer to Exchange under the heading “Conditions of the Exchange Offer” in the section entitled “The Exchange Offer” is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

·

|

“the market price for the shares of Series B Preferred Shares

on the NYSE as of the close of trading on the expiration date shall not have decreased by more than 10%, as measured from the close

of trading on the trading day immediately prior to the date of this Offer to Exchange; or”

|

|

|

|

|

|

8.

|

The following language is hereby added as the last bullet on page 18 of the Offer to Exchange under the heading “Conditions of the Exchange Offer” in the section entitled “The Exchange Offer”:

|

|

|

|

|

|

·

|

“consummation of the Exchange Offer

and the purchase of the Series B Preferred Shares pursuant to the Exchange Offer shall not be reasonably likely to cause the Series B Preferred Shares to be (1) delisted from the NYSE or (2)

eligible for deregistration under the Exchange Act (the “Continued Listing Condition”).

|

|

|

|

|

|

9.

|

The sentence below is hereby added as the second sentence in the

last paragraph on page 18 of the Offer to Exchange under the heading “Conditions of the Exchange Offer” in the

section entitled “The Exchange Offer”:

|

|

|

|

|

|

“Notwithstanding the foregoing, the Continued Listing

Condition is not waivable by us under any circumstances.”

|

|

|

|

|

10.

|

The second paragraph on page 24 of the Offer to Exchange under the heading “Liquidity; Listing” in the section entitled “The Exchange Offer” is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

“Following the consummation of the Exchange Offer, the remaining outstanding Series B Preferred Shares are expected to continue to be traded on the NYSE; however, the number of Series B Preferred Shares that are outstanding and publicly traded may be significantly reduced. This may reduce the volume of trading and make it more difficult to buy or sell Series B Preferred Shares, or to do so without affecting the market price. Thus, your ability to buy and sell Series B Preferred Shares, and the market price of the Series B Preferred Shares, may fluctuate significantly. See “Risk Factors – Risks to Holders of Series B Preferred Shares After the Exchange Offer – Series B Preferred Shares that you continue to hold after the Exchange Offer are expected to become less liquid following the Exchange Offer.””

|

|

|

|

|

11.

|

The first paragraph on page 37 of the Offer to Exchange under the heading “Listing” in the section entitled “Comparison of Rights Between the Series B Preferred Shares and the Common Stock” is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

“

Series B Preferred Shares:

Series B Preferred Shares are listed on the NYSE (SB.PR.B), and are expected to continue to be listed on the NYSE following consummation of the Exchange Offer. If the Exchange Offer is consummated, the number of Series B Preferred Shares that are publicly traded may be significantly reduced. This may reduce the volume of trading and make it more difficult to buy or sell Series B Preferred Shares, or to do so without affecting the market price. See “Risk Factors – Risks to Holders of Series B Preferred Shares After the Exchange Offer – Series B Preferred Shares that you continue to hold after the Exchange Offer are expected to become less liquid following the Exchange Offer.””

|

|

|

|

|

12.

|

The heading “Consequences of Not Participating

in the Exchange Offer” on page 43 of the Offer to Exchange in the section

entitled “Certain U.S. Federal Income Tax Considerations” and the two paragraphs following such heading are hereby deleted in their entirety.

|

|

|

|

|

13.

|

In addition to the foregoing, we hereby amend the Offer to Exchange

by replacing throughout the Offer to Exchange all references to the phrase or phrases similar to "we may waive any and all

conditions of the Exchange Offer" with "we may waive any and all conditions of the Exchange Offer (except for the Continued

Listing Condition)”.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

(a)(1)(A)*

|

|

Offer to Exchange, dated March 9, 2017.

|

|

|

|

|

|

(a)(1)(B)*

|

|

Letter of Transmittal to the holders of Series B Preferred Shares, dated March 9, 2017.

|

|

|

|

|

|

(a)(1)(C)*

|

|

Form of Letter to Brokers, Dealers and Other Securities Intermediaries.

|

|

|

|

|

|

(a)(1)(D)*

|

|

Form of Letter to Clients for use by Brokers, Dealers and Other Securities Intermediaries.

|

|

|

|

|

|

(a)(5)(A)*

|

|

Press release, dated March 9, 2017.

|

|

|

|

|

|

(a)(5)(B)

|

|

Press release, dated March 17, 2017.

|

|

|

|

|

|

(d)(1)(A)*

|

|

Specimen Copy of 8.00% Series B Cumulative Redeemable Perpetual Preferred Share Certificate (filed as Exhibit 4.1 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on June 18, 2013, and incorporated by reference herein).

|

|

|

|

|

|

(d)(1)(B)*

|

|

Statement of Designation of 8.00% Series B Cumulative Redeemable Perpetual Preferred Shares (Par Value $0.01 Per Share) (filed as Exhibit 3.4 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on June 18, 2013, and incorporated by reference herein).

|

|

|

|

|

|

(d)(1)(C)*

|

|

Underwriting Agreement, dated as of June 6, 2013, by and among Safe Bulkers, Inc., and Incapital LLC and DNB Markets, Inc., as representatives of the several underwriters named therein, relating to the purchase of 800,000 shares of the Company’s 8.00% Series B Cumulative Redeemable Perpetual Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on June 13, 2013, and incorporated by reference herein).

|

|

|

|

|

|

d(2)*

|

|

Shareholder Rights Agreement, dated as of May 14,

2008, between Safe Bulkers. Inc. and American Stock Transfer & Trust Company LLC (filed as Exhibit 10.5 to the Company’s

Registration Statement on Form F-1 (File No. 333-150995), filed on May 16, 2008, and incorporated by reference herein).

|

|

|

|

|

|

d(3)*

|

|

Form of Registration Rights Agreement between Safe Bulkers, Inc. and Vorini Holdings Inc. (filed as Exhibit 4.2 to the Company’s Registration Statement on Form F-1/A (File No. 333-150995), filed on May 23, 2008, and incorporated by reference herein).

|

|

|

|

|

|

d(4)*

|

|

Specimen Common Share Certificate (filed as Exhibit 4.1 to the Company’s Registration Statement on Form F-1 (File No. 333-150995), filed on May 16, 2008, and incorporated by reference herein).

|

|

|

|

|

|

d(5)*

|

|

Specimen Copy of 8.00% Series C Cumulative Redeemable Perpetual Preferred Share Certificate (filed as Exhibit 4.1 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on May 7, 2014, and incorporated by reference herein).

|

|

|

|

|

|

d(6)*

|

|

Statement of Designation of the 8.00% Series C Cumulative Redeemable Perpetual Preferred Shares (Par Value $0.01 Per Share) (filed as Exhibit 3.4 on the Company’s Form 8-A (File No. 001-34077), filed on May 7, 2014, and incorporated by reference herein).

|

|

|

|

|

|

d(7)*

|

|

Underwriting Agreement, dated as of April 30, 2014, by and among Safe Bulkers, Inc., and Morgan Stanley & Co. LLC and UBS Securities LLC, as representatives of the several underwriters named therein, relating to the purchase of 2,000,000 shares of the Company’s 8.00% Series C Cumulative Redeemable Perpetual Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on May 7, 2014, and incorporated by reference herein).

|

|

|

|

|

|

d(8)*

|

|

Specimen Copy of 8.00% Series D Cumulative Redeemable Perpetual Preferred Share Certificate (filed as Exhibit 4.1 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on June 30, 2014, and incorporated by reference herein).

|

|

|

|

|

|

d(9)*

|

|

Statement of Designation of the 8.00% Series D Cumulative Redeemable Perpetual Preferred Shares (Par Value $0.01 Per Share) (filed as Exhibit 3.4 on the Company’s Form 8-A (File No. 001-34077), filed on June 30, 2014, and incorporated by reference herein).

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

d(10)*

|

|

Underwriting Agreement, dated as of June 23, 2014, by and among Safe Bulkers, Inc., Morgan Stanley & Co. LLC, UBS Securities LLC and each of the other underwriters named in Schedule A therein, relating to the purchase of 2,800,000 shares of the Company’s 8.00% Series D Cumulative Redeemable Perpetual Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on June 30, 2014, and incorporated by reference herein).

|

|

|

|

|

|

(d)(11)*

|

|

Purchase Agreement, dated as of April 12, 2011 between Safe Bulkers, Inc., Morgan Stanley & Co. Incorporated and Merrill Lynch, Pierce, Fenner & Smith Incorporated, relating to the purchase of 5,000,000 shares Common Stock (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on April 15, 2011, and incorporated by reference herein).

|

|

|

|

|

|

(d)(12)*

|

|

Purchase Agreement, dated March 13, 2012, between Safe Bulkers, Inc., Morgan Stanley & Co. LLC, and Merrill Lynch, Pierce, Fenner & Smith Incorporated, relating to the purchase of 5,000,000 shares Common Stock (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on March 16, 2012, and incorporated by reference herein).

|

|

|

|

|

|

(d)(13)*

|

|

Underwriting Agreement, dated as of November 13, 2013, by and among Safe Bulkers, Inc., and Morgan Stanley & Co. LLC as representatives of the several underwriters named therein, relating to the purchase of 5,000,000 shares Common Stock (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on November 18, 2013, and incorporated by reference herein).

|

|

|

|

|

|

(d)(14)*

|

|

Underwriting Agreement, dated as of December 6, 2016, by and among Safe Bulkers, Inc., Stifel, Nicolaus & Company, Incorporated, DNB Markets, Inc. and each of the other underwriters named in Schedule A therein, for whom Stifel, Nicolaus & Company, Incorporated and DNB Markets, Inc. are acting as representatives, relating to the purchase of 13,600,000 shares Common Stock (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on December 9, 2016, and incorporated by reference herein).

|

* Previously filed.

SIGNATURE

After due inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

SAFE BULKERS, INC.

|

|

|

|

|

|

|

|

Date: March 17, 2017

|

By:

|

/s/ Dr. Loukas Barmparis

|

|

|

|

Name:

|

Dr. Loukas Barmparis

|

|

|

|

Title:

|

President

|

|

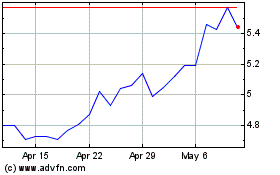

Safe Bulkers (NYSE:SB)

Historical Stock Chart

From Mar 2024 to Apr 2024

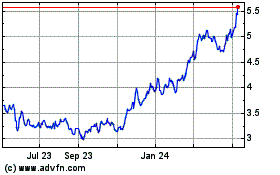

Safe Bulkers (NYSE:SB)

Historical Stock Chart

From Apr 2023 to Apr 2024