Amgen's Money-Back Guarantee

March 17 2017 - 2:00PM

Dow Jones News

By Charley Grant

For insurance companies, drug stock investors, and the

president, price matters.

Amgen served as a reminder on Friday. New clinical data from the

biotech giant show its anti-cholesterol drug Repatha, when used in

combination with statins, caused a 20% reduction in deaths, strokes

and heart attacks, compared to traditional statin therapy. However,

the data do not show a meaningful reduction in cardiovascular

mortality rates for patients on Repatha.

The data are strong in an absolute sense, but left investors

disappointed. Amgen shares were down more than 7% Friday morning,

after having rallied by about 23% this year. Smaller biotech

companies developing similar drugs fell as much as 20% Friday.

One reason: insurers will weigh the data against Repatha's

price. The drug costs more than $14,500 annually before rebates and

discounts. A statin, meanwhile, has a minimal cost. That dynamic

has weighed on Repatha sales since the drug's launch in 2015.

To help win over those insurers, Amgen made an unusual public

offer of refunds if patients on the drug suffer a heart attack or

stroke. That is a sensible step to boost sales given Friday's data

and the rising pressure that drug makers are feeling on prices from

insurers and from President Donald Trump.

While Amgen has signed deals with insurers offering discounts on

Repatha if the drug doesn't perform, the drug maker took it a step

further by offering its guarantee in the company's press release

that announced the data. The company's refund offer to insurers

could make paying for performance a more accepted way to balance

drug prices with their value.

For Amgen, even the refund offer may not bring insurers on board

given the drug's failure to improve in cardiovascular mortality

outcomes, according to analysts at Robert W. Baird & Co. As

such, Amgen will have an uphill battle to meet Wall Street's

revenue expectations for the drug. Analyst consensus calls for more

than $3 billion in annual sales by 2022, according to FactSet.

Amgen has booked less than $150 million in cumulative drug sales

since approval.

Those projections are counting on Repatha to generate

essentially all of Amgen's revenue growth through 2022. Sales of

Amgen's current best-selling product, the anti-inflammatory drug

Enbrel, are expected to fall 20% over that period as the product

ages.

The good news: Amgen trades at less than 14 times forward

earnings, more or less on par with most of its large biotech and

pharma peers. That should keep Friday's slide from turning into a

prolonged slump. However, Friday's results suggest that investors,

just like health plans, are more likely to pay for performance in

the future.

Until then, Amgen's sharp rally to start the year is likely to

be put on hold.

Write to Charley Grant at charles.grant@wsj.com

(END) Dow Jones Newswires

March 17, 2017 13:45 ET (17:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

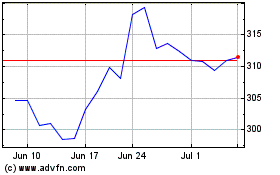

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024