As filed with the Securities and Exchange Commission on March 17, 2017

Registration

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

TimkenSteel Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Ohio

|

|

46-4024951

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

1835 Dueber Ave. S.W.

Canton, Ohio 44706-2798

Phone: (330)

471-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Frank A. DiPiero

Executive Vice President, General Counsel and Secretary

TimkenSteel Corporation

1835 Dueber Ave. S.W.

Canton, Ohio 44706-2798

Phone: (330)

471-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

Michael J. Solecki

Jones

Day

901 Lakeside Avenue

Cleveland, Ohio 44114

Phone: (216)

586-3939

Fax: (216)

579-0212

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the

following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under

the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D.

filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule

12b-2

of the Securities Exchange Act of 1934.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☒

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

|

|

Proposed

Maximum

Offering

Price

Per Unit

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Common Shares, without par value

|

|

322,159 (1)(2)

|

|

$18.3750

(3)

|

|

$5,919,671.63

(3)

|

|

$686.09

(3)(4)

|

|

|

|

|

|

(1)

|

Represents the maximum number of common shares, without par value, of TimkenSteel Corporation (the “

Registrant

”) issuable pursuant to the TimkenSteel Corporation Amended and Restated 2014 Equity

and Incentive Compensation Plan (the “

Plan

”) being registered hereon.

|

|

(2)

|

Pursuant to Rule 416 of the Securities Act of 1933 (the “

Securities Act

”), this Registration Statement also covers such additional common shares as may become issuable pursuant to the

anti-dilution provisions of the Plan.

|

|

(3)

|

Estimated solely for purposes of calculating the registration fee, pursuant to Rule 457(c) and 457(h) under the Securities Act, based upon the average of the high and low prices of the Registrant’s common shares

reported on the New York Stock Exchange as of March

14, 2017, a date that is within five business days prior to the filing of this registration statement.

|

|

(4)

|

Pursuant to Rule 457(p) under the Securities Act, the total amount of the registration fee due is fully offset, representing a portion of the dollar amount of the filing fee previously paid by the Registrant pursuant to

the Registrant’s Registration Statement on Form

S-1

(Registration No.

333-196287)

filed under the Securities Act on May 27, 2014 and subsequently

withdrawn on March 17, 2017.

|

Prospectus

TimkenSteel Corporation

TimkenSteel Corporation

Amended and Restated 2014 Equity and Incentive Compensation Plan

Common Shares

(without

par value)

The 322,159 common shares covered by this prospectus may be acquired by participants in the TimkenSteel Corporation Amended and Restated 2014

Equity and Incentive Compensation Plan, which we refer to as the Plan, upon the exercise of certain options to purchase our common shares and upon vesting of restricted shares, performance shares, restricted stock units and deferred share awards

(collectively, “awards”) issued pursuant to the Plan. All awards are subject to the terms of the Plan and the applicable award agreement. Any proceeds received by us from the exercise of stock options covered by the Plan will be used for

general corporate purposes.

Our common shares are listed on the New York Stock Exchange under the symbol “TMST.” On

March 16, 2017, the closing price of our common shares on the New York Stock Exchange was $19.53 per share.

In reviewing

this prospectus, you should carefully consider the matters described under the caption “

Risk Factors

” beginning on page 2.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 17, 2017.

Table of Contents

-i-

About This Prospectus

We have not authorized anyone to provide you with different information from the information contained or incorporated by reference in this

prospectus. You should not assume that the information contained in this prospectus or any document incorporated by reference is accurate as of any date, other than the date mentioned on the cover page of these documents. We are not making offers to

sell the common shares in any jurisdiction in which an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

Unless we otherwise state or the context otherwise indicates, all references in this prospectus to “TimkenSteel,”

“us,” “our,” or “we” mean TimkenSteel Corporation and its subsidiaries.

Where

You Can Find More Information

We are subject to the informational reporting requirements of the Securities Exchange Act of 1934, or

the Exchange Act. We file reports, proxy statements and other information with the Securities and Exchange Commission, or the SEC. Our SEC filings are available at the SEC’s website at http://www.sec.gov. You may read and copy any reports,

statements and other information filed by us at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call

1-800-SEC-0330

for further information on the Public Reference Room. You may also inspect our SEC reports and other information

at our website at http://investors.timkensteel.com. The information contained on or accessible through our website is not a part of this prospectus, other than the documents that we file with the SEC that are incorporated by reference into this

prospectus.

Information We Incorporate By Reference

The SEC allows us to “incorporate by reference” into this prospectus the information in documents we file with it, which means that

we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and

supersede this information. Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained

in or omitted from this prospectus or any accompanying prospectus supplement, or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so

modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate

by reference the documents listed below and any future documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (1) after the date of the initial filing of the registration statement of which this

prospectus forms a part prior to the effectiveness of the registration statement and (2) after the date of this prospectus until the offering of the securities is terminated:

|

|

•

|

|

our Annual Report on Form

10-K

for the year ended December 31, 2016; and

|

|

|

•

|

|

the description of our capital stock contained in our Information Statement, filed as Exhibit 99.1 to Amendment No. 3 to our Registration Statement on Form 10 (File

No. 001-36313),

filed on May 15, 2014, including any amendment or report filed for the purpose of updating such description.

|

We will not, however, incorporate by reference in this prospectus any documents or portions thereof that are not deemed “filed” with

the SEC, including any information furnished pursuant to Item 2.02 or Item 7.01 of our current reports on Form

8-K

unless, and except to the extent, specified in such current reports.

We will provide you with a copy of any of these filings (other than an exhibit to these filings, unless the exhibit is specifically

incorporated by reference into the filing requested) at no cost, if you submit a request to us by writing or telephoning us at the following address and telephone number:

TimkenSteel Corporation

1835

Dueber Ave., S.W.

Canton, Ohio 44706-2798

Phone: (330)

471-7000

Attention: Investor Relations

-ii-

The Company

TimkenSteel was incorporated in Ohio on October 24, 2013, and became an independent, publicly traded company as the result of a spinoff,

which we refer to as the spinoff, from The Timken Company, or Timken, on June 30, 2014.

We manufacture alloy steel, as well as

carbon and micro-alloy steel, with an annual melt capacity of approximately 2 million tons and shipment capacity of 1.5 million tons. Our portfolio includes special bar quality (SBQ) bars, seamless mechanical tubing (tubes) and

value-add

solutions, such as precision steel components. In addition, we supply machining and thermal treatment services, as well as manage raw material recycling programs, which are used as a feeder system for our

melt operations. Our products and services are used in a diverse range of demanding applications in the following market sectors: oil and gas; oil country tubular goods; automotive; industrial equipment; mining; construction; rail; aerospace and

defense; heavy truck; agriculture; and power generation.

Based on our knowledge of the steel industry, we believe we are the only focused

SBQ steel producer in North America and have the largest SBQ steel large bar

(6-inch

diameter and greater) production capacity among the North American steel producers. In addition, we are the only steel

manufacturer able to produce rolled SBQ steel large bars up to

16-inches

in diameter. SBQ steel is made to restrictive chemical compositions and high internal purity levels and is used in critical mechanical

applications. We make these products from nearly 100% recycled steel, using our expertise in raw materials to create custom steel products with a competitive cost structure similar to that of a high-volume producer. We focus on creating tailored

products and services for our customers’ most demanding applications. Our engineers are experts in both materials and applications, so we can work closely with each customer to deliver flexible solutions related to our products as well as to

their applications and supply chains. We believe our unique operating model and production assets give us a competitive advantage in our industry.

Corporate Information

We are

incorporated under the laws of the State of Ohio. Our principal executive offices are located at 1835 Dueber Ave. S.W., Canton, Ohio 44706-2798. Our telephone number is (330)

471-7000.

Our website is

http://www.timkensteel.com. The information contained on or accessible through our website is not part of this prospectus, other than the documents that we file with the SEC that are incorporated by reference into this prospectus.

- 1 -

Risk Factors

An investment in our common shares involves risk. We urge you to carefully consider the risks and other information described under the

caption “Risk Factors” included in Part I, Item 1A of our Annual Report on

Form 10-K

for the fiscal year ended December 31, 2016, which is incorporated herein by reference, and in

other filings we make with the SEC. Any of the risks, as well as additional risks and uncertainties not currently known to us or that we currently deem immaterial, could materially and adversely affect our results of operations or financial

condition.

Disclosure Regarding Forward-Looking Statements

Certain statements set forth in this prospectus (including our forecasts, beliefs and expectations) that are not historical in nature are

“forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “forecast,” “outlook,” “intend,” “may,” “plan,” “possible,” “potential,” “predict,” “project,”

“seek,” “should,” “target,” “would,” or other similar words, phrases or expressions that convey the uncertainty of future events or outcomes. You are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date of this prospectus. We caution readers that actual results may differ materially from those expressed or implied in forward-looking statements made by or on behalf of us due to a variety of factors, such

as:

|

|

•

|

|

deterioration in world economic conditions, or in economic conditions in any of the geographic regions in which we conduct business, including additional adverse effects from global economic slowdown, terrorism or

hostilities. This includes: political risks associated with the potential instability of governments and legal systems in countries in which we or our customers conduct business, and changes in currency valuations;

|

|

|

•

|

|

the effects of fluctuations in customer demand on sales, product mix and prices in the industries in which we operate. This includes: our ability to respond to rapid changes in customer demand; the effects of customer

bankruptcies or liquidations; the impact of changes in industrial business cycles; and whether conditions of fair trade exist in the U.S. markets;

|

|

|

•

|

|

competitive factors, including changes in market penetration; increasing price competition by existing or new foreign and domestic competitors; the introduction of new products by existing and new competitors; and new

technology that may impact the way our products are sold or distributed;

|

|

|

•

|

|

changes in operating costs, including the effect of changes in our manufacturing processes; changes in costs associated with varying levels of operations and manufacturing capacity; availability of raw materials and

energy; our ability to mitigate the impact of fluctuations in raw materials and energy costs and the effectiveness of our surcharge mechanism; changes in the expected costs associated with product warranty claims; changes resulting from inventory

management, cost reduction initiatives and different levels of customer demands; the effects of unplanned work stoppages; and changes in the cost of labor and benefits;

|

|

|

•

|

|

the success of our operating plans, announced programs, initiatives and capital investments (including the jumbo bloom vertical caster and advanced

quench-and-temper

facility); the ability to integrate acquired companies; the ability of acquired companies to achieve satisfactory operating results, including results

being accretive to earnings; and our ability to maintain appropriate relations with unions that represent our associates in certain locations in order to avoid disruptions of business;

|

|

|

•

|

|

unanticipated litigation, claims or assessments, including claims or problems related to intellectual property, product liability or warranty, and environmental issues and taxes, among other matters;

|

|

|

•

|

|

the availability of financing and interest rates, which affect: our cost of funds and/or ability to raise capital; our pension obligations and investment performance; and/or customer demand and the ability of customers

to obtain financing to purchase our products or equipment that contain our products; and the amount of any dividend declared by our Board of Directors in our common shares; and

|

|

|

•

|

|

those items identified under “Risk Factors” in our Annual Report on Form

10-K

for the year ended December 31, 2016.

|

You are cautioned that it is not possible to predict or identify all of the risks, uncertainties and other factors that may affect future

results and that the above list should not be considered to be a complete list. Except as required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

- 2 -

Use of Proceeds

Any proceeds received by us from the exercise of stock options covered by the Plan will be used for general corporate purposes. These proceeds

represent the exercise prices for the stock options.

- 3 -

Description of Capital Stock

Introduction

In the discussion that

follows, we have summarized selected provisions of our articles of incorporation and regulations relating to our capital stock. This summary is not complete. This discussion is subject to the relevant provisions of Ohio law and qualified in its

entirety by reference to our articles of incorporation and regulations. You should read the provisions of our articles of incorporation and regulations as currently in effect for more details regarding the provisions described below and for other

provisions that may be important to you. We have filed copies of those documents with the SEC, and they are incorporated by reference as exhibits to the registration statement of which this prospectus forms a part. See “Information We

Incorporate By Reference.”

Authorized Capital Stock

Our authorized capital stock consists of:

|

|

•

|

|

200,000,000 common shares; and

|

|

|

•

|

|

10,000,000 preferred shares, issuable in series.

|

Common Shares

Subject to the restrictions described below, the holders of our common shares are entitled to receive dividends from funds legally available

when, as and if declared by our board of directors and, upon our liquidation, dissolution or winding up, are entitled to receive pro rata our net assets after satisfaction in full of the prior rights of our creditors and holders of any preferred

shares.

Each of our common shares entitles its holder to one vote in the election of each director and on all other matters voted on

generally by our shareholders. None of our common shares affords any cumulative voting rights. This means that the holders of a majority of the voting power of the shares voting for the election of directors can elect all directors to be elected if

they choose to do so. Our board of directors may grant holders of preferred shares, in the amendment or amendments creating the series of preferred shares, the right to vote on the election of directors or any questions affecting our company.

Holders of our common shares have no preemptive or conversion rights or other subscription rights, and there are no redemption or sinking fund

provisions applicable to the common shares. After the distribution, all of our outstanding common shares will be fully paid and

non-assessable.

The rights, preferences and privileges of the holders of our

common shares are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred shares that we may designate and issue in the future.

Preferred Shares

At the direction of our

board of directors, without any action by the holders of our common shares, we may issue one or more series of preferred shares from time to time. Our board of directors can determine the number of shares of each series of preferred shares and the

designation and relative, participating, optional or other special powers, preferences or qualifications, limitations or restrictions applicable to any of those rights, including dividend rights, voting rights, conversion or exchange rights,

pre-emptive

rights, terms of redemption and liquidation preferences, of each series.

We believe that

the ability of our board of directors to issue one or more series of our preferred shares will provide us with flexibility in structuring possible future financings and acquisitions, and in meeting other corporate needs that might arise. Our

authorized preferred shares, as well as our common shares, will be available for issuance without further action by our shareholders, unless such action is required by applicable law or the rules of any stock exchange on which our securities may be

listed or traded. If the approval of our shareholders is not required for the issuance of our preferred shares or our common shares our board may determine not to seek shareholder approval.

The existence of undesignated preferred shares may enable our board of directors to render more difficult or to discourage an attempt to

obtain control of our company by means of a tender offer, proxy contest, merger or

- 4 -

otherwise, and thereby to protect the continuity of our management. The terms of one or more classes or series of preferred shares could dilute the voting power or reduce the value of our common

shares. For example, we could grant holders of preferred shares the right to elect some number of our directors in all events or on the happening of specified events or the right to veto specified transactions. Similarly, the repurchase or

redemption rights or liquidation preferences we could assign to holders of preferred shares could affect the residual value of the common shares. As a result, the issuance of preferred shares, or the issuance of rights to purchase preferred shares,

may discourage an unsolicited acquisition proposal or may materially and adversely affect the market price of our common shares or any existing preferred shares.

Limitation on Directors’ Liability

Ohio law provides that a corporation may indemnify directors, officers, employees and agents within prescribed limits, and must indemnify them

under certain circumstances. Ohio law does not authorize payment by a corporation of judgments against a director, officer, employee or agent after a finding of negligence or misconduct in a derivative suit absent a court order. Indemnification is

required, however, to the extent such person succeeds on the merits. In all other cases, if it is determined that a director, officer, employee, or agent acted in good faith and in a manner such person reasonably believed to be in or not opposed to

the best interests of the corporation, indemnification is discretionary, except as otherwise provided by a corporation’s articles of incorporation or regulations, or by contract, except with respect to the advancement of expenses to directors

(as discussed in the next paragraph). The statutory right to indemnification is not exclusive under Ohio law, and Ohio corporations may, among other things, purchase insurance to indemnify such persons.

Ohio law also provides that a director (but not an officer, employee, or agent) is entitled to mandatory advancement of expenses, including

attorneys’ fees, incurred in defending any action, including derivative actions, brought against the director, provided that the director agrees to cooperate with the corporation concerning the matter and to repay the amount advanced if it is

proved by clear and convincing evidence that such director’s act or failure to act was done with deliberate intent to cause injury to the corporation or with reckless disregard for the corporation’s best interests.

Our regulations limit the liability of the members of our board of directors by providing that we will indemnify, to the fullest extent

permitted by law, any director who is party to an action, lawsuit or proceeding by reason of the fact that they are a director. However, we will not be required to indemnify a director if the action, lawsuit or proceeding was initiated by the

director, unless the action, lawsuit or proceeding was initiated by the director to enforce their right to indemnification and it is finally adjudicated that they are entitled to indemnification.

This provision could have the effect of reducing the likelihood of derivative litigation against our directors and may discourage or deter our

shareholders or management from bringing a lawsuit against our directors, even though such an action, if successful, might otherwise have benefited us and our shareholders.

Statutory Business Combination Provision

As an Ohio corporation, we are subject to Chapter 1704 and Section 1701.831 of the Ohio Revised Code and we have not opted out of the

application of these provisions. For a further discussion, please see “Risk Factors–Provisions in our corporate documents and Ohio law could have the effect of delaying, deferring or preventing a change in control of us, even if that

change may be considered beneficial by some of our shareholders, which could reduce the market price of our common shares” which is incorporated herein by reference from our Annual Report on Form

10-K

for

the fiscal year ended December 31, 2016.

Anti-Takeover Effects of Provisions of our Articles of Incorporation and Regulations

Pursuant to our articles of incorporation, our board of directors is divided, with respect to the terms for which the directors severally hold

office, into three classes. Each class will consist, as nearly as may be possible, of

one-third

of the total number of directors constituting the whole board of directors, with the three-year term of office of

one class of directors expiring each year. In addition, our regulations provide that our board of directors may fix the number of directors within a range of nine to 11 directors. These provisions will prevent our shareholders from removing

incumbent directors without cause and filling the resulting vacancies with their own nominees.

- 5 -

The provisions of our regulations may be amended (i) to the extent permitted by law, by the

directors or (ii) at a meeting of the shareholders by the affirmative vote of the shareholders of record entitling them to exercise a majority of the voting power on the proposal, if such proposal has been recommended by a vote of the directors

then in office as being in the best interests of the company and its shareholders. The provisions of our articles of incorporation may be amended at a meeting of the shareholders by the affirmative vote of the shareholders of record entitling them

to exercise

two-thirds

of the voting power on the proposal.

Our regulations contain

advance-notice and other procedural requirements that apply to shareholder nominations of persons for election to our board of directors at any annual meeting of shareholders and to shareholder proposals that shareholders take any other action at

any annual meeting. In the case of any annual meeting, a shareholder proposing to nominate a person for election to our board of directors or proposing that any other action be taken must give our corporate secretary written notice of the proposal

not less than 90 days and not more than 120 days before the first anniversary of the date of the immediately preceding year’s annual meeting of shareholders. These shareholder proposal deadlines are subject to exceptions if the pending

annual meeting date is more than 30 days prior to or more than 30 days after the first anniversary of the immediately preceding year’s annual meeting. Our regulations prescribe specific information that any such shareholder notice must

contain. These advance-notice provisions may have the effect of precluding a contest for the election of our directors or the consideration of shareholder proposals if the proper procedures are not followed, and of discouraging or deterring a third

party from conducting a solicitation of proxies to elect its own slate of directors or to approve its own proposal, without regard to whether consideration of those nominees or proposals might be harmful or beneficial to us and our shareholders.

As discussed above under “Description of Capital Stock-Preferred Shares,” our articles of incorporation authorize our board of

directors, without the approval of our shareholders, to provide for the issuance of all or any preferred shares in one or more series and to determine the number of shares of each series of preferred shares and the designation and relative,

participating, optional or other special powers, preferences or qualifications, limitations or restrictions applicable to any of those rights, including dividend rights, voting rights, conversion or exchange rights,

pre-emptive

rights, terms of redemption and liquidation preferences, of each series. The issuance of preferred shares, or the issuance of rights to purchase preferred shares, could be used to discourage an

unsolicited acquisition proposal. In addition, under some circumstances, the issuance of preferred shares could adversely affect the voting power of our common shareholders.

In addition to the purposes described above, these provisions of our articles of incorporation and regulations are also intended to increase

the bargaining leverage of our board of directors, on behalf of our shareholders, in any future negotiations concerning a potential change of control of our company. Our board of directors has observed that certain tactics that bidders employ in

making unsolicited bids for control of a corporation, including hostile tender offers and proxy contests, have become relatively common in modern takeover practice. Our board of directors considers those tactics to be highly disruptive to a

corporation and often contrary to the overall best interests of its shareholders. In particular, bidders may use these tactics in conjunction with an attempt to acquire a corporation at an unfairly low price. In some cases, a bidder will make an

offer for less than all the outstanding capital stock of the target company, potentially leaving shareholders with the alternatives of partially liquidating their investment at a time that may be disadvantageous to them or retaining an investment in

the target company under substantially different management with objectives that may not be the same as the new controlling shareholder. The concentration of control in our company that could result from such an offer could deprive our remaining

shareholders of the benefits of listing on the NYSE and public reporting under the Exchange Act.

While our board of directors does not

intend to foreclose or discourage reasonable merger or acquisition proposals, it believes that value for our shareholders can be enhanced by encouraging

would-be

acquirers to forego hostile or coercive tender

offers and negotiate with the board of directors terms that are fair to all shareholders. Our board of directors believes that the provisions described above will (1) discourage disruptive tactics and takeover attempts at unfair prices or on

terms that do not provide all shareholders with the opportunity to sell their shares at a fair price and (2) encourage third parties who may seek to acquire control of our company to initiate such an acquisition through negotiations directly

with our board of directors. Our board of directors also believes these provisions will help give it the time necessary to evaluate unsolicited offers, as well as appropriate alternatives, in a manner that assures fair treatment of our shareholders.

Our board of directors recognizes that a takeover might in some circumstances be beneficial to some or all of our shareholders, but, nevertheless, believes that the benefits of seeking to protect its ability to negotiate with the proponent of an

unfriendly or unsolicited proposal to take over or restructure our company outweigh the disadvantages of discouraging those proposals.

- 6 -

Plan of Distribution

In connection with the spinoff, holders of Timken equity awards under Timken’s equity compensation programs received “Replacement

Awards,” meaning they had those awards adjusted into an award based on Timken’s common shares and an award based on our common shares, as described below under “—Description of Award Adjustments.” The awards that are based

on our common shares were granted by us under the Plan, in accordance with the terms of the employee matters agreement that we entered into with Timken in connection with the spinoff, and were made in substitution of, or in connection with stock

options, restricted shares, performance shares, restricted stock units (other than strategic performance shares) and deferred share awards that were granted under a Timken equity compensation program. The registration statement of which this

prospectus forms a part covers Replacement Awards that were granted to individuals who, at the time of the spinoff, were no longer employed by, or serving on the board of directors of, Timken and their donees, pledgees, permitted transferees,

assignees, successors and others who come to hold any such Replacement Awards. The prospectus does not cover any Replacement Awards that were granted to any individual who, upon completion of the spinoff, was employed by or served on the board of

directors of either Timken or TimkenSteel, or any other awards that we may grant under the Plan in the future.

- 7 -

Description of Award Adjustments

The employee matters agreement provides, among other things, the mechanics for the conversion and adjustment of equity awards granted under

Timken’s equity compensation programs into adjusted Timken awards and Replacement Awards, as follows:

Each outstanding Timken stock

option, restricted share, restricted stock unit (other than a strategic performance share) or deferred share award will be treated in a manner similar to that experienced by Timken shareholders with respect to their Timken common shares (the

treatment for restricted stock units will be substantially the same as that for deferred share awards, so for purposes of this prospectus references to deferred share awards will also cover restricted stock unit awards). More specifically, each of

these awards is deemed bifurcated into two separate awards: (1) a modified award covering Timken common shares; and (2) an award of the same type covering TimkenSteel common shares. Each of these two awards are subject to the same terms

and conditions as the terms and conditions applicable to the original Timken award, except:

|

|

•

|

|

with respect to each modified stock option award covering Timken common shares and stock option award covering TimkenSteel common shares, the

per-share

exercise price for such

award has been adjusted or established, as applicable, so that the two awards, together, retained, in the aggregate, the same intrinsic value that the original Timken stock option award had immediately prior to the spinoff (subject to rounding);

|

|

|

•

|

|

with respect to each award covering TimkenSteel common shares, the number of underlying shares subject to such award have been determined based on application of the distribution ratio in the spinoff to the number of

Timken common shares subject to the original Timken award prior to bifurcation; and

|

|

|

•

|

|

with respect to any continuous employment requirement associated with any equity incentive awards, such requirement will be satisfied (a) by a TimkenSteel employee based on his or her continuous employment with

TimkenSteel (for equity incentive awards of either TimkenSteel or Timken) and (b) by a Timken employee based on his or her continuous employment with Timken (for equity incentive awards of either Timken or TimkenSteel).

|

To the extent any original Timken equity incentive award was subject to accelerated vesting or exercisability in the event of a “change

of control,” the corresponding post-spinoff Timken and TimkenSteel equity incentive awards will generally accelerate in the same manner in the event of (a) a change of control of the issuer of the shares underlying such awards, or

(b) a change of control of the employer of the grantee.

- 8 -

The Plan

The Plan is generally administered by the Compensation Committee of our board of directors and will enable the Compensation Committee to

provide equity and incentive compensation to our officers, other key employees and our

non-employee

directors. Pursuant to the Plan, we may grant stock options (including “incentive stock options” as

defined in Section 422 of the Code), stock appreciation rights, restricted shares, restricted stock units, deferred shares, performance shares, performance units, cash incentive awards, and certain other awards based on or related to our common

shares, subject to certain share and dollar limitations as described in the Plan. The Plan permits us to grant both awards that are intended to qualify as “qualified performance-based compensation” under Section 162(m) of the Code and

awards that are not intended to so qualify.

The Plan permits the evidence of award with respect to any grant under the Plan to provide

for accelerated vesting or exercise, including in the event of the grantee’s retirement, death or disability, or in the event of a “change in control,” as defined in the Plan. Further, it requires the Compensation Committee to make

adjustments to outstanding awards in the event of certain corporate transactions or changes in the capital structure of TimkenSteel.

Subject to adjustment as described in the Plan, total awards under the Plan are limited to 11,050,000 TimkenSteel common shares. These shares

may be shares of original issuance or treasury shares or a combination of the foregoing.

The Plan also provides that, subject to

adjustment as described in the Plan:

|

|

•

|

|

the aggregate number of common shares actually issued or transferred upon the exercise of incentive stock options will not exceed 11,050,000 common shares;

|

|

|

•

|

|

no participant will be granted stock options or stock appreciation rights, in the aggregate, for more than 1,000,000 common shares during any calendar year;

|

|

|

•

|

|

no participant will be granted awards of restricted shares, restricted stock units, performance shares or other stock-based awards that are intended to qualify as “qualified performance-based compensation”

under Section 162(m) of the Code, in the aggregate, for more than 1,000,000 common shares during any calendar year;

|

|

|

•

|

|

no participant in any calendar year will receive an award of performance units or other awards payable in cash that are intended to qualify as “qualified performance-based compensation” under Section 162(m) of

the Code, other than cash incentive awards, having an aggregate maximum value in excess of $6,000,000; and

|

|

|

•

|

|

no

non-employee

director of TimkenSteel will be granted in any calendar year awards under the Plan having an aggregate maximum value in excess of $500,000.

|

The Plan contains fungible share counting mechanics, which generally means that awards other than stock options and stock appreciation rights

will be counted against the aggregate share limit as 2.50 common shares for every one common share that is actually issued or transferred under such awards.

Common shares issued or transferred pursuant to awards granted under the Plan in substitution for or in conversion of, or in connection with

the assumption of, awards held by awardees of an entity engaging in a corporate acquisition or merger with us or any of our subsidiaries will not count against the share limits under the Plan. Additionally, shares available under certain plans that

we or our subsidiaries may assume in connection with corporate transactions from another entity may be available for certain awards under the Plan, under circumstances further described in the Plan, but will not count against the share limits under

the Plan.

The Compensation Committee generally will be able to amend the Plan, subject to shareholder approval in certain circumstances

as described in the Plan.

- 9 -

Legal Matters

Jones Day will pass upon the validity of common shares being offered hereby.

Experts

The consolidated financial statements and schedule of TimkenSteel Corporation appearing in TimkenSteel Corporation’s Annual Report (Form

10-K)

for the year ended December 31, 2016 and the effectiveness of TimkenSteel Corporation’s internal control over financial reporting as of December 31, 2016 have been audited by Ernst &

Young LLP, independent registered public accounting firm, as set forth in their reports thereon included therein, and incorporated herein by reference. Such consolidated financial statements and schedule, have been incorporated herein by reference

in reliance upon such reports given on the authority of such firm as experts in accounting and auditing.

- 10 -

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution

.

|

The following are the

estimated expenses of the issuance and distribution of the securities being registered, all of which are payable by us. All of the items below, except for the registration fee, are estimates.

|

|

|

|

|

|

|

Item

|

|

Amount

|

|

|

Securities and Exchange Commission registration fee

|

|

$

|

686

|

|

|

Legal fees and expenses

|

|

|

20,000

|

|

|

Accounting fees and expenses

|

|

|

5,000

|

|

|

Miscellaneous expenses

|

|

|

5,000

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

30,686

|

|

|

Item 15.

|

Indemnification of Directors and Officers

.

|

Our regulations provide

that we will indemnify, to the fullest extent permitted by law, any person who was or is party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or

investigative, by reason of the fact that he is or was a director or officer of us, or is or was serving at our request as a director, trustee or officer of another corporation, domestic or foreign,

non-profit

or

for-profit,

partnership, joint venture, trust or other enterprise. We will not be required to indemnify any person with respect to any action, suit or proceeding that was initiated by that person unless the

action, suit or proceeding was initiated to enforce any rights to indemnification under our regulations and the person is formally adjudged to be entitled to indemnity. The indemnification obligation provided in our regulations is not exclusive of

any other rights to which those seeking indemnification may be entitled under any law, the articles of incorporation or any agreement, vote of shareholders or of disinterested directors or otherwise, both as to action in official capacities and as

to action in another capacity while he is our director or officer and shall continue as to a person who has ceased to be a director, trustee or officer and shall inure to the benefit of the heirs, executors and administrators of that person.

Our regulations also permit us to purchase and maintain insurance on behalf of any persons that we are required to indemnify under the

regulations against any liability asserted against and incurred by that person, in their status or capacity as a party we must indemnify, whether or not we would have the power to indemnify such person against such liability. We may also, to the

fullest extent permitted by law, enter into an indemnification agreement with any persons that we are required to indemnify under the regulations.

We have entered into contracts with some of our directors and officers and indemnify them against many of the types of claims that may be made

against them. We also maintain insurance coverage for the benefit of directors and officers with respect to many types of claims that may be made against them, some of which may be in addition to those described in the regulations.

Section 1701.13 of the Ohio Revised Code, or Section 1701.13, generally permits indemnification of any director, officer or employee

with respect to any proceeding against any such person provided that: (a) such person acted in good faith, (b) such person reasonably believed that the conduct was in or not opposed to the best interests of the corporation, and (c) in

the case of criminal proceedings, such person had no reasonable cause to believe that the conduct was unlawful. Indemnification may be made against expenses (including attorneys’ fees), judgments, fines and settlements actually and reasonably

incurred by such person in connection with the proceeding; provided, however, that if the proceeding is one by or in the right of the corporation, indemnification may be made only against actual and reasonable expenses (including attorneys’

fees) and may not be made with respect to any proceeding in which the director, officer or employee has been adjudged to be liable to the corporation, except to the extent that the court in which the proceeding was brought shall determine, upon

application, that such person is, in view of all the circumstances, entitled to indemnity for such expenses as the court shall deem proper. To the extent that a director, officer or employee is successful on the merits or otherwise in defense of the

proceeding,

indemnification is required. The termination of any proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent does not, of itself, create a

presumption that the director, officer or employee did not meet the standard of conduct required for indemnification to be permitted.

Section 1701.13 further provides that indemnification thereunder may not be made by the corporation unless authorized after a

determination has been made that such indemnification is proper, with that determination to be made (a) by the Board of Directors by a majority vote of a quorum consisting of directors not parties to the proceedings; (b) if such a quorum

is not obtainable, or, even if obtainable, but a quorum of disinterested directors so directs, by independent legal counsel in a written opinion; (c) by the shareholders; or (d) by the court in which the proceeding was brought. However, a

director (but not an officer, employee or agent) is entitled to mandatory advancement of expenses, including attorneys’ fees, incurred in defending any action, including derivative actions, brought against the director, provided that the

director agrees to cooperate with the corporation concerning the matter and to repay the amount advanced if it is proved by clear and convincing evidence that such director’s act or failure to act was done with deliberate intent to cause injury

to the corporation or with reckless disregard for the corporation’s best interests.

Finally, Section 1701.13 provides that

indemnification or advancement of expense provided by that Section is not exclusive of any other rights to which those seeking indemnification may be entitled under the articles of incorporation or regulations or any agreement, vote of shareholders

or disinterested directors or otherwise.

The following documents are exhibits to the registration statement:

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

4.1(a)

|

|

Amended and Restated Articles of Incorporation of TimkenSteel Corporation.

|

|

|

|

|

4.2(b)

|

|

Code of Regulations of TimkenSteel Corporation.

|

|

|

|

|

4.3(c)

|

|

TimkenSteel Corporation Amended and Restated 2014 Equity and Incentive Compensation Plan.

|

|

|

|

|

5.1

|

|

Opinion of Jones Day.

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm.

|

|

|

|

|

23.2

|

|

Consent of Jones Day (Included in Exhibit 5.1 to this Registration Statement).

|

|

|

|

|

24.1

|

|

Power of Attorney.

|

|

(a)

|

Incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form

8-K

filed on June 13, 2014 (File

No. 001-36313).

|

|

(b)

|

Incorporated by reference to Exhibit 3.2 of Amendment No. 3 to the Company’s Registration Statement on Form 10 filed on May 15, 2014 (File

No. 001-36313).

|

|

(c)

|

Incorporated by reference to Exhibit 4.3 of the Company’s Registration Statement on Form

S-8

filed on October 28, 2016 (File

No. 333-214297).

|

The undersigned registrant hereby undertakes:

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

(i)

|

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933, as amended, which we refer to as the Securities Act or the Act;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement

(or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in

|

|

|

volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in

the “Calculation of Registration Fee” table in the effective registration statement;

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

|

Provided, however,

that:

|

|

(A)

|

Paragraphs (1)(i), (ii), and (iii) of this Item 17 do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the

SEC by the registrant pursuant to section 13 or section 15(d) of the Exchange Act that are incorporated by reference in the registration statement or is contained in a form of prospectus filed pursuant to Rule 424(b) under the Exchange Act that is

part of the registration statement.

|

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

|

|

(i)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) under the Exchange Act shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in

the registration statement; and

|

|

|

(ii)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or

(x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first

used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such

date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the

initial

bona fide

offering thereof.

Provided, however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference

into the registration statement or prospectus that is a part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

|

|

(5)

|

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities:

|

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell

the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the

purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

(i)

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

|

|

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

|

|

|

(iv)

|

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

|

|

(6)

|

That, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Exchange Act (and, where applicable, each

filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(7)

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the

registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against

such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer

or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

Signatures

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form

S-3

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Canton, State of Ohio, on

March 17, 2017.

|

|

|

|

|

TIMKENSTEEL CORPORATION

|

|

|

|

|

By:

|

|

/s/ Christopher J. Holding

|

|

|

|

Christopher J. Holding

|

|

|

|

Executive Vice President and Chief Financial Officer

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement on Form

S-3

has been signed below by the following persons in the capacities indicated as of March 17, 2017:

|

|

|

|

|

Signature

|

|

Title

|

|

*

|

|

Chairman, Chief Executive Officer and President

(Principal Executive Officer) and Director

|

|

Ward J. Timken, Jr.

|

|

|

|

|

|

/s/ Christopher J. Holding

|

|

Executive Vice President and Chief Financial Officer

(Principal Financial Officer)

|

|

Christopher J. Holding

|

|

|

|

|

|

/s/ Tina M. Beskid

|

|

Vice President - Corporate Controller and Investor Relations

(Principal Accounting Officer)

|

|

Tina M. Beskid

|

|

|

|

|

|

*

Joseph A. Carrabba

|

|

Director

|

|

|

|

|

*

Phillip R. Cox

|

|

Director

|

|

|

|

|

*

Diane C. Creel

|

|

Director

|

|

|

|

|

*

Terry L. Dunlap

|

|

Director

|

|

|

|

|

*

Randall H. Edwards

|

|

Director

|

|

|

|

|

*

Donald T. Misheff

|

|

Director

|

|

|

|

|

*

John P. Reilly

|

|

Director

|

|

|

|

|

*

Ronald Rice

|

|

Director

|

|

|

|

|

*

Randall J. Wotring

|

|

Director

|

|

*

|

The undersigned, by signing his name hereto, does hereby sign this registration statement on behalf of each of the officers and directors of the registrant identified above pursuant to a Power of Attorney executed by

the officers and directors identified above, which Power of Attorney which is being filed with this registration statement.

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Frank A. DiPiero

Frank A. DiPiero,

Attorney-in-Fact

|

|

|

|

March

17, 2017

|

Index to Exhibits

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

4.1(a)

|

|

Amended and Restated Articles of Incorporation of TimkenSteel Corporation.

|

|

|

|

|

4.2(b)

|

|

Code of Regulations of TimkenSteel Corporation.

|

|

|

|

|

4.3(c)

|

|

TimkenSteel Corporation Amended and Restated 2014 Equity and Incentive Compensation Plan.

|

|

|

|

|

5.1

|

|

Opinion of Jones Day.

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm.

|

|

|

|

|

23.2

|

|

Consent of Jones Day (Included in Exhibit 5.1 to this Registration Statement).

|

|

|

|

|

24.1

|

|

Power of Attorney.

|

|

(a)

|

Incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form

8-K

filed on June 13, 2014

(File No. 001-36313).

|

|

(b)

|

Incorporated by reference to Exhibit 3.2 of Amendment No. 3 to the Company’s Registration Statement on Form 10 filed on May 15, 2014 (File

No. 001-36313).

|

|

(c)

|

Incorporated by reference to Exhibit 4.3 of the Company’s Registration Statement on Form

S-8

filed on October 28, 2016

(File No. 333-214297).

|

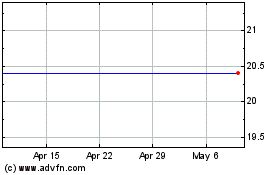

TimkenSteel (NYSE:TMST)

Historical Stock Chart

From Mar 2024 to Apr 2024

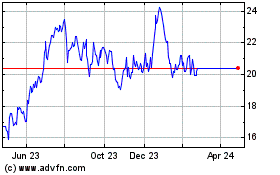

TimkenSteel (NYSE:TMST)

Historical Stock Chart

From Apr 2023 to Apr 2024