Report of Foreign Issuer (6-k)

March 17 2017 - 6:03AM

Edgar (US Regulatory)

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

March 2017

Vale S.A.

Avenida das Américas, No. 700 – Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

|

|

(Check One) Form 20-F

x

Form 40-F

o

|

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Table of Contents

|

|

Press Releas

e

|

Vale informs on the partial ratification of the Preliminary Agreement entered with Federal Prosecutors on January 18, 2017

Rio de Janeiro, March 16, 2017 — Vale S.A. (Vale) informs that 12

th

Federal Civil Court of Minas Gerais partially ratified the preliminary agreement (Preliminary Agreement) entered by Samarco Mineração S.A (Samarco) and its shareholders, Vale and BHP Billiton Brasil Ltda (BHPB) with the Federal Prosecutor’s Office in Brazil (Federal Prosecutors) on January 18, 2017, which established procedures and timeframe for the entering of a final agreement, engagement of experts to provide technical support to the Federal Prosecutors and establishment of guarantees.

The general terms of the decision of the 12

th

Federal Civil Court of Minas Gerais are the following: (i) ratification of the engagement of experts to perform a socioenvironmental impact assessment and assessment of programs under the Framework Agreement signed on March 2nd, 2016 and a period of 60 days for the companies to engage an expert to perform the socioeconomic impact assessment; (ii) suspended claim nº 023863-07.2016.4.01.3800, filed by the Federal Prosecutors (total value of R$ 155 billion), and the claim nº 0069758-61.2015.4.01.3400, filed by the Federal Government, the states of Minas Gerais and Espírito Santo and other governmental authorities (total value of R$ 20 billion), and determined the consolidation and suspension of other related claims aiming to avoid contradictory or conflicting decisions and to establish a unified judicial procedure in order for the parties to be able to reach a final agreement; (iii) accepted the guarantees proposed by Samarco and its shareholders under the Preliminary Agreement on a temporary basis.

This is an important decision that recognizes the complexity and importance of reaching a consensual solution in order to implement the necessary measures to remediate all the impacts caused by the Samarco dam failure. All the programs under the Framework Agreement entered into by the companies and the governmental authorities on March 2

nd

, 2016 continue to be effective and are currently being implemented.

For further information, please contact:

+55-21-3485-3900

Andre Figueiredo: andre.figueiredo@vale.com

Carla Albano Miller: carla.albano@vale.com

Fernando Mascarenhas: fernando.mascarenhas@vale.com

Andrea

Gutman: andrea.gutman@vale.com

Bruno Siqueira: bruno.siqueira@vale.com

Claudia Rodrigues: claudia.rodrigues@vale.com

Denise Caruncho: denise.caruncho@vale.com

Mariano Szachtman: mariano.szachtman@vale.com

Renata Capanema: renata.capanema@vale.com

This press release may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM), and the French Autorité des Marchés Financiers (AMF), and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F.

3

Table of Contents

Signatu

res

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale S.A.

|

|

|

(Registrant)

|

|

|

|

|

|

By:

|

/s/ André Figueiredo

|

|

|

|

Director of Investor Relations

|

|

|

|

|

|

Date: March 16, 2017

|

|

|

4

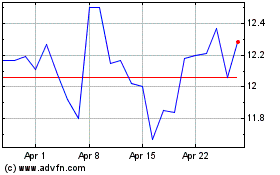

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

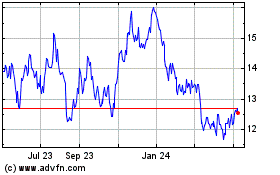

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024