Amended Current Report Filing (8-k/a)

March 16 2017 - 4:55PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K/A

(AMENDMENT NO. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report: (Date of earliest event reported): January 17, 2017

Nexstar Media Group, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

Delaware

(State or other jurisdiction of incorporation)

|

000-50478

(Commission File Number)

|

23-3083125

(IRS Employer Identification No.)

|

545 E. John Carpenter Freeway, Suite 700

Irving, Texas 75062

(Address of Principal Executive Offices, including Zip Code)

(972) 373-8800

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instructions A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory Note

This Amendment No. 1 on Form 8-K/A (this “Form 8-K/A”) is an amendment to the Current Report on Form 8-K of Nexstar Media Group, Inc. (“Nexstar”), filed on January 17, 2017 (the “Original Form 8-K”). This Form 8-K/A is being filed to provide financial statements of the acquired business required by Item 9.01 (a) and the pro forma financial information required by Item 9.01 (b). This Form 8-K/A supplements Item 9.01 of the Original Form 8-K.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On January 17, 2017, Nexstar completed its previously announced merger with Media General, Inc. (“Media General”), a Virginia corporation (the “Merger”). Following the Merger, Nexstar owns, operates, programs or provides sales and other services to 171 full power television stations in 100 markets, reaching approximately 44.7 million viewers or nearly 39% of all U.S. television households. The Merger was effected pursuant to the Agreement and Plan of Merger, dated as of January 27, 2016 (the “Merger Agreement”), by and among Nexstar, Neptune Merger Sub, Inc., a Virginia corporation and a wholly-owned subsidiary of Nexstar, and Media General. Concurrent with the Merger, Nexstar also completed the previously announced sale of the assets of 12 full power television stations in 12 markets. For additional information, including the consideration transferred and divestiture selling price, refer to the unaudited pro forma financial information filed hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired

The audited financial statements of Media General, Inc. as of December 31, 2016 and 2015 and for the three years ended December 31, 2016, 2015 and 2014, the notes related thereto and the independent auditors report of Deloitte & Touche LLP are filed hereto as Exhibit 99.2

(b) Pro Forma Financial Information

The unaudited pro forma financial information required by this item are filed hereto as Exhibit 99.1.

(d) Exhibits

|

Exhibit No.

|

Description

|

|

2.1

|

Agreement and Plan of Merger, dated as of January 27, 2016, by and among Nexstar Broadcasting Group, Inc., Neptune Merger Sub, Inc. and Media General, Inc. (incorporated by reference to Exhibit 2.1 to Nexstar’s Current Report on Form 8-K filed January 28, 2016).+

|

|

10.1

|

Contingent Value Rights Agreement, dated as of January 13, 2017, by and between Nexstar Broadcasting Group, Inc. and American Stock Transfer & Trust Company, LLC as rights agent (incorporated by reference to Exhibit 10.1 to Nexstar’s Current Report on Form 8-K filed January 17, 2017).

|

|

23.1

|

Consent of Deloitte & Touche LLP, independent registered public accounting firm of Media General, Inc.*

|

|

99.1

|

Unaudited Pro Forma Combined Financial Information*

|

|

99.2

|

Audited financial statements of Media General, Inc. as of December 31, 2016 and 2015 and for the three years ended December 31, 2016*

|

|

99.3

|

Press Release dated January 17, 2017 (Incorporated by reference to Exhibit 99.1 to Current Report on Form 8-K (File No. 000-50478) filed by Nexstar Broadcasting Group, Inc. on January 17, 2017).

|

|

99.4

|

Press Release dated June 13, 2016, announcing the entry into a definitive agreement to sell five stations in five markets (Incorporated by reference to Exhibit 99.1 to Current Report on Form 8-K (File No. 000-50478) filed by Nexstar Broadcasting Group, Inc. on June 14, 2016).

|

|

99.5

|

Press Release dated May 27, 2016, announcing entry into definitive agreements to sell five stations in four markets (Incorporated by reference to Exhibit 99.1 to Current Report on Form 8-K (File No. 000-50478) filed by Nexstar Broadcasting Group, Inc. on June 6, 2016).

|

|

99.6

|

Press Release dated June 3, 2016, announcing entry into a definitive agreement to sell two stations (Incorporated by reference to Exhibit 99.2 to Current Report on Form 8-K (File No. 000-50478) filed by Nexstar Broadcasting Group, Inc. on June 6, 2016).

|

|

|

+

|

Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The descriptions of the omitted schedules and exhibits are contained within the Agreement and Plan of Merger and the Form of Stock Rollover and Equity Purchase Agreement. The Company hereby agrees to furnish a copy of any omitted schedule or exhibit to the Securities and Exchange Commission upon request.

|

This Form 8-K/A contains forward-looking statements that contain risks and uncertainties. These forward-looking statements contain statements of intent, belief or current expectations of Nexstar and its management. Such forward-looking statements are not guarantees of future results and involve risks and uncertainties that may cause actual results to differ materially from the potential results discussed in the forward-looking statements. The Company is not obligated to update forward-looking statements based on circumstances or events that occur in the future. Risks and uncertainties that may cause such differences include but are not limited to the risk factors listed in the Company’s most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC on Febraury 28, 2017. The Company assumes no obligation to update any forward-looking information contained in this Form 8-K/A.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NEXSTAR MEDIA GROUP, INC.

|

|

|

By:

|

/s/ Thomas E. Carter

|

|

Date: March 16, 2017

|

|

Name:

|

Thomas E. Carter

|

|

|

|

Title:

|

Chief Financial Officer

|

|

|

|

|

(Principal Financial Officer)

|

Exhibit Index

|

Exhibit No.

|

Description

|

|

2.1

|

Agreement and Plan of Merger, dated as of January 27, 2016, by and among Nexstar Broadcasting Group, Inc., Neptune Merger Sub, Inc. and Media General, Inc. (incorporated by reference to Exhibit 2.1 to Nexstar’s Current Report on Form 8-K filed January 28, 2016).+

|

|

10.1

|

Contingent Value Rights Agreement, dated as of January 13, 2017, by and between Nexstar Broadcasting Group, Inc. and American Stock Transfer & Trust Company, LLC as rights agent (incorporated by reference to Exhibit 10.1 to Nexstar’s Current Report on Form 8-K filed January 17, 2017).

|

|

23.1

|

Consent of Deloitte & Touche LLP, independent registered public accounting firm of Media General, Inc.*

|

|

99.1

|

Unaudited Pro Forma Combined Financial Information*

|

|

99.2

|

Audited financial statements of Media General, Inc. as of December 31, 2016 and 2015 and for the three years ended December 31, 2016*

|

|

99.3

|

Press Release dated January 17, 2017 (Incorporated by reference to Exhibit 99.1 to Current Report on Form 8-K (File No. 000-50478) filed by Nexstar Broadcasting Group, Inc. on January 17, 2017).

|

|

99.4

|

Press Release dated June 13, 2016, announcing the entry into a definitive agreement to sell five stations in five markets (Incorporated by reference to Exhibit 99.1 to Current Report on Form 8-K (File No. 000-50478) filed by Nexstar Broadcasting Group, Inc. on June 14, 2016).

|

|

99.5

|

Press Release dated May 27, 2016, announcing entry into definitive agreements to sell five stations in four markets (Incorporated by reference to Exhibit 99.1 to Current Report on Form 8-K (File No. 000-50478) filed by Nexstar Broadcasting Group, Inc. on June 6, 2016).

|

|

99.6

|

Press Release dated June 3, 2016, announcing entry into a definitive agreement to sell two stations (Incorporated by reference to Exhibit 99.2 to Current Report on Form 8-K (File No. 000-50478) filed by Nexstar Broadcasting Group, Inc. on June 6, 2016).

|

|

|

+

|

Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The descriptions of the omitted schedules and exhibits are contained within the Agreement and Plan of Merger and the Form of Stock Rollover and Equity Purchase Agreement. The Company hereby agrees to furnish a copy of any omitted schedule or exhibit to the Securities and Exchange Commission upon request.

|

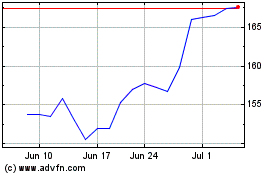

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Mar 2024 to Apr 2024

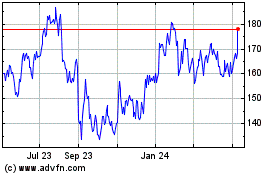

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Apr 2023 to Apr 2024